Dear Valued Clients and Friends,

I wrote this week’s Dividend Cafe in the first half of the week, whereas generally when you are receiving these on a Friday, I usually wrote it in the second half of the week, and very often on the actual Friday in which you are reading it. Because of our annual team retreat meetings taking place Thursday and Friday, I had to write earlier than normal this week, but not too early, because by Monday at 1:00 pm, it was obvious that there was an avalanche of executive orders, announcements, and other such releases coming from the newly-inaugurated President and the Trump 2.0 team that were going to require some processing.

I did a lot of that processing in the two days that followed, and this week in the Dividend Cafe, we are going to try and break all of it down. I am back in that danger zone where much of my market commentary on these actions is likely to be misunderstood, even with my declarations and caveats to help avoid misunderstanding. All I can do is try. Where I am minimizing the efficacy of a given order in terms of its actual teeth or market impact, I am not saying anything negative about a given order, nor am I condoning it; I am merely objectively stating where something is more cosmetic or symbolic than substantive. This is not something either side of the Trump divide should take offense to because it is exactly what it is intended to be (in these cases, I am referring to) – a sort of public signal and nothing more. Other orders and announcements and intentions have impact for us as investors, and I will try to analyze those, particularly, and obviously reasonable people can disagree as to case-by-case opinions. I hope you will at least find the economic and market analysis of all this to be illuminating, not toxic, and to be useful, not grandstanding.

So let’s jump into the Dividend Cafe, see what we can see after the first couple days of Trump 2.0 (a lot of which happened in the first two hours), and get ready for what lies ahead. This stuff is worthy of coverage and analysis, so I do not merely do it just because I suspect readers find this more interesting than if I were to unpack the latest ISM data. I will say, though, that with earnings season underway, a portfolio manager like me is happy to be spending more time in the weeds of company activity and less time in these political clouds. But for today’s Dividend Cafe, I give you more political clouds. You’re either welcome, or I am sorry, depending on how you feel. Off we go.

|

Subscribe on |

Executive Orders

After the inauguration Monday, President Trump signed over 25 executive orders (that day) and has since signed nearly twenty more. Some were verbatim promises fulfilled from the campaign trail. Some are begging for legal challenges, and the Trump administration knows that (and is prepared for it). Some mean nothing but sound good. Some mean nothing but sound bad. Some mean something and sound good or bad, depending on your point of view. The noisier ones that are not real market-sensitive include:

- An end to birthright citizenship (in other words, a declaration that babies born in America to parents not here legally should not be considered legal citizens). One can argue what the 14th Amendment means or what it ought to mean, and actually, that is exactly what will happen because this is going to court, where arguments happen. It’s a controversial topic that is likely not going to be upheld by the courts and is not something I think warrants much coverage in the Dividend Cafe, but it was one of the higher-profile orders signed this week that will generate a lot of noise.

- An end to DEI programs in federal government agencies (all such employees are now on paid leave). I can make an argument there is an indirect market relevance here to the extent this move provides a greater permission structure in the private sector to do the same, and move the pendulum further still towards a meritocratic orientation.

- An order to “end the weaponization of the federal government“ (intended as a general shot across the bow seeking to discourage governmental overreach where politically driven, etc.).

Here are some of the more relevant ones in terms of policy and markets:

- A “national energy emergency” was declared, and the story of energy independence was linked to national security, at least by declaration. It essentially frees agencies and bureaus to identify areas where federal restrictions and regulations are impeding their ability to produce and distribute U.S. energy sources. The Biden-era ban on new LNG export permits was reversed. I would add that a major order around Alaska’s energy exploration was included, and he rescinded President Biden’s rescission of his prior rescission of U.S. participation in the Paris Climate Treaty (so you read that right – we entered by executive order, not legislation; we pulled out by executive order; we went back in by executive order; and now are out again by executive order – this seems like a really meaningful treaty we are talking about).

- While no tariffs were mentioned at all regarding Mexico, a national emergency at the border with Mexico was declared, the “remain in Mexico” policy for asylum-seekers was reinstated, and yet no specifics for deportation plans were laid out. Why is this economically sensitive, you ask? Many have suggested that if President Trump is successful in deporting millions of illegal immigrants, it could create a labor shortage that has a profound impact on prices (in other words, it becomes inflationary). However, if deportation plans prove more modest and targeted, it removes a tail risk consideration in terms of the economic impact.

- He issued an order to delay the TikTok ban (Congressionally passed last year) for 75 days. The courts will likely overrule the delay of the law, but it is the administration’s hope to use the delay to broker a deal in the meantime. Why does this matter to all of us who couldn’t care less about TikTok other than wanting our teens to spend less time on it? Because it speaks to the broader context of the relationship with China

- The Biden-era electric vehicle mandates were repealed

Some big differences I see from the 2017 entry to power versus now:

- Organization. I simply cannot put into words how unorganized Trump 1.0 was entering the White House compared to Trump 2.0. Many refer to this as a “mulligan” (h/t Mark Halperin), but even that needs to add that this time, the golfer got new equipment, took years of lessons, and added a much better caddie versus the last round. I am not referring to good or bad things before or good or bad things now, but simply organization and preparation around whatever it is that he now wants to do. It’s night and day.

- Indifference about reaction or perception. The normal playbook of a lot of noise being stirred around controversial actions or decisions is not likely to phase Trump 2.0, and in many cases is seen as a a feature, not a bug. Mainstream media hysteria (whether warranted or not) is not going to regulate or moderate the administration’s intentions, and my read on a lot of it is that he is having an absolute blast.

- It feels like too much. While it may seem like this contradicts point #1 regarding Organization, I am referring to a different category. There have been so many topics covered this week, so many actions, and so much noise, that it feels a bit disconnected from the standard “let’s go do three things bigly” approach that is often the best way to move the needle politically. We can’t truly analyze priorities, strategy, and efficacy until the airwaves are less cluttered and this week the zone got clogged, to say the least. Was that on purpose? Maybe. Was it just overly ambitious? Perhaps. Is there an attempt to throw a bone to too many people? I suspect so. But to analyze what is likely to sustainably and effectively happen in various key policy domains in the days, weeks, and months ahead, there is going to have to be a narrowing of priorities.

Key Takeaways – The Bottom Line Important Stuff:

- No executive orders were signed trying to use any pretextual rationale for any unilateral tariffs against China. Some tariffs may be coming. Plans and talks and threats and all that surely are. But out of the gate, of all the things done, the one thing markets would most be sensitive to … did not happen. I believe Q1 is going to be spent setting the table for a deal, with actions around a deal (for good or for bad) coming Q2 or later.

- We are seeing tweets and announcements from both President Trump and President Xi announcing phone calls already taking place, complete with statements that they are on their way to balancing trade, addressing Fentanyl, addressing TikTok, and “making the world more peaceful.” It does not appear an escalation of conflict and tension is the first play here, for either side (see theme #3).

- Energy was the top priority I saw out of the administration this week. That was, in my opinion, expected, and welcome.

- When asked if he was ready to do “universal tariffs on all countries” (something he certainly talked about in the campaign, and not exactly something markets, or David Bahnsen, ever took very seriously), President Trump said on Monday, and I quote, “I may [do that], but we are not ready for that.” Would I rule out any possibility of full-blown global protectionism running amok in the months or years ahead? No, the chances of that awful outcome are not 0%. But they are low, and seemingly getting lower as time goes by.

A Parting Gift

- The top-performing sector throughout the entire Biden Presidency? ENERGY

- The weight of the entire energy sector right now in the entire S&P 500? 3.2%

- The weight of Apple in the S&P 500? 7.6%

- The weight of Microsoft in the S&P 500? 6.3%

- So every energy company put together in the S&P 500 is worth well less than half of Apple and basically right at half of Microsoft.

- And this comes AFTER Energy was up +284% over the last four years, compared to the second place +120% performance in Technology.

Speaking of Which

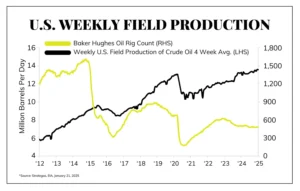

That rig count is less than half of where it was ten years ago and yet daily production is more than double what it was is one of the greatest stories of efficiency improvement I have ever seen. It has profoundly impacted the success of investment in upstream production, and at the same time confounded skeptics.

$500 Billion

President Trump announced via a splashy news conference Tuesday night that OpenAI, Oracle, and Softbank are creating a joint venture called Stargate wherein $100 billion will be collectively committed, and plans may expand to $500 billion, for investment in “artificial intelligence infrastructure.” Data centers are a huge priority here (and have been already receiving heavy investment dollars for years from such companies as Blackstone and Brookfield). The equity is largely funded by international investors (United Arab Emirates, Japan), which I guess I find kind of fascinating.

Growth and Valuation

That the Mag 7 names are a huge part of the S&P’s earnings is not up for debate. It would be silly for each Mag 7 name to be 1/500th of the S&P when the seven names put together equal 23% of the expected 2025 earnings of the index. So there – I am justifying a premium weighting in the index for these behemoths!

But wait, there’s more. They are 34% of the market cap of the index. So, while they make up a disproportionate representation of profits in the index, that is already reflected in valuation, with another 43% on top (the delta divided by the earnings). This captures the entirety of the tension for index investors and cap-weighted reality – sometimes the thing you believe in is believed by everybody else, too – and then some, and then some more.

Diagnosis

People often ask me, “What areas of the market are in a top?” or “How do we know when something is in a bubble?” I generally answer that we know something was in a top after it collapses, and we know something was in a bubble after it bursts, and I have found that a lot of people resent that kind of deep, sincere honesty.

It is not true, of course, that something was not in a bubble until we know it was a bubble. Bubbles exist before we can call them such – it is just that calling them such is predictive and not identifying until we have a validation that only comes from a burst. This is rather obvious stuff, but it is frustrating because, understandably, every investor feels their returns would be enhanced with a crystal ball. Truth be told, I am not even sure that is true (I’ve seen some things). But the real heart of the matter is not knowing when a top or bubble will be revealed, but having a feel for what is avoidable in investing relative to one’s own risk tolerance of investment objectives.

I would suggest that when “frivolous assets go parabolic” (h/t Louie Gave), you have a good feel for that which is avoidable. Defining frivolous seems hard for some people, and I suppose even

Chart of the Week

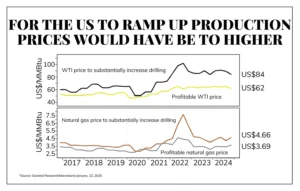

Why I do not believe production is going meaningfully higher in the short term despite needed energy deregulation:

Quote of the Week

“Common sense cannot be taught.”

~Quintilian

* * *

We still have a whole week to go in January. It’s been an exciting start to the year on numerous fronts. TBG is loving all of it – but that’s what we’re about at TBG – love. The action is the juice. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet