Dear Valued Clients and Friends,

The weird week in the markets doesn’t change what I want to be doing with each Dividend Cafe. As of press time, the market is up ~1,000 points on the week, with pre-market futures on this Friday pointing to a +100 point open. The day-to-day and week-by-week movements in the market are not the subject of the Dividend Cafe, but they are what we do each Monday through Thursday at The DC Today.

This week it is tempting to dive more into the cluster of these infrastructure talks. On Thursday, there was a White House briefing that it was a done deal; on Friday, it appears to be falling apart; I can write about all this now, but I think by the time it hits your inbox, the deal may be back on, and by the time you are done reading it back off.

Yet, in these “current events,” there is, indeed, a “timeless principle” that warrants immediate application. A week ago, markets were experiencing nearly irrelevant levels of volatility – and the media declared it the new apocalypse as they went about drooling on themselves in a sea of inaccuracies about what the Fed did, said, and meant. A week later, markets have been rallying, and the new question is what to do about “investing at the top” (it is “new” in that the last time I heard this concern, was almost three weeks ago).

So I want to dive this week into some fun history, some actionable application out of that history, and leave you with some crucial reminders about markets. These things will be useful whether the market is down a thousand or up a thousand next week.

Come on into the Dividend Cafe …

Some historical perspective

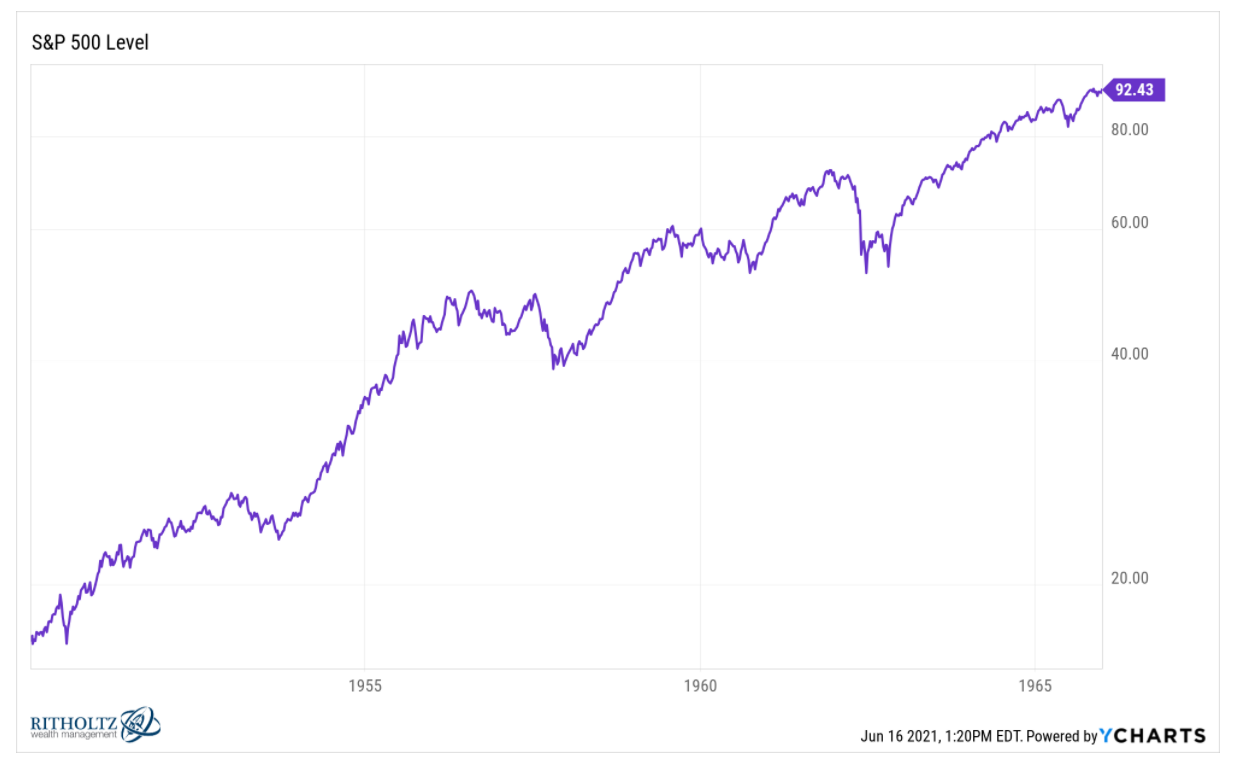

The bull market post-WW2 lasted through 1966 and saw market returns average 15.5% per year.

But what has to be understood about that 20+ year bull market is not what the positive returns were, but rather the fact that FOURTEEN TIMES along the way – 14 times – the market dropped anywhere from 10% to a quite high 28%.

So can 20%+ drops take place in the middle of a bull market? Absolutely. There was a six-month drop of 28% in the first half of 1962 (I wonder what caused that?). But there were ample 10%, 15%, and 20% drops along the way not linked to a nuclear missile crisis.

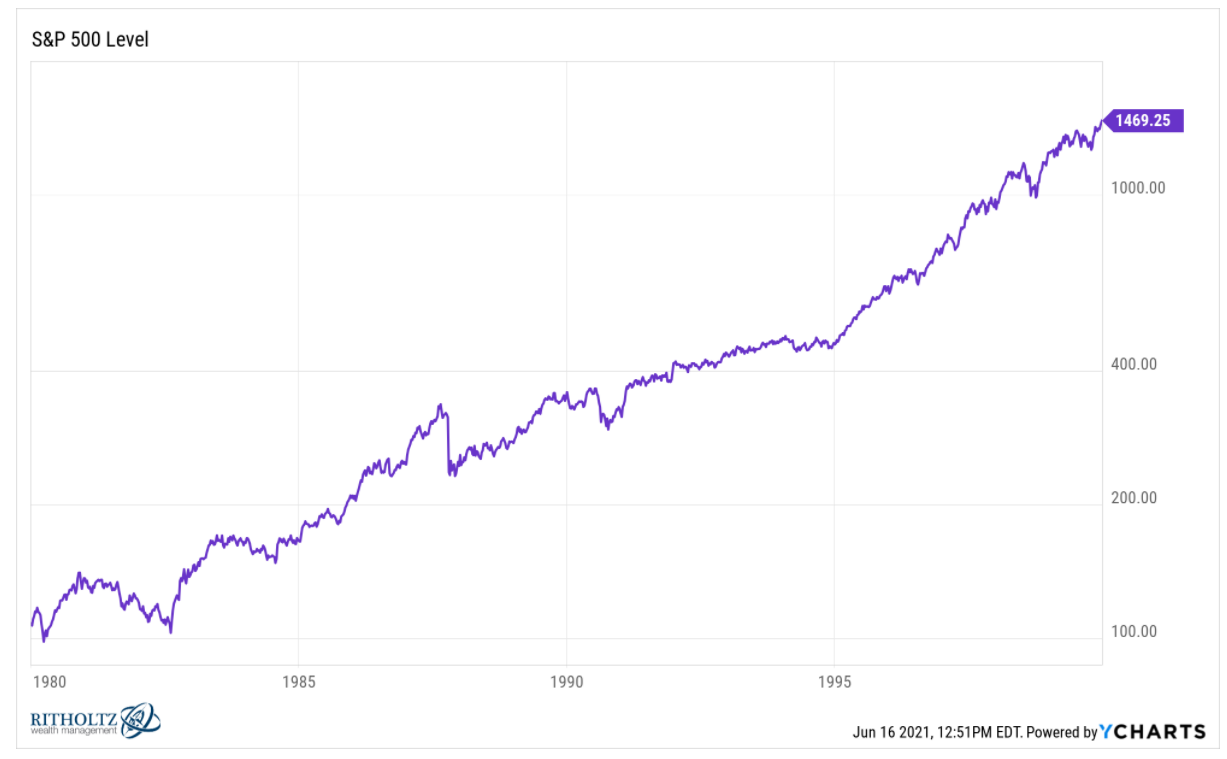

You got almost 18% per year in the ’80s and ’90s…

But that came with a 34% hit in 1987, a 27% hit in the early 1980’s double-dip recession, and a couple of 20% hits along the way. Nine corrections above 10% along the way, some violent, and yet in looking at the above chart, they seem barely noticeable.

What is your point?

Well, I was going to make a different point, but now I am distracted by this point I want to make first … If you think 15-18% returns were good for holding the index in those long periods, imagine the returns someone got for actually reinvesting dividends that were paying out in all those market dips. Imagine compounding the returns with extra shares afforded you by extra share reinvestment that those delicious market corrections provided. In other words, high return two-decade bull markets are good; but reinvesting the dividends of high dividend growers throughout the volatility of such is great.

But the point I started to make in my mind before the aforementioned dividend distraction is this: The entire narrative of long-term stock returns is true, and the entire narrative co-exists with the frequency of violent market setbacks. Yet, some believe they can time around such, always being in the market when up and avoiding the market when fantastically down. These people are called delusional, or else they are called dishonest. As I always say, “show me the confirms.” Enough said.

The better perspective for rational investors is to (a) Accept that the returns you want are largely made possible by the violence and frequency of setbacks (lacking such volatility, the risk premium would evaporate); and (b) Seek to capitalize on such.

As for letter (a) – just understand it is easier said than done. It is why we are here on planet earth – to do such for you. Because the next violent setback will ALSO provoke the question, “well, is this one different?” It won’t be. But people will ask because people are human. And as for letter (b) – see the top paragraph in this section on dividend growth.

A Moment Like This

I think that the entering of markets at a 25x forward multiple and a 1.5% (or lower) bond yield suggests a higher need for recalibrating return expectations. Put more succinctly, historically, these entry positions mean index returns that are lower than have been historically achieved.

Here are two things I did not say:

(1) These entry levels mean negative returns over the next decade for stock and bond investors

(2) These entry levels in the indexes will affect all investors the same

How could #1 and #2 NOT play out that way? Well, in the case of #1, it is entirely possible that forward returns disappoint relative to historical returns but still deliver a positive return. This would frankly be my forecast for a 2020’s investor in stock and bond indices over the next ten years.

But as for #2, what one enters at current multiples matters. Not all valuations are created equal. Active management means the potential to avoid certain over-priced assets or potentially to miss out on some under-priced opportunities. The decisions made will impact the results vs. the base story of the market.

TBG application

We believe forward returns for risk assets will not come easily, at least not in the way they generally do coming out of a recession or a sustained bear market. Moving from trough valuations to peak valuations is a profitable exercise. Starting at an elevated valuation level, at best, enhances the possibility of sub-normal returns and, at worst, creates a more challenging path to positive absolute returns amidst higher volatility.

But we do not want to rely upon easy market beta for our results over the next decade (and we believe over 90% of the financial advisor profession is doing just that). Our view is that a few major steps inside portfolio construction can do great good towards enhancing expected returns and reducing portfolio risk.

(1) Dividend Growth – as mentioned above (and every chance I get to scream it from the hilltops), we do subscribe to a dividend growth orientation for equity investment, and it is one of the great passions of my life. But in this context, we are not simply talking about the benefits of dividend reinvestment during times of heightened volatility. And we are not simply talking about the reliability of cash flow for withdrawers versus the risk of negative compounding. I would hold both of those advantages up as intrinsic superiority for either category of equity investors (accumulators or withdrawers). But right now, in the context of market valuations, Fed dependencies, low yields, insane behavior, and all sorts of other things – I bring up our dividend growth orientation to particularly focus on its single most important feature – what I devoted all of chapter three in my book to: The inherent superiority of dividend growth companies.

What I mean here is exhaustively covered in that chapter and has been the subject of hundreds of references in the Dividend Cafe over the years. But what I am saying here is really simple – as a general rule, without any attempt to universalize this across or against all companies – I am firmly convinced that the track record and future commitment to dividend growth both evidences and creates more stable companies. Balance sheets have to be more robust. Cash flow generation less cyclical. Management interests are more aligned. Business models are more mature. Broadly speaking, there is an undeniable hedge against other people’s behavioral insanity, against frothy valuations, and against extrinsic circumstances that ought not to be in one’s investment thesis.

It allows the investor objective to be company-driven, not market-driven, and it captures the actual source of returns the entire equity class is entirely dependent on: Paying today for the cash flows (profits) of tomorrow. This is why equities are bought. Period. Everything else is an internal contradiction that falls under the weight of reality, eventually.

(2) Alternatives – we are plenty sensitive to the realities of market volatility and the bandwidths that exist in one’s emotional comfort level with those “tail risk” moments (I here do NOT refer to standard market volatility that is par for the course since the beginning of time in equities; those who fret over 1-10% market movements have no business owning any equities at all, ever). Rather, I refer to moments like COVID, Q4 2018, Summer 2011, the Great Financial Crisis, 9/11, the dotcom bubble crash, and Black Monday 1987 – quick, sudden, violent experiences that “drawdown” 20% if it’s mild and much more if it’s not. They happen. They always have. They always will. And when they happen, it feels tempting to hit the exit button, making temporary drops a permanent loss.

A very common tool to avoid such a behavioral tragedy (unforced error) – in other words, to mitigate the risk of human nature – is to implement other asset classes not positively correlated to equities to the extent the return needs of the portfolio afford one such freedom. Bonds have played this role for a long time, and to a lesser degree, still, play a part. But it has to be a smaller part in the reality of 1-2% yields and Fed accommodation. Two of the three benefits of the “boring bond” world have been diminished (yield and tail risk hedge).

It is the world of alternatives that we use as a larger vehicle to diversify equities where such volatility mitigation is needed and appropriate. They are not owned to time the market, beat the market, or because of fear of the market. They are owned because humans have emotions, fears, and impulses. For most, a 100% equity allocation (even an allocation to the glories of dividend growth) can be too much to bear during those rare but recurring periods of stock market violence. Period.

Our alternative selection is exponentially better since we left the conflict-jailhouse of a big firm menu. While alternatives have risks all of their own, those risks do not correlate directly to the left tail risk of equity beta in times of market violence. We take the risk of manager talent and implementation in pursuit of non-correlated returns. I believe we do this very well.

(3) Leverage/credit reality check – Finally, again, only speaking to the realities of the present moment, we are intently focused on where leverage realities exist in our holdings. We do not buy securities on margin (using our debt’s collateral to buy more of the underlying collateral itself). But that is not what I mean here – I instead refer to what underlying financial leverage exists in our holdings. Our credit portfolio is the purchase of debt instruments (by definition), and yet we enter this world with a real respect for risk and a deep affection for underwriting prowess. We do not say stupid things like, “Hey, I found a fund paying 5% – no risk!” A professional person who says that to you is either an idiot, a charlatan, or most likely, both. We know there is risk in a reflated, levered-up financial system. We want to be paid for that risk but also be hyper-diligent in managing it, even as the Fed tells us, “keep going, the water’s warm!”

A Blast from the Past

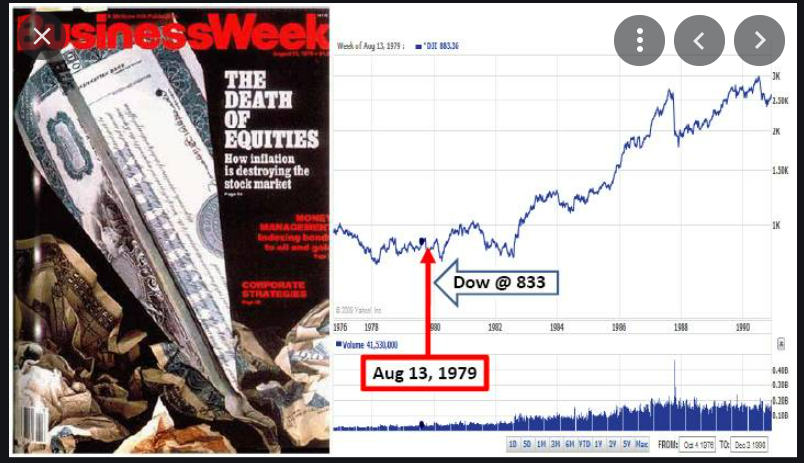

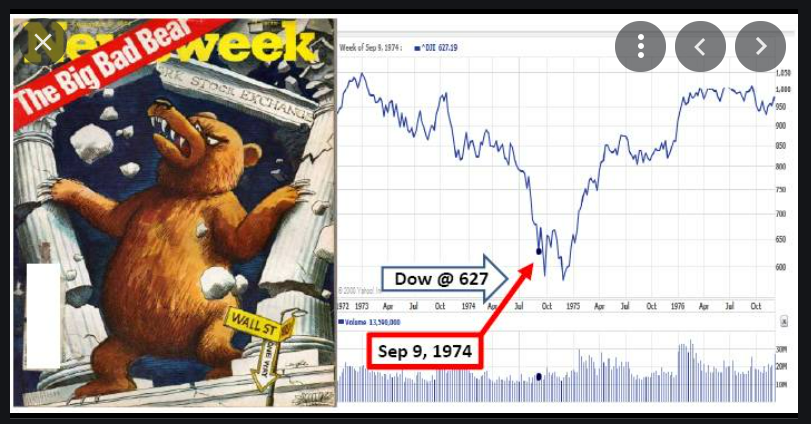

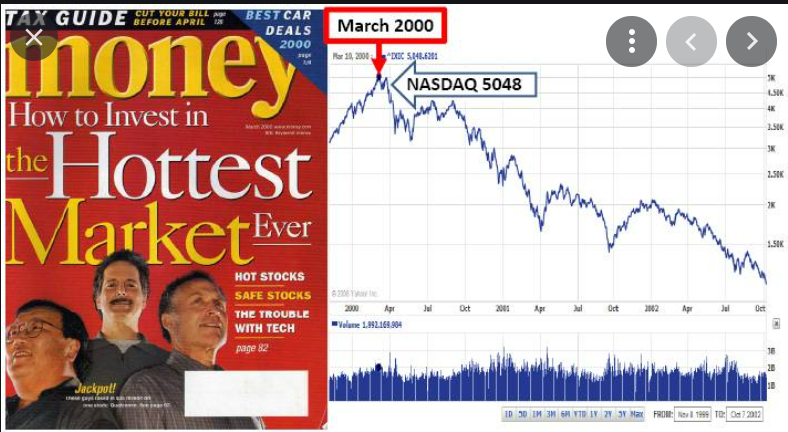

When you hear the media start running special sections on “Inflation Watch” or giving almost unending coverage to crypto or bemoaning SPAC’s one day or praising them another day – just take your pick from the current trends in financial media – I encourage you to visualize some of these past magazine covers and charts.

*Sources: Nasdaq.com, Nov. 11, 2009, InvestingCaffeine.com, Sept. 7, 2014

Am I picking on these magazines and covers unfairly? Maybe, but I can’t post the 100+ that I could have posted! I can’t post every link, every article, every interview that makes my point – and these magazine covers with corresponding data are just so, so fun.

So is the media the only enemy?

You need to understand the way financial products are created (and if you understand how financial products are created, you will then understand how MOST advisors choose to “sell” them).

I quote here from a book I recently read, written in 2002 about the history of Wall Street. These excerpts were in the chapter on the 1990’s tech bubble.

“Funds appeal to the basic instincts of the investing public. If telecom is hot let’s do a telecom fund. If technology is good, do a tech fund. These things come and go. But they’re born to die. Unfortunately, they take a lot of innocent people’s money with them.

We brought our Internet funds, telecom funds, tech funds, all at the high of the market, without any thought of whether any of this would be good for investors. They were good for the managers because they enabled you to gather a lot of assets. Bringing out funds only a moron would buy is not illegal.”

And I quote from the same chapter from the great Jack Bogle, founder of Vanguard Funds:

“What happened is that the business went from being a management business to a marketing business, a business of stewardship to a business of salesmanship. The idea isn’t to sell what you make; it’s to make what you sell.”

TBG application again

So here I offer a clear line of demarcation: We will be guilty of that over my dead body. Playing into the fads of the day devoid of investment conviction is a heresy I will not tolerate, and no one at The Bahnsen Group will tolerate. We will present the unvarnished truth, we will present our beliefs and convictions, and we will present ourselves – for good or for bad – and nothing else.

To that end, we work.

Chart of the Week

Consumer Staples, Industrials, and Materials have not gotten the 2020 Fed memo, apparently. Hmmmmm …

*Strategas Research, June 24, 2021

Quote of the Week

“Between stimulus and response there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.”

~ Viktor Frankl

* * *

I really enjoyed writing this week’s Dividend Cafe. I love history. I love applying it to the present and the future. And I love The Bahnsen Group. This business may have plenty of creepers lingering around, but I promise you that we are anti-creeper – from insidious press coverage to conflicted product manufacturers, to those who would tell someone something just because they know it is what they want to hear.

All of this stuff is about as good of a hedge against the anxieties of today that you are going to find.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet