“Buy land, they’re not making it anymore.” – Mark Twain

Special note: As a follow-up to the recent “Be Better Than Me in 2023” post, look for an Appendix at the end of this edition, where I share some reader feedback regarding additional security measures you can take to protect your family and your data. Now onto today’s topic.

There are some common sources that have allowed the wealthiest people I know to grow their balance sheets so significantly: creating/growing private businesses, running public companies (i.e., “corporate executives”), or owning/developing real estate. [It shouldn’t be overlooked that these success stories also tend to be accompanied by a lifetime of hard work, optimism, and passion.] The third item – real estate – also happens to be a major focus of alternative investing and touches every person in some way, so I thought diving deeper into this topic would be fun. It’s going to require a multi-part series to look at some of the things I have in mind – and we’ll still probably only scratch the surface of the behemoth asset class that is real estate. Here we go!

It’s big

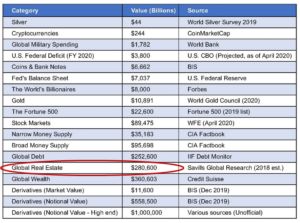

The global real estate market is enormous. A way to gain visual perspective on this is to see What $280 Trillion of Real Estate Looks Like. Real estate dwarfs the value of items we worry about being far too large – like the US budget deficit – and significantly exceeds the size of global stock markets or even the world’s money supply. The below is from 2018, but still very useful for a concise juxtaposition of real estate against other categories.

Source: Bigger Pockets Blog, 1/9/2021

More recent estimates vary, but the consensus is that the total amount of real estate in the world was more than $325 trillion in 2020: almost $260 trillion in residential real estate, while commercial property and agricultural land split the difference of the remainder (so about $35 trillion each).

It’s everywhere

Compared to the other items on the above list, a unique attribute of real estate is that it’s all around us. We literally stroll down streets composed of real estate that are lined with real estate, walk through forests and fields of real estate, and sleep in or on real estate. It’s difficult to overstate its omnipresence, and – aside from being at sea or basking in the warmth of Antarctica (fun fact: no one officially owns the land there) – I’m struggling to come up with examples of situations that don’t involve real estate. Perhaps that’s why real estate is so interesting: It has qualities of both tangibility and relatability that simply don’t exist within other investment choices.

Something old, something blue

You may have recently listened to a “new” but very familiar song. Said another way, you may have heard a cover of the old 1998 Eurodance song, “Blue (Da Ba Dee),” by Eiffel 65, where Bebe Rexa and David Ghetta have stripped out the intro and added lyrics instead of the “I’m Blue, da ba dee” chorus. The new version is called “I’m Good,” and our daughters and their friends LOVE it (at least the clean version they’re allowed to listen to)! And what’s not to like? The sound quality is far better, and the song is even catchier than the original version.

Something borrowed

Sampling old music is nothing new, but you may have also noticed that we’re now in the midst of a ‘90s fashion renaissance. A clear sign of that phenomenon is “young people” (you know you’re officially old when you can use blanket references like that) running around us in baggy clothes, big pants, and Champion sweatshirts. Unfortunately, we haven’t yet had an accompanying second coming of ‘90s music, but one can hope (a lot of new music has an ‘80s flavor to it, so maybe the ‘90s are next?). Fortunately, some of the biggest 90s bands are still making great music (e.g., the Red Hot Chili Peppers), but I digress…

While the new versions of 90s music and clothing are all the rage, ‘90s real-estate finishes, thankfully, aren’t what people desire these days. WAIT…WHAT!? ‘90s home interiors (sans the long weekend-afternoon parties) are also making a comeback!? Among my least favorites on the hyperlinked list are light wood, gold fixtures, and beige. God help us. In their defense, perhaps those new-old designs can be implemented far more tastefully than when I was thrashing the streets of suburban Pittsburgh on my skateboard in the mid-90s. I have my doubts.

Before my above accidental discovery of a pending ‘90s-real-estate-finishes nightmare, what I was going to say is that – unlike the clothing reemergence, which consists of precisely the same garments we wore 30 years ago – ‘90s real estate is pretty outdated at this point, so it needs a facelift to be desirable. That notion presents a lot of opportunity for real estate managers we’re in touch with, and it’s common to employ a “value add” approach to those types of properties. The ingredients are to a) buy a property at a reasonable price (with attractive financing) and b) focus on the finishes/upgrades that are most desirable for tenants. The goal is to drive higher occupancy and rents, making a piece of commercial real estate more valuable to own or sell; these strategies are not new.

Something new

What is new are the structures in which real estate investment strategies are now available. One exciting “package” is the interval mutual fund we’ve discussed numerous times in Alt Blend over the years. [A brief refresher: interval mutual funds look and feel just like a typical daily-liquid mutual fund, but with the vital difference that liquidity may be limited. They typically can be sold only one day per calendar quarter, and they can employ gating to restrict the amount of liquidity available.] The beauty of the interval mutual fund is that the liquidity can be more aligned with less-liquid holdings (like real estate), and the funds don’t require qualification hurdles that often accompany alternative investments. I believe it’s a game-changer in the democratization of Alts, and it’s very convenient for advisors and clients alike: no K-1s and no additional paperwork to buy or sell them.

What’s also new is that – unlike every Alt Blend series I’ve written to date – this time, I’m offering a preview of the topics we may cover along the way. If you have feedback on something I may be missing, please let me know, and perhaps it can be added to the below list. Also, keep in mind that the list isn’t intended to be exhaustive, as a natural part of the writing process is discovering new rabbit holes to fall into along the way (we don’t know what we don’t know):

- Geographies/regions or market tiers (Tier I, Tier II, and Tier III cities)

- Property types: office, medical office, student housing, self-storage, industrial, retail, workforce housing, single-family homes, etc.

- Quality of properties: e.g., A, B, C grades

- Strategies: development, value-add, etc.

- Private REITs vs. Public REITs

- Tax or ownership/mandates: e.g., opportunity zones or triple-net leases

I look forward to getting into those topics (and more) soon.

Until next time, this is the end of alt.Blend.

Thanks for reading,

Steve

Appendix:

Thank you to Andrew for these additional data/security insights you may want to consider:

- Freeze your credit with the big three agencies – leave it frozen and do a temporary lift if you need to take out a new loan. Do not leave your credit open. ST NOTE: Agreed. We immediately moved to this method after the burglary.

- Encrypt ALL of your hard drives and electronic devices. Do NOT use any non-end-to-end encrypted cloud services for data storage. Encrypt all backups as well, including local backup disks.

- Have at least two data backups – local and remote (cloud).

- Use a password manager and different passwords for everything, and TURN ON TWO-FACTOR AUTHENTICATION for every service that supports it. Where possible, use an RSA-key / one-time code two-factor scheme, not the insecure text-a-code-to-a-cell-phone-number scheme.

It’s probably a good idea to install an actual security system instead of just using one Ring camera on a front door. I use the Ring security system, which is pretty good, very easy to set up yourself, and not very expensive. I’m less excited about their video cameras since you can’t use end-to-end encryption on all of them, and once you turn it on for supported cameras, it’s a bit of a pain to use. But the base security system with door/window/motion sensors is pretty good. ST NOTE: Andrew is being kind regarding our previous lackluster security setup. We have since installed a more complete system using Arlo wireless cameras and sensors (similar concept to Ring). The additional demand it placed on our WiFi network resulted in needing to upgrade our internet from 400 MB to 1 Gig (which did resolve the slowness issue we were having)…so be warned. And, a disclaimer to try and make our compliance department happy: these aren’t product recommendations 😊.