The big idea and why it matters: Finding ways to be awe-struck in life can help us to embrace challenges. Crypto and blockchain continue to offer a near-endless list of such challenges – not just in the technology but also regarding adoption.

“And when it’s time for leavin’ I hope you’ll understand that I was born a ramblin’ man” – Forrest Richard Betts (aka Dickey Betts, from the song “Ramblin’ Man,” 1973)

If I had to give an award for the “most emotionally captivating musician” I’ve experienced, there’s a clear winner that immediately comes to mind: Dickey Betts. The first time I saw the Allman Brothers live was in my mid-teens at the Coca-Cola Starlake Amphitheater, just outside of Pittsburgh, PA. There was a guy near us on the lawn who found out it was our first time seeing them, and he said something to the effect of, “Watch out for Dickey – you won’t even understand it, but he might make you cry.” Sure enough, we looked at one of our friends during the show, and he was balling his eyes out (of course, we made fun of him for it).

A couple of years later – during my freshman fall at Penn State, in 1998 – I was lucky enough to catch the Allmans again with Dickey at the Bryce Jordan Center. Making it even more special, an usher brought my friend, Kari, and me down from the cheap seats we could afford to a few rows from the side of the stage. We were so close, and it was a truly awesome performance, complete with an acoustic set performed by Dickey and Jack Pearson (who had a short touring stint with the band) that made it unlike any other I’ve seen.

While I saw the Allmans many more times at their famous Beacon Theatre shows in NYC, those were with the newer Derek-Trucks-led lineup after a falling out with Dickey. Don’t get me wrong, it was still an incredible band, but a very different one. Dickey had a magic power that could take you from utter joy to tears of sorrow and back to euphoria, all in a single guitar solo – but it’s impossible to put into words. Aside from the awe-inspiring moments of the live performances, those experiences also led me to spend many hours learning the riffs and solos of his timeless classics, like Blue Sky and Jessica, and playing those songs with/for others over the years. Multiply my story by the thousands of others in attendance, and it’s interesting to contemplate the repercussions of a single great live performance. It’s not an exaggeration to say it helps humans flourish across multiple generations. Thank you, and rest in peace, Dickey.

Awe: Navigating Challenges

In his book Chatter, Ethan Kross discusses how awe-inspiring experiences can enhance our ability to navigate life’s most difficult challenges. While that could come via an incredible musical performance by icons like Dickey Betts, it may also be as simple as getting out into nature. So, if all this talk about blockchain and change flusters you, a literal walk in the park may be a helpful coping mechanism. It can also help to shift one’s mindset from “fear of change” to “excitement about challenges” that lay before us.

Distributed ledger technology (i.e., crypto or blockchain) isn’t something we need to fear. If it brings about changes that help us improve – e.g., constructing future internet solutions, being able to trust/verify the digital world, or streamlining otherwise painfully slow transactions – I’m all for it! But there’s a long road ahead with many opportunities for embracing challenges along the way. Here we go!

Channels are the splice of life

As briefly mentioned in our last edition, splicing is a way of increasing the capacity of the Lightning Network [A quick reminder: Lightning is like an express lane (called a “channel”) for Bitcoin transactions that runs parallel to the main Bitcoin blockchain]. If you’d like to dig into the details, here’s a resource from Fidelity, but I’ll focus our takeaways on the pragmatic implications of Lightning channel splicing:

- When it comes to payments, it means being able to track a single balance (“one balance wallets”) rather than separate balances for Lightning vs. the main blockchain (aka “on-chain”).

- Less on-chain transactions imply decreasing fees.

- Adds flexibility to payment processing, which allows providers (Lightning Service Providers, or LSPs) to help optimize liquidity reserves and costs.

- => Lower costs and greater efficiencies can lead to lower barriers to entry and greater adoption of Bitcoin/Lightning as a viable payment system.

Despite those promising developments, the Fidelity Digital Assets team concludes, “There is little evidence of mass demand and adoption of Bitcoin as a payment system from merchants that would benefit most from these proposed benefits.” In other words, there’s a long road ahead.

Halve you heard?

This isn’t where I intended for this crypto update series to go next, but while we’re still on the topic of Bitcoin, I have to mention that the fourth “halving” recently took place on April 19th, 2024. It refers to Bitcoin’s mining reward being split in half. With incentives in mind, halving has always been part of the Bitcoin protocol to slow the mining rates over time (i.e., less reward should reduce the incentive to mine and slow the rate of Bitcoin issuance).

A fair (but far-from-perfect) analogy would be to imagine that gold was suddenly worth $1 million/ounce (and not because of USD weakness). You’d quickly find everyone donning their Levi’s jeans and panning for gold like it was 1849. Now imagine the opposite situation (i.e., gold being worth much less than it is now), where fewer players would remain in the gold-mining game. You get the idea: Less mining would maintain a greater scarcity of gold. It’s the same with Bitcoin’s halving.

Bitcoin halving was designed to occur every four years, based on blocks being mined every 10 minutes, which we covered in Crypto Dip-Toe – Part 5. Investopedia perfectly lays out the actual halving history, so here that is verbatim:

The first reward was 50 bitcoin. Previous halving dates were:

- 28, 2012, to 25 bitcoins

- July 9, 2016, to 12.5 bitcoins

- May 11, 2020, to 6.25 bitcoins

- April 19, 2024, to 3.125 bitcoins

The next halving is expected to occur in 2028 when the block reward will fall to 1.625 BTC.

What it means depends on what you believe

If you’re in Camp A: Bitcoin’s value is derived simply from more people owning it, demanding more of it, and being willing to pay more for it (the “greater fool” theory) because it’s a core part of our technological infrastructure; the halving figures into keeping it expectedly scarce and on track for the eventual total creation/mining of only 21 million Bitcoin. Thus, halving is a positive event.

If you’re in Camp B (the opposite camp): Bitcoin can best be summed up as “nonsense”; people should steer entirely clear of it, as it lacks any viable utility (and that will always be the case). Then, the halving is irrelevant.

If you’re in Camp C, somewhere between Camps A and B (more where I find myself): There’s a non-zero chance that Bitcoin will eventually have real utility, but – if so – there’s a long way to go. The halving was priced in the same way known news/events are priced into equity markets, so any effect of the halving would have surfaced in Bitcoin’s price well ahead of the event itself.

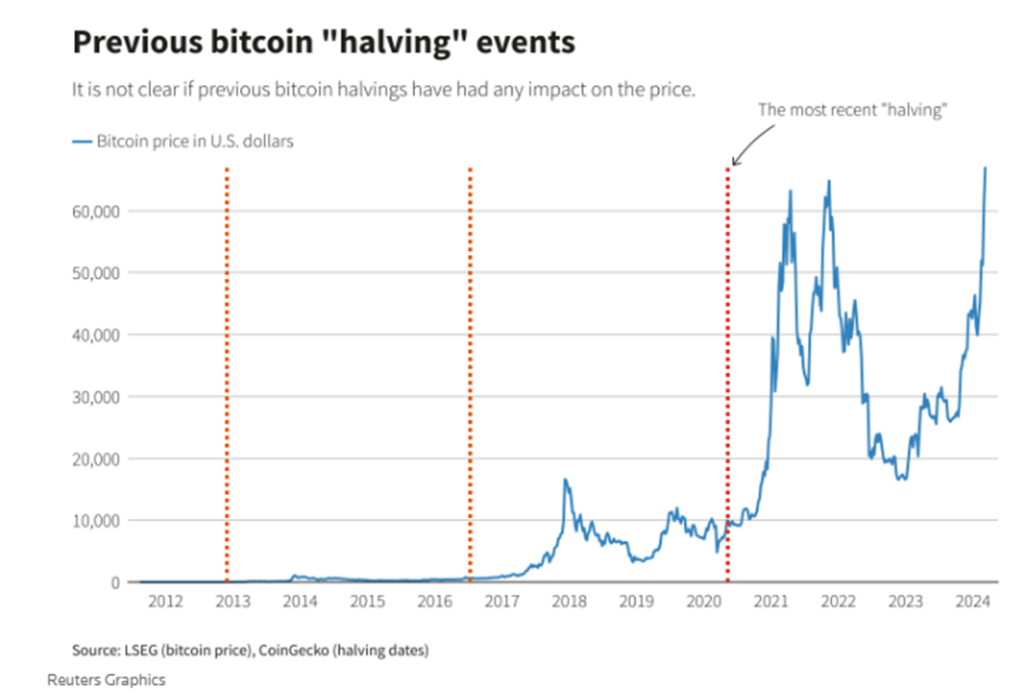

This picture from Reuters puts past halvings into the context of Bitcoin’s price, which would favor either Camp B or Camp C. It may also be impossible to derive any impact if it was all priced in from the start.

Stay tuned for Part 3, as there are more exciting updates to cover.

Until next time, this is the end of alt.Blend.

Thanks for reading,

Steve