With our busy schedules and juggling so many responsibilities, we often make some significant personal decisions that can have financial consequences that we fail to carefully consider. We can protect ourselves from unanticipated twists and turns in situations with some forethought and planning.

What are some of these unseen risks?

In the tapestry of life, we regularly make decisions as to who we live with whether it is a significant other or a roommate, whether we commingle our assets with our spouses, and how we establish our credit, whether jointly or independently. These decisions are wrapped up in personal relationships and the hidden risks, though not patently obvious, should be considered. As always, an honest, open, and practical approach is the best strategy to be fulfilled personally and to protect your individual financial status.

Let’s get into a few examples.

Cohabitation

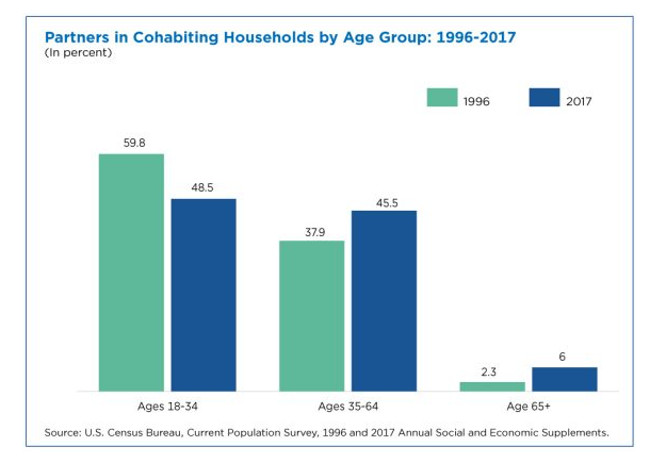

Over the years marriage rates have declined, and the percentage of U.S. adults who cohabitate with an unmarried partner has risen, according to a Pew Research Center Study. The U.S. Census Bureau cited in 2019 that the number of unmarried partners living together in the United States nearly tripled in two decades from 6 million to 17 million, which is 7% of the total adult population. The demographics of cohabiters have also evolved with a significant increase in cohabitation among older adults as divorce rates have risen.

Currently, a larger share of adults has cohabited than has been married. Pew Research reports that among adults 18 to 44, 59% have lived with an unmarried partner at some point, while only 50% have ever been married, and 38% of the cohabiters have had 2 or more partners over the course of their life. Further, according to Pew, more than half of cohabiting adults have children living in the household with them.

Whether it’s you, your daughter or son, a brother or a sister, a parent, or a friend, it is likely that somebody in your orbit is living with, or has lived with, a significant other without being married. This is no longer just an issue for younger people.

So, what’s the big deal? Plain and simple, whether you choose to cohabitate because of love, a step toward marriage, convenience or finances, it is probable that over time, assets and money may be commingled, intentionally or unintentionally, and individuals may unintentionally acquire or relinquish certain rights because of their cohabitation with their partner.

Unlike married couples, property rights for unmarried couples are not afforded similar legal protections. Currently, only a small number of states permit couples to get married through common law marriage, and the requirements for doing so are much more stringent than just living together. Hence most couples living together are not deemed to be common law married and don’t have the legal protections of a married couple.

Given that, if you are intending to live with someone for more than a short -time, it is in your best interest to have a cohabitation agreement that spells out who owns what and how it would be distributed, support payments and estate planning issues, if the couple parts company. The agreement can also address issues while living together such as who is responsible for which monthly expenses, how much you will each contribute to monthly expenses, etc. Basically, a cohabitation agreement is a written contract between two people that are not married which is designed to address the variety of personal, financial, and family issues you and your partner may face in the event of an emergency or a breakup. If couples do get married after living together, the cohabitation agreement will be a basis for a prenuptial agreement, which is always recommended.

Right about now, you are saying this is the most unromantic thing to do, and why upset the apple cart and discuss this with my partner?? Because even with the best of intentions, things can change in a relationship, and it is better to create a fair agreement at the outset without pressure to address what happens if the relationship breaks down. It will save you a lot of emotional and financial heartache in the future if something comes to pass. Being practical doesn’t mean you aren’t romantic – in fact, I would argue that it shows you have greater confidence and trust in your relationship by addressing the issues early on. If you are fearful to discuss this with your partner, it probably isn’t much of a solid relationship anyway.

What should be included in the Cohabitation Agreement

Most agreements include:

- How specific assets are owned

- Whether or not, and how, income and expenses are shared

- How newly acquired assets are owned

- How bank accounts, credit cards, insurance policies, etc. will be managed

- How specific assets will be distributed in the event of a separation, or what process will be used for resolving disputes of property rights

- If you buy a house together address “how” the ownership is listed on the deed, whether as joint tenants or tenants-in-common, how much of the house each partner owns, buyout rights and how the house will be appraised, and who stays in the house if there is a breakup.

- Liability for debts – unmarried partners are not responsible for each other’s debt unless they have a joint account or are a cosigner or guarantor which is different from married couples that can be held liable for marital debts.

- Support payments after the breakup for one of the partners.

- Surviving Partners – if one of the partners dies the surviving partner has no rights to the deceased partner’s individual property unless left to the surviving partner by a will or trust of the deceased partner. You can also include medical directives and powers of attorney.

Roommates

If you have roommates, you often share all kinds of things. When you rent an apartment or a home, you will be required to have renter’s insurance. Unlike immediate family members living together, roommates are not automatically covered on renter’s insurance policies unless they are actually listed on the policy. The following are a few pointers about renter’s insurance:

- A roommate does not have to be on the lease to be added to the policy.

- A maximum of two unrelated people can be on a single policy, so additional roommates will need to buy a separate policy.

- There’s no extra charge to add a roommate, and it won’t change your premium either. You may want to increase your coverage if you have a lot of valuables, but you’ll still probably pay less than you would alone since you get to split the cost.

- Theft by a roommate—or intentional damage—is not covered by insurance, whether they’re on the policy or not. Be judicious in your choice or roommates.

- Since you are sharing the coverage with your roommate, all claim checks will be payable to both of you, and either person can change or cancel the policy. Again, sharing coverage is something you do only with someone you know and trust.

Credit – Being credit-wise

Once you commingle debt with a spouse, it is almost impossible to de-mingle it! Even if you get divorced, a creditor will not recognize the court’s assignment of debt responsibility because lenders are not bound by your divorce agreement because they are not a party to it. That means just because you and your soon-to-be ex-spouse agree that one of you will pay the Visa while the other pays the MasterCard, it means nothing to the lender. If credit cards are held jointly, then whether you are divorced or not, the lender can come after you for repayment.

Maintaining separate credit when you’re married has nothing to do with trust, whether you love the person, whether you think the marriage will last, or whether you are cold-hearted – it is just practical. Beware though, in the few community property states (Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Washington, Wisconsin, and Texas), you will both be liable for credit card debt even if only one of you applied for the card. Community property states believe that you both probably benefitted from the debt, hence you should both be liable. If you live in a community property state, my recommendation is to review credit card bills monthly and monitor charges incurred by both parties so at least you know where you stand debt wise. Don’t delegate payment to your partner and have no knowledge of balances.

Bad credit will follow you and have many detrimental ripple effects in your life, so do not feel uncomfortable having separate credit from your spouse, or, monitoring it closely if you live in a community property state.

What about commingling assets? What is it and how does it affect me?

This concept applies to marital property and can be a complex topic. That said, it can be managed with some planning and strategy, which will benefit each spouse in the event of divorce. Best to discuss this and plan for this before you get married. It will pave the way for future harmony and if you were to get divorced, it will save you both time, money, and lots of stress.

Before you get married, the property you own is considered separate property. If you had $20,000 before you got married then that amount qualifies as separate property unless you commingle it with marital property later (for example, by putting that money in a joint account with your spouse). Another example is if you owned a home before you got married, moved into it with your new spouse, and both of you paid the mortgage moving forward, it would no longer be just separate property. Your new spouse will then have an interest in it should the two of you divorce in the future and your house is now considered commingled property.

Here are a few examples of how funds get commingled:

- You inherit money and deposit the inheritance into a joint account you share with your spouse, those funds will become marital property.

- You owned a home before your marriage and the rest of the mortgage is paid for using funds from a joint bank account, the home will become marital property.

- You and your spouse combine your resources during your marriage to buy a car, television, home, or any other type of property, that property will become marital property.

- You have an investment account or start one that both you and your spouse’s incomes contribute to, the funds in the account will be considered marital property.

- You have a checking or savings account that both you and your spouse are depositing funds into, those funds will be considered marital property.

- You borrowed money from family and used it to benefit you and your spouse, those funds would become marital property. In cases where money is owed, at the time of the divorce, it would be the responsibility of both spouses to repay it.

To avoid the hassle of dividing marital property during a divorce, it is optimal to keep property separate that you would like to continue being legally yours, and yours alone.

How can you do this? Here are a few suggestions to avoid commingling:

- One of the easiest ways to go about keeping separate property from commingling and becoming marital property is to set up a prenuptial agreement in which it is plainly stated which property will be considered marital property and which will remain separate.

- Never use your separate property to pay off marital debts. If your parents were to give you a large sum of money as a gift, for example, do not use it to pay off your home or to pay for a credit card debt. When a marriage benefits from funds, those funds become marital property.

- If you own property prior to your marriage, keep your name alone on the deed, and, if that separate property requires maintenance, only use your income to fund it. You should also keep strict records to prove that your spouse did not contribute to its maintenance.

- Before making a large purchase, such as a home or a car, consider discussing if it should be marital property or separate property. If you want to have an equal interest in it, use marital funds to purchase it.

- If you want any property purchases to remain separate, only use funds that are considered separate property to buy them and keep records about the funds used to make the purchases.

Here’s my take…

I know this may all sound very draconian, calculated, and very unromantic. But I don’t agree with that assessment at all! Almost half (48%) of Americans who are married or cohabitate say they argue with the other person over money, according to a survey by The Cashlorette. Two studies by TD Ameritrade found that 41% of divorced Gen Xers and 29% of Boomers say they ended their marriage due to disagreements about money. According to a study of 4500 couples published in the journal Family Relationships, if you are arguing about money early on in your relationship, watch out: That may be the number one predictor of whether or not you’ll end up divorced. The stats bear out the fact that being transparent, honest, and direct with your partner about finances increases the probable longevity and success of your relationship!

Of course, it is difficult to talk about money, but why not plan a weekend trip with the intent of addressing finances in a relaxed setting, or plan a dinner with that in mind. Understand that open communication about money is essential to a healthy relationship and get creative in finding ways to discuss it in a neutral and relaxed environment. You will have a better relationship for it and eliminate a boatload of possible problems down the line when you may not be in the best mental state to deal with it…