Dear Valued Clients and Friends,

I thought about calling this week’s Post-Election Commentary Part 2 since, well, last week really was Part 1. But this week has turned into such a massive treatise that I would rather it all stand on its own.

I am sure I will find much to nitpick in this week’s Dividend Cafe when I re-read it, and I welcome any of you critiquing it now – I never mind criticism (even unhinged hysteria). But I do humbly feel that this week’s Dividend Cafe is a useful tool for investors interested in a realistic, non-partisan, objective, but still opinionated look at the lay of the land as we prepare for a second Trump administration. In a week that generated some appointments and nominations that thrilled me and others that just left me dumbfounded (not in a good way), there really is a lot to say about pending personnel, pending policy, and what makes sense in terms of expectations for priorities and activities next year. We covered all the bases this week, and I am reasonably happy with the effort (at least until my next re-read).

I appreciate those of you who expressed appreciation to me for my attempts at even-handedness. I am quite aware of the embedded challenges here, as for some, I am sure my conservative leanings politically make me “not anti-Trump enough,” and for others, my frequent criticism of President-elect Trump’s temperament or certain decisions makes me “not pro-Trump enough.” Please understand that being criticized on both sides of this national divide is not something I am remotely ashamed of. I feel duty-bound to call balls and strikes, both as a citizen and free thinker, but especially in this professional capacity as an investment fiduciary and market commentator. If there is ever any offense, it is unintended. If there is ever any disagreement, that is a good thing (it has never struck me as a good thing to be surrounded by groupthink). And if there is ever any lack of civility, call me out on it. I am not letting go of that commitment.

And most of all, I am committed to applying the perspective shared herein to the best of my ability in the portfolio decisions we make for clients. It is not always easy, but it is always at the top of my mind. To that end, we work – never to commentate for the sake of commentary but to allow ideas, principles, and cogent analysis to lead to better portfolio results for our clients.

Let’s jump into the Dividend Cafe…

|

Subscribe on |

Incumbency is a four-letter word: LOSE

This is the first time since 1884-1892 that the incumbent party has lost three elections in a row. From the Trump win in 2016 replacing Obama to the Biden win in 2020 replacing Trump to the Trump win in 2024 replacing Biden, we have seen the party prevailing for the White House replace the other party in three consecutive elections, something that is rare, indeed. Incumbency is thought of as an advantage in our country (familiarity, fundraising, comfort with the status quo, campaign infrastructure, etc.), but it has recently proven to be anything but. Three of the Republican Senate pick-ups (Pennsylvania, Ohio, and Montana) were replacing very deeply entrenched Democrat incumbents well-known to their constituents for decades!

(Incidentally, if my 1884 party change trivia fact above was not fascinating enough for you, do you know the last time a sitting Vice President was elected President? Well, George Bush Sr. in 1988 – so 36 years ago is not THAT long ago. But do you know when it was before that? Try Martin Van Buren in 1836!!!! Yep. Only Bush was elected President as a sitting Vice President in nearly two hundred years!! Other VPs became President – Biden, Roosevelt, Coolidge, Truman, LBJ, Nixon, Ford – but in each case, it was because of death or resignation or running later and winning when they were not VP).

Incumbency becomes a liability when people don’t feel good about things, but even that is a tricky thing to say, which requires nuance. In most elections, people like to say they are dissatisfied with something – the very partisan nature of our system means at any given time, there is generally something around 50% who won’t like “things.” But this is different. There is some level of dissatisfaction – somewhat measurable, but somewhat not measurable – that alters the landscape. People can debate about why that is now, and obviously, many people have. What matters to the state of markets and how we think about economic expectations in the period to come is that we are not in a climate where the people want things to stay the same. Whether it is just merely the hope for lower grocery bills, some feeling of security at the border, better management of our nation’s big cities, or something else entirely remains to be seen. But I believe that certain categories of public life complacency have given way to a palpable desire for paradigmatic change, even to the point of desiring unconventional and surprising political solutions to get there.

Some of this may go in a direction investors don’t like. Some may go in a direction investors love. And if I were a betting man, I would say the challenge of dealing with heightened levels of voter angst in an anti-incumbency election will end up doing BOTH. Volatility feels all one-way right now, and tragically, many investors think that is a great thing. It is not. Voter complacency got high, and then an anti-incumbency wave hit. Investor complacency generally doesn’t end well. And I suspect that investor volatility picks up as the reality of some of these changes hits. Could it be that this volatility feels troublesome for a time before feeling much better? That is the history of markets. And who knows? Maybe there is a double meaning here right now … One can pray.

Personnel personified

So here is the lay of the land as of the time I had to submit for publication:

- Elon Musk and Vivek Ramaswamy are co-heads of a newly created Department of Government Efficiency

- As of press time, there has been no announcement of who the Treasury Secretary nominee is going to be. Scott Bessent, a respected and accomplished investment professional for decades, has surfaced as the lead candidate and has done a lot to jockey for the job publicly. He is bright and philosophical, knows capital markets, and has the respect of the President-elect. Media reports indicate (and my sources confirm) that Cantor Fitzgerald CEO Howard Lutnick, who is managing the transition process, is lobbying for the job for himself. I have had sources indicate to me that David Malpass, former head of the World Bank who has served in the Treasury Department of three Presidents, is also a dark-horse candidate (though he is also likely to be mentioned as a candidate for the Federal Reserve at some point, too).

- As of press time, there has been no announcement about the National Economic Council Director (likely the most important announcement to come outside of Treasury) or the Council of Economic Advisors. The latter is more big-picture focused, and the former has more responsibility for coordinating policy objectives with Capitol Hill and with the business community. The two NEC directors President Trump had in his first term were Gary Cohn (former president of Goldman Sachs and current vice chair at IBM) and Larry Kudlow (former Fed economist, Reagan OMB advisor, Wall Street economist, and CNBC/Fox Business anchor), were two of best people President Trump had in term #1.

- Former Rep. Lee Zeldin as head of the Environmental Protection Agency (EPA).

- Rep. Matt Gaetz as Attorney General (I don’t really know what to say here).

- Former SEC Chairman Jay Clayton, as U.S. Attorney at Southern District of New York.

- Robert Kennedy Jr. as Secretary of Health & Human Services (see “Drugs & Snacks” below).

- Gov. Doug Burgum as Secretary of Interior.

- Former Rep. Doug Collins as director of the Veteran’s Affairs Department.

- A lot of foreign policy and “non-economic” positions were appointed this week:

- Tom Homan, former head of ICE as a new “border czar”

- Gov. Kristi Noem as Secretary of Homeland Security

- Rep. Elise Stefanik, as Ambassador to the United Nations

- Rep. Mike Waltz as National Security Advisor

- John Ratcliffe as CIA Director

- Pete Hegseth as Secretary of Defense

- Tulsi Gabbard as Director of National Intelligence

- Sen. Marco Rubio as Secretary of State

One comment I would share about the Republican Congressmen and women that Trump has nominated for Cabinet and administration positions: Due to time constraints and processes in getting replacements named in the House, paradoxically, if the GOP majority in the House is not large enough when the final races are called, these appointments may very well cost President Trump the ability to get a tax bill done early in his term! I am not sure that the math will be that tight, but I am sure that one of my best political analysts thinks it is a good possibility.

Did someone say government efficiency?

I certainly am optimistic that some good can come from this new “Department of Government Efficiency” that the President-elect has appointed Elon Musk and Vivek Ramaswamy to run. I wish that Musk had not said they were targeting $2 trillion of government spending cuts for the simple reason that there is no way on God’s green earth they are going to achieve $2 trillion in government spending cuts, and I think it would be more effective to under-promise and over-deliver. But let’s be clear on a few things about what is and is not around the “department of government efficiency.”

First, it is not actually a department. Departments are permanent and enshrined and created by Congress. This entity will exist outside of government, will not be funded by government, will not be overseen by Congress, and will not have any power, apportionment, or formal oversight.

But, second, that does not mean it can not have teeth! It can, and I suspect it will. It is just that the teeth will have the power to embarrass. Finding fraud, waste, and corruption and using their high profile and public relations skills (and platforms) to shine a light on mismanagement will likely be more effective than Congressional formalities in driving change. Between the ability to highlight inefficiency and then wage a pressure campaign, I suspect it will allow marginal movement at (a) the regulatory and departmental level and (b) the congressional and budget level.

The ambitions the President-elect has articulated for this are substantial, with rhetoric like “the Manhattan Project” of our time being attached to it. It is more advisory than authoritative, but the vision is to create a direct pipeline between their work and the Office of Management and Budget (OMB).

I suspect they will focus on low-hanging fruit with Medicare fraud (which is prevalent but hard to do anything about) and various programs of federal funding to states that are being mismanaged and misappropriated. I’d count it a success if $250 billion is recovered or salvaged from this effort, and something around $500 billion would be the biggest success story I have ever seen from a federal government initiative.

A Sequence of Strategy

Here is the optimistic vision if one is concerned about the impact of tariffs on the economy (which would include me) … In 2017, President Trump did not begin with a tariff program or even much rhetoric about tariffs. He spent the first year of his Presidency focused on sweeping tax changes, largely having Rep. Kevin Brady of the House Ways & Means Committee and Speaker of the House Paul Ryan drive a corporate tax reform bill that ended up becoming law by the end of the year. Then, NEC Director Gary Cohn was also very involved. Various elements of tax policy, border security, and energy policy were the priority in 2017, so that when the trade war issues surfaced in 2018 there was already a certain acceptance in the market of where things stood with policy. By the end of 2018, it was obvious the focus was on a deal, not persistent tariffs, and many imposed tariffs were repealed or flattened in 2019. What does that first-term precedent have to do with the second term? In theory, if the policy agenda in 2025 starts with achieving an extension of the 2017 tax cuts, broadening U.S. energy independence (expanding production and capacity and infrastructure), deregulation, government efficiency, and border security, it is entirely possible that tariffs will, again, take a backseat, or get to pushed into a later part of the agenda. And if some of these other components take place first, the need for tariffs, the priority of tariffs, and the impact of tariffs are all going to be much less.

Now, is this an assured sequence of activity? No. Plenty has changed since 2017, and there are reasons to believe it may play out differently. Until there is more clarity on the personnel driving policy priorities, it will be hard to know where this is all headed.

Tariff path

So, while I do not necessarily believe tariffs are going to be an immediate policy priority when the new term starts, I do believe some form of executive order will come early, ordering agencies to “study” tariff impacts and such, moving some conversation and process even as the teeth of it will be held back until a later date. Executive orders make for good headlines without having to get deep into action. Where President-elect Trump places Robert Lighthizer in this new administration will be telling (he was a U.S. Representative in the first term, Trump has apparently floated that he wants him in that role again, and my sources tell me Mr. Lighthizer wants a more prominent role). As the most protectionist of Trump’s advisors, Lighthizer’s elevated role indicates more serious tariff protectionism on the horizon; a horizontal or diminished role indicates something else. If Pete Navarro’s name surfaces (and so far, I am hearing that it will not from people I trust), that, too, would indicate a more robust protectionist agenda on the horizon.

Would President Trump really use the International Economic Emergency Powers Act to levy a universal 20% tariff? I would suggest that it is possible, as a trial balloon, and the response it would generate would not be something I’d expect President Trump to like. As long as we are asking questions like this, though, we have to be prepared for enhanced volatility as the administration finds its footing on tariffs and tariff communications.

Is Social Security Secure?

A very thoughtful question came in as to what I thought President Trump’s return to the White House might mean for social security benefits and the overall future of the program. This is one area where candidate Trump campaigned far outside the conventional GOP position on the issue, in the sense that most Republicans have long believed that some plan is needed to ensure fiscal solvency for the program. In the Republican primary, Trump went after opponents such as Ron DeSantis for suggesting that some changes were needed to ensure long-term solvency and stability. In the general election, Trump and candidate Harris essentially left the issue alone, basically sharing the political consensus view that “nothing should be done” and certainly “nothing should be talked about.”

I would place the odds at 0% (and that is a ceiling) that any changes to benefits would take place in a Trump administration. I also believe some discussion of what can/should be done to ensure the long-term solvency of the program is (a) Unlikely to happen in the next four years and (b) Absolutely and inevitably going to happen.

Note: Point B in my above paragraph does not mean I am suggesting that current benefits to current retirees are going to be adjusted or should be adjusted. Not only do I not believe it is necessary economically, but I also share the view that it is a non-starter politically. However, do I believe that those under a certain age now who are nowhere near the age of receiving benefits (say those currently under 55 or currently under 50) will end up seeing some adjustment to their benefits age and formula? Yes, I do. Should, will, could, and yes. But not anyone currently receiving benefits. And none of this happening while Trump is in office.

Which tax cuts are coming?

At last count, the following represent various tax cuts candidate Trump threw out there on the campaign trail:

- No tax on tips (elimination of taxes for hospitality workers who receive gratuities from customers)

- No tax on social security income (for those with over 34k income who file individually or 44k married, up to 85% of the benefits are taxable; there is a lower tax amount for incomes lower, and there is no tax where incomes are less than 25k individual and 32k joint)

- No tax on overtime wages (for hourly workers who receive compensation premium for overtime hours, Trump proposed exemption from federal income tax)

- A child tax credit of $5,000 per child paid to all families of all incomes (to be more clear here, candidate Trump did not elaborate on this much on the campaign trail; the above was mostly spelled out by his running mate, JD Vance; Trump did frequently allude to a general increase in child tax credit but wasn’t as specific)

- An increase of the SALT deduction cap (state and local taxes are currently only deductible up to $10,000 on one’s federal return)

What is most likely to happen? I think they work on shoring up the extension of the 2017 tax provisions that are set to sunset first, and then put an omnibus bill out that covers some of the aforementioned other cuts together. From there it gets shredded, modified, and substantially adjusted, with plenty left out, and all in a way that will have to be compatible with the “deficit budget window” since this will only happen through budget reconciliation.

Drugs and Snacks

Some have speculated what the involvement of Robert F. Kennedy Jr. may mean for the state of the pharmaceutical sector. Is there going to be a decrease in doctor-prescribed medications in the new administration? Is the FDA’s posture going to change? Will there be new regulations on snack items that impact consumer staples? What should one make of the Make America Healthy Again rhetoric and potential policy portfolio?

I am just going to talk about this realistically and not prescriptively. I know enough not to get into the areas where people have strongly held beliefs about what they believe ought to be in matters of public health (or private health, for that matter), and my opinions here are totally irrelevant (plus, I barely have opinions here, if I am being honest). But what is a realistic forecast for what to expect?

President-elect Trump has now nominated RFK Jr. as Secretary of Health and Human Services. He has not nominated a new commissioner at the Food and Drug Administration (FDA), though the chances of him replacing Robert Califf (the current FDA head) are over 100% (better odds than the chance I treat myself to a McRib next time I hear McDonalds’s brings it back, as those odds are only about 99%). But I think the following are safe to say:

- HHS has regulatory jurisdiction, not legislative authority

- Some things the President will have no authority over, and other things will require Congressional approval

- Even if a role is more formal or even Senate-approved Cabinet-like, the governmental bodies are unlikely to make meaningful changes in life-saving or life-altering drug treatments

- FDA reform would likely be geared towards EASIER approval for treatments in the marketplace, not harder approval

- There is virtually no chance of changes in vaccine requirements since those are set by states, not federal bodies

- Any effort to see Americans eat healthier than the processed food garbage so many eat is less likely to come by federal edict and more likely to come as a result of cultural choice and education. That said, the leading consumer staple companies engaged in snack food options are also the same exact companies that make healthier food options. The soda companies are also the bottled water companies. There is a diversification of product mix here that I think renders exposure to leading staple companies moot.

Neighborly Considerations: Thinking Globally

With so much focus on domestic policy ramifications (tax, personnel, energy) or global considerations that seem almost exclusively focused on trade with China, it is worth considering what international ramifications are on the table as the new administration prepares its return. As tariffs have already been covered and a more comprehensive treatment is coming, let’s look at some non-tariff elements of a Trump administration for international investing.

It’s worth noting that “re-shoring” and “on-shoring” and other alleged focus on domestic manufacturing activity is more than just “tariffs on imports from China.” Suppose the focus is truly just to “even the playing field with China,” then more activity with Mexico, Vietnam, and South Korea would all aid the U.S. in its rivalry with China but wouldn’t exactly be scratching the alleged “domestic manufacturing” agenda. A tension exists between two different talking points that are not actually one and the same. Is the agenda to diminish activity with China, or is it to boost domestic activity? If it is the latter, then that would mean any movement of activity out of China and into another foreign domicile would not be considered a policy victory. I believe the agenda is going to have to prove more humble as time goes by – diminishing reliance on China or some appearance of better trade deals with China will have to be considered a victory, even if a supplemental beneficiary in the deal is Mexico or South Korea.

I would anticipate that the U.S-Saudi relations, which frayed a great deal at the end of the Trump term in 2020 (the Saudis were not playing nice when the COVID shutdown happened and added to a supply glut when demand had collapsed that caused no shortage of agony for the Trump administration). The Biden-era saw the U.S.-Saudi relationship take a big step down further, and only recently have there been signs of relational improvement (largely around mutual alignment of interest as it pertains to Israel and Iran). The U.S. interest in a stronger coalition with Sunni Arab states (which are led by Saudi Arabia) is massive, and whether it be protection or support of Israel, general positioning against giving Iran more leverage, or other regional stability objectives, I expect Saudi relations to be a big priority in the next term. What I do not know is who will head this up this time around, with the President-elect’s former advisor and son-in-law, Jared Kushner, not returning to the role.

It is hard to analyze what the new administration means for Europe until we know where things are headed with Russia and Ukraine. Again, not prescribing what I want as much describing what I expect, I do suspect Ukraine will end up taking a deal with Russia that surrenders some territory yet begins a massive Ukrainian rebuild. And I do believe European nations will end up paying more towards their freight with NATO. The major impact on Europe out of a Trumpian policy portfolio will be in the currency (does the dollar strengthen, bringing down the Euro, or weaken, helping to rally the Euro) and then the aforementioned Ukraine issues.

I don’t think there is going to be any accommodation with Iran in this second term, and I think their contribution to the global oil supply is going down, not up.

The last thing I want to say about China: If President Trump can get what he wants from China via currency revaluation, I don’t doubt for a second he would take it. A Chinese commitment similar to what Japan (and, back then, others) did in the Plaza Accord of 1985 to strengthen their currency and allow the dollar to devalue would be perfectly in line with Trumpian objectives, give him the chance for a high spectacle win (the media and some prospective advisors have referred to this idea as a “Mar-a-Lago Accord”), and achieve a sellable benefit to domestic manufacturers (making their own exports more competitive). I am sorry for sounding like a broken record, but (a) I need to know who is on the President’s economic team before I can analyze this more, and (b) I need more time to ascertain if this is something China could really be convinced to do.

If I were a betting man, I would say that:

- Mexico benefits from Trumpian policy after first suffering. First, moves to fight industrialization in Mexico hurt Mexico, but then, the Mexican agreement to support Trump administration efforts at the border resulted in a bounce-back benefit to their economy

- Vietnam, Korea, and India benefit in almost everything, as no efforts against China (trade, currency, etc.) are going to NOT result in more opportunities for them.

- If the dollar does weaken as part of the holistic policy agenda (something that will be hard to do without the administration focusing on making it happen), then virtually all emerging markets benefit in the end. Tariff threats linger over the dollar in the meantime.

A Game of Monopoly

One of the most controversial components of the Biden administration in corporate America has been the aggressive posture his Federal Trade Commission (FTC) has taken in blocking mergers and acquisitions and seeking action against companies it deems to be antitrust violators. The vast majority of “big tech” companies have some action pending against them, in some cases, substantial ones. Does this stand to change in a new Trump administration?

President Trump has more tech-sector support than he did in 2016, and there is more Silicon Valley mindset in his team than there has been. That said, some of his VC supporters are not exactly fans of the mega-cap tech names themselves. My expectation is that he will:

- Continue with antitrust cases against big tech names, but,

- Not pursue break-ups of these names, and,

- Favor a FTC posture that is more favorable to M&A,

I won’t get into the specific possibilities or remedies around specific cases (i.e., Google, Amazon, Meta, Apple), but in all cases, I expect something (a) Still to proceed and (b) That is less than the Biden FTC was pursuing.

A Strategic Bitcoin Reserve

I hear through the grapevine that bitcoin enthusiasts believe that one of the advantages to a Trump Presidency for their bitcoin position is that the federal government will take on a large bitcoin reserve for future emergencies (like the strategic petroleum reserve was intended to be for oil). As has been the case for many years, I have no outlook on what happens to the price of something with no internal rate of return, and I will save my comments for the folly of this whole universe for a future Dividend Cafe. But let’s talk about this idea of a governmental strategic reserve of, ummmm, bitcoin.

If I could only answer in one sentence, it would be this: “In my line of work, you hear a lot of stupid things, but this is the stupidest thing I have ever heard.”

But since I can answer in more than one sentence, let me just ask a question: In what world could the United States federal government ever need “an emergency reserve of bitcoin”? One in which the U.S. has so much debt that they need to use cryptocurrency to pay their bills? How, pray tell, are they going to fund the acquisition of this Bitcoin reserve? Oh, with more debt. Okay. So, take all the arguments bitcoin enthusiasts have for the use of bitcoin as a currency substitute – the dollar, inflation, debt, etc. In each case, the allegation of misdeeds is against who? Oh, the federal government. So rather than address the dollar, inflation, and debt, the U.S. federal government would have an easier time “buying a reserve of bitcoin” – that they only need if there is an emergency they create, and that if they did create such an emergency, could never, ever, ever, ever be enough to do anyone any good anyways.

Sometimes, you just can’t make this stuff up. “Vibes” over coherence, I guess.

Conclusion

I believe the primary policy priorities of the new Trump administration will be, in order:

- Trade and Immigration

- Tax and Regulation

- Energy

There are pro-market scenarios in all of that, yet all pro-market aspects of the new Trump administration do not exist in isolation. They exist in tandem with (a) Broad economic conditions (which right now are also mostly constructive), (b) Monetary policy (which right is also mostly constructive), and (c) Valuation (which right now is, ummmm, concerning).

So once you get past the “Is the market going higher or not higher” question, you realize that in the new administration, the valuation question cannot be answered by policy. In the weeds, there are themes that make sense: Energy infrastructure, M&A, and financial deregulation. And there are vulnerabilities that have to be addressed (technology antitrust, tariff impact). We would be shocked if there was no noise and volatility to come, even in the midst of a constructive market setup between policy expectations, the economy, and the Fed.

But personnel matters. Right now, there is internal politicking (human nature is what it is), and it is unlikely to go away any time soon. Across each category covered in this Dividend Cafe, there is a bandwidth of outcomes that personnel will impact. We will continue to watch for personnel as drivers of policy and do so in the framework of what we laid out above. We think the President cares about immigration more than snacks, regulation more than vaccines, and energy more than currency. With some ups and downs along the way, we expect those priorities to be manifested in markets in the four years ahead.

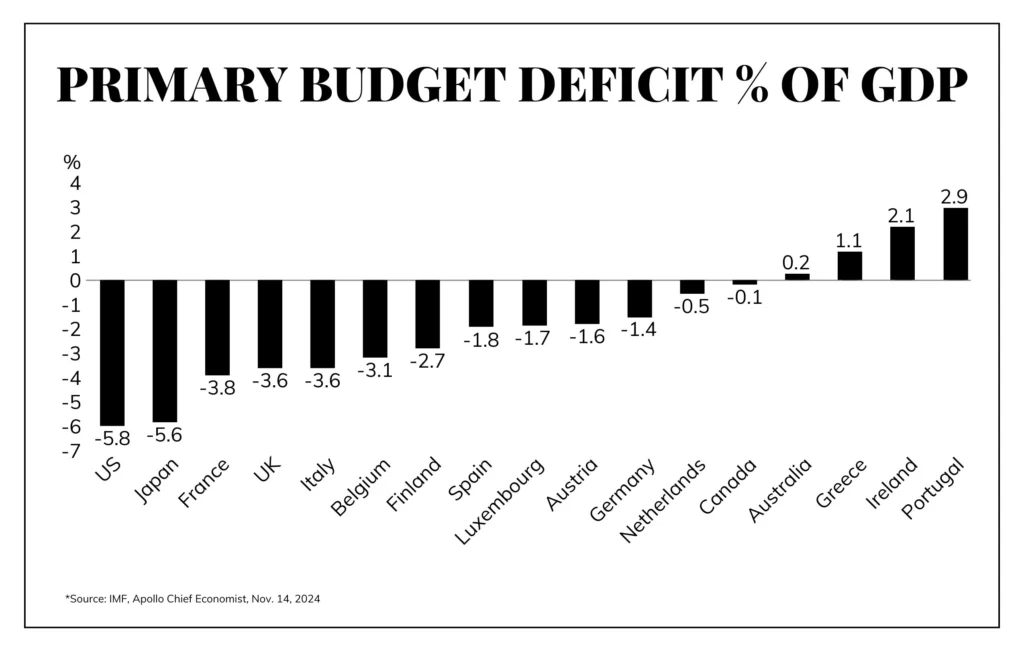

Chart of the Week

The U.S. has the largest budget deficit as a % of GDP this year of any major country on earth. Reducing this annual budget deficit as a percentage of GDP is the most we can hope for out of the next four years, and it is not going to be easy.

Quote of the Week

“You can always spot a fool, for he is the man who will tell you he knows who is going to win an election.”

~ Robert Harris

* * *

I didn’t mean for this to be 5,000 words, but I hope it scratches some itches, answers some questions, and provokes some thought. And I hope you are at peace with this simple reality: Policy matters to markets, but it is not primary. Politics matters to markets, but it is not close to the primary. And your discipline, behavior, and prudence matter in investing, and they are most certainly primary. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet