Dear Valued Clients and Friends,

Consider this week’s Dividend Cafe an early Christmas present, not just because of Brexit and the phase one China trade deal and, of course, a 2019 in risk assets that has been one for the ages … but mostly because this is essentially a double issue Dividend Cafe with ample coverage on all the things you should be caring about right now as an investor. Because there will not be a Dividend Cafe next week we doubled up for you this week, so take a break from wrapping presents, grab a coffee (or egg nog), and jump on into the Dividend Cafe …

Dividend Cafe – Investment Committee Podcast

Dividend Cafe – Video

What a weekend!

On Monday, we released a special Dividend Cafe to address the results of the phase one China-trade deal and the special British election, complete with a podcast and a video from our Investment Committee. It was an action-packed weekend as the phase one China-trade deal was verbally reached (signatures of a bilingual, legal document are expected in January). This came on top of the shocking results of the special election in Britain, which all but assured the completion of Brexit under the newly-constituted Parliament next month, and the stirring up of the NAFTA 2.0 deal (USMCA), the final version of which is receiving pushback from Canada and Mexico. The China and Britain news was and is quite positive for markets, and markets responded in kind going into these events, and particularly on Friday of last week and into this week as well.

An ambitious declaration

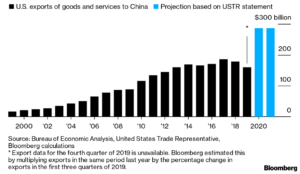

One thing that has stood out to me more and more since the rough announcements about the phase one trade deal is not anything critical of what it aspires to do, but some questioning about the basic mathematical feasibility of one particular part. Is $40-50 billion of agricultural purchases and an additional $100 billion of total U.S. products (in 2020 and 2021) even possible? It will be interesting to see, to say the least.

In all thy getting, get this

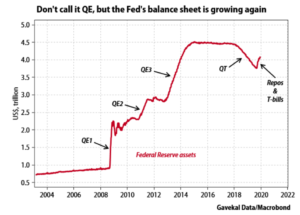

It strikes me as beyond indisputable how correlated risk assets are to what the Fed is doing with its own balance sheet. When the Fed began paring down the size of assets on its balance sheet in 2018, we had our first negative year in markets in a decade. As the Fed retreated from that tightening in 2019, the markets reversed to the upside, and in more recent months as the Fed has been increasing the size of its balance sheet (via repo market activity), markets have eaten it up. The Fed has been buying $60 billion of T-bills a month, primarily to provide dollar liquidity where it feared there was the risk of shortage. The market loves liquidity in the economy because it means access to credit and low cost of credit.

But …

The recent fed bond-buying program (what many sarcastically or perhaps literally call “non-QE, QE”) has not caused the reversal in U.S. dollar strength or rally in emerging markets some expected. A very simple explanation may be that this is simply a case of “not yet.” But I also believe that there is trepidation about how lasting this new-found fed liquidity love may prove to be.

My own conclusion is that this cyclical factor is but one reason of many that the dollar is likely to weaken, and with it, a price reflation in many emerging markets. More on that in the 2020 perspective & forecast piece coming in the new year …

Politics or Economics? A difference with a distinction

The budget bill passed this week ($1.4 trillion of spending) can be called a political story for a lot of reasons, and certainly, if it were passed in a Democratic administration, the Republicans would be furious about it. But the reality is this: The government does not have the money in their collected revenues to pay for this level of spending, so they issue new debt to do so. That excess debt (called Treasury bonds or Treasury bills depending on the maturity) sits on the balance sheet of the financial institutions of our country (as an asset) – the dealers own the bonds; the government owes them money. This matters because of the mechanics in how our financial system works (see my section below on Fed liquidity), but it matters more because it simply means a larger government doing more crowding out of the private sector.

Some Brexit follow-up

In the aftermath of last week’s stunning British election results, the sterling, pound rallied, UK stocks rallied, and this week they both “settled” a bit (way up from lower levels of a few weeks but a tad off highs of late last week). The chain of events that led us here is rather simple:

- In 2013, then Prime Minister David Cameron promised a referendum on Britain’s membership in the European Union if he won the election. He did.

- In 2016 the British people shocked the world by voting to exit the European Union and negotiate their own terms and conditions for trade and such outside of the ghastly centralized bureaucracy. Cameron resigned as Prime Minister, and Theresa May became Prime Minister, tasked with a reasonable and sober-minded execution of the people’s democratic will.

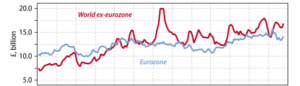

- Many from Wall Street to the press to the European Union predicted Armageddon for Britain if this happened. For three years now, Britain’s growth has outperformed the rest of Europe’s, and Britain’s economic, currency and stock performance have embarrassed the critics of Brexit.

- In 2017 Brussels (EU) and London began negotiating for the exit. Brussels lived up to expectations and made it as difficult as possible for an orderly and economically sensible exit.

- Theresa May spent the better part of the next two years trying to navigate conflicting forces and wills, sometimes within her own party, but ultimately left office unable to deliver her mandate of an orderly exit.

- Boris Johnson became Prime Minister on the promise of a Brexit no matter what, even if it meant a so-called “no-deal Brexit” (independent of negotiated terms and such with the European Union)

- A deal with the EU was agreed to, but Parliament did not agree to proceed by the agreed timeline. Boris Johnson called for a special election which would re-align Parliament (and the Prime Minister), presumably with clarity and adequate force either for or against a special election.

- Last week, the people soundly voted against the far left-wing Jeremy Corbyn and the Labour Party, and with the conservative Tories, setting the table for the Brexit package already negotiated with the EU.

- No “hard Brexit.” No “Brexit in name only.” The will of the people – a real Brexit, with sensibility and opportunity for all. The idea that Prime Minister Johnson is proposing “too quick” of an exit will be yet another embarrassment for critics of Brexit, who seem not to understand how badly European trading partners need Britain. British exports to the rest of the world are growing 7.5% in the last twelve years (vs. 1.7% within Europe). Britain will be just fine.

* Gavekal Research, The Daily, Charles Gave, Dec. 19, 2019

Europe has gone down a path of manipulating their exchange rate and offering fake money to zombie banks to stay afloat. It is not sustainable and will lead to more of the same generational stagnation they are already living in. The UK will not merely be honoring the will of their electorate in reasserting greater sovereignty and political freedom with this Brexit; they will be decoupling from what is the biggest economic hot potato on planet earth …

I’m old enough to remember a few months ago

A key part of my year-in-review discussion is going to center around the inverted yield curve and recession hysteria of three months ago. As I type, the three-month Treasury bill is at 1.56%, and the 10-year is at 1.93%. That’s not the steepest yield curve I’ve ever seen, but it’s certainly not the 2% 3-month vs. 1.5% ten-year of four months ago. Yes, the yield curve briefly inverted late summer, and yes, many past inversions have been followed by a recession. We argued then (and argue now) that a recession will come eventually, because recessions are cyclical realities that are unavoidable through time. We further argued that the yield curve inversion at that time was not necessarily indicative of a pending recession, as idiosyncratic events were causing it (namely, global bond yields forcing unnatural buyers into U.S. debt at unnatural yields). The reality is that down pressure on short term bond yields had been artificially created by Fed activity, and that downward pressure was taken away when the Fed stopped buying short term T-bills. They now are buying short-term T-bills, and lo and behold, the yield curve has steepened.

Now, shouldn’t the yield curve slope naturally with longer-dated bonds offering higher yields than shorter-dated ones just in a natural and organic way, independent of Fed interventions? Of course, it should, but we don’t live in a Fed-laissez faire world, do we? The Fed is the marginal buyer of U.S. debt and therefore is controlling the shape of the yield curve more than market forces that otherwise may be telling us something important about the economy.

So a recession will, in fact, come someday, and I pity those whose livelihoods or portfolio results depend on accurately predicting such. History has not been kind to them. 2019 was a case in point.

Speaking of a few months ago …

Another story from a few months ago that did not age well was the “repo market” fiasco that saw unexplained rate spikes as the Fed scrambled to create liquidity in the overnight repo market that is so important to a plethora of funding mechanisms. Admittedly, there was reason for the differing explanations of what had caused it, and I am all for a spike in paranoia when odd things with disputed explanations start happening in funding markets (consider it my own PTSD from 2008’s auction-rate market, repo market, TED spreads, commercial paper market, and any other number of funding debacles that the world suffered in the early innings of the financial crisis). That said, the “wrong theories” on what the repo mess was a few months ago are now debunked, and the Occam’s razor of it all played out (as it almost always does). Dollars were on short supply, and the Fed’s actions since have served the purpose of being “liquidity provider of last resort.” Treasury itself is no longer draining liquidity from the system the same way they were in September, and the Fed has replenished that capital on bank balance sheets.

I don’t like risk assets being boosted because of technical factors like liquidity demands, bank excess reserves, and the like, but if I were a betting man, I would say that net-net the Fed is likely to err on the side of greater liquidity still into 2020, leading to more permanent levels of elevated reserves and downward pressure on the dollar.

Politics & Money: Beltway Bulls and Bears

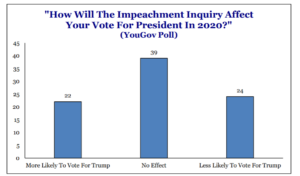

- On Wednesday, the House voted to impeach President Trump with all but four Democrats voting yes, and not a single Republican voting no. Markets were flat going into the vote Wednesday and up Thursday morning after the nighttime vote – meaning, markets didn’t care. The action will now move to the Senate, where an acquittal is essentially assured, the only questions being how long the trial goes and how much fun and adventure will come out of the process. Polling indicators are quite clear that few Americans are paying attention to the whole escapade, and one’s assessment of the event itself is virtually entirely tied to their own partisan leaning.

- Of course, one could suggest that the impeachment activity may not be a market-moving event now, but will be if it impacts voters in the 2020 election. It is interesting to note that a recent CNN poll (not a right-wing bastion, in case you haven’t noticed) recently showed the budget deficit, healthcare, infrastructure, immigration, climate change, DACA, economic issues, gun rights, and big tech as all more important to voters than impeachment. The objective observation must be that the market does not care about this, and the voters do not seem too much either. That said, the voters care a lot about various issues, and of course, the specifics of candidates – and how that will play out in 2020 is anyone’s guess.

* Strategas Research, Policy Outlook, Dec. 18, 2019, p. 3

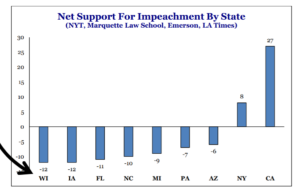

- I might argue that this is the most important chart on impeachment as far as what it says politically, and culturally.

* Strategas Research, Policy Outlook, Dec. 18, 2019, p. 7

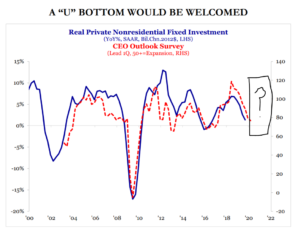

Chart of the Week

There is no chart that is more important to answering what happens in the next phase of economic expansion than this. Will business investment experience a “U-shaped recovery” in the present state of the trade war, or has enough business investment deterioration taking place that this fails to become catalytic in enhancing economic growth? This is not an issue we have a crystal ball on, but it is what we believe will be the primary determinant of economic health in 2020-2022.

Strategas Research, Weekend Reader, Dec. 14, 2019, p. 3

Quote of the Week

“Common sense and a sense of humor are the same thing, moving at different speeds. A sense of humor is just common sense, dancing. Those who lack humor are without judgment and should be trusted with nothing.”

~ Clive James

* * *

And just like that, you have finished the final Dividend Cafe of 2019! The market is closed half-day next week on Christmas Eve and the whole day on Christmas itself, but a Dividend Cafe in the days after Christmas didn’t sound like something people would want to read (or something I will want to write, hosting family next week and all the festive-holiday things) …

We may do a brief Dividend Cafe during the abridged week that ends January 3, but it too is a fragmented and distracted week in markets. The official launch of the 2020 year is Monday, January 6, and we will not only have a robust Dividend Cafe that week (like normal), but will also be releasing that week our annual “Year in Review/Year Ahead” piece that seeks to thoroughly analyze the year behind us (including gauging the outcomes of our prior year themes and forecasts), but also provide a comprehensive look at the year ahead of us. Our thoughts on 2020 are many, and we look forward not only to what lies ahead in 2020 but to sharing with you our economic and market positioning and perspective.

In the meantime, may you and yours enjoy a thoroughly delightful holiday week, a Christmas filled with memories, family, and good cheer, and all of the special warmth and love this season truly represents. Merry Christmas and Happy Holidays to you and yours …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Café features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet