Dear Valued Clients and Friends,

These shortened market weeks (due to the President’s Day holiday) tend to feel a bit different than a full market week, compounded by the fact that earnings season is essentially over, and the media’s favorite topic these days (coronavirus) seems to be in a slow period of news developments …

Nevertheless we have the whole week unpacked in this week’s Dividend Cafe, and ample commentary on the Fed, earnings, debt, and more.

Week in Review

The market was closed Monday for the President’s Day holiday, and we saw markets decline over 150 points Tuesday, then go up by about the same Wednesday. We dropped 125 points on Thursday without a clear catalyst (my favorite kind of down days) but had been down well over 300 points earlier in the day Thursday. The markets look poised to open down a hundred points or so as of press time Friday.

Fed Mistake

No, not a mistake by the Fed itself … A mistake investors may be making about the Fed … The market is currently pricing in an 85%+ chance of a Fed rate cut some time in 2020. This certainly could happen, especially if the short-term rate remains too close to the 10-year yield (though even that is likely addressed through increased T-bill buying). And should macro data or some transitory event happen that warrants market coddling, we agree that the Fed would indeed cut from here.

But 80% implied probability does not suggest an “insurance cut” or “macro conditions warranting one.” The market seems to be simply expecting it, and I do not agree. It is hard to set odds on something like this, but 30-50% seems much more appropriate. I believe there was some push-back within the FOMC even getting the 75 basis points cut they have done in the last six months; an entirely new cut in an election year, with economic conditions strong, just strikes us as a more difficult sell without some catalyst that gives them cover.

But wait!

Why might the Fed cut after all, and why is the futures market so confident they will? Well, that pesky yield curve has inverted yet again (the 3-month T-bill is sitting at 1.57%, and the 10-year is at 1.48%). As this argument goes, the reasons for it all are irrelevant – and the bottom line (i.e., an inverted yield curve) is why they should be expected to act. Should bond-buying efforts in the T-bill market not work in the weeks/months ahead, I will very much agree that the curve inversion will lead to more fed funds rate cuts.

Earnings report card as promised

Positive earnings surprises have added $8.5 billion to aggregate S&P earnings this quarter. We will likely end up with a +1% earnings growth rate on the quarter (year-over-year, meaning, Q4 2019 results vs. Q4 2018 results). Operating earnings, by the way, have grown significantly more (vs. the “as reported” earnings we generally use as the barometer). The expectations coming into the quarter were for a decline of 2-3%.

Can anything break the dollar’s rise?

The Fed in 2019 went from modestly hawkish to extraordinarily dovish, and while the dollar’s ascendancy paused, it hardly forced a decline. And now two months into 2020, the Euro is making a 3-year low against the dollar, and the Yen is at a 10-month low (again, all in the backdrop of Fed dovishness). A continued depreciation of Euro to the dollar would/should lead to a growing trade surplus for Europe which would/should trigger a self-correcting currency adjustment. But that has not happened yet, and direct interventions in the currency market are not likely right now. There exists no fundamental way to state what we believe any currency will do, just what economists and traders think it should do.

In a heavy period of monetary intervention and structural economic challenges all over the globe, currencies do not always cooperate with what the intelligentsia anticipates.

Credit market clarification

Are P/E ratios in the S&P 500 high? Yes, a bit over 18x forward – on the high side, yet nowhere near the mid-20’s of past bubbles. Are credit spreads tight (also a reflection of an expensive asset class)? Yes, at 350 basis points, the High Yield marker is tight, but nowhere near the 250 we have seen in periods of unforgivable risk complacency. Both things are true – high/tight, but not the highest/tightest.

You owe me the money they owe me

I have been reading more and more lately that the healthy position of household balance sheets and declining personal leverage is a sign that the growing government and corporate debt is not a problem. And I certainly agree a de-levered household sector puts us in an infinitely better place than we were 12 years ago. But it is important to understand – first, that leverage is lower in the household sector – not overall debt. What that means is the debt divided by the assets is lower even as the debt itself is higher, because the value of the assets is higher. And that counts; that means something! But it is different than saying debt has been declining.

But secondly, let’s address something about the idea that government debt is an entirely separate category from personal and corporate debt. And let’s especially address the idea that somehow we are supposed to be comforted by that.

What revenue exactly pays the government debt? By what mechanism do they deal with their debt? Their revenues are taxes – period. Their tricky mechanism is inflation – period. Of course, they could try cutting spending and services, too. Once you are done laughing about that, think about what services would be cut that would make people happy. All government debt is personal household debt. The timing of payment and complexity of mechanism may be different, but make no mistake about it – government debt translates to household debt in every meaning of the word.

And what about corporate debt? Well, this may have one further degree of separation from household debt relative to government debt, but it is really not much different. Individuals are employees of companies, shareholders of companies, or customers of companies. Excessive debt for a company will be dealt with by lower wages, lower returns to shareholders, or higher prices to customers (or some combination thereof).

The combination of healthy organic economic growth and low interest rates has kept any of this from negatively affecting shareholders for quite some time. And it would not surprise me at all if the benign environment continues.

But no one should be under any misnomers here – the growing level of sovereign and corporate debt is a personal household matter!

Speaking of government debt …

Total tax receipts were up 4% in 2019. Corporate tax receipts were up 12% in 2019. But tax rates were cut in 2018, so how can this happen?? One explanation: Laffer’s Curve (the very simple economic calculus that declining tax rates drive economic growth where revenue increases, not the opposite – named for Reagan economic guru, Art Laffer).

Now, cut spending, and we’d actually be getting somewhere.

Politics & Money: Beltway Bulls and Bears

- There is no question that the big story of the week in politics was the Democratic debate/brawl on Wednesday night, where Mayor Bloomberg was just utterly pummeled by all of the candidates on stage, and only Mayor Pete Buttigieg seemed interested in laying a finger on Bernie Sanders. The Nevada caucus is Saturday, and Bernie Sanders appears to have a wide lead. We will know a lot more after South Carolina (the following Saturday), where if Joe Biden performs poorly, he will likely exit the race. In a nutshell, Bernie Sanders is the candidate to beat for the nomination, yet multiple candidates are diluting each other and reducing the likelihood of that happening for now. The candidate who has spent over $400 million thus far to be the one to take out Sanders was possibly left for dead (politically) on that debate stage Wednesday night.

- I discussed the political climate on Bloomberg Thursday morning after the debate.

- It isn’t generating a ton of attention, especially compared to election conversation, but the Trump administration’s plans to finally unload the national atrocity that was Fannie Mae and Freddie Mac (government-sponsored housing enterprises). Secretary Mnuchin has stated the government will maintain “limited and tailored” support, but the conservatorship launched in 2008 will come to an end. The path and timeline is not clear, but this has the potential to be a much bigger story than it is right now.

- Judy Shelton’s nomination to the Federal Reserve board is still held up in Senate hearings, and is likely to come down to the wire. A Republican dissent or two would torpedo it.

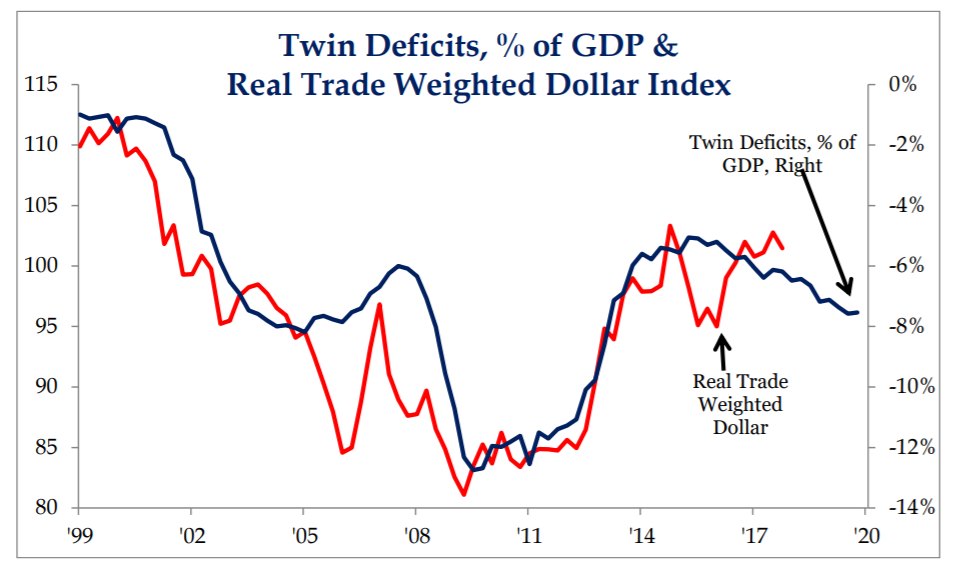

Chart of the Week

Is it easier to believe that deficits are about to reverse, or that the dollar is about to decline? Or, is it possible this correlation itself breaks down, and that deficits continue to decline while the dollar continues to ascend? That latter view has been playing out, but reversions to the mean are the rule of economics.

* Strategas Research, Investment Strategy Report, Feb. 21, 2020, p. 2

Quote of the Week

“History is merely a list of surprises. It can only prepare us to be surprised yet again.”

~ Kurt Vonnegut

* * *

I will leave it there for the week. February seems to have been taken over by up-and-down uncertainty, much of it around coronavirus, and much of it around, well, the uncertainty of the moment. An uncertain earnings picture for the year. An uncertain political climate. An uncertain macroeconomic picture (will business investment join the consumer in promoting economic growth). Who would have guessed that Fed action and trade war drama would be completely removed from the calculus and conversation?

These are great times to be clipping dividends, especially the ones that grow. Of course, I have yet to come across a time that it was not great to be clipping dividends. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet