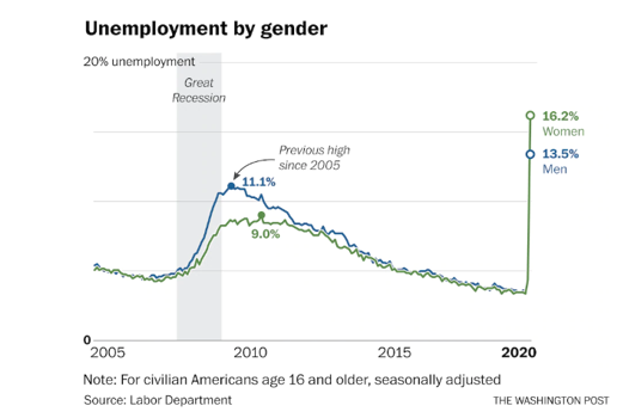

We are all aware that Covid-19 caused unprecedented unemployment for all people due to the shutdown and the economy is struggling to make a comeback. As I discussed in a prior blog on The She-cession, unfortunately, women suffered more acutely from unemployment than men. To recap, in April, women accounted for 55% of the job losses and yet represented only 49% of the overall workforce. The unemployment rate for men aged 16 years and older was 13.3% in April compared to an unemployment rate of 15.7% for women during the same period. April’s job losses erased a decade of job gains for women. (National Women’s Law Center, May 2020)

Even with employment improving in May and June, the net effect is that even accounting for the gains, women continue to be hit hardest by job losses. According to Pew Research, the official reported rate of unemployment may be greater for women than stated with the unemployment rate in May actually being 17.8% instead of the reported 14.3%. (pewresearch.org)

What about the stimulus package and the CARES Act? Didn’t they help?

The stimulus package granted assistance through stimulus checks and increased unemployment insurance as a stop-gap measure for the unemployed to survive during the initial shut down. The federal government also provided $600 billion in financial assistance through the Paycheck Protection Program (PPP) under the Coronavirus Aid Relief and Economic Security (CARES) Act.

However, the Small Business Administration did not provide guidance to lenders who would be distributing the funds under the Act to prioritize borrowers in underserved markets such as women-owned businesses and minority businesses. Hence, it was less effective than it could have been because it did not address how the pandemic harmed women and minorities more than others.

Not so much…

According to a CBS news report, up to 90% of minority and women, small business owners may be denied a PPP loan because banks are favoring pre-existing customers. In 2018, the average size loan for women-owned businesses was 31% less than the average size loan for male-owned businesses, reports online credit marketplace Biz2Credit which indicates that there is gender inequality in the lending market generally.

According to a CNBC report, nearly 1 in 5 loan applications from women-owned businesses in 2018 were in services (19.7%), retail (18.2%), accommodation and food services (14.3%), health care and social assistance (7.6%) and construction (6.4%). These are exactly the businesses hit hardest by the coronavirus shut down that need help now. Without it, all the progress made by these women-owned businesses will evaporate because they won’t survive if they don’t get loans. Women as business owners and employees are overrepresented in retail, restaurants, health care, childcare, and other service industries. They are absolutely on the frontlines of this pandemic.

We cannot have a gender-blind approach to fiscal stimulus because it results in an inefficient allocation of resources and exacerbates existing inequities for women.

And then there is the other issue…. The Invisible Labor Issue

That would be the childcare and care for elderly family members coupled with domestic work issues! You know, the work nobody pays you to do!

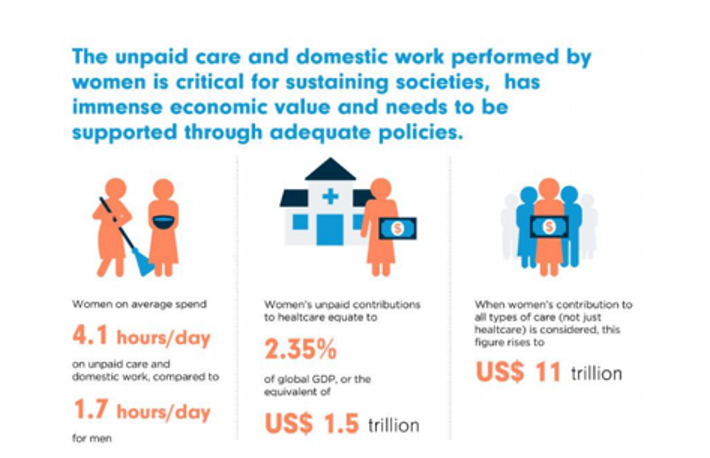

- Fact: Before COVID 19 women were doing 3 times as much unpaid care and domestic work as men and they provide 70% of childcare during standard working hours (nytimes.com). This unseen economy has a real impact on the formal economy and women’s lives. This is unpaid work. The Covid-19 pandemic has highlighted that the maintenance of our daily lives is built on the invisible, unpaid labor of women. Increased demand for childcare and care of elderly family members is deepening the already existing inequalities in the gender division of labor.

Policy Brief: The Impact of Covid-19 on Women, April 9, 2020, United Nations

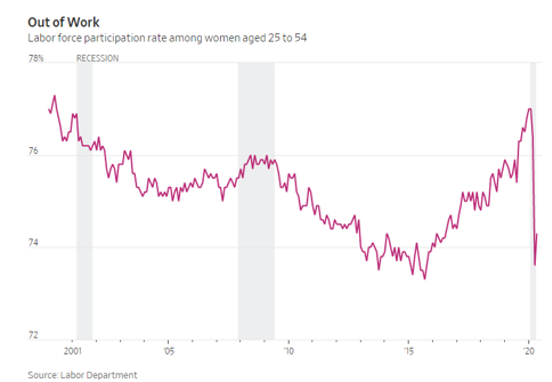

If we don’t help women with childcare and elderly care issues, they will work less or step away from the workforce due to these responsibilities, and this will have a detrimental financial effect on them, their children, and the economy in general.

How can we fix this infinite loop of inequality with the Covid-19 response?

Women’s unpaid care and domestic work is a recognized driver of inequality. According to a UN Report, “It has a direct link to wage inequality, lower-income, poorer education outcomes, and physical and mental health stressors. The unpaid and invisible labor in this sector has been exacerbated exponentially by the COVID-19 pandemic.”

The pandemic has made it crystal clear that the daily functioning of families, communities, and the formal economy is dependent on women’s invisible work. Their unpaid work is not “infinitely elastic”. We cannot continue to stretch women’s capacity to patch up the holes in providing childcare and domestic work.

We need immediate steps to ensure that the effects of Covid-19 do NOT reverse the progress women have achieved in labor force participation. How government policies and investments are formulated matter. For example, after the 2008 financial crisis, support measures were directed towards large infrastructure projects that employ men while jobs were cut in teaching, nursing and public services, all women-intensive industries.

What type of measures???

Gender Budgeting with Economic Policy and Initiatives. Mitigating the damage from Covid-19 without a gender lens dilutes the efficacy of the action. We cannot prosper as an economy if half of the population is ignored and treated inequitably. According to a Pipeline report, we could unlock $12 trillion in economic gains by closing the gender equity gap. How do we place gender as the center of fiscal policy creation:

- Create a women’s budget. Gender-disaggregate all economic data. When data is collected, disaggregate the information based on gender. Iceland, the Netherlands, Canada, and Mexico have already done this. Consider the impact (NY Times): “In 2015, Iceland abandoned a legislative proposal to simplify the income tax system after a gender analysis revealed it would have inadvertently widened the income gap. In Mexico, gender budgeting has resulted in funding targeted toward diseases affecting women, like cervical, ovarian, and breast cancer.”

- Use a gender lens to craft relief programs. Let the gender-disaggregated data guide the policy creation.

- Focus on the quantity of jobs available by gender including underemployment.

- Focus on the quality of work, wages, and social protections.

- Focus on the most vulnerable employees, namely women.

Targeted economic stimulus packages that focus on women.

- Subsidize childcare costs through wages or other government subsidy transfers or vouchers so that women can have adequate childcare to be able to work effectively without being stretched beyond belief. This is good for families and the economy.

- Targeted support for women-owned enterprises.

- Improved education and training opportunities for women would facilitate the shift from precarious jobs to more stable and better-protected employment.

What can we do personally to move ahead?

We all have different circumstances and demands on us but each of us needs to continue to fight the good fight to improve our individual circumstances. Educate yourself on policies that can help women get ahead and support them with your vote or participation in the effort. Try to advocate for policies in your workplace that allow women more flexibility in their work schedule or work from home. If you have a partner, try to establish some gender equity in the home with respect to the care and domestic duties, I.e., share them! Don’t be silent.

According to Rachel Vogelstein, of the Council on Foreign Relations, as of 2018, ”we have a strong body of evidence that shows that women’s participation in the economy is critical because when women are able to fulfill their economic potential, GDP goes up and poverty goes down.”

My take…

We have more work to do clearly on many fronts, but women’s equitable participation in the workforce can only benefit the economy and we must continue to raise awareness on the issues that confront them from the glass ceiling, to lending to women’s businesses, to education, to the funding of women-specific issues like childcare. We are all in this together, and it is up to us to spread the message…