Dear Valued Clients and Friends,

As of press time on Friday, the market was down -1,600 points (-3.9%) in 48 hours, and the Nasdaq was down -6% in 48 hours (and down over -10% since the high of three weeks ago). My planned topic for today’s Dividend Cafe is more connected to the events of this week than many will realize.

Fundamentals rule the market, right? As earnings go, so goes the market, right? When companies are growing revenues and profits, their stock prices can only go higher, right?

This is the part where you now expect me to say, “No, fooled you! I have something contrary to conventional wisdom to say,” but alas, there is essentially great truth in the statement that “as earnings go, so goes the market.” Fundamentals do [ultimately] rule the market, and business conditions do dictate a stock price over time. Lots and lots and lots of noise may trump fundamentals along the way, but stock prices ought to, over time, track earnings.

Benjamin Graham’s dictum remains unimprovable – in the short term, markets are voting machines (sentiment, mood, etc.), but in the long term, they are weighing machines (and what they weigh, is profits).

This week’s Dividend Cafe is going to reset our understanding of price, value, and that which drives investor returns. And it is going to allow us to look at the current lay of the land. Warning: you may not like what you hear. Second warning: you may really like what you hear. It all depends on what you are hoping to hear.

I am hoping you will hear, the Dividend Cafe.

|

Subscribe on |

Price and Value

So if all that matters is that a company is doing well, won’t stock prices just always go higher for companies that are, well, doing well? This is where an added dimension comes in that requires real understanding for those who want to be invested in public markets (especially those who desperately want to understand their returns around the price printed on a statement versus the cash returned to them). Sometimes, the expectations of a company doing well can be pre-priced in, or overly-priced in, and then, the future performance of the company may very well have to do with its stock price, but it has to do with the stock price that was already set, not the one that is to be.

Fundamentalists care about price because they believe that the value of fundamentals requires a price that has not already captured them. I think declining company fundamentals lead to a declining stock price, and I think improving company fundamentals lead to an improving stock price. But that just can’t be the end of the conversation. A valuation may very well reflect strong optimism in a company’s prospects, but fail to capture how good things will be for that company in the future. Think of Apple after the iPhone came out, and even after Apple got expensive … A $600 billion valuation seemed absurd, no matter how popular the phone was becoming. But $600 billion now at $3.4 trillion does not seem so absurd (no comment on the $3.4tn).

This is the tricky part for us price-conscious fundamentalists … You have to worry about fundamentals, you have to worry about the price (valuation), and you have to worry about how much the future fundamental opportunity is already reflected in the valuation. The hardest part about this is predicting the future. Let’s come back to that.

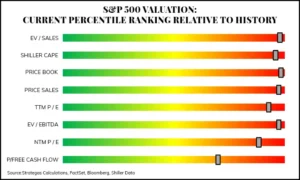

A picture to set the stage

I love this chart, regularly updated by my friends at Strategas Research, because it presents a diversified set of valuation metrics in unmistakable graphic form. If one metric was in the far green, and another in the far red, and a few in the middle, you’d have a pretty confused landscape about where things stand. Not only do we get graphic validation and affirmation that there are no confusing outliers at play, but we are also looking at valuation metrics relative to their own history.

I can argue that at given times, for given reasons, one of these metrics may offer a concerning read relative to historical norms that is not necessarily indicative of a broader narrative. I cannot plausibly argue such across the board. The Enterprise Value of the S&P 500 companies divided by sales of those companies, the price of the S&P holdings divided by the book value, the price divided by earnings (forward and trailing), and finally, the enterprise value divided by earnings – these are all telling the story of markets that are extreme historical levels of valuation.

Trailing vs. Forward Earnings

It is always possible that a trailing multiple could be really high, but a forward multiple is not really high when there is a certain earnings growth coming, or expected to come, year-over-year. In the case of 2025 earnings vs. 2024, the markets had (a) Been pricing in 11-13% year-over-year profit growth, AND (b) Attaching a 21x multiple to those forward earnings hope.

Not all items in the grocery store are over-priced

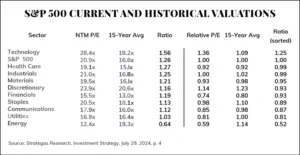

So this chart does three things that are worth noting. One, it shows the S&P 500 is 26% above its own historical valuation. That does NOT mean “it is about to go down 26%.” It just doesn’t. Earnings can come up. Historical averages can move higher. Over-valuation can stay over-valuated for longer than expected. For our purposes, all this chart says is that the S&P’s FORWARD earnings multiple is 26% above historical averages. But then it shows a few other things in terms of valuation – it shows that, by their own historical averages, energy is deeply under-valued, Utilities are in line, and Technology is 56% above its own historical average. Now, Communications, Staples, and Financials are above their average, but not by a lot. In other words, this shows that (a) The market is over-valued, (b) Energy and Utilities are not, and (c) Almost all of the over-valuation is in Technology. Okay, fair enough. But what else does it show?

If you adjust the S&P to its current valuation, and then look at how all the other sectors are valued relative to the S&P’s current valuation, ONLY Technology is over-valued. It measures the sectors relative to one another, in terms of historical relationships and valuations.

The challenge of the day

I said we would come back to the challenge of looking at valuation relative to fundamentals when future fundamentals could outperform expectations and leave current valuations looking a lot less silly than they otherwise do. I want to make three points about this, and then I want to never talk about it again, or at least not until next week when someone asks me about it …

- Sometimes, we are not talking about a high valuation that gets justified by future rapid growth and success; we are talking about math that just cannot pencil, ever. I understand the way Google in 2006 or Amazon in 2001 or Apple in 2013 grew into what they are today, and if you think setting an investment policy around three or four outlier companies in history is a good thing to do as it pertains to the future, be my guest. But let’s be very clear … Some of the valuation excess today requires inputs into a model that transcends logic and, at the very least, represents a highly uncompelling risk-reward proposition. Some of the valuation excess in history was the same thing. Some were not a story of failed delivery of future promise, but like Cisco in 1999, a success story of future promise attached to an absurdity of math. And that applies to some of what we see today, too.

- There ARE companies that will grow earnings at 30-50% per year for a time, but they will only protect a compound annual growth rate like that with monopolistic advantages (either legal or maybe not so legal) that are very, very, very hard to come by, and very, very, very, very hard to maintain. Therefore, the rapid growers of today become the less robust growers of tomorrow, because of business evolution and mathematical logic, and high present valuations almost always fail to capture this.

- My problem in this space of high growth/high valuation investing is not that I doubt the existence of companies that can sustain above-average growth for long periods of time. It is that, very candidly, that is not why people are buying them. Those who assert that XYZ’s famous hot dot tech company can, and will, outperform its own lofty expectations for either years or decades or generations to come, based on real cash flow projections and otherwise, are never the base case for high growth/high valuation. The investment case is, always, popularity. Fad. Momentum. “This time it’s different.” Hype. ‘I am cool and you boomers don’t know’ arrogance. First of all, I am no boomer (GenX baby!). Second of all, those things always end the same way. Always. Always. Always. Valuation bubbles connected to hype, where we are told to disregard the lessons of history, scare me because they should scare me.

Expected rates of return

If nothing else, my friends, understand this: When something of high growth is bought at a high valuation, its expected rate of return is lower than if it were bought at a lower or more moderate valuation. This does not mean the return will be negative. But the expectation has to be muted when the high growth is priced in, or at least more priced in than it used to be. And this may be the dumbest, most unnecessary paragraph I have ever typed in the Dividend Cafe, all the while being the thing I suspect most investors need to comprehend the most, despite its insultingly obvious simplicity.

Concluding Thoughts

Macroeconomic issues all scream for stability, logic, strength, and durability in risk asset investing. Fiscal conditions (excessive government indebtedness), monetary policy (the hyper-interventionist ambitions it now has), and geopolitics (do I need to elaborate?) all present a macro backdrop to invest in good quality and value. But risk asset investing is risk asset investing … there can still be price volatility in anything, and there will be.

But in these present times, the Pelotons of 2020, the FTXs of 2022, and the wide array of shiny objects that become valuation perversions must be avoided unless one is consciously gambling – not investing.

That is all the easy part. What to do with GOOD companies of HIGH valuations becomes less clear. One can start by comparing these to the three-prong test I give above. Is the math even remotely logical? Does the growth rate assumed eventually run into the law of numbers (or the law, itself)? And finally, is it rooted in reality or hype?

I believe that historical valuations are useful and that huge excesses to such are problematic. They can play out for a long time, and I don’t care. I know from history what happens in playing that game wrongly.

Therefore, a time-tested way to remove one’s self from this escapade, is to focus on distributable cash flow. It turns out that when you do that, you don’t just get the fruit from the tree you are after, but you also avoid overpaying for a tree that will never grow to the size you wanted.

Quote of the Week

“If something cannot go on forever, it will stop.”

~Herbert Stein

“Buy when the cannons are thundering and sell when the violins are playing.”

~N. M. Rothschild

“If you require a forecast in order for your investment thesis to do well, then I think you’re doing it wrong.”

~ Mark Spitznagel

Had to do three quotes today. Each has its own purpose in today’s message.

* * *

If you are watching morning market news this coming Friday, August 9, you may recognize some of the people ringing the bell on the floor of the New York Stock Exchange! More to come on that front … =)

In the meantime, happy Olympic watching, have a wonderful weekend, and reach out any time. We offer a consistent execution of a consistent philosophy at The Bahnsen Group. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet