Dear Valued Clients and Friends,

Anyone who knows me personally knows that I loathe melodrama. And hopefully, anyone who has followed my writing for any period of time, especially my financial writing, knows that I hate click-bait, hype, exaggeration, dramatic hyperbole, shock and awe, and other such media-friendly tactics designed to scare, provoke, or just plain manipulate us.

I believe almost every day I am writing The DC Today is a boring day in the grand scheme of things. Markets may be up or down a lot on a given day, but as a goals-based investment advisor, with a few exceptions, those day-to-day movements in markets are almost entirely irrelevant. Some days have legitimate policy news, and every day has some aspect of economic information or perspective (Fed, housing, COVID, energy, etc.) that I genuinely love sharing. But it would take a lot for one of my daily investment pieces to warrant some kind of a, “not this is a day that changed history!”

This week saw the highest levels of market volatility we have seen all year. It was primarily in high tech and small-cap and more growthy/saucy parts of the market, but the Dow had a couple big down days, Japan got whacked, and it was the kind of day where financial TV media ratings are up 40% or so from the norm.

And I am of the belief that this was a big, profound, and potentially impactful and historic week. At least, I think it will prove to be.

I just don’t think the bigness of this week had anything to do with market volatility. I don’t think it had anything to do with tech, with the Nasdaq, with Japan, with the CPI number, with bond yields, or anything else in that vein.

And while it may be a good “next guess,” I don’t think it had anything to do with the CDC finally saying vaccinated people no longer need to wear masks inside or outside (or, for that matter, the President finally saying so). Don’t get me wrong, I think it is big news (and by all means, let your friends know who may not have gotten the memo), but it is not world-changing, and in 31 states or so it was pretty much already happening.

So what do I mean? Why am I being “dramatic”? And what does it mean for you as an investor?

Jump on into the Dividend Cafe … (and no, this is not melodrama or clickbait; I am just out of room in my intro letter) … =)

What I am not talking about

Two events took place this week that I am sure seem very unrelated to one another. And neither of them is connected to the “big market news” of the week. By “big market news” I simply mean the couple big down days the Dow saw on Tuesday and Wednesday, the big recovery day Thursday (and as of press time, Friday), and the Nasdaq volatility that has that index down a thousand points in the last two weeks.

Earnings season was gangbuster for the markets, and corporate America on both the top and bottom line substantially outperformed expectations in Q1. Markets responded favorably, and this was on top of what had already been six months of favorable market action around economic recovery, the vaccine, normalization, and other such things (speaking of which, did I mention that the CDC said masks are no longer needed inside or outside for vaccinated people?).

There continue to be questions about inflationary pressures as input prices come higher, bond yields normalize, and post-COVID economic realities kick in. I write about this all the time, have ample opportunity of these discussions to apply our carefully developed investment philosophy, and do not lack for opinions or beliefs when it comes to these key discussions around valuation, national debt, economic growth, and portfolio positioning.

But nothing happened this week in markets that should be considered even remotely surprising. Nothing happened this week in markets that are remotely outside of historical expectation. And nothing happened this week in markets that are not going to happen again, perhaps very soon.

So what am I talking about?

I believe that two stories are uniquely important to us as a society, and particularly the readers of Dividend Cafe as investors. And as I will explain, I am quite convinced the two stories are more connected than we think.

Number one was the shocking takeover of the Colonial Pipeline by a group of Russian cyber-gangsters.

And number two was the large drop in crypto-currency prices, reportedly because of a tweet from (Saturday Night Live host) CEO, Elon Musk, regarding the environmental dangers of mining it.

Neither of these stories at face value had any effect on 99% of the clients of The Bahnsen Group because I very much doubt any of our clients were unable to access gasoline, and at least through us and our investment strategy, we are not, and will not be, crypto “investors”.

I need to start connecting the dots, I know.

First, the conclusion

I believe the vast majority of public sentiment, public understanding, and policymaker biases have been decidedly against the midstream energy sector in our country for over five years. I believe this week teed up a massive reversal of that, for entirely sensible reasons.

And I believe that the vast majority of cryptocurrency “investing” has been speculative in nature, divorced from a sensible worldview or understanding of what the actual intrinsic value may be. But nevertheless, those in pursuit of a thoughtful or substantive rationale for its use have believed it to be in the future legitimization of crypto as a medium of exchange. In other words, some have believed that, despite 50-80% swings in tradable value, the real reason the digital coins should trade at 500% or 1,000% price gains is because, well, one-day crypto will supersede the U.S. dollar as a means of purchasing goods or services.

And this week that theory got partially proven – in that someone used it as a medium of exchange, all right – that is, an international gang of criminals who used it as a ransom demand in order to turn on access to oil and gas and heat and power for millions of Americans.

And guess what?

It worked. It actually freaking worked. A totally untraceable and dark “money payment” was sent to DarkSide, in order for malware to be removed that had shut down the Colonial Pipeline operations.

And it is my opinion that this week will be remembered as a week – very early innings, perhaps – but a week in which the societal opinion of “crypto” will move to that of viewing it as “a currency for criminality.”

Pipelines are here to stay

I really do believe that the midstream energy sector was vastly under-valued on the fundamentals even before this week. And I say that despite the fact that the index of the sector is up 38% YTD and has effectively doubled from its COVID bottom of 14 months ago. This is an asset class that must be valued on its yield (properly defined), its yield spread, and the sustainability of its cash flows.

Yields are basically 7-10%. Spreads are basically 6-8%. And the sustainability of cash flows are substantially improved after multiple years of reorganizations, recapitalizations, debt restructures, deleveraging, and right-sizing distributions.

But underneath all such financial assessments, there must be a real company, with a real business model, and a real forecast for business conditions. Sentiment around energy prices is great, but that is not and should not be the reason for bullishness in the midstream space. My basis theses come down to these three sentences:

(1) There is an insatiable need for natural gas and crude oil to feed the energy needs, electricity production, and even trade-export opportunities in our society.

(2) It is very profitable to get paid to transport such oil and gas from the upstream point to the downstream point (i.e. from producers to users).

(3) Pipelines are the best, and safest, way to do such.

There are supplemental arguments for the midstream thesis. Gathering and processing businesses, while more volatile, can juice earnings. Storage is an underrated service these companies can offer, something that happened in the supply excess of Q2 2020 to great profits. These midstream companies can play a role in other renewables in a plethora of ways.

But at its core, the pipeline business is about getting paid to do what somebody simply has to do to see our society function – transport oil and gas.

There are financial reasons companies can experience distress here (i.e. too much debt to fund expansion where cost of debt service ends up riding too close to available cash flows). Hence, our obsession with higher-quality names that operate with healthier distribution coverage ratios and healthier leverage ratios. But the business model remains as simple as outlined above.

I wrote above about the sector offering yield spreads of 6-8% over Treasuries, and 5-7% over Corporate Bond spreads. These spreads have averaged 3% and 2%, respectively, for a long, long time. If you decide that the distress in the energy patch post-fracking has permanently widened spreads 100-200 basis points more than their average (a pretty bold decision, but I’ll play along), you still have 300-400 basis points of further spread tightening to capture.

I have no intention of rooting for such. I very much enjoy the current yields reinvesting for accumulators and paying out to withdrawers, and having the stock prices higher but yield %s lower doesn’t help me at all for future purchases. But nevertheless, I strongly suspect it is coming, and most investors will be very happy.

But what changed this week?

Most people do not know how the gas gets to their gas station, and they don’t know how their electricity is powered. They don’t know how electric car companies produce their batteries, and they likely don’t know how their built-in BBQ grills work or what exactly is going on behind the scenes to warm their house. And nor should they! People pay their bills and they want to take these things for granted.

What they do know is when they can’t get gas, or when prices skyrocket higher, or when their houses are freezing. This is life – a made field goal gets no attention; a missed field goal creates agony.

When the hackers shut down such a prominent pipeline this week they brought attention to a basic reality never discussed in our society: Oil and gas does not show up courtesy of the tooth fairy. That such a large region of the country was so dependent on one major pipeline is a direct by-product of two basic realities.

(1) We do not have pipelines

(2) The alternate sources of providing oil and gas (truck and rail) are slow, unresponsive, environmentally inferior, and inadequate.

The current administration’s Energy Secretary, Jennifer Granholm, said this week that “pipelines are the best way to transport fuel.” I agree with her. Many on the right tried to use the line as a sort of “gotcha” moment based on the administration’s relative aversion to pipeline expansion, but that is not my intent here. I am not looking to “dunk” politically; I am trying to make an economic point … in foxholes, everyone believes in the pipeline thesis.

Liquid fuel (oil and gas) consumption was down the most last year since 1949, as the world suffered unprecedented shutdowns during the global pandemic. Transportation use was down 15% alone, and jet fuel was down 38%. We have a resurgence of need for more fuel than last year, and we have quadruple the production capacity in our country that we had just over a decade ago.

And after an inexplicable hack and shutdown and crisis, we have a new appreciation of the “middle ground” solution to this conversation.

Connect this to crypto now?

It was bitcoin used to pay off the international criminal ring that perpetrated this mess. And the success of the payoff was on the front page of every newspaper in the world (success to the criminals). It would be impossible to imagine a greater incentive to criminals using demand for crypto payment to effect their ill intents than what they saw play out this week.

I simply do not believe it is sustainable, that vital economic and national security concerns can be exposed to such risks, with an untraceable payment system on the ready to facilitate it all, and incent a new attack, and a new attack, and another new attack, etc. This was a front page, massively publicized declaration, that this “method of payment” works for those looking to maintain untraceable, criminal status.

Can someone buy bananas with crypto, too? Sure, if they want to buy bananas with a medium of exchange going up or down 20% in multi-day periods. But obviously, that has not been its function. I have always maintained – always – that it keeps the status it keeps as a “disruptor” because the regulators, authorities, and establishment, DO NOT view it as a disruptor. The entire thesis from the iconoclastic argument has been “this will turn the world on its head.” Then you see Goldman Sachs buying it and Fidelity putting a crypto coin pool on their website and you go, “hmmmm, the world’s head doesn’t seem too bothered.”

There is a function, though, and we saw it this week in the world’s biggest news story. Actions are not coming from the Fed, or the NSC, or the DOD, or the State Department, or Treasury, or the Comptroller, or any of the other half-dozen regulators and interested actors, this week or this month. But it is my belief that actions are coming, and that it will drastically change the narrative.

We are talking about a weapon of mass distraction that people are buying with their government stimulus checks. Maybe this is the week some grown-ups decided to start acting like such.

What I am not saying about crypto

I am not saying it is going straight down. I am not saying it is going straight up. I am saying that there is a confused investment thesis around this thing, and confusion never ends well. The world we are living in is an increasingly dangerous place, and people are going to die. I expect the conversation and connotation to change, and in whatever period of time it takes for that play out, I suspect we will look back one day on this week as the week it started.

Chart of the Week

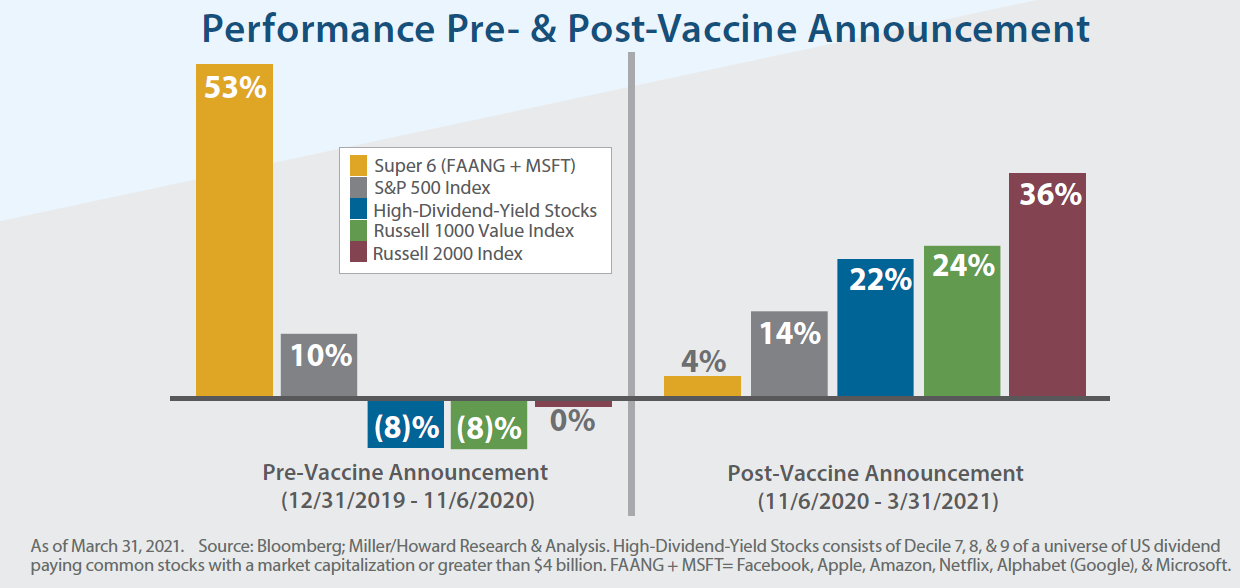

Note the real story of markets through 2020/COVID/shutdown, and the story of markets since … Sometimes “top line” numbers don’t tell the whole story, but a look under the hood can be fascinating. 2020 was one bizarre year, for a whole lot of reasons.

Quote of the Week

“There are decades where nothing happens; and there are weeks where decades happen”

~ Vladimir Lenin

* * *

You may or may not know that I do not quote Vladimir Lenin very often. But sometimes a quote perfectly captures what I am going for, regardless of who may have actually said it.

Time will tell if I am right that potentially decades of things happened this week. I think it will at least prove to have been a foundation.

Have a wonderful weekend, and reach out with any questions, comments, or needs you may have.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet