Dear Valued Clients and Friends,

Monday and Tuesday of this week produced the largest two-day point drop in market history, and while the percentage drop does not even rank in the top fifty, investors can be forgiven for feeling uneasy with the state of affairs. This special Dividend Cafe seeks to provide a very sober and substantive view of the whole picture. The coronavirus matter is unpacked, along with other relevant ramifications for the market.

What to expect

I do believe the market is trying to find a bottom out of the violence of this recent market drop, but I offer no forecast as to when exactly it may find such! It is better for investors to have dropped ~2,000+ points in three days than to have a slow drip of downside that suggests prolonged pain. This sell-off is clearly enhanced by the wash-out of investors who had no business owning equities, to begin with, and when “weak hand” investors are washed out it generally means (a) A more violent and accelerated quick drop, and (b) A quicker resolution once those folks are moved to the sidelines.

Now, because of the basic uncertainty of things behind this (coronavirus) we cannot say exactly how this will shake out. But the lesson learned in the last dozen market drops is that the more violent and sudden the drop, the quicker the resolution has come.

Okay, but …

Now, as far as the economic impact from the coronavirus itself, I would love to break here in the pages of Dividend Cafe exactly what the resolution will look like, how the health epidemic will play out, and what the intersection of a health scare and markets will mean in this case. But I, like everyone else on God’s green earth, do not know … I am somewhat encouraged by the level of hysteria and panic I am seeing, because the greater the hysterical panic around things, the quicker normalcy and improvement has generally come historically (humans are not good at this prediction stuff, and their own pathologies play heavily into the way they respond to things like this).

The market’s resilience throughout February is a bigger surprise than the market’s panic of the last three days. My prior feeling was that maybe the market had been burned so badly in the past by overreacting to SARS, Zika, swine flu, EBOLA, and the rest that this time they weren’t going to go there. The market fell a stunning 12.8% in 38 days back in 2003 with the SARS scare. It fell by the same during the ZIKA scare. Investors who capitulated to those incidents regretted it, deeply, in just a matter of weeks as markets rebounded with force. New highs came just weeks after those sell-offs. Such is the life of an equity investor.

How are we thinking about this

I am perfectly aware of the arguments that China’s contribution to global GDP growth is larger now than it was in the SARS fear of 2003, and that is true. 80,000 cases of the virus and 2,700 deaths (worldwide) is a big deal, certainly in the human tragedy and loss of it, and in the potential for economic impact if the pace of growth were to accelerate. Active cases of the virus have declined since mid-February, and the number of false diagnoses around the globe has been disheartening. The annual fatalities in America alone from the flu are still four times the amount of global fatalities from coronavirus thus far. This cannot be used to belittle the human tragedy, and it cannot be used to argue that things cannot worsen, but the perspective is important.

The market is not trading on known bad news; it is trading on uncertain unknown news.

So from here?

There are promising medical treatments on the horizon, including potential vaccination remedies. I do not have the scientific or medical knowledge to comment on the timing, likelihood, and specifics of how the treatment options will play out. I do believe in the side of rationality and experience that the most advanced medical intellects in world history will bring us to the point of solution. And of course I pray that containment will be successful along the way.

BUT!

However, my response as an investment manager to the coronavirus scare is not based on a belief in this vaccine or that remedy or this containment or that outbreak. I expect good news to come one moment and bad news to come another, and for this to continue. My response as an investment manager is rooted in the humble acceptance of uncertainty as a permanent precondition of being an investor.

When coronavirus is out of the news, there will still be uncertain risks and unknown concerns that render not just investing but living on planet earth “risky.” This is not new. This did not start with coronavirus. This is not exceptional in the midst of this market sell-off. This is life. This is investing. This is human nature. And I owe it to my clients to not let fear and panic of unknown conditions and outcomes drive investment policy.

Investment 101

We will add to positions (and have done so) where we believe extreme distress creates a disconnection from value attractive enough to do so. There is no question this distress has already impacted Q1 earnings expectations for most companies. We do not worry about another 5-10% equity drop because our asset allocations custom-designed for every single client already baked in the reality that equities occasionally (much more frequently than anyone seems to appreciate) suffer such downside fluctuations. Bond portfolios are substantially up in the last month. And read below about alternative exposures.

Asset allocation is the defense you have against coronavirus. And it is working.

And it is the defense you have against the next market disruption, as well.

Time to get greedy?

Not yet. Things can get worse before they get better. One has to remember – and this is so important – when some catalyst for market distress comes when the market is already frothy in valuation (like now), it is very different than a correction out of low or median valuations. In other words, a lot of steam needed to come out of certain stocks and sectors, anyway.

I am very confident that emerging markets and energy (cheap before this correction) are even cheaper and more attractive now. The only reason to not be optimistic here is the misguided desire to time the bottom perfectly. We have no such confidence in our abilities, and are driven by valuations and enhanced expected returns in reasonable timelines. Period.

An alternative way to think

I look at the liquid alternative strategy in our portfolio (up 1% year-to-date and down just half a percentage point compared to market’s 5%+ drop in recent days), and I am reminded of the zig/zag effect we herald as the reason for owning alternative investments. The execution matters, and manager talent matters, but the extra weighting into alternatives we have emphasized in 2020 has helped to offset the downside volatility of the equity market turbulence.

Get me some illiquidity

The discomfort of not just daily marks in one’s stock portfolio but actual second-by-second marks is an inevitable reality in the highly liquid world of highly marketable stocks. Our overweight in less liquid real estate and private credit and private equity strategies has served to temper the volatility of the last week as well. Allow me to really spell this out? Am I suggesting that our “illiquid” holdings in these alternative asset classes have also been impaired in their value, yet we should be happy because we don’t have to see it? Not at all! Rather, I am suggesting that the vast majority of publicly-traded companies have not seen their real intrinsic value fundamentally altered, yet the instant pricing of public equities (almost entirely driven by other-investor-sentiment and behavior) makes one feel as if they did. Illiquid investments provide a price tempering because they largely eliminate the insanity of other investor’s behavior and temperament.

Illiquidity is a problem when one needs to sell an investment quickly, but if one needs to sell an investment quickly, we do not believe they should be in liquid public stock markets either! Our bullish view on a discriminated approach to private credit is providing not just a reduction of volatility in the present distress, but a significant creation of value out of the fundamental earnings power of the asset class.

Middle market lending (direct loans) with first-lien positions and very conservative underwriting and loan-to-value ratios represent a truly attractive way to earn risk premium, to enhance stability of daily values, and most importantly, to generate cash flows that are the bread and butter of all investor objectives (whether that cash is needed now or in the future).

Note the following

The dollar has NOT surged, as of yet, muting the idea of a global panic. This is important, and good.

The inverted yield curve is certainly right now from the heavy flight to safety into U.S. Treasuries. When this story is gone, we still have to evaluate the longer-term issue of why the yield curve is not healthier.

Chinese GDP growth is certainly going to be impacted by this … Less direct exposure to China is better. But global GDP slowness does not generally mean American recessions – our economic weakness brings the world into recession, not vice versa!

I truly hope the Fed does not use this to cut rates further, but it is clear that the odds of that happening are growing.

Politics & Money: Beltway Bulls and Bears

- I will elaborate on all the political aspects of this, and the updates in the Democratic primary, in the normal Friday Dividend Cafe.

Chart of the Week

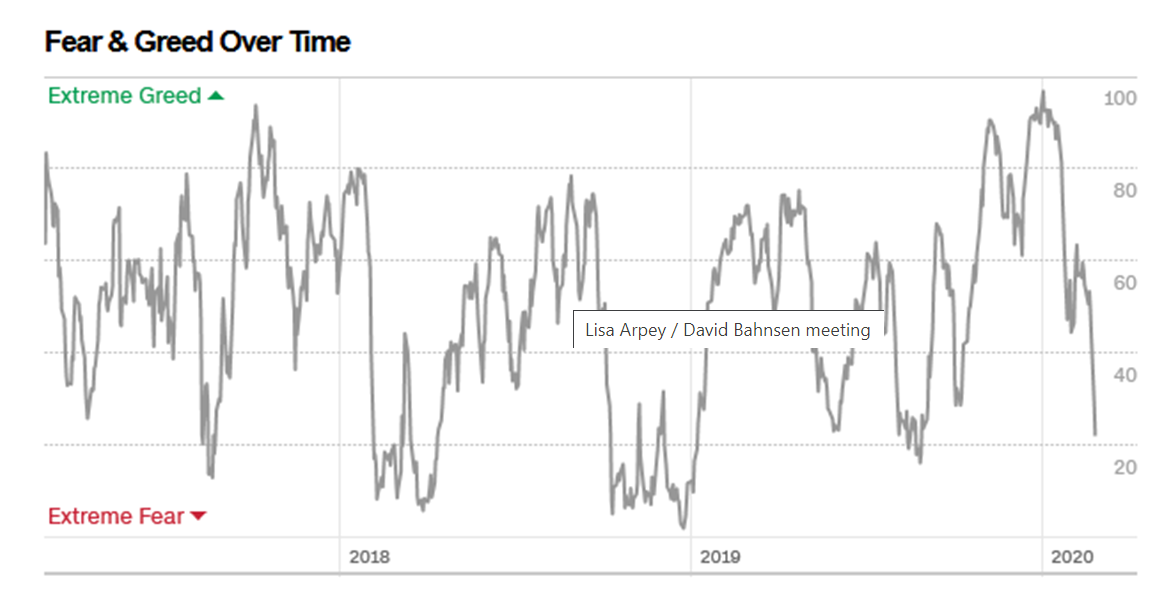

Contrarians of the world, unite!

* Jones Trading, February 26, 2020

Quote of the Week

“The real movement of history, it turns out, is fueled not by matter but by spirit, by the will to freedom.”

~ Gertrude Himmelfarb

* * *

A normal Friday Dividend Cafe is still forthcoming. This edition is additive, because of market conditions. Please reach out with any questions, comments, or inquiries. We are here for you. Our steady hands are on the wheel. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet