Many of us are familiar with the traditional asset classes, such as stocks, bonds, and cash, but probably less familiar with a class of investments categorized as “Alternatives” or “Alternative Investments.” I thought TOM would be the perfect place to provide a primer on the topic. Who knows, maybe you were reviewing your investment statement recently and were curious about what that slice of the allocation pie chart labeled alternatives was all about. If so, you came to the right place. Off we go…

So, What Are They?

The tough thing about the term alternative investments is that it captures a lot of different types of investments all in one category. It’s a sort of “catch all.” When you think about stocks, we understand that there is a varying degree of risk for investing in different types of stocks (e.g. Netflix vs. Proctor & Gamble), but all stocks have something in common – they are pieces of equity ownership in a company. Equally simple, bonds are debt issued by a company and if I am a bondholder then I am a lender to that company. And cash is cash. So, what happens when there is a potential investment that doesn’t fit one of those three buckets? Well… we call it an alternative.

An alternative investment could be anything from hedge funds to commodities to private equity to real estate and countless other investable instruments. I mean it could even be as obscure as a collectible art piece or music rights.

Here’s a fun one, I recently heard an interview on the Capital Allocators Podcast with Michael Schwimer the CEO of Big League Advance, a company that makes investments in Minor League baseball players in exchange for an agreed-upon percentage of their future earnings. In today’s world, if there is money to made then someone is out there looking to create a marketplace for it.

Ok, But Why?

Just because they [alternatives] are different shouldn’t make them attractive, right? Yes and no. For an investor, the real difference you are looking for is an investment that behaves differently than your stocks, bonds, and cash and has a high probability of being worth more in the future than it is today. We covered this topic and reasoning in a former issue of TOM called, The Exercise of Diversification. Remember, our friend Harry Markowitz and his noble prize winning study Portfolio Selection: Efficient Diversification– if we own a diverse group of investments in which some zig while others zag then the result will be improved performance and reduced volatility.

Another potential benefit of some alternative investments is the fact that they are illiquid. Wait a tick! That doesn’t make sense, does it? We, as investors, love liquidity and we appreciate the fact that we can easily sell our stocks and bonds at the push of a button. David Swensen, long time CIO of the Yale Endowment, popularized this idea of an “illiquidity premium” and has constructed the Yale portfolio seeking to maximize this opportunity. The idea is that investors are compensated with additional long term returns when purchasing investments that are less liquid. Now, this is an oversimplification of the concept, but it gives you the idea.

Tell Me More About Yale

For a long time now, Yale has become the poster child for alternative investments. Within the industry and specifically amongst institutional allocators many have tried to duplicate their approach, so much so that it is deemed the “Yale Model.” Does this mean that this is an approach that you should replicate for your own investments? Of course not. Each portfolio needs to be constructed based a number of factors that are unique to the beneficiary, but this doesn’t mean we can’t glean some wisdom from their approach. As an old boss always used to tell me, “success leaves clues.” So, what does the Yale portfolio look like?

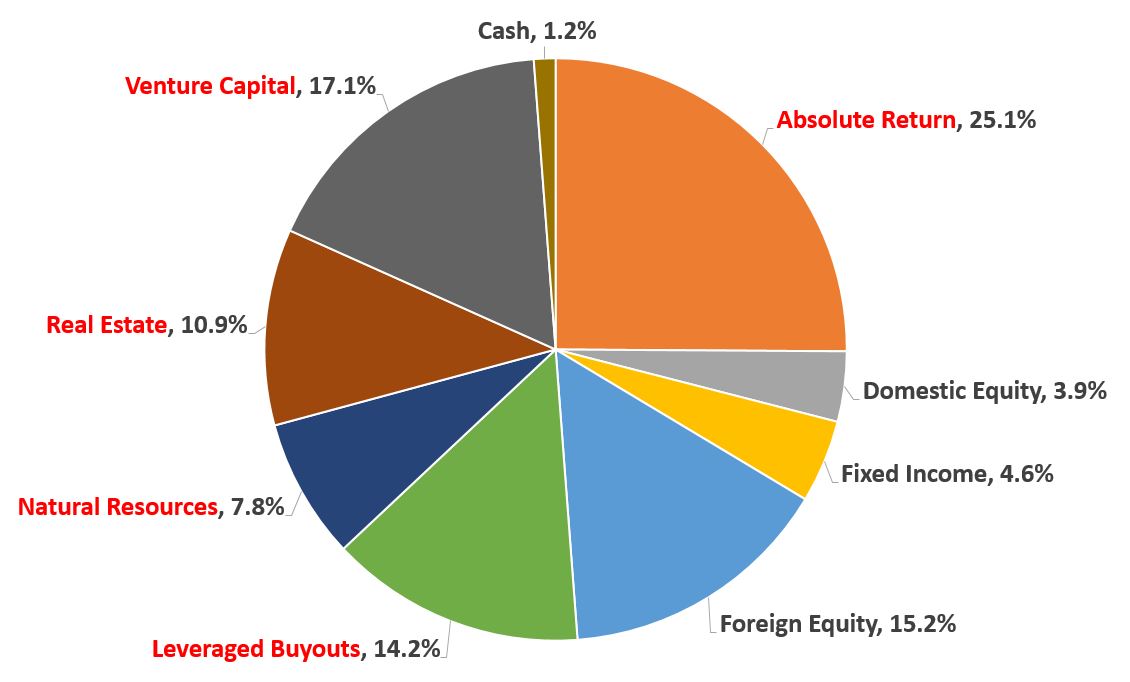

Source: 2017 Yale Endowment Update

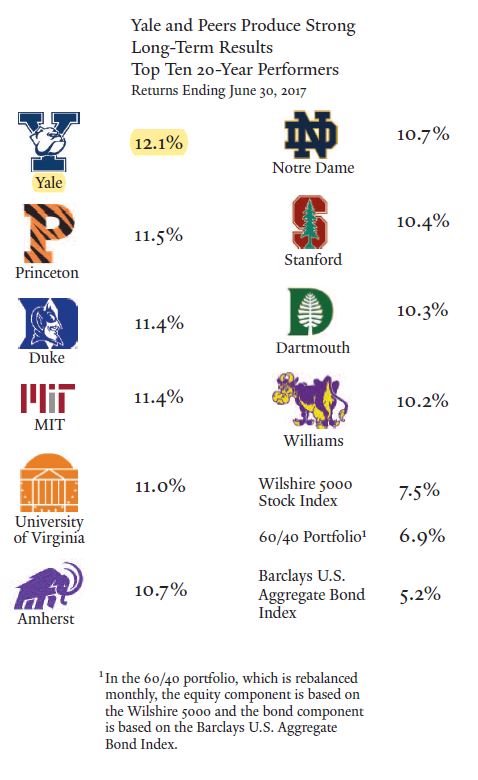

I highlighted in red those allocations that would be deemed alternatives, which as of the 2017 Yale Endowment Update accounted for about 75% of the investment portfolio. Perhaps needless to say, but we bestow this attention to Yale’s approach because their long-term results have been PHENOMENAL (see below).

Source: 2017 Yale Endowment Update

Not All Alternatives Are Created Equal

As I mentioned earlier and as the Yale portfolio can attest to, there are numerous different types of alternative investments. It would be foolish if one was to just go out and randomly purchase a smattering of different alternatives and combine them together with hopes for superior results. Each alternative has a different objective and it is best paired with other particular investments to achieve a certain desired outcome. These pairings and groupings have a lot to do with how each investment reacts to different market environments – rising inflation or deflation, rising or falling interest rates, different currency moves, where we are in an economic cycle, etc. Think of it like cooking, you would never just grab a random combination of ingredients from the cupboard, but rather you would thoughtfully follow a recipe to create your desired dish. Allocating to alternatives is much the same.

Understanding the purpose or reasoning for an investment within the context of a diversified portfolio is also important so that you don’t misjudge the results. Yes, we all want investments that only go up and never go down, so inevitably we will always wish we owned more of “fill in the blank” and less of “fill in the bank.” If you are feeling this type of disappointment, it probably means that you are diversified, which is a good thing. As an example, perhaps you owned something that benefited from rising inflation and inflation was flat or less than expected. This might hurt that particular allocation for the stated time period, but ideally, you own an opposing investment that would benefit from this outcome. Remember, we want things that zig while others zag and vice versa.

Bringing It All Together

Ok, so now you have a good general understanding of what alternatives are. I wanted to wrap up with some final food for thought. We spent a fair amount of time describing the different types of alternatives and the idea that many of the investments within this category are very unique from one another. The pure breadth of investments alone might make it unfair to always group them together or really call them an “asset class.” I heard one commentator’s criticism that the idea of bundling all alternatives together and judging them as a group would be like bundling all mutual funds together and applying the same critique. I hope this is obvious why this wouldn’t work – mutual funds are an investment vehicle and can be as conservative as a money market fund or as risky as a leveraged biotech fund. Not all, but much of the alternative space is really about creating non-correlating returns, which can help allocators to reduce risk within client portfolios.

Like many of the topics we cover on TOM, they are meant to be informative, but we also know that a primer like this one isn’t enough to equip an investor to begin taking action. I encourage you to meet with your advisor, learn more about your portfolio, and inquire if alternatives are a current part of your allocation or if they would be additive based on your goals. Most importantly, I wish you well on all your investing adventures in 2019!

This is TOM signing off until next week… over and out.