Dear Valued Clients and Friends,

Markets moved around a bit this week (not much) but mostly stayed in a reasonably tight range as the Fed did what everyone knew they were going to do (or rather, didn’t do what everyone knew they weren’t going to do), trade discussions continued, and general uncertainty persisted as the world continued to turn.

I decided to use today’s Dividend Cafe to bounce around with brevity and precision from one topic to the next, and I hope each topic’s coverage provides needed punch. From the UK trade announcement to pending talks with China to where things stand with the tax bill to the reality of the U.S. energy story to a Mar-a-Lago accord coming early, this is a true trip around the horn.

So let’s jump in, to the Dividend Cafe …

|

Subscribe on |

Not Really a Sneak Preview

On Thursday, the United States announced the framework of a new trade deal with the United Kingdom. Markets were up +600 points in the aftermath of the announcement, which came with President Trump urging people to “go buy stocks now.” It is my preference to wait for the fine print (the “final details will come in a few weeks,” according to the President). That said, what we are being told is that the 25% tariff on autos and auto parts is being lowered to 10% and that the U.S. is eliminating the 25% tariff on steel and aluminum it implemented a couple of months ago. The UK is opening more markets for agricultural, chemical, machinery, and industrial products. I want to do a deeper dive when the deal is actually presented to the public.

One thing I would point out is that the U.S. runs a trade surplus with the UK. To some, that means we have been ripping them off. I wish I could add a smiley face emoji or an LOL or something like that, but actually, that is what some think. That little fact sort of makes this particular deal hard to use as a model for what to expect in other deals.

What I Like to Hear More

The hype, buzz, and noise may be more intense around the talk of trade deals, but from the vantage point of pro-growth, supply-side economics, I would argue that the bigger story potentially playing out is the talk that the tax bill will include:

- 100% expensing for capital equipment purchases (i.e., no depreciation schedules; just complete dollar-for-dollar deductibility at the time of purchase)

- R&D expensing (presumably also dollar-for-dollar at time of expense)

- Interest expense deductibility up to 30% of EBITDA

- More favorable rules for small business expensing

Now, a fair question may be how they can get these things done given the tight window by which the bill must reconcile with the budget. In other words, between making permanent President Trump’s 2017 tax bill and other desired tax cuts they want in the bill, there is not supposed to be room for anything else, right? Well, here’s the thing: The aforementioned tax reforms were all part of legislation that passed the House already in 2024, but never got a vote in the Senate. And guess what? The official Congressional scoring has these particular tax moves with accompanying pay-fors actually reducing the deficit over ten years by $33 billion! These are the lay-ups of the plan cost-wise, and they are far more stimulative than other cuts being discussed.

It isn’t hard to picture who benefits from such a scenario in public equity markets: Companies with high capital expenditures, and companies with high R&D that is not currently deductible (pharma already has the deduction). But this is not primarily an issue for public equity markets – it has far more to do with the broad economy and the beneficial effects of incentivizing business investment.

Where do Things Stand with China?

Treasury Secretary Scott Bessent is scheduled to meet with Chinese Vice Premier He Lifeng this weekend in Geneva. Beijing has appointed Lifeng their top official for trade matters, so while this is not yet President Trump meeting with President Xi, it is a far more senior dialogue than was originally understood. I, of course, have the privilege of writing about it now, just a day or so before it happens, with no idea whatsoever as to whether or not the meeting will amount to an “agreement to agree to talk about talking” or whether or not there will be substantive moves towards de-escalation. Obviously, there is not going to be a deal that comes out of this weekend, but there are reasons to believe both sides are more anxious to move the ball than has been previously articulated.

Secretary Bessent was clear that China is not, yet, one of the 17 countries the U.S. is in “active negotiations” with, but I believe this Swiss weekender is meant to negotiate the terms of beginning negotiations.

What we know is that China’s exports for the month of April were up +8.1% from April of 2024 (in dollar terms), but that shipments to the United States were down -21%. However, exports to the European Union were up +8.3%, to Latin America +17%, to Africa +25%, and to Southeast Asia +21% (most analysts agree that much of the surge in exports to other southeast Asian countries is a re-routing of U.S. orders to other countries to skirt the tariffs and trade embargo). So, in all of the data, there is a basic concern for both parties: China does not want U.S. exports down 21% (and falling), and the U.S. can see that China is replacing the U.S. as a customer, at least for now. Additionally, China’s 8.1% export growth may seem like a solid year-over-year number given the trade war with the U.S., but it is a stark deceleration from the 12.4% seen in the months prior. China has also targeted 5% real GDP growth this year, and they are almost certainly going to be closer to 4% with trade with the U.S. on such a decline. Though the U.S. would kill for 4% real GDP growth, a 20% reduction in the growth target (from 5% to 4%) is monumentally bad.

The reality is that the data points of concern get worse, not better, from here, for both parties, and incentives are vast for both countries to find a path to de-escalation.

My best guess (and I assure you, I have absolutely no chance of perfectly forecasting how all of this will play out):

- The U.S. drastically reduces current tariff levels, quickly, as a good-faith step in beginning negotiations (just before press time this morning President Trump floated the idea of lowering from 145% to 80%, which means they are going to 40-50%; I guess I don’t always find the ‘art of the deal’ that four-dimensional)

- The talks begin, and China ends up making big promises on curtailing fentanyl

- China agrees to a bunch of purchases of U.S. products

- The U.S. lowers tariffs further

- We settle with reciprocal tariffs, various waivers and exceptions, headline announcements about new markets and new terms, and trade goes back to what it was before, with a few tweaks around the edges.

I stand by my forecasts above, but without timelines on each of them, they are pretty worthless, and the devil-in-the-details of #5 is really all that matters.

Don’t Look Now, but the Accord is Enjoying a Pre-Game

A significant part of my outlook headed into this year, around all this trade and tariff talk, was that currency and foreign exchange would be a big part of the agenda, and a big part of the toolbox towards resolution. Secretary Bessent (before he was Secretary) wrote an op-ed that scratched all the itches he wanted to scratch describing a “Mar-a-Lago Accord” which would codify a new era of reduced currency manipulation and a structurally stronger Chinese Yuan relative to the U.S. dollar (believing a stronger dollar and weaker Yuan has been used to benefit China in our trade exchange).

And indeed, the dollar is down 1.5% against the Yuan over the last month. However, it doesn’t require pulling the lens back too far to see that the Dollar and Yuan are basically at the same exchange rate they were one year ago (actually, the dollar is up a tad).

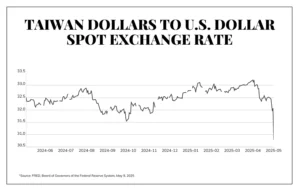

The Taiwanese gapped up 5.8% last week against the U.S. dollar, the largest one-day and one-week gains in its history. The U.S. dollar is now down over 12% relative to the Taiwanese dollar in just over a month.

The administration has people (Miran, to a lesser degree, Bessent) who explicitly say they want a weaker dollar. This issue or its technicalities do not especially animate President Trump, but he clearly believes a stronger dollar harms American competitiveness. What countries would strengthen their own currency against the dollar as a bone to throw the U.S. in trade negotiations largely depends on the nature of the relationship that country has with the U.S. Taiwan and South Korea’s reliance on the U.S. security apparatus provide incentives towards a currency accommodation that China and even India do not have.

In theory, what investment space is the seeming winner if the dollar is declining and energy prices are declining? Well, emerging markets equities for one, are currently about 10% better than the S&P 500 year-to-date.

Dry Powder

In April, corporate M&A fell to the lowest level in 25 years (public companies were dealing with massive volatility and tariff uncertainty, you may have heard). And yet, private equity buyouts increased 25% in April over April of last year, and the dollar volume of transactions was about double the monthly average of the last three years. What gives?

There were some big transactions, and that helps run up the count (if you need help understanding how big transactions increase the dollar volume of transactions, take a minute and say it out loud slowly). But fundamentally, we are seeing the heavy dry powder many leading private equity sponsors have acquired become a tailwind for deals. It is estimated that, globally, private equity managers entered 2025 with $1.2 trillion of cash available for deployment (i.e., uncalled capital commitments). Some of this has been available for years as the higher rate environment ushered in during 2022 slowed deal flow behind less attractive underwriting.

Financing these deals was not an issue, either, despite credit spreads having widened in the month of April as private credit continues not only taking market share from bank financing but from the high yield bond market, too. And since private credit deals can fund far quicker than either the syndicated loan market or the bond market, the nature of the market (flush with liquidity, itself) complemented private equity’s leveraged buyout needs quite well.

There is still a huge backlog of private market deals that need to happen by way of exits (i.e., well-performing businesses that sponsors want to sell but have lacked a high volume of divestment options). There is a lot of wood to chop here for 2025 to become the healthy year in M&A and corporate finance I forecasted, but private equity is doing much more than its fair share of the lifting, led by better financing options and a significant build-up of LP equity capital commitments.

Does This Say it All?

From a major producer of oil in the Permian Basin:

“Put simply, we would prefer to use the incremental dollars generated to repurchase shares and pay down debt over drilling and completing wells at these prices today.”

Concerns about demand for oil in a tariff recession, combined with concerns of increased OPEC+ production, have weighed on crude oil prices and performance in the energy sector over the last month. Natural gas and midstream energy are really a very different story here, and any dislocations in those sectors out of broader distress in crude production become very buyable opportunities.

The Tug-of-War That Ends Where it Started

The argument for a weaker stock market from here is that this trade war continues, perhaps worsens, and that the economic damage is deeper and severe than markets currently expect. This, combined with high market valuations, leads to a weaker market.

The argument against that is that the trade stand-off ends, the damage already done proves already priced in, and of a lesser magnitude than feared. Lower oil prices help the economy, but without a broader deflationary surge, and the Fed’s ongoing stimulus boosts valuations, and everything threads the needle. Add in tax reform, tax cuts, and even some other geopolitical or policy luck, and things land well.

Or, of course, there are hundreds of scenarios in between.

What should you count on?

That no one knows.

Chart of the Week

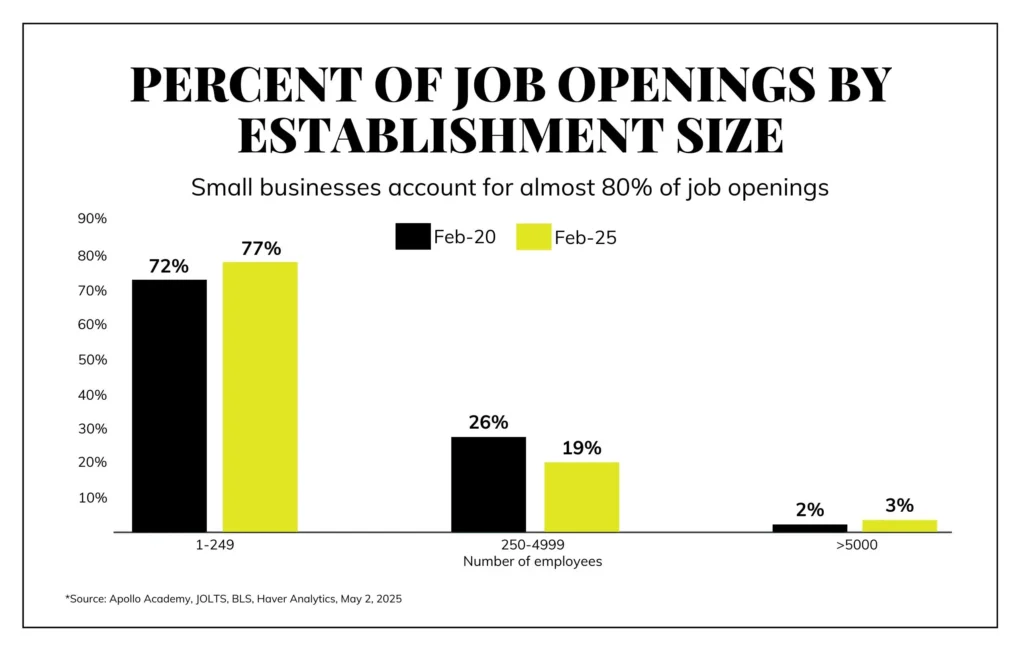

If I am right that the biggest vulnerability from tariffs for the U.S. economy is with small businesses (those who lack the political clout to secure waivers and exceptions and who lack access to capital markets to navigate securely), then this data highlights the economic vulnerability in the current moment. Nearly 80% of job openings are with businesses that have 250 employees or fewer. Should the trade war hurt the hiring ability of small businesses, the impact will be more severe than if it were merely hitting large companies. Put differently, the risk is that job hiring runs into a significant freeze if the trade damage grows and bleeds into the small business domain of the economy, where most job openings lie.

Quote of the Week

“Bulls make more than bears, so if anything, being an optimist about life and about things in general is a great attribute as an investor. You just can’t be starry-eyed and naive.”

~ Stanley Druckenmiller

* * *

I am going to dedicate next week’s Dividend Cafe to what we can learn from the investment success of Warren Buffett. There are different takeaways in my analysis than you often read in the media, and I am excited to share them with you next week in a very special Dividend Cafe.

In the meantime, I am looking forward to seeing many of you in Minneapolis this coming week. Enjoy your weekends, and may all of you moms particularly enjoy the Mother’s Day holiday!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet