What is the She-Cession?

The coronavirus pandemic has caused people throughout the country to suffer financially due to job losses. The Bureau of Labor Statistics shows that unemployment has risen more acutely for American women than men with an even bleaker picture for women of color. The Covid-19 crisis has highlighted the consequences of gender and racial inequities in the workforce, with women being particularly vulnerable on several fronts to the pandemic’s aftermath. Betsey Stevenson, a former chief economist at the U.S. Labor Department, said: “This pandemic has exposed some weaknesses in American society that were always there, and one of them is the incomplete transition of women into truly equal roles in the labor market.” C. Nicole Mason, president and chief executive of the Institute for Women’s Policy Research, said: “I think we should go ahead and call this a ‘shecession’”.

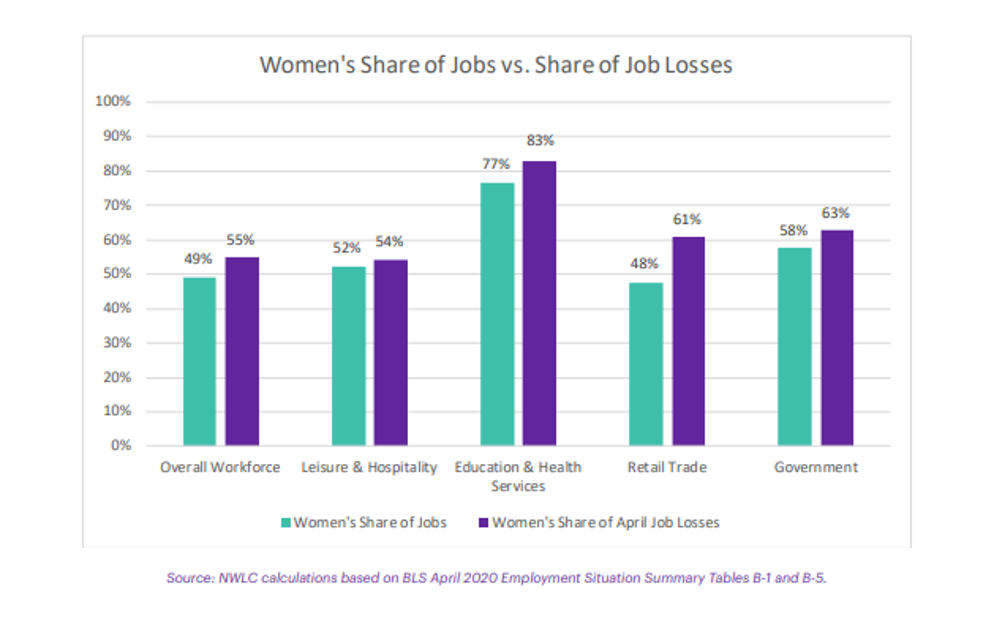

In the massive April job loss numbers, women accounted for 55% of the job losses and yet represented only 49% of the overall workforce. The unemployment rate for men aged 16 years and older was 13.3% in April compared to an unemployment rate of 15.7% for women during the same period. April’s job losses erased a decade of job gains for women.

Some recent historical context to consider.

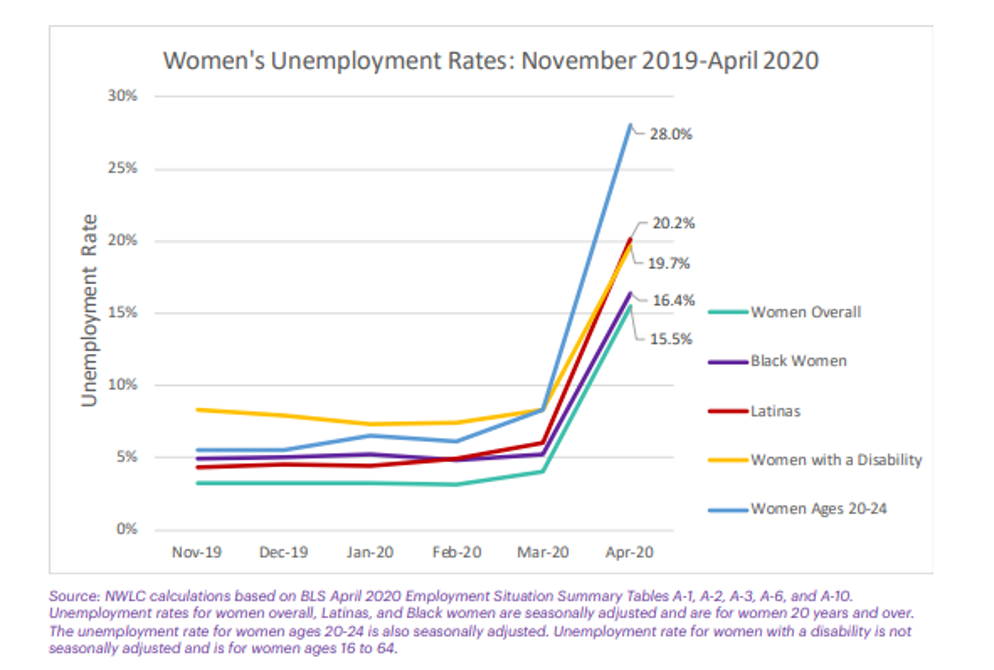

From the end of the Great Recession in July 2010 to the beginning of the Covid-19 crisis in February 2020, women gained 11.1 million jobs, and in April, 100% of those gains were wiped out. For the same period, men gained 10.8 million jobs and saw 85% of those gains wiped out. Women of color were especially hit hard by the pandemic’s job losses. The unemployment rate increased by 16.4% for Black women, and 20.2% for Latina women. Younger women between the ages of 20 and 24 experienced unemployment rates reaching 28% compared to 24% for men in the same age group.

Women have never experienced an unemployment rate in the double digits since the Bureau of Labor Statistics began reporting data by gender in 1948 until now.

In January 2020 before the Covid-19 pandemic, according to The Washington Post, “For just the second time, women outnumbered men in the U.S. paid workforce, with their new majority buoyed by fast job growth in health care and education over the past year, as well as the tight labor market.” Women garnered 50.04% of payroll jobs in December 2019, up from 49.99% the prior month which equated to 139,000 jobs out of 145,000 jobs picked up totally in December.

Why did women’s employment get hit so hard by the pandemic?

The short answer: most jobs lost due to the pandemic were in industry sectors where women’s participation is concentrated such as hospitality and leisure, education, health services, retail, and government. In the hospitality and leisure sector (bars, restaurants, hotels), women accounted for 54% of the job losses even though they made up only 52% of that sector’s workforce. In the education and health services sectors (teachers and nurses), women accounted for 83% of the job losses while making up 77% of that sector’s workforce. Government employment declined substantially driven by losses in education jobs in the local and state government, with women losing 63% of those jobs, despite representing 58% of the workforce.

Gender Pay Inequality

To add to this, women continue to struggle with gender pay inequality and carrying the outsized share of the domestic responsibilities of childcare, homeschooling, and housework.

In 2020, women earn 81 cents for every one dollar earned by a man – hence, an average women’s annual salary is 81% of the average man’s salary. Although women have been the majority of college-educated adults for almost four decades and women’s representation of the college-educated workforce has expanded, they still continue to earn less than men. According to a 2018 Census Bureau report, “the average worker, between ages 25 and 64, earned $41,900 in 2017, compared to a worker with at least a bachelor’s degree who earned $61,300. When specifically comparing gender pay differences, the earnings vary greatly between men and women. The median income of a man with a college degree is $74,900. A college-educated woman, on the other hand, will earn just $51,600.”

Outsized Share of Domestic Responsibilities

Recent economic research indicates that among married couples who work full time, women provide 70% of childcare during standard working hours, which has been exacerbated by the closing of schools and daycare, and cleaning and babysitting services being curtailed. A Boston Consulting Group report states “that parents in the United States have nearly doubled the time they were spending on education and household tasks before the coronavirus outbreak, to 59 hours per week from 30, with mothers spending 15 hours more on average than fathers. Even before the pandemic, women with children were more likely than men to be worried about their performance reviews at work and their mental well-being and to be sleeping fewer hours.”

And as work begins to open up, it is more likely that women will work less or step away from the workforce because they have childcare responsibilities due to continuing school and daycare closures or there is no job for them to return to because the sectors they were working in have a slow ramp-up in employment due to coronavirus restraints. For single mothers, the pressure is especially intense now with many contending with lay-offs, childcare, and worrying about what happens to them and their children after unemployment benefits stop.

Detrimental effects of temporary or long-term absences from the workforce

The ramifications of leaving the workforce for an extended time period are not insignificant and have long-term deleterious effects on the financial well-being of the woman doing so. Women will not only relinquish any retirement savings opportunities they may have had by continuing to contribute to 401(K)s but their social security benefits will be reduced as benefits are calculated on the highest years of earnings and if a woman hasn’t been in the workforce that long, zero earnings will be substituted in non-working years reducing her ultimate Social Security payout.

Also, re-entering the workforce becomes more difficult the longer someone is out of it. Pre-COVID 19 women were making strides in joining the workforce over the past few years, and that was primarily because of a historically tight labor market – unemployment was low and companies needed employees, and they invested in broader recruiting efforts and diverse talent. Unfortunately, during high unemployment periods, diversity and inclusion are disposable. Joanne Lipman points out in her op-ed on CNBC, “the “disproportionate negative effect” on women’s employment is “likely to be persistent,” and workers who lose jobs are “likely to have less secure employment in the future,” according to a new working paper from researchers at Northwestern University, the University of California San Diego and the University of Mannheim.”

What can be done to contain the damage to women’s livelihoods?

The gains that were made pre-COVID 19 with women making up the majority of the entire U.S. workforce are now threatened. Women are an important segment of the workforce and contribute substantially to the growth of our economy and the well-being of the country. Further, capitalism and opportunity aren’t reserved for men…women enjoy being productive, self-sufficient, independent, and successful too!

We need to have a serious conversation about the gender wage-gap, subsidized childcare, flexibility in the workplace and why having a diverse workplace is just good business sense. A study discussed in a recent Fortune magazine article, states that workplace equity isn’t only the right thing to do, it is better for business. Great Place to Work has documented that inclusive organizations have more than three times the revenue growth of less inclusive workplaces. Fortune’s analysis also cited that while stock prices declined 35.5% between 2007 and 2009 (The Great Recession), companies that were most diverse posted a 14.4% gain in stock prices. Companies should conduct gender wage-gap analyses and we should invest in companies that support families and are working towards equal gender representation.

Congress provided some help to families in the stimulus bill, but we need more permanent measures for assistance with childcare, especially for single moms who make up the majority of single-parent households. In the U.S., couples spend almost 26% of their income on childcare costs, and the number skyrockets to almost 53% for single parents according to a report from the Organisation for Economic Co-operation and Development. Currently in the U.S. most childcare is privately operated as for-profits or nonprofits, and some childcare is operated by the public sector, such as the Head Start program. But this mixed bag means that the type of childcare received depends heavily on where you live and your socioeconomic status. We need to level the playing field with this for the sake of mothers and families.

Also, we need to institute paid maternity or family leave across all industries along with paid sick leave.

At this time, when people are working remotely, perhaps it is time to acknowledge that flexibility and working from home are possible. Let’s learn from the pandemic and its effects on women’s employment. Now is the time to realize that diversity in the workforce, gender pay equality, family leave, and childcare provisions, are not optional, they are essential and they are not only good for women but for families and the overall.