Dear Valued Clients and Friends,

I wouldn’t describe this as a refreshing week, but I did have the chance to ponder a great deal about our meetings of last week. Today’s Dividend Cafe will elaborate on a couple of the themes I feel most important right now and hopefully will inspire you with an opportunity, a consideration, or at least a general refresher of things that matter in your investing life.

If you happen to be a financial advisor reading Dividend Cafe, would you mind sending me a note to ? We are considering a fresh content idea for fellow advisors and would like to get your opinion on something! No need to reply if you already did after the Monday request.

Off we go!

Download Podcast Transcription

|

Subscribe on |

In all thy getting, what is the theme?

Last week, I promised some sort of follow-up on much of the intellectual stimulation during our annual money manager week. A week ago, at this time, I was still processing everything, and my brain was a little fogged over. 23 meetings in five days and hundreds of pages of post-meeting decks and papers to absorb requires a little freshness to write about it all, and a week ago, that freshness was lacking. Fast forward a week, and I am ready to bite the a$$ off a bear.

As useful as the macroeconomic discussions were, I do not think those narratives are new news to readers of the Dividend Cafe. Debates persist about:

- Inflation expectations that will impact bond yields

- Growth expectations that will impact bond yields

- Stock market valuations that will impact index investors

- Whether China is a buy, a sell, or just a big story to the global economy

I am sure there are other topics that came up in certain meetings and not others, but those four issues came up in every meeting, and the discussions, arguments, expectations, and especially the applications about them all were invigorating. For those who want to know …

- We believe inflation expectations will come down when housing unfreezes, and that goods inflation and producer prices are already basically 0% (or lower). This is not new in terms of our view.

- We believe there is a chance of a temporary boost to growth expectations in the short-to-medium term, but not an assurance of such. What could impede that is a change in tax or regulatory policy (for the worse) after the election, and what could catalyze that is capex – business investment that drives productivity for a period. Our longer-term growth expectations are very muted due to the Japanification effect of excessive government debt.

- You may have heard that we believe stock market valuations, as captured in the cap-weighted indexes, are excessive, priced above perfection, and highly vulnerable – just not open to market timing.

- And just last week we made clear why structural, not cyclical, issues keep us from investing in Chinese equities.

But outside of the major macro themes, there were a couple of other things I feel compelled to touch on. I talk about private markets a lot, but I am quite sure that most readers (and clients) only believe that discussing such things matters to them if they own the private markets being discussed. And the industry’s obsessive chatter about the challenges for private equity to effect desirable exits and return money to shareholders has largely been a topic that I believe most people believe does not impact them. If you own a private equity investment that seems behind the curve in returning capital to you or seems to be impacted by rates moving higher and the effect that has had on exit multiples, then sure, you feel like this matters to you. And indeed, a fair amount of purchases done in, say, 2020 or 2021 were done at a high purchase multiple and a low borrowing rate, and now, as we sit in 2024 and certain operating conditions and profitability have improved, normal exits are being impeded by lower sale multiples and higher borrowing costs. It isn’t anything that has spilled over into the broader market; marks on the books of private equity remain positive (and have mostly been rationalized as such thus far), and defaults, despite the elevated leverage and higher borrowing costs, have been quite minimal.

Well, a few things here … There are more interventions into the terms of that underlying debt than meets the eye. Interventions are not defaults and in fact, are the perfectly rational actions of economically rational actors. But amend and extend provisions to loan documents have impacted about 5% of LBO deals since the Fed began raising rates. 5% is not very high, either, by the way, but it isn’t the 1-2% that the default rate indicates, either. Now, does this mean something? Why should I care what very smart private equity sponsors do to protect the equity of their investments they can’t currently sell at a price they like with the very smart private credit lenders who hold the debt on these deals? And why do I care if someone else invested in private equity has not yet gotten paid for a great investment they made four years ago, even though they will be paid eventually?

Because I think there is a backlog of private companies owned by private equity companies – and I mean, a lot, that have performed fine, have grown, have improved, and have essentially executed on what the private equity company wanted, but who are not able to find an exit in the IPO market or from a larger private equity firm buying them for more than the other private equity company did 3-4 years ago. And what that means to me is that public companies are going to be strategic buyers of a lot of these companies.

That the private equity companies have to sell (over time, at varying degrees of priority, etc.) is not up for debate. Now, so-called “continuation vehicles” buy some time and allow for more value creation. And some may very well lower their exit expectation a bit to realize some gains and allow their investors to receive money back. But at the volume and magnitude and seriousness of deals out there, and with the challenges many public companies have in generating impressive organic growth, I believe a period of strategic M&A is about to ensue whereby a lot of public companies acquire a lot of private companies, and I mean a lot.

Now, this may be good to know for the investment banks we own and the private credit managers we own, and the asset managers with deal teams that we own. But it also is going to impact much of the public markets because (a) Some good deals will get done, and (b) Some bad deals will get done, and (c) Some purchase multiples will be accretive for the buyer, and (d) Some will not be.

So, in a nutshell, I think a reasonably significant change in certain aspects of capital markets is coming, where a ton of large, successful, private companies get bought by public companies, providing fee revenue and activity to those involved in the deals, but also impacting the strategery of acquiring companies. We intend to monetize this through the former and pay close attention to the latter.

Speaking of themes, is private credit the next shoe to drop?

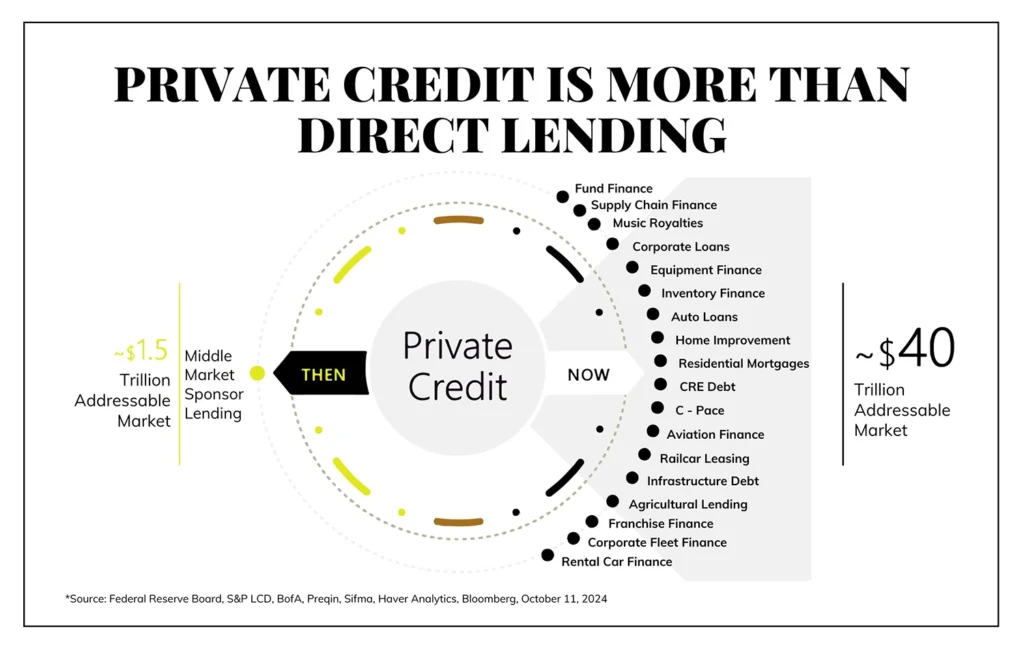

One of my favorite charts of the week was this beauty from Apollo. There continues to be a lot of chatter as to whether or not the debt extended on leveraged buyouts is now into the “thin layers” where the deals are less good, and the space is over-invested, over-saturated, and over-loved. And very candidly, we have been abundantly diligent to ensure that we understand what we own, what is being bought, and how macro and micro risks impact clients. But that said, the notion that there is a fully mature industry called private credit which has essentially captured a bunch of market share from banks (true) and from the high-yield bond market (true) fails to capture the entirety of the universe.

While many of these categories are better defined as “asset-backed” lending and structured credit, the point is that a period of investor-based vs. bank-based lending across multiple categories of debt, risk, collateral, terms, and opportunity is in very early innings, and it’s true appeal continues to be (a) the systemic benefits relative to having this degree of lending in the banking system, and (b) the investor benefits to capture yield premium where a new category exists adding value to borrowers and lenders alike.

Signals in the yields

It is worth pointing out – bond yields are up 40 basis points since their low point a month or so ago, and at the same time, TIP spreads are up 40 basis points, as well. In other words, the implied expectations for inflation over five years are up 0.40% in the same month that bond yields are up 0.40%, which is another way of saying that real growth expectations have increased a grand total of zero percent.

More debt but less leverage

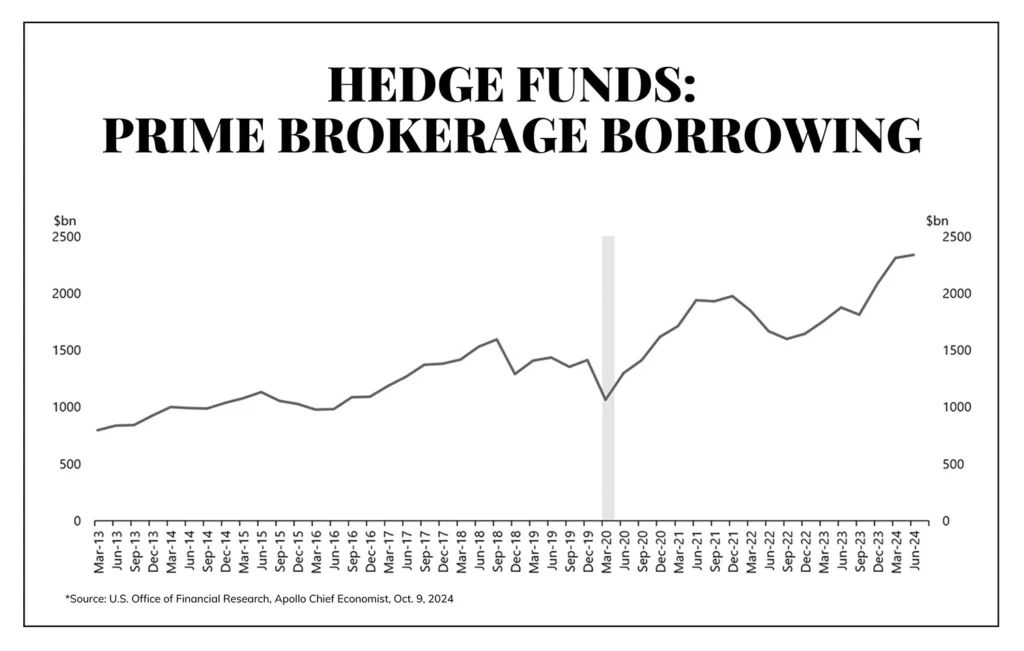

Hedge funds had borrowed about $1.5 trillion as leverage on portfolio positions prior to the pandemic. That number is near $2.5 trillion now. So there has been a big levering up since COVID with hedge funds? Not exactly. $2.4 trillion against asset values now is likely the same or even lower leverage than $1.5 trillion against then asset levels. Leverage is a ratio of debt against assets (or income, or cash flow, or whatever financial metric one is using).

Sector History

The best-performing sectors in a period of Fed rate cutting that was not attached to a recession are Health Care, Financials, and Consumer Staples (each up roughly +40% in such periods). Do I believe this will repeat itself this time? There are all kinds of factors that can change the way things play out this time, both in terms of broad market response to rate cuts and the details of how certain parts of the market respond relative to other parts. But by far the most significant variable will be the economy; Rate cuts when the market is in recession create a very different market impact than rate cuts when it is not.

Chart of the Week

I suppose $70 to $90 may seem like a wide range, but it really isn’t when you consider that we were frequently between $0 and $50 from 2014-2020, and then above $120 several times in 2022. The right and left tails have, for now, come significantly in for oil prices, and two years of this kind of stability has been the definition of goldilocks (no demand erosion and ample margins for producers).

Quote of the Week

“If I had to summarize money success in a single word it would be “survival.”

~ Morgan Housel

* * *

I really don’t know what to say about what has transpired in Florida over the last week and a half or so. Our new Palm Beach office was not in the heart of anything but was closed a couple days this week, and tornadoes right nearby did take down lines of palm trees just outside our building. But all our people are safe, and despite a few flight cancellations and strandings, everyone is unscathed. Our friends in the western part of the state, and of course, two weeks ago now in the Carolinas, not so much. Our thoughts and prayers sincerely go to anyone dealing with this horrific chain of events. Godspeed to safety and recovery.

Reach out with any questions, and have a wonderful weekend.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet