Dear Valued Clients and Friends –

A trip around the horn like a normal Monday in the Dividend Cafe, only this is no normal Monday. This is a winter tundra Monday. Lots of nuggets as we go around ….

Dividend Cafe on Friday looked at how the entertainment culture of screen time, quick fixes, and online social community has bled into the world of investing, and how that might possibly prove dangerous, even for those not doing it at all. The written version is here (my favorite, especially this week), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

- Markets opened up a hundred points this morning and steadily moved higher throughout the day

- The Dow closed up +314 points (+0.64%) with the S&P 500 up +0.50% and the Nasdaq +0.43%

*CNBC, DJIA, January 26, 2026

- Last Tuesday’s market drawdown didn’t last, but it is still a good time to remind you that the market goes down an average of -14% each year. If the median is a better indicator than the mean in this case (which, in fairness, it is), the median decline is still -10% each year. It is normal stuff. What is very not normal? A year without it.

- The weakening U.S. dollar is likely to warrant further analysis soon of what it means for U.S. stocks and bonds. The commodity rally is clear enough, as is the benefit to U.S. multi-national companies with a large export business. But what it means for foreign appetite for U.S. stocks and bonds is the bigger issue, and I think it is too early to intelligently comment on that.

- Along those lines … I know there are four trading days left to go still, but the huge winner of January, far and away: Emerging Markets.

- The ten-year bond yield closed today at 4.21%, down 2.4 basis points on the day

- Top-performing sector for the day: Communication Services (+1.32%)

- Bottom-performing sector for the day: Consumer Discretionary (-0.71%)

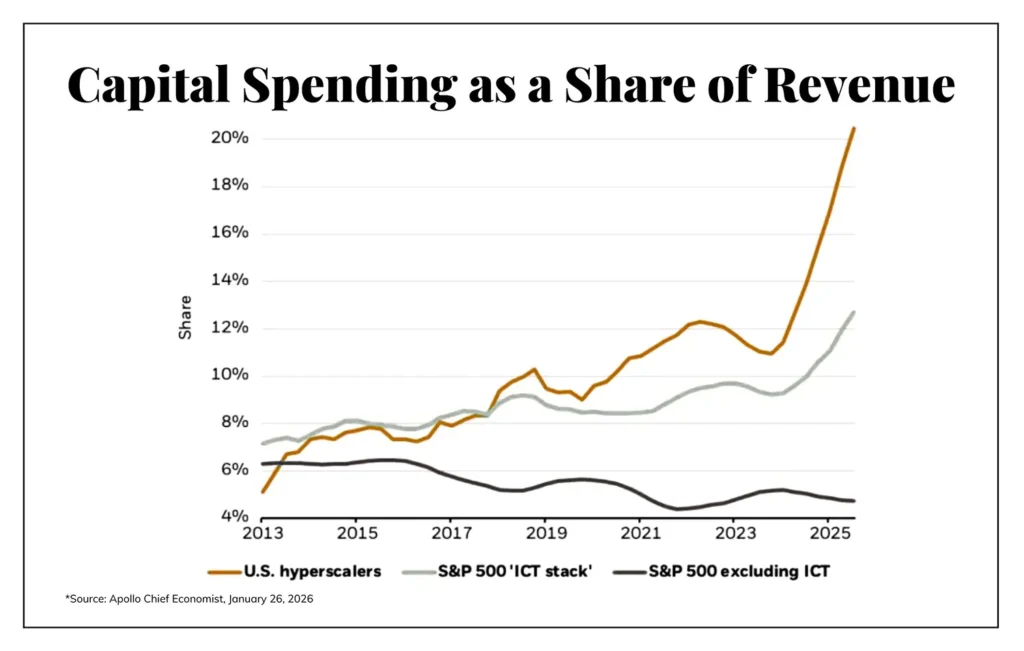

- This chart says so much that I hardly know where to begin. On one hand, the AI capex spending seems, well, substantial (you can decide for yourself how that ends). On the other hand, the total Technology and Communications spend is also noteworthy (either problematic or opportunistic depending on your perspective). And then finally, the non-tech capex is perhaps the most concerning component for the U.S. economy overall.

Top News Stories

- A winter storm has taken over the news cycle, covering much of the eastern United States (from Texas all the way through the Northeast). Power outages have been rampant throughout the South, and the temperature with wind chill is below zero for over half of the country!

- Trilateral negotiations with the U.S., Russia, and Ukraine took place over the weekend and are supposed to continue later this week. Without a lot of specificity, all sides are referring to the talks as “constructive.”

Public Policy

- It appears a partial government shutdown is on the table, and even likely, as Democrats are talking about not supporting a funding package in protest of spending approved for immigration enforcement.

Economic Front

- So far, over 20,000 flights have been cancelled because of the winter storm

- Durable Goods orders were up +5.3% in November, above the +4% consensus expectation. Most of the gain was related to commercial aircraft orders, which tend to be very volatile.

Federal Reserve

- Today marks the 100-day mark until Chairman Powell’s term as Fed chair ends. I am actually quite surprised that the President has not yet named his successor nominee.

- Rick Rieder, CIO of BlackRock, is now the front-runner in the prediction markets for Fed Chair.

- The Fed’s FOMC meeting begins tomorrow and will result in a Wednesday announcement and standard Powell press conference. The futures are essentially at 100% that there will be no cut or hike this week.

Oil and Energy

- WTI Crude closed at $60.82, down -0.46% on the day

- Midstream was positive last week and is now up more than +5% since the new year began. The overall energy sector is the top performer so far this year. Natural gas prices flew higher last week, and obviously, a lot of that was in anticipation of massively higher heating demand as a brutal winter storm covered much of the country.

- Midstream was not hurt by the first major company in the sector to release quarterly results. Kinder Morgan‘s strong performance and reiteration of natural gas demand led by LNG and LNG export opportunities was a big reinforcement to midstream bulls.

- Over 50% of Energy stocks are now at 3-month highs.

Ask TBG

| “I agree with your diagnosis that markets have become increasingly gamified and narrative-driven. Where I struggle is with the implied solution. My question is whether you view this primarily as a behavioral problem for investors, or as a regime problem for portfolio construction. If it’s the latter, what structural tools do you believe are necessary to preserve capital when dispersion collapses and everything moves together? Put differently: what does a serious investor do differently when fundamentals no longer differentiate in real time?” ~ Karl W. |

| I do not believe it is a regime problem for portfolio construction, or even close to it. I believe it is a cultural problem that will behaviorally lure some people in if they are not careful. I do not believe the immutable laws of investing change, or even can change. The essential truisms behind dividend growth investing (primacy or profits, profit growth, and return of profits to the minority owner of the businesses) are, themselves, unimpacted by bad behavior of others. Fundamentals do not have to differentiate in real time, and in fact rarely do. They certainly transcend through time, even though not in real time. |

On Deck

- Fed Day Wednesday

- Huge amount of company quarterly earnings announcements are coming this week

- A Dividend Cafe on Friday about rebalancing as the ultimate concession of a very important fact of investing life …

Congrats, Patriots and Seahawks fans, and congrats to those who know what it means to fight on. I am talking to Sam Darnold, the pride of San Clemente. Have a great night …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.