Dear Valued Clients and Friends,

I have always done some sort of special Dividend Cafe devoted to the implications of the pending election in Presidential election years. The 2020 issue is most recent, and 2016 feels like ancient history. The 2012 and 2008 writings were at my past firm, so no archive exists, but if a tree falls in the forest and no one is there to hear it, it still falls.

In 2004 and 2000, I wasn’t yet doing this weekly writing, but I was talking to clients all the time about the state of the election. In a lot of ways, I miss those days. I do not remember anyone ever getting mad at me when I shared an opinion about this policy or shared a thought about that candidate. People were partisan, of course, and people had strong opinions, no doubt. But it was around fifteen years ago, it seems to me, when people’s partisan or political beliefs and aspirations became intensely connected to their portfolio aspirations and market predictions. That very unhealthy connection is, I suspect, directly correlated to the intensity of tribalization and polarization that has been a hallmark of American cultural and political life the last fifteen years.

So I tee up the 2024 special election issue of the Dividend Cafe with appropriate caveats: I am writing to reflect on what I believe may be, not what I want to be. I am writing as an objective observer of American politics who frankly finds most of it reprehensible, yet like the person driving by the car accident, keeps looking anyway. I suspect the majority of you know, but I will say it anyway: I was a Ronald Reagan fan at age five, began reading National Review magazine the same year, and have no reservations about identifying myself as a “movement conservative.” Now, if you think that tells you where I stand in American politics in 2024, it does not. If anyone cared what I personally thought, and they shouldn’t, I have buckets of critiques of both candidates in this year’s Presidential race. My opinions on all of that – the “prescriptive” side of my assessment – are available in all sorts of my own editorials, social media postings, and television appearances. This Dividend Cafe, however, is my attempt at the “descriptive” side. It involves subjective assessment, of course, and is not free of biases (“there is no neutrality” – my dad, Cornelius Van Til, Francis Schaeffer, and many others, quoting God). I do not promise you neutrality, but I do promise you objectivity and civility.

Hey, if it catches on, it might just feel like twenty years ago again, eh?

Let’s jump into a very special ELECTION ISSUE of the Dividend Cafe. And note that after every section I have provided a bold-faced bottom line for those who prefer Cliff Notes. I can hardly expect readers to love policy details in THIS year’s election! (see what I did there?)

|

Subscribe on |

Some history

I would like to start with some basic historical framework around the question of “how will a given election outcome impact my portfolio?” The answer for U.S. investors has mostly been, “not very much at all.” One could interpret what I am saying as, “he doesn’t believe policy matters” (I do), or “he doesn’t believe personnel matters” (I absolutely do), but in reality what I am saying is, “markets have historically gone up regardless of what political party is in office, because markets have historically followed corporate profits, and corporate profits tend to go higher in a free enterprise system with [mostly] skilled operators and managers driving business strategy and execution.

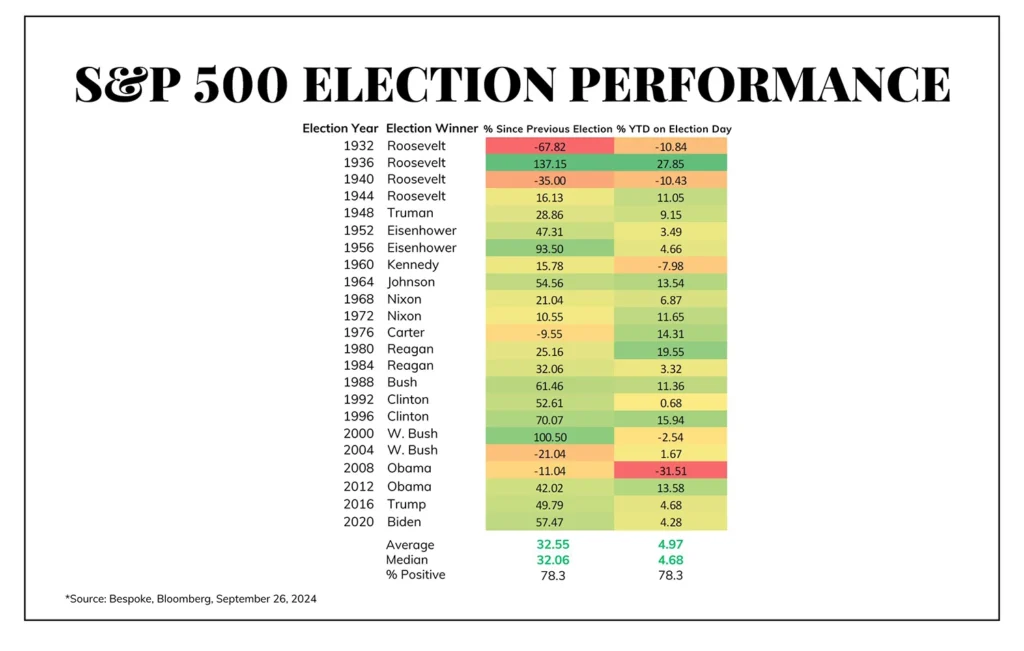

78% of the time a “four-year term” saw positive market results (since the Great Depression), with an average four-year return of 33%.

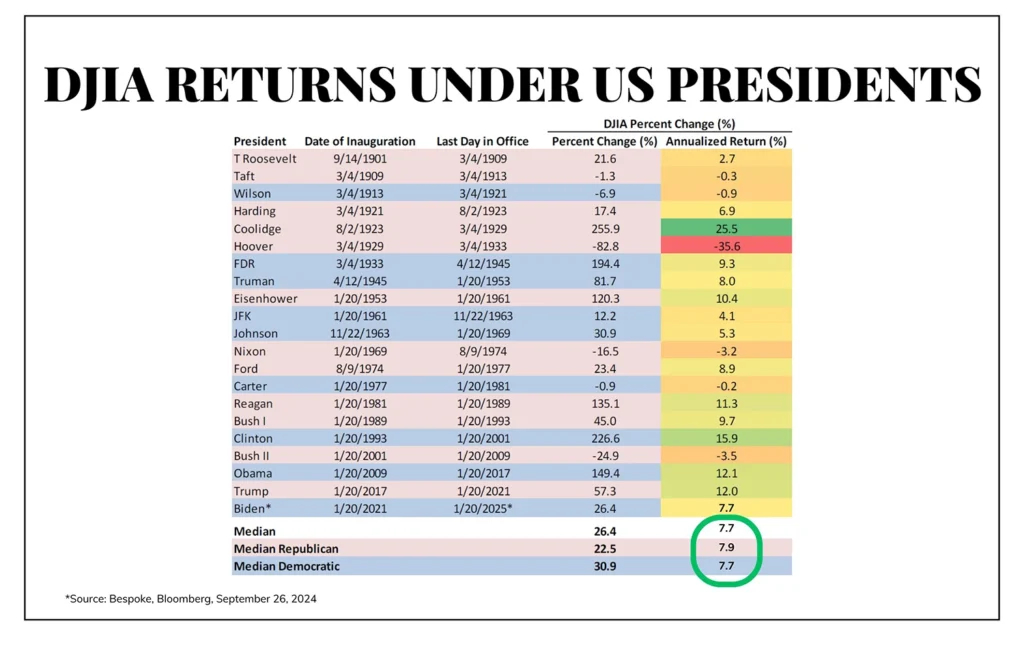

The “per year” return of the market is basically the exact same regardless of which party is in office, though the very dispersion of results makes it incontestable that something other than the party in office is driving returns.

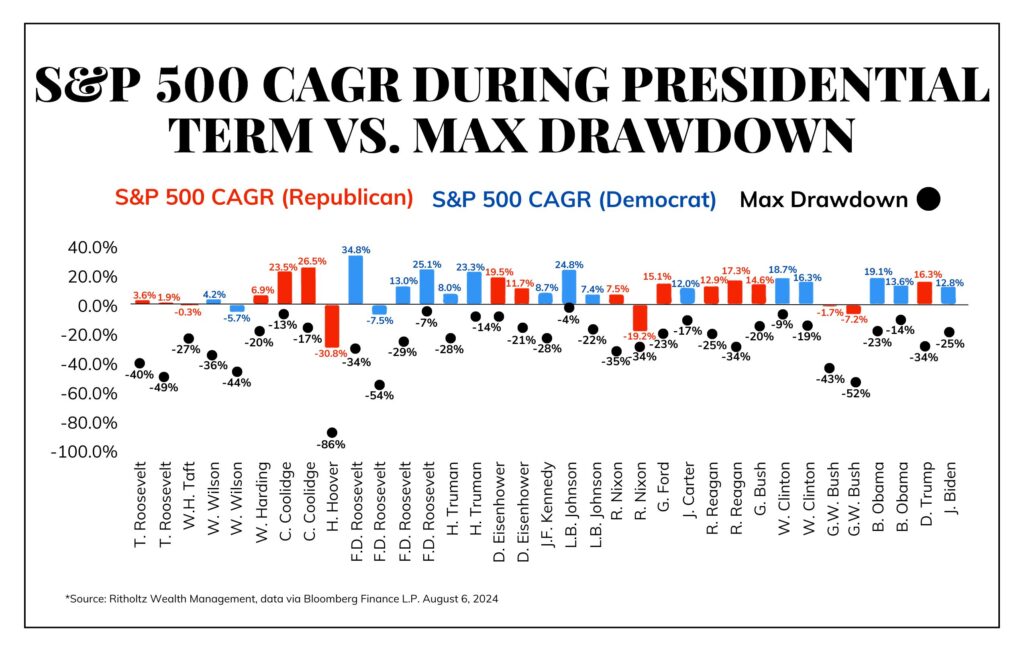

Seeing it all with drawdowns is useful, too:

Bottom line: There is no historical data indicating a special factor around partisan politics and stock market results

Gridlock is gold?

I have often written about markets fondness for “gridlock” – where the party with a majority in either the Senate or House of Representatives (or both) us different than the party of the President. For example, of all possible combinations (i.e. a Republican President, a Democrat President, Republican House, Democrat House, Republican Senate, Democrat Senate), by far, the best annualized return is when the Republicans control one chamber of Congress and a Democrat is in the White House (by a 3.6% per year spread over the average annual return). The percentage of time up goes from 70% to 75% in such a scenario, as well. Other combinations fo gridlock also yield a superior result, historically, but that particular combo has been smiled upon historically (in more recent decades think of the Clinton/Gingrich years and the Obama/Boehner years).

Since World War 2 there has only been ONE occurrence where there was a Republican President, a Democrat controlled Senate, and a Republican controlled House. That is not likely to change this time, as it would be highly unlikely for President Trump to win the White House, but the Republicans to not win the Senate seat in Montana. The opposite could very well happen, but the chances of a Trump White House with Democrat majority Senate are very low. Most other combinations have happened many times since World War 2. In fact, a Democrat President, Republican Senate, Republican House has happened five times and a Republican President, Republican Senate, Democrat House has happened four times.

You know what has NEVER happened? A Democrat President, Democrat House, Republican Senate. It has not happened once since World War 2 began. The odds of that scenario in 2024 are well above 0%.

Bottom line: A mixed result between one or both houses of Congress and the White House is very possible this year, and has historically been correlated to superlative results in the market

A Party Difference

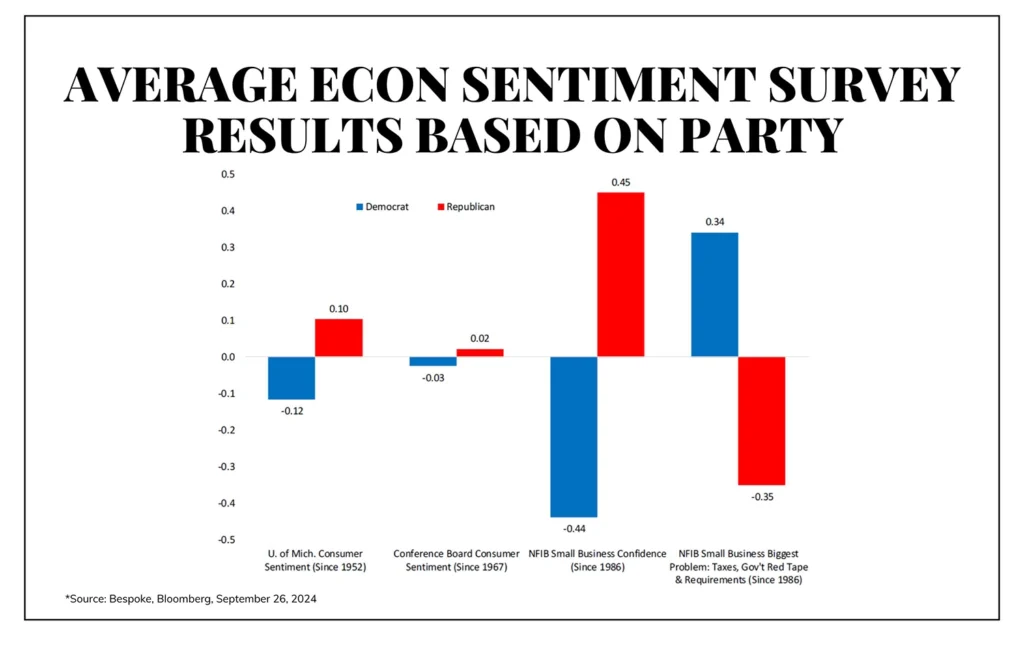

Noting that markets have generally performed the same on an annual basis regardless of who was President does not mean that business sentiment has been the same. Economic expectations in the small business community have generally been far more optimistic in Republican administrations than Democrat ones:

And yet, given what we have learned about the uniformity of market results under both parties, perhaps this simply tells us that sentiment at large is not a very good predictive indicator?

The primary issue in sentiment is the general feeling that the bully pulpit of the Presidency represents. There can, at times, be a delta between how public company CEO confidence looks compared to small business confidence. But tax policy and especially regulatory policy impact sentiment. When President Trump was elected in 2017, the sentiment indicators flew higher out of anticipation for deregulation (it happened) and especially corporate tax reduction (it happened). I expect this time there would be more mixed results as issues of infrastructure spending, crony deals, tax rates, and regulation are possibly different for big cap companies versus smaller businesses (way too complex and nuanced to unpack here).

Bottom line: Sentiment doesn’t correlate with market results, but there is reason to believe small business optimism would increase if faced with the promise of deregulation

Sector Significance

Energy was the worst-performing sector under Presidents Trump and President Obama. They had polar opposite policies around the subject but the same result in the stock market. Energy collapsed at the beginning of President Obama’s Presidency as the nation went through the Great Recession. It collapsed at the end of his Presidency as OPEC declared economic war on America’s shale industry. It collapsed at the end of President Trump’s Presidency as the world shut down in the COVID pandemic. In other words, those things that affect particular sectors at particular times most profoundly are not generally related to politics at all.

All that said:

I would expect a general disposition toward more green energy subsidies in a Harris administration, and more of a deregulatory/hold back the EPA disposition with Trump.

I would expect defense spending to be the same under BOTH Presidents, but market PERCEPTION to be that defense spending will be higher under Harris.

I would expect more attempts to involve the Federal government in negotiating drug prices with Harris. Health care has not been a subject Trump has shown a lot of zeal for in terms of policy specifics.

I would see some generally more favorable conditions for the Financial sector with a Trump administration than a Harris one, but really that is very marginal, at the most.

One of my favorite macro analysts (in fact, whose research is utilized throughout this very commentary you are reading now) has a take that goes something like this:

- The Industrial sector will do well if Kamala Harris wins due to the Inflation Reduction Act spending, trade with Mexico, and support for Ukraine.

- The Defense sector will do poorly if President Trump wins due to his intent to end all the wars.

Okay. Perhaps you read this and think it makes prima facie sense, and perhaps it does. But here is the problem:

- The Inflation Reduction Act (i.e., green spending) was passed into law a couple years ago, and its spending is already underway. Nothing about past support of that bill is pertinent to the future.

- Don’t global industrials do well if there is MORE capex, period, regardless of where the capex is being spent? In theory, higher capital expenditures across the economy is higher revenue for the industrials building, supplying, and producing. The Presidential politics could change the why/where/what of the capex and the Industrial beneficiaries, but there is not a real partisan identifier in how this is parsed out.

- Regarding #2 – unless there is. Maybe I am wrong. My point: It is not so easy or pedestrian, and it is all fallible.

- Regarding defense stocks, what if a President Trump doesn’t end those wars? What if the market has already priced it? What is a President ended one war but ramped up defense spending to prepare for another strategic initiative? Is anyone interested in betting that the Ukraine war is NOT over in 1-2 years and that there will NOT be additional spending in advance of preparation to deter China/help Taiwan? (in other words, I reckon those two things could both be very much on the table, at least potentially). All that to say, converting a headline “narrative” to an “investment thesis” is really, really hard to do.

- If one had tried to do with Energy under President Biden what has been suggested about Defense and Trump, they would have missed a 300% gain since he was elected in the S&P Energy sector. Go figure.

Bottom line: Associating sector exposure with what you think a candidate likes or doesn’t like, or even will do or not do, is not so easy, ignores contrary evidence, presupposes things that can’t be known, and is just not very easy to do.

The Taxes Question

A good portion of the 2017 tax bill signed into law by then-President Trump is set to expire at the end of 2025. Let’s get the simple part out of the way: If Trump wins the election and the Senate goes GOP (the latter is highly likely to be the case if the former happens), it is a virtual certainty that the portions of the 2017 tax bill set to sunset will be made permanent. This includes the modestly lower individual marginal income tax rates and the higher estate tax exclusion amount. Should Harris prevail, she has said she would seek to extend the marginal rates for those under 400k in income but allow the rates for the top brackets to sunset higher (to their pre-2017 levels).

Aside from sunsetting provisions of the 2017 tax bill, here are other elements of tax policy on the table:

- Trump has said he would push for the 21% corporate income rate to be lowered to 15% (but only for companies who satisfy certain domestic hiring policies – whatever that will mean). Harris has said she would push for the 21% corporate income rate to be increased to 28%.

- Trump has said he wants to repeal the SALT limit (the one he signed into law in 2017), whereas Harris has really not addressed her plans for SALT directly (I have to believe she favors repealing it, and Democrat Senate Majority Leader, Chuck Schumer, says it is his top priority – to repeal that limit – but I really cannot find anything where Harris directly states her policy intent on SALT).

- For those unfamiliar with this, SALT (“state and local taxes” paid) were previously deductible on a federal income return for those who itemize. The 2017 bill limited that deduction to $10,000. Those in high tax brackets in high tax states generally have significantly higher state tax bills, let alone property tax bills, than $10,000. Marginal rates went down in 2017, though, as did AMT (Alternative Minimum Tax) exposure, but netted against each other, virtually all high-bracket, high-state tax federal filers saw their total tax liability go higher.

- In a rare move for a strong low-tax supply-sider like me, I am in the rare position of very much favoring the SALT deduction LIMIT, despite the fact that it raised my personal income taxes dramatically. I would prefer the marginal rates were lower, but the SALT deduction itself strikes me as problematic, essentially causing low-tax state citizens to subsidize high-tax state citizens in terms of federal dollars. But that’s just my two cents

- Harris has said she wants a 4% tax on stock buybacks. It is hard to believe this would pass the Senate regardless of its exact composition.

- Harris wants a 28% tax on capital gains and dividends (vs. 20% for high earners now). However, she also wants to increase the so-called ObamaCare surtax on investment income from 3.8% to 5%, meaning the effective capital gains rate in this scenario would be 33%

- Harris wants to limit 1031 exchanges (that defer capital gains on real estate sales) to the first $500,000 of gains.

- Harris wants to extend the Section 195 deduction limit for a start-up business from $5,000 to $50,000

- Both candidates have said they want to see a $6,000 child tax credit, though with slightly different provisions in each plan on how it would work (and the Trump/Vance plan started at $5,000, but I have heard $6,000 thrown out since the Harris plan was released (“Do I hear 7? Is that an 8? Who bids 9? Is there a 9?”)

- Harris wants to provide a $25,000 tax credit to first-time homebuyers

- Trump has said he wants to eliminate taxes on Social Security income

- Trump has said he wants to eliminate taxes on overtime pay (details are thin)

- Both Trump and Harris have said they want to eliminate taxes on tips in the hospitality sector (details are thin)

- Harris has proposed a “wealth tax” on those with a net worth over $100 million, whereby they would pay 25% on income and unrealized capital gains if that number is higher than their normal income tax liability.

The non-partisan Tax Foundation has estimated Harris’s tax proposals would increase taxes by $2.2 trillion on corporations and $1.2 trillion on individuals over the next ten years. Adjusted for dynamic scoring, they see it increasing tax revenue by $642 billion over ten years. They estimate the aggregate tax proposals would reduce long-run GDP by 2%. Their assessment, though, assumes all of these policies are actually enacted, where the truth is that a Harris Presidency would not ensure any of these tax proposals become law, and certainly not all of them. That issue of majority approval from a bicameral legislature lingers.

The non-partisan Tax Foundation has estimated Trump’s tax policies would increase the deficit by $1.2 trillion over the next decade. Their scoring of the proposals relies on a lot of assumptions because a large portion of Trump tax proposals are in pretty embryonic form in the campaign, and assumptions about tariffs are all over the map. Oh, tariffs. That leads to the next issue (see next section) …

Bottom line: It is very hard to truly assess actual tax policy impact from either candidate because so much of what is being thrown out on the campaign trail is never, ever, ever going to become law. That said, it is extremely fair to say that, from the vantage point of investment tax considerations, corporate tax considerations, and high earner considerations, the philosophical bend and policy intentions of Candidate Trump are more favorable than those of Candidate Harris.

The Tariff Question

The elephant in the room around the economic agenda of a second Trump administration has to do with tariffs. Left alone to the subject of corporate tax rates, regulation, and energy policy, and looked at purely through the lens of (a) Trump’s prior term in office and (b) What most people generally assume to be Trump’s disposition around taxes, regulation, and energy, it is fair to say that markets would be generally warm to this aspect of the Trump economic agenda. Where things get more complicated, though, is where tariffs and trade are concerned.

For our purposes here, we won’t look at the policy merits of the tariff issue. It is certainly possible one could concur that tariffs would be a net negative for markets and still support the policy (if, for example, one believed they were more fair or more suitable for American economic interests, etc.). It is true that I do not support the tariff framework proposed by President Trump as a matter of policy [I am planning on a future Dividend Café just on the subject of tariffs], but it is logically possible to believe that they should be supported, even if not good for markets. But are they a clear and present danger for markets? This is a trickier question to answer for the simple reason that one knows what is rhetoric, what is negotiating posture, and what is policy. Would 200% tariffs on certain goods be problematic for certain companies and sectors? Of course. Are 200% tariffs really likely to happen? No, they are not. It is hard for markets to price in a “bad” thing that would be bad that someone is talking about doing if markets don’t believe it will happen.

But let me offer a further nuanced view that I believe is unique in the marketplace, a by-product of my own access to people within the administration, and a part of my own analysis. What if there were to be huge tariffs implemented (they were not mere negotiating tactics), and then the market was to drop a large amount? That seems like something investors would fret about, right? Some disagree that these tariffs will happen (fair enough), and some disagree they would damage markets (okay, whatever). But what if those two things did happen? Might I gently suggest that that very response is what would end the policy implementation? Again, reasonable people can disagree, but I believe the candidate threatening tariffs has used the stock market as a scoreboard so many hundreds of times in the last few years (including in real time during his prior term), that I believe the market response would catalyze the market un-doing.

It is worth noting that the Biden-Harris administration did not take off any of the Trump tariffs that were implemented in the prior years, though the “threats” of new tariffs are far greater from the Trump campaign than the Harris campaign.

Bottom line: The tariff issue is a wildcard in this election. They have a certain political popularity to them because they sound like they do good things for American workers (highly debatable) and are not easily understood. They have a mystery to them in what impact will be because they are simultaneously held up as a mere threat and also a source of revenue. And, their full implementation is very unlikely due to the impact they end up having.

The Debt & Deficit Question

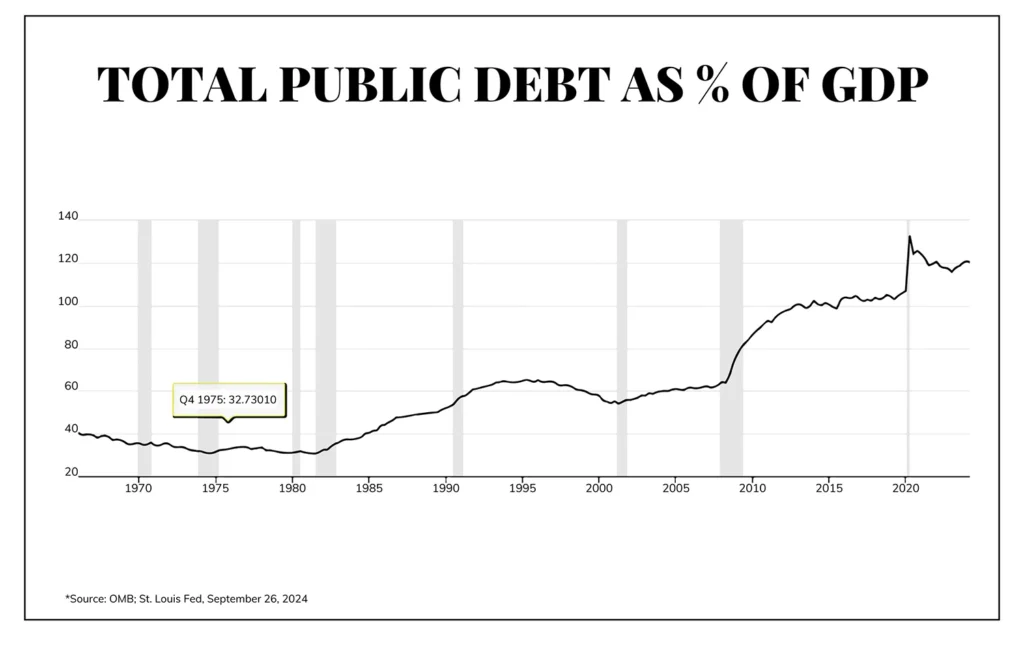

If I wanted to write an article about long-term economic impact of a given election, all I would write about is the issue of American federal debt, and American economic growth. As I have written time and time again, this is about excessive indebtedness, BUT that is defined in the context of the size of the debt AND the growth of the debt RELATIVE to the size of the economy AND the growth of the economy. The ratio of debt to GDP is the metric I obsess over, not the absolute size of the debt. Put differently, if the economy were growing at a faster clip than the debt, the growth of the debt would be far less significant.

But alas, the idea of GDP growing more than the federal public debt feels like a distant pipe dream, an era of long ago and a feat not to be repeated in the future. I can dream, and in fact, I do, because one day, it HAS to happen. But in the meantime, the issue limiting economic growth is government spending as a percentage of the economy. From 1998-2008 that number was consistently 17-19%. The number has been 20-25% over the last five years, and even after the COVID spike has settled around 22%.

The DEBT-to-GDP numbers are worse. What was basically 50-60% from 1990-2008 is now 120%. The budget deficit this year is going to come in at $1.9 trillion, which is 6.7% of GDP. We have no major war going on (that we are involved in) and certainly no recession. In 2019 the deficit was 4.6% of GDP. It is now 6.7%. How does this increase 45% in five years? Well, it certainly isn’t because of a lack of revenue! In fact, revenue is now 17.2% of GDP, and in 2019 it was 16.3%. We raised $3.5 trillion in taxes in 2019; we raised $4.9 trillion this year. So, ummmmm, how could this be?

Math is hard, I guess. We. Are. Spending. A. Lot. More. Money.

There is no economic issue that I believe is more important in an election than this, and there is no issue that is less discussed by either candidate than this one. A million spending ideas are thrown out. A million tax cuts are thrown out. Some tax increases are thrown out (Harris – businesses, capital gains, high earners; Trump – tariffs on American importers), but the idea of (a) Entitlement reform, and (b) Budget balance, are never, ever mentioned.

I do not believe either electoral outcome will impact debt or deficits one iota. I do reckon some form of divided government is more likely to impose some form of fiscal restraint than either party having uniformity, but even that is marginal. Ultimately, the American people do not want spending cuts, and the mere discussion of entitlement reform is considered off-limits.

Bottom line: This topic is going to be one of the most significant political topics in history, at some point, in some election But that time is not the 2024 election, and it is not with either Kamala Harris or Donald Trump as candidates.

The Energy Question

A confusing irony exists right now in American life. On one hand, domestic production of crude oil is at all-time highs; on the other hand, the current administration doesn’t ever mention it. One would think in the midst of a competitive campaign that candidate Harris would be eager to brag about such a positive thing. 13 million barrels per day is vastly higher than it was, and an important achievement as it pertains to economic, geopolitical, and even environmental concerns.

But alas, they cannot brag about it because it runs against the environmental consensus of their base, and it has happened despite other policy decisions that are profoundly anti-American energy independence. And from the vantage point of those who want to see greater American oil production, the 13 million figure is an increase from prior levels, but also far below the number needed to clear the market.

The market impact of all this is tricky. A posture that is friendly to new production (Trump) favors E&P companies, smaller capitalization names, and lower prices for consumers. A posture that is less friendly to new production (Harris) favors drillers where rigs already exist, essentially the incumbent mega-cap names that already have market dominance.

We also are talking about a lot more than oil production when we talk about energy policy. LNG exports (liquefied natural gas) had picked up a great deal after the COVID re-openings, and especially when Russia invaded Ukraine, and the whole world saw first-hand the problem of Asia and Europe not having these arrangements with America fully developed. But then somewhat shockingly, the Biden administration announced a pause on any new permitting for LNG export terminals.

This quote summarized my feelings on that decision well, which basically took a potential victory (LNG export increase) off the table for the administration in their scorecard:

“When it comes to advancing economic prosperity, energy security, and environmental protection, an LNG permitting pause fails on all three.” – Mike Wirth, CEO, Chevron

I am bullish energy because of underlying fundamentals, a better business model in the midstream, and the reality of the economics for the upstream. If Harris were President I think it would favor big cap energy (drillers vs. E&P and large pipeline companies); if Trump were President I think national energy policy would be better for the consumer, create more jobs, and facilitate more export opportunity, especially with natural gas. M&A has been a reality in upstream and midstream energy regardless, and we see that continuing.

Bottom line: I see the Energy sector doing well, regardless in terms of public company investment, but for different reasons with each candidate (export LNG with Trump, incumbent pipelines with Harris as new ones don’t get approved). But aside from the public market ramifications, the broader energy policy portfolio in a Trump administration is far more likely to be pro-growth than in a Harris administration.

Personnel is Policy

It is understandable that most people believe the campaign speeches and most outlandish promises (or threats) of the Presidential candidates will be the most important components of an election result in driving markets and economic impact. It is also untrue. I estimate somewhere between 90% and 95% of things said in a Presidential campaign never happen, partially because of the separation of powers, and partially because candidates say things sometimes that are simply not serious. The bully-pulpit matters, but only to a point. The veto pen should matter, but really, who even uses that anymore? The courts and foreign policy matter in terms of the power of the executive branch, but that is less germane to markets (at least in the short and intermediate-term). So what is the lowest hanging fruit where a Presidential election matters in terms of economic policy?

Personnel.

At the end of the day, there is a lot of bandwidth for the Director of the National Economic Council and the chair of the Council of Economic Advisors to shape policy and priorities (the last head of Trump’s NEC, Larry Kudlow, is an advisor to The Bahnsen Group and close confidant). The staff economists at Treasury matter. The enforcement people at the SEC matters. The chair of the FTC matters. And the FDA. And the EPA. And of course, cabinet positions.

I could go on and on about who I believe the Trump administration would appoint if it were to prevail, but I don’t want to speak out of turn, and a lot of those things are still in flux. There are some people in leading economic roles who I adore that I believe would be a part of a second Trump term, and there are some who I do not care for at all. I suspect the Harris team would have a lot of continuity with the Biden team, but I am unclear how much of the old Obama and Clinton teams would be involved.

I remember distinctly when President Obama announced Tim Geithner (former head of the NY Fed) as his Treasury Secretary and Larry Summers (former Clinton Treasury Secretary) as his National Economic Council Director. These were center-left neo-Keynesian Clinton alumni, but they were not radicals. I have ample disagreements, but they were market-friendly guys. It alleviated concerns some had about who an Obama administration might bring into critical economic roles. I believe this “personnel is policy” fact has been responsible for some of the most amazing things in history, sometimes for bad (Sununu picking judges) and sometimes for good (all things James Baker). =)

Bottom line: Whoever wins the election will not tell me all I need to know on election night. Once we start seeing personnel appointments, we will know a lot more.

Conclusion

30% of businesses (CFO survey) say they are holding off on investment pending election results. Is this true? I don’t know – I only know that they are saying it. But chances are that it is abundantly true that plenty will twist, move, and change after the election. Some may just be pent-up activity until the uncertainty of the election is over. Some may be a desire to know the outcome. But for those who want me to conclude with some prediction of investment horror if the candidate you do not like wins, you came to the wrong place. Those who want me to predict easy riches in investing if the candidate you like wins, you came to the wrong place. I have strong policy opinions and preferences and beliefs, but I also have studied history enough and understand our system of government enough to know that binary outcomes devoid of nuance are not the way this works.

I believe some of the market-damaging things that candidate Harris wants to do will be mitigated by reality, and very likely (though not electorally assured) by a Republican majority Senate. I believe some of the market-damaging things candidate Trump wants to do will be mitigated by reality, and personnel.

And I believe the thing we most need – a moderation of government spending and serious approach to the national debt – is not going to happen in this election. And that is probably the saddest thing of all, no matter who wins and loses.

Chart of the Week

This is the chart that I wish was on a campaign poster. It isn’t. At some point, it will be.

Quote of the Week

“Nothing could be better than living a modest, simple, and free life in an egalitarian society. It took some time before I recognized this as no more than a beautiful dream; that freedom is more important than equality; that the attempt to realize equality endangers freedom; and that, if freedom is lost, there will not even be equality among the unfree.”

~ Karl Popper

* * *

I am ready for any angry mail that comes my way. In fact, that’s what Ctrl-D is for! But in all seriousness, I can handle your disagreement and, in fact, I believe civil disagreement is the need of the hour. I hope this presentation of the 2024 election and its impact on markets has been valuable and informative. To the extent it caused any offense, just know it was not intended. To the extent you have more questions, I will answer them. To that end, I work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet