Millennials have had to suffer the double whammy of the global financial crisis of 2007-2008, and now the economic repercussions of the Covid-19 pandemic. A person is referred to as a “millennial” if they were born between 1982 and 2000 (ages 20 to 38) according to the US Census Bureau. Believe it or not, some older millennials are approaching that middle-age mark of 40! As a mother of three millennial daughters, I think millennials often are unfairly maligned as selfish, entitled, and not mature adults. But they are no longer mainly college kids or recent college grads, they are professionals, parents and represent a quarter of the U.S. population.

What’s spin and what are the facts of the Millennial journey?

There is a stereotype of Millennials as entitled, disloyal, passionate, self-directed, and seeking an unrealistic work-life balance. Clearly this is an oversimplification of a generational group as is often the case with sweeping generalizations about groups of people. In fact, Millennials as a generation are more diverse than previous generations with 44.2% being part of a minority race or ethnic group.

According to research by Arthur Levine and Diane Dean (Generation on a Tightrope), there are six key events that have affected the shaping of the Millennial generation:

- The most important event was the launch of the internet and the world wide web which changed the way that they acquired and processed information compared to previous generations.

- The second most important factor has been the economy, specifically the global financial crisis of 2008, which set the stage for their thinking about their future financial prospects and negatively affected them disproportionately.

- The third event was the September 11th attacks which caused fear and anxiety about global uncertainty and terrorist attacks.

- The election of President Obama is the fourth factor as it provided the multi-ethnic Millennials with a vision of leadership that was different from the typical leadership dominated by white males.

- The fifth influential element is the ubiquitous use of cell phones to communicate.

- And the final key event was the launch of search engines which allowed for the pooling of information in one site for an easy search tool.

Now adding to these events, the Covid-19 pandemic and the economic fallout therefrom, will also have a direct effect on their economic progression.

How did the Millennials survive the 2008 Global Financial Crisis?

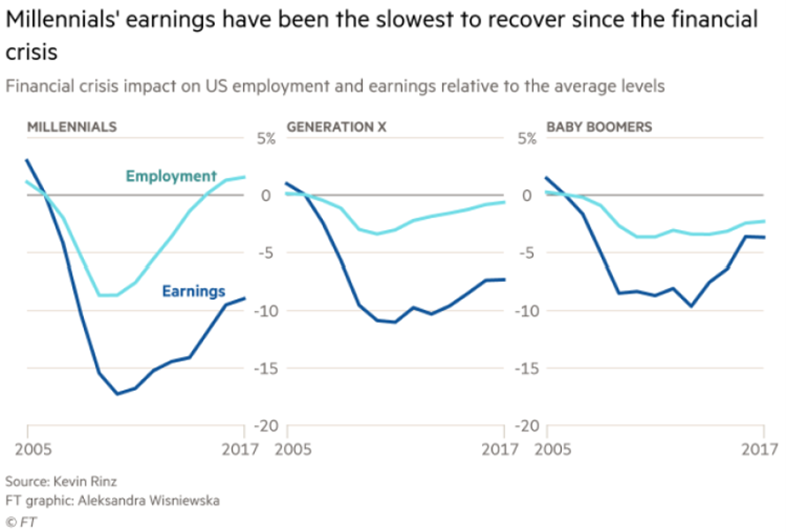

between the young and all working-age adults—roughly 15 percentage points—was the widest in recorded history. For those ages 16 to 24, the unemployment rate surged by nearly 8 percentage points between the fall of 2007 and the fall of 2009, reaching a high of 19%. For other age brackets, unemployment at this time rose slightly over 5%. Further, young adults employed full-time experienced a greater drop in weekly earnings (down 6%) than any other age group over the four-year time span.

Millennials were searching for employment after high school or college graduation immediately in the wake of the financial crisis. To add to that, they graduated with a mountain of student loans the size of which their parents’ generation never had.

Four years after 2008, among all 18- to 34-year-olds (Millennials), 49% stated they took a job they didn’t want just to pay the bills, with 24% saying they had taken an unpaid job to gain work experience. More than one-third (35%) stated that, as a result of the poor economy, they had gone back to school, 31% had postponed either getting married or having a baby, and 24% stated they had moved back in with their parents after living on their own. Millennials have also had to cope with having the slowest earnings recovery since the financial crisis.

How are Millennials Surviving the Pandemic?

Due to the 2008 recession, Millennials have found it more difficult to launch their careers and achieve financial independence, and as a result, they have less wealth than predecessor generations had at the same age; about one-quarter of millennial households have more debt than assets. The upshot is that they aren’t as prepared for economic upheaval because they haven’t had an environment in which to build up their assets, hence they entered the pandemic in a weaker position.

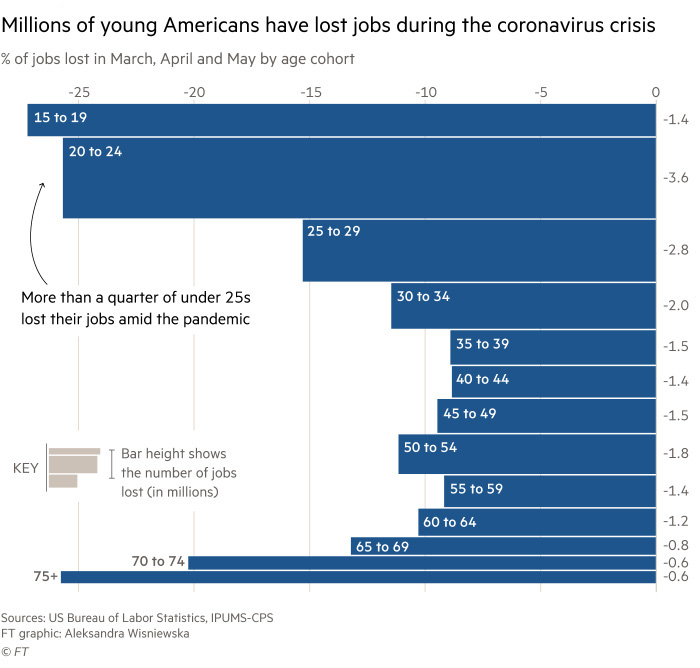

Unfortunately, Millennials have been harder hit than older generations during the pandemic and have lost more jobs than other generations.

Upsolve, a nonprofit, app-based platform that helps people who can’t afford the legal fees to file for bankruptcy, stated 40% of the people citing job loss as the reason for a bankruptcy filing, said the pandemic was the tipping point — and the average age of users is 39. “All the millennials we help have less than $10,000 in assets,” a representative said. For the most part, “They’re renting their homes, and they’re living paycheck to paycheck.” According to the St. Louis Fed, one in six millennials were unable to cover a $400 emergency expense before the start of the pandemic.

Exposure to economic turmoil twice in the early part of your career can have negative long-term effects on people’s financial health and long-term prospects. Demographers posit that financial instability has prompted millennials to cohabit instead of getting married, and delay childbearing or forego it altogether. Millennials contributed to the decrease in the marriage rate to its lowest level in 2018 coupled with the all-time lowest level fertility rate the following year. As of 2016, millennials had wealth levels 34% below where they would most likely have been if the financial crisis hadn’t occurred, the report found.

The Millennials’ situation is comparable to the experiences of the G.I. Generation (born between 1901-1924) who were first hit by the Spanish Flu pandemic (1918), then the 1929 stock market crash followed by the Great Depression. That generation regained economic footing later in life with the availability of increased educational opportunities and the post-World War II economy.

The Stats and The Strategy – and maybe some good news!

So here is a bit of good news for Millennials. The percentage of young adults with bachelor’s degrees or higher has steadily climbed since 1968, and millennials have the greatest percentage of bachelor’s degrees by generation (39%) as compared to 29% for Gen X and 25% for Baby Boomers. :

Although Millennials have less wealth than Baby Boomers at the same age, they are keeping pace with Gen Xers. Millennials with a bachelor’s degree or more and a full-time job had median annual earnings valued at $56,000 in 2018, roughly equal to those of college-educated Generation X workers in 2001 (comparable period). However, for Millennials with some college or less, annual earnings were lower than their counterparts in prior generations.

Other positive news according to the Wall Street Journal is that Millennials reached a milestone in July 2019 and made up 38% of home buyers. Older Millennials have delayed home buying and marry later than previous generations in order to build up resources. With very low-interest rates now, many Millennials are now ready to take the plunge into homeownership. https://www.wsj.com/articles/millennials-help-power-this-years-housing-market-rebound-11598520601

However, more than 70% of Millennials have one source of long-term debt and 30% have multiple sources of debt. They tend to have greater outstanding student debt than other generations, and the amount they owe is greater. This results in fragile money management and according to the National Endowment for Financial Education (NEFE), 1 in 4 have overdrawn their checking accounts in the past year and 23% have taken a hardship withdrawal from a retirement account.

A recent report by the National Institute on Retirement Security found that 66% of Millennials in the workforce have nothing put away for their retirement, citing high unemployment after the 2008-2009 recession as well as stagnant wages. Source: However, those who do have retirement accounts are more conservative in their strategy preferring cash as an investment choice (this leaves little opportunity for long-term growth).

In 2014, UBS found that millennials were the most financially conservative generation since the Great Depression and dedicate 52% of their investment portfolios to cash compared to 23% cash for other investors. UBS also found that “Millennials are more likely to believe that working hard (69%) and living frugally (45%) puts you on a path to success rather than long-term investing.” https://www.businessinsider.com/millennials-financially-conservative-generation-2014-1

A few tips…

So, the good news is that Millennials believe in hard work and frugal living, but their conservative bent will prevent them from growing assets over time. Here are some tips for Millennials to consider for their personal finance strategy:

- Debt: Investing while you are carrying debt is a challenge. It is best to eliminate credit card debt before investing. With respect to student loans, you can refinance at a lower rate and pay them off with an aggressive plan. With no credit card debt and an aggressive student loan pay off strategy, engage in strategic investing.

- Income: Consider the long-term prospects of career choices and honestly evaluate what your desired lifestyle requires in income generation. It is important to enjoy your profession and have a balance in life as well as financial security, so be intentional in your choices and strategy.

- Budget: Have a good handle on your expenses and what discretionary expenses are unnecessary. Prepare a budget and set up automated savings and investment deposits.

- Emergency Fund: Have 4-6 months of emergency savings to keep you afloat through unexpected life turmoil, like a pandemic!

- Retirement Funding: If you work and have a 401(K) it is very important that you max out on your contribution regardless of how young you are. The sooner you do so the more compounded growth can occur. Not thinking about retirement savings as early as possible can have long-term deleterious effects on your financial situation in retirement and when you are ready to retire it is too late to do anything about it if you aren’t prepared. It is not prudent to rely on Social Security payments to fund retirement.

- Invest: Keeping large cash balances as savings as a long-term strategy will not allow you to keep pace with inflation and successfully provide for your retirement needs. The best way to build assets is to set up automated deposits to invest monthly. Diversified index funds are a good entry strategy with less risk. If you prefer a managed portfolio, I recommend finding a fiduciary financial advisor to assist you with financial planning and constructing a suitable portfolio. It is risky to create your own portfolio without guidance and a holistic approach. Financial planning is an invaluable tool to give you clarity in your long-term strategy and to help you achieve your goals over your lifetime.

With intentional planning, saving, debt eradication, and investing, Millennials can overcome the aftermath of the extraordinary economic events that happened during the crucial early years of their professional lives and the effects of the current pandemic. It may not be easy, but it will be worth it because striving for a secure financial future is the key to peace of mind and living in dignity in retirement!

Sources:

https://www.census.gov/newsroom/press-releases/2015/cb15-113.html

https://www.investopedia.com/insights/how-financial-crisis-affected-millennials/

https://www.wsj.com/articles/millennials-covid-financial-crisis-fall-behind-jobless-11596811470

https://www.nbcnews.com/business/business-news/millennials-had-barely-recovered-great-recession-then-came-pandemic-n1232488

https://www.businessinsider.com/how-the-great-recession-affected-millennials-2019-8#it-put-older-millennials-at-risk-of-becoming-a-lost-generation-in-terms-of-wealth-accumulation-2