Dear Valued Clients and Friends,

The market ended the month of February with a level of pain in the markets not seen since December of 2018 (fourteen months ago). As of press time Friday morning we have experienced sell-offs every day this week, creating the worst week for markets since the financial crisis. The details are unpacked in the Dividend Cafe … The level of sell-off in the market is discussed but so are a variety of circumstances around it that very much warrant additional analysis. I made the decision this Friday morning to ditch literally pages of commentary and analysis I wrote over the last few days and just write afresh straight from the heart on all that is going on. Please click through and read.

This is not a Dividend Cafe to miss.

Just breaking it all down – at least read this section

The market was down roughly 400 points last week (the shortened President’s Day week), yet was still up 750 points on the month of February coming into this week. In literally just four days the market dropped 1,000 points Monday, then another 900 points Tuesday, then 130 Wednesday, and then Thursday 1,200 points (worst point drop in history) – an absolutely stunning 3,200 points. As I type on Friday morning at 4:00 in the morning pacific time, the futures have been all over the place but point to more downside. Whether or not there ends up being additional spikes and drops throughout the day today, my expectation is that markets will not rally Friday as traders seek to be less invested going into the weekend.

That moment is coming when this free-fall ends. It probably will feel very good when it arrives. The real process of market pricing repair can’t come until some footing and some end to the panic ends. That could be hours away or a week away – I don’t know. Thursday’s late day sell-off was the first point at which it was obvious to me computers were taking over as well. In a day and age of massive indexing sell-offs become a self-fulfilling prophecy as selling begets more selling. The pure unadulterated uncertainty of it all combined with technical considerations like machine-selling/indexing is an awful combination, and an impossible one to rationally handicap or process.

My expectation from a significant amount of experience with these violent and sudden sell-offs is that some rally day is coming that will punish people for selling out. There comes a time when markets stop going down because, well, they went down enough. I stand behind what I said earlier in the week that the extraordinary speed of this sell-off is likely better than the alternative, as you get to the point of footing/settlement/stabilization quicker. It doesn’t make it fun, I know.

In the fourth quarter of 2018 the S&P 500 dropped 19.9% from high point to low point. It then had a 1,000 point up day the day after Christmas, and of course a few days later the market rally of 2019 ensued. Add the last week of February 2020 (coronavirus) to the middle of August 2019 (China/trade/currency), the end of May 2019 (trade/Mexico/China), the fourth quarter of 2018 (Fed tightening/trade war), several weeks in both February and March of 2018 (trade war), June of 2016 (Brexit), January of 2016 (China/oil), August of 2015 (China), Summer of 2012, Summer of 2011, Summer of 2010 (Greece, Greece, and Greece), in your long list of market disruptions. These disruptions are the rule, not the exception, in the history of markets. They are painful. They are unsettling. But I owe you the truth when I say – they are the source of the out-sized returns that have been the reward for all who have persevered through them for a hundred years.

I want my clients to know (and you non-client readers) that I mean every single word I have ever uttered about the primacy of being invested in actual companies, and focusing on the fundamentals of the companies we own, not the day to day pricing of the stock market. I do not feel the slightest bit of concern about the dividend sustainability of the portfolio of companies we own. If some how, some way, in an imaginary world where there was no stock market, no second-by-second pricing, and we all owned the exact same companies, I would feel incredibly good right now. We own very well-run companies, some of which will have cyclical challenges to their businesses from time to time (whether from extrinsic events like a coronavirus, or other circumstances), but have the balance sheets and business models to withstand those periods. That is not the world we live in; public stock markets bring public transparency to pricing, and that pricing is almost entirely driven by other people’s sentiment in short term horizons, not by the underlying realities of the businesses we own.

Don’t get me wrong. The coronavirus may very well effect the businesses we own, too. At least for a short period. But this is kind of the point, my friends. The world is not capable of delivering an environment where there is no outside effect even to high quality businesses. Weather, war, disease, and pestilence are as old as the planet itself, and from creation these are permanent parts of the human condition.

And yet four days ago we were flirting with Dow 30,000. And we will be again. Of that there should be no ambiguity.

It is entirely understandable for a pricing drop like this to be incredibly upsetting, and I do not want to minimize any of the emotional realities that go with investing a period like this. To see the market drop like this in just four days is surreal, even for me, and I offer nothing but my unbridled empathy and support.

But that empathy and support must be accompanied by truth-telling and prudent decision-making. If I thought it were best to sell out of a properly constructed portfolio after four days of a violent equity sell-off, I would do so. I would do so with my portfolio. I would do so with your portfolios. I am taking the position I am taking in this period because I do not believe it is best. I believe that investing is the challenging process of making decisions around the trade-off between risk and reward propositions, and that right now the optimal treatment of risk/reward is to let this sell-off run its course, allow the non-stock parts of the portfolio to buffer the stock parts of the portfolio, and to come out of this on the other side with the unhampered dividend growth of roughly 30 businesses well in place.

We are business owners. We are not stock market speculators. The businesses we own are highly established franchises with extraordinary capacity for innovation, cash flow generation, and profitability. They will have ebbs and flows in their results. But the pricing put upon their stock prices in periods of a market sell-off will not impact their actual material conditions. The dividends they share with us from their profits in exchange for being an equity investor in their operation will continue, and will grow. This has always been my thesis for investing your capital. That hasn’t changed this week for me. It is not going to change next week for me. I want to reaffirm it in the most unambiguous way possible. We are investing for dividend growth with a humble acceptance that we cannot control pricing along the way. I ask that that be your focus even more now than normal.

I want to now delve into a more “normal” Dividend Cafe, evaluating the economics, monetary ramifications, and other such “heady” stuff surrounding the week that just was … But if you are ready to be done reading, I get it. At least you read this part. I believe that these equity sell-offs are a permanent part of being an equity investor, and no investor in history has cracked the code for avoiding them (other than those who also never, ever lose in Las Vegas – and always knew that the Chiefs would win the Super Bowl, etc.). I also believe that just because these things come with the territory, it does not make them fun or easy, and I understand the discomfort they create. My job, and my fiduciary duty, is to guide you in the right way, and I believe with every ounce of breath in my body that your portfolio was constructed to withstand periods like this. We will continue making adjustments, tethering in opportunistic buys, and evaluating ways to optimize portfolio results through these awful conditions.

But the greatest asset we will have right now is patience (as this will absolutely take time), and conviction. I have enough conviction for all of us. It is the patience part I can’t totally impart to you. I look forward to the conviction rewarding your patience. Because it will.

On to the wonky stuff …

Coronavirus

The potential for greater economic slowdown from this coronavirus is, of course, real. Ironically, the very efforts that help contain it from a health standpoint may be what do the most damage economically (the out-sized precautions by governments that impact supply chains, producer activity, and consumer activity).

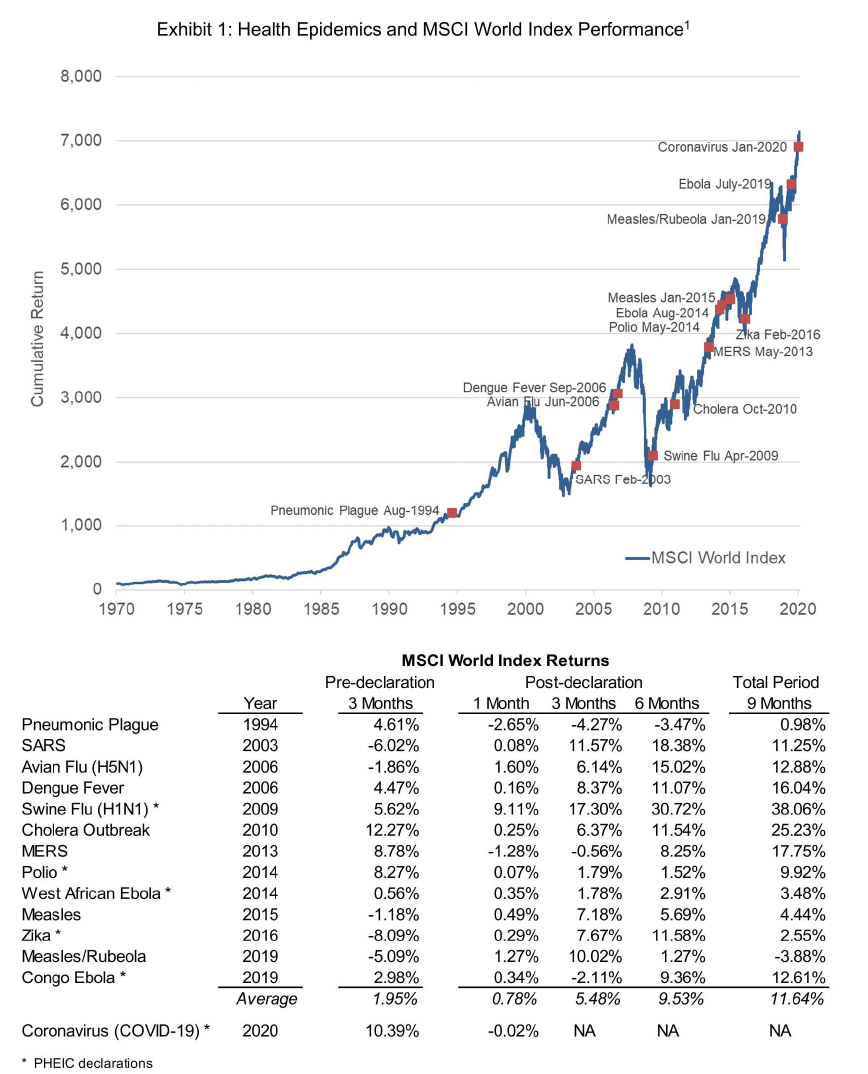

This is the sixth declaration of a “public health emergency of international concern” by the World Health Organization in the past 15 years. That isn’t said to minimize it – this certainly is worse than many of those other declarations. I won’t delve into the medical minutiae here, but there are things about COVID-2019 that are worse than past health epidemics, and things that are more encouraging.

I believe the past data around market action and health epidemics is instructive, even if this proves to be less severe or more severe. Data and evidence and historical record matter, and while past is no prologue, one’s understanding of current events ought to be informed by history.

* Cliffwater LLC, Coronavirus, February 2020

VIX, thou art our friend

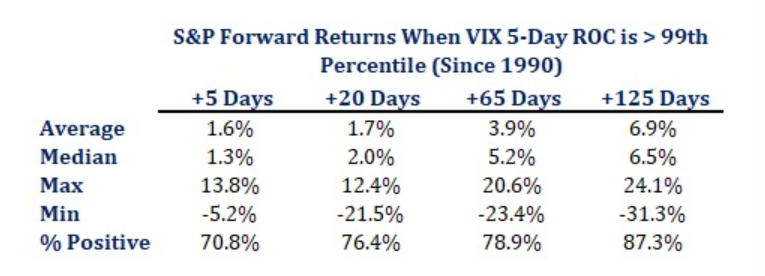

The VIX is what we call the “fear gauge,” an indexed measurement of the cost of buying protection on the market. When it skyrockets up, it obviously indicates fear and turmoil in the market. It exploded up this week to levels not seen since 2011. There has never been an period where the VIX jumped 30% in a week (let alone over 100%) where one year later market returns were not positive. And in fact, there have barely been any periods where three months later market returns were not positive.

* Strategas Research, Feb. 28, 2020

How to get to a bottom

A bottom comes in the market sell-off at the maximum point of capitulation. When the sellers are done. When the fear has been exhausted out of investor behavior. High volume. Forced selling. Margin selling. Sudden. Accelerated by machines. Massively “backwardated” VIX (paying more for 30 days of protection than 90 days, for example). Retail investors leading the sell-off. Run-up in treasury bonds. Oversold indexes running higher. All of these things are happening. Capitulation may come today, it may come next week. But it is the process of people returning stocks to their rightful owners, as Buffett has brilliantly said over the years. It will happen.

Speaking of the Fed

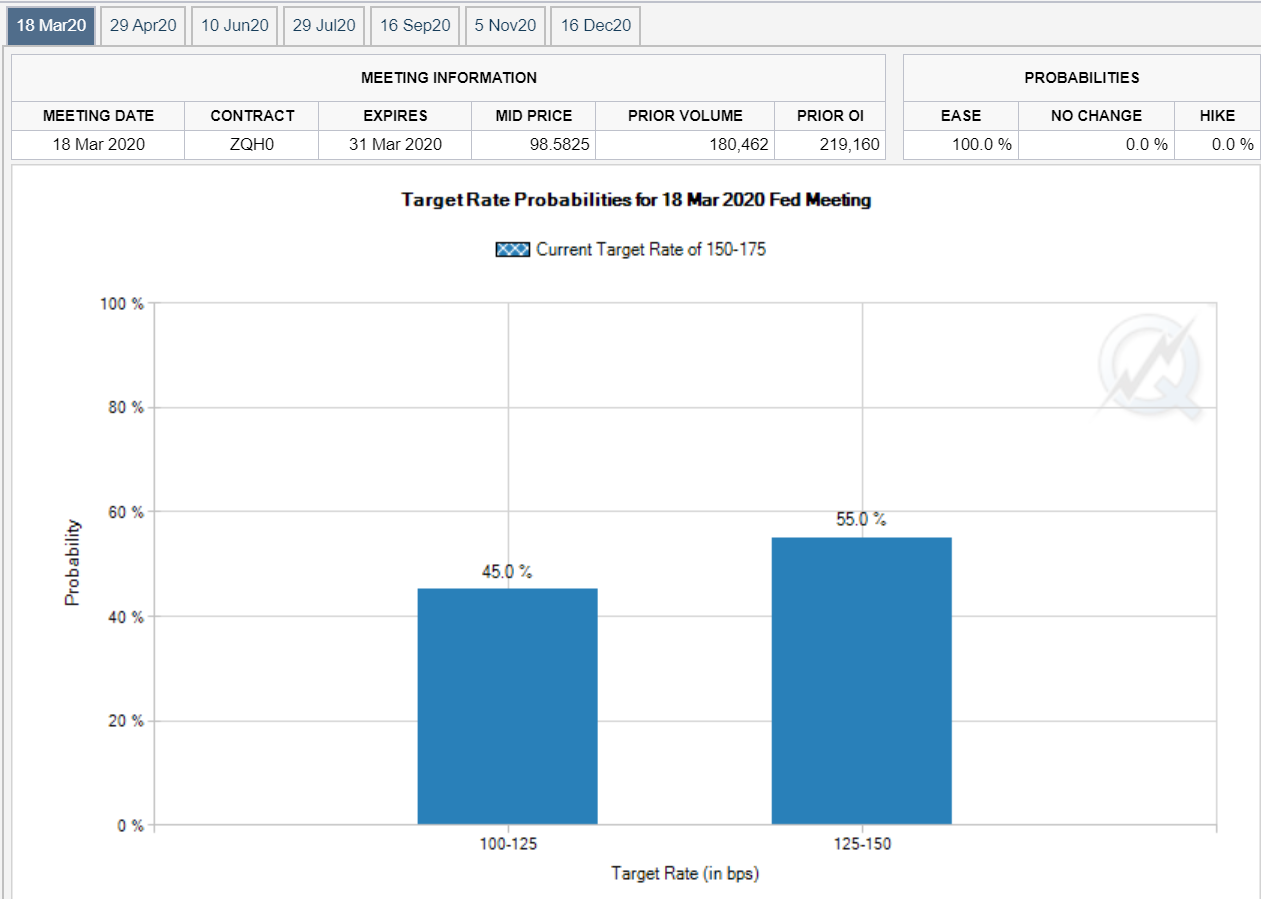

Two weeks ago the idea of the Fed cutting rates this year was likely, per the futures market, but not assured. Where we sit now, the fed funds futures market is not merely pricing in the idea of a rate cut, but now a 75% chance of three rate cuts by the end of the year.

And there is now a 100% likelihood of one rate cut at the March meeting (and close to a 50% chance of two rate cuts), in the fed futures market.

* CME, Fedwatch, February 28, 2020

Opportunistic activity

It has been a long time that one asset class in a portfolio moved up so much and another asset class in a portfolio moved down so much that a re-balance could be effected such that initial target allocations re-achieved, and meaningful numbers actually moved. For example, in 2019 stocks moved up so much that one would think asset allocations were altered, but in reality bonds moved up a lot too so allocations were not quite as disrupted. However, as violent as the sell-off in stocks has been, so has the rally higher in bonds been. Some modest tweaking out of bond allocations into equity allocations can likely be done now, without actually lowering one’s target bond allocation or raising one’s equity allocation.

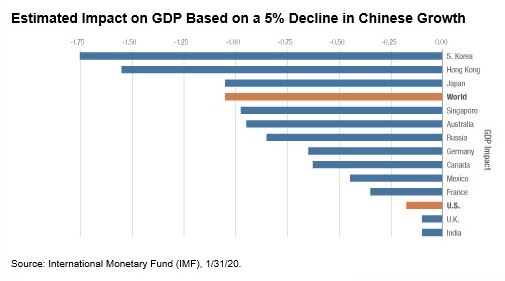

Is the global economy really at risk?

No one really knows what the impact will be from coronavirus – the fear right now is based on unknowns and uncertainties, as the actual cases and such are not as severe. But it is helpful to see what impact China’s growth constraints may have on world economic growth, and particularly other regions (like the U.S.). The numbers (at these levels) do not suggest something extreme, but the uncertainty remains the key issue.

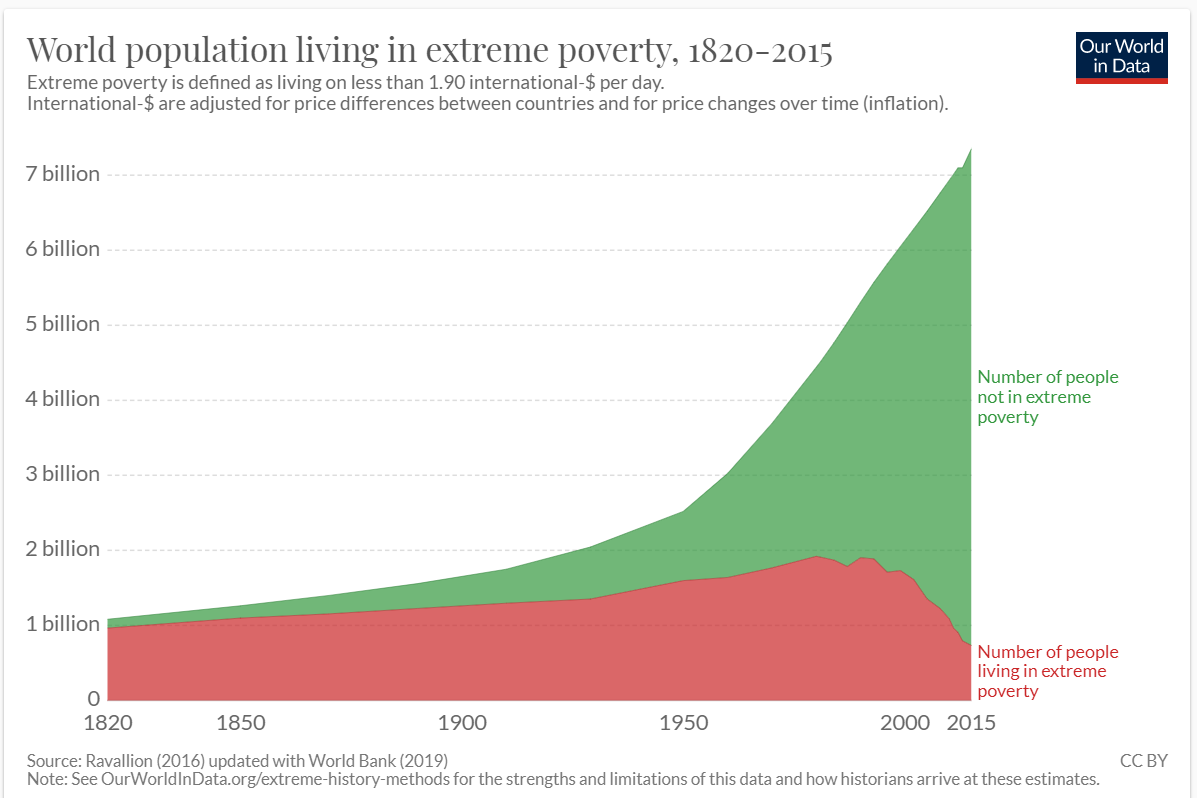

A refreshing case of alternative (real) news

It strikes me as unbelievably irrational to look at every news event, economic trajectory, political circumstance, and cultural phenomena as exclusively negative. In fact, some may argue that the decline of “extreme poverty” is not merely an anecdotal exception to negativity but, well, a mass repudiation of it (I know formerly poor people would). We invest for clients long-term financial goals with long-term realities in mind. The stunning reversal of extreme global poverty belongs at the top of everyone’s list of what is really happening in the world economically and culturally (if historical context matters).

Review

Feel free to re-visit what was embedded in the special Dividend Cafe I published on Wednesday. Please click to it if you did not digest it in the middle of the week, as we believe many of the nuggets you may be looking for right now are found there. Topics covered include:

- Historical context with other health scare outbreaks

- The uncertainty effect and uncertainty remedy for investors

- Where asset allocation fits in as a strategy for dealing with the volatility caused by this, or anything else

- Emerging Markets and the Energy sector

- How alternatives are holding up in this environment

- The advantage to illiquid investments right now

- What the state of Fear and Greed looks like (for investors) at present

Politics & Money: Beltway Bulls and Bears

- A very real thing I am going to be studying and researching over the weekend is the role of Bernie Sanders ascendancy in driving markets lower this week. Now, am I daring to suggest something so stupid as the idea that it was NOT coronarvirus panic? NO, I am not. It was coronavirus, and it was not Bernie Sanders winning Nevada. BUT, here is something I simply have to work through … Is it possible that the coronavirus scare damages the economy, and with the damage to the stock market, damages President Trump’s re-election chances, at the same time Bernie Sanders is potentially (likely) firming up his odds of becoming the candidate? It most certainly is! And therefore, in a very unsettling way, one could argue the coronavirus tensions of this week are in fact correlated to Bernie Sanders tensions, in a potential self-fulfilling prophecy kind of way! Allow me to explore this more over the weekend …

- In a weird way, it may be better for the cause of Bernie Sanders NOT winning the nomination if Biden does not win South Carolina. Some consolidation around a non-Bernie candidate is going to have to happen for Bernie to not win the nomination. Biden winning South Carolina keeps him alive but still not totally viable.

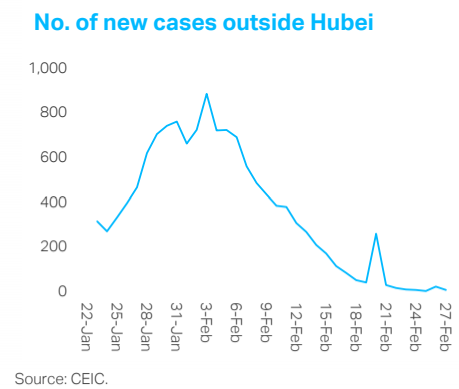

Chart of the Week

New cases of coronavirus in China

Quote of the Week

“Your success in investing will depend in part on your character and guts and in part on your ability to realize, at the height of ebullience and the depth of despair alike, that this too, shall pass.”

~ Jack Bogle

* * *

I care deeply for every single one of my clients. My long-time clients know this. I hate weeks like this, for those of you whom it creates anxiety and fear. I and my team will continue to do our job of taking on that anxiety for you to the degree you can let us do that.

And we will make the decisions we know to be best for you as best as we can. It is an uncertain world. We are in uncertain times. And yet, we know from the testimony of history who inherits successful outcomes. We are working tirelessly to that end.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet