Dear Valued Clients and Friends –

For those who missed last week’s Dividend Cafe, the special election issue is here, and nothing has happened yet to cause me to take anything I said back.

This week we are going to look at China, a topic I don’t generally cover a lot because we have historically been so lightly invested there. This week’s discussion is really not so much about China as an investible thesis, but rather how what is happening there may impact U.S. investors (whether invested directly in China or not), as well as how it may more broadly impact the global economy. It’s a needed discussion and one I hope you find almost as interesting as last week’s history of the U.S. Senate. I know, it’s a high bar!

So let’s jump into the Dividend Cafe, where a China discussion awaits, but one that has a lot more to do with you than you might think!

|

Subscribe on |

When ABC changes its meaning

My friend (and brilliant economic strategist) Louie Gave said this week that for a long time, the mantra among investors has been ABC—”Anything But China.” Within the last two weeks, it suddenly changed to ABC—”All in, Buy China!” (This is the stuff that passes for funny with money nerds like me and Louie, and we’re actually the cool kids, relatively speaking).

But there is no question that both sides of this acronym humor are substantively true: China has been a pariah for institutional global investors for quite some time, and in the last two weeks, the rally to the upside has been like nothing anyone could have imagined.

A three-year high got hit in about ten hours last week, and after lagging the S&P 500 on the year by over 10%, Chinese equities passed the S&P 500 (which has a pretty stellar +20% return YTD, itself) in just days. What exactly drove this manic move into Chinese equities in the last two weeks?

What they did

The specific catalyst connected to the timing of what happened is undoubtedly the decision of Chinese policymakers to throw a small kitchen sink at various measures of monetary and fiscal stimulus. Now, it may be more like a single sink in a New York studio apartment, not a kitchen sink in an industrial kitchen, but it was dramatic and reasonably unexpected. How does one know when the actions of policymakers were “unexpected”? You can write this down if you’d like:

When there is no market response at all to a policymaker announcement or decision, it was expected. When some financial market moves 10% in response to an announcement or decision, it was not expected. You’re welcome.

The lesson in what China did last week is not so much about the magnitude of the moves themselves. One can absolutely argue that the cuts they made in policy rates, mortgage rates, and reserve requirements were actually not that dramatic, but the underlying issue was the dramatic shift in expectations. The main policy rate in China is their 7-day reverse repo rate, which they cut by 20 basis points. Our own central bank cut rates by 50 basis points (our policy rate is called the federal funds rate), and they telegraphed something like 200 basis points of more cuts by the end of 2025. Why in the world did China’s minor 20bp cut provoke such a response? Because it had not been expected and because it forced market actors to re-calibrate the entire direction and magnitude of their expectations going forward. Markets are miraculous little invisible miracles of creation. And they price expectations just as much as they price known facts.

In addition to the 20bp cut in their policy rate, they also cut the reserve requirement for banks by 50 basis points (essentially creating substantial allowance and encouragement for banks to lend more). They are “guiding” banks to re-finance existing mortgages to lower rates (I have never been “guided” by the CCP, but I suspect it means that banks are, well, going to do it). They are targeting 50bps of reduction in mortgage rates, and they are lowering the requirement of a down payment to 15% (versus the prior 25%).

And then, they basically made abundantly clear in their Politburo meeting that “more is coming” … They will be issuing additional public debt this year, approximately 2 trillion renminbi is expected (my research indicates one trillion only plugs the current budget shortfall; two trillion becomes “stimulus”).

Why are they doing this?

Growth expectations have collapsed in China. Equity valuations and bond spreads have been at COVID shutdown levels, which is really bad since one would think growth would be higher when your economy is not shut down than when it is. 2025 forecasts for real GDP growth had been +5% and now sits at +4.5%. Why does economic growth more than double in the United States represent such a problem? Because we have 4% unemployment, and they have 5.3% unemployment across their population, but 25% unemployment for young people.

Their industrial output is dropping. New exports are not increasing. Their reliance for growth on their property market has become hugely problematic. One investigative journalist we met with in New York City this week tells us that there are 90 million vacant housing units sitting in China. 90 million! And because the government’s revenue is so wildly dependent on the property taxes from ownership AND transaction taxes on sales, this decline in growth self-reinforcing the challenges in the property market (they feed off each other) is decimating public budgets. They announced intentions to “adjust housing purchase restrictions” and are likely to push aggressively to facilitate big-city housing activity.

No housing reflation program is complete without some banking system reliquefication. Their chief financial regulator, Li Yunze, also announced plans to boost tier one capital of their largest commercial banks. These banks, though, are already well above their regulatory capital ratios. They are not under-capitalized; they are under-profitized – which is economic slang for the more formal articulation: “They ain’t making no money!” Banks are not taking risks, and bad loans are picking up, pushing risk appetite lower at a time they desperately want it to go higher (Irving Fisher, your legacy remains intact).

Finally, they announced plans to “promote income gains for low and middle-income groups.” With 25% unemployment for young people, they clearly see the deflationary spiral that their property bubble burst has enabled.

Deja Vu all over again

“Property prices became unsustainable” … “State public funds became dependent on the housing sector” … “Unemployment has risen as the aftermath of this bubble burst has played out” … “The government is looking to support the banking system to provide a lifeline after balance sheet deterioration” … “Support is needed for the middle class” … “Encouragement for the banks to lend” … “Lower cost of capital” … “Growth is sacrificed when an asset bubble bursts” …

Do all of these things sound familiar? Did reporters even need to change the language from 2008 U.S. articles or 1990’s Japan articles? Because I didn’t! This is as classic a repeat of history as one could even imagine. That doesn’t mean all the particulars are the same – there are many differences inside the culture, government, population, history, and framework of Japan, the United States, and China – but the basic economic dominoes here are the same.

Why the rally?

On the one hand, there was a feeling of desperation around the monetary and fiscal actions (and indications) of Chinese authorities last week. On the other hand, investors are hardly unaccustomed to what government interventions do for asset prices and what they generally can’t do for economic fundamentals: And that is, work. It’s hardly an unfamiliar narrative – debt increases, real wages do not, governmental instability rises, and yet, stocks and real estate increase in value.

Why the hesitation?

So why not load up on Chinese equities if they are about to go full Bernanke/Japan/Abe/Fiscal/Keynes crazy on things? Here is why:

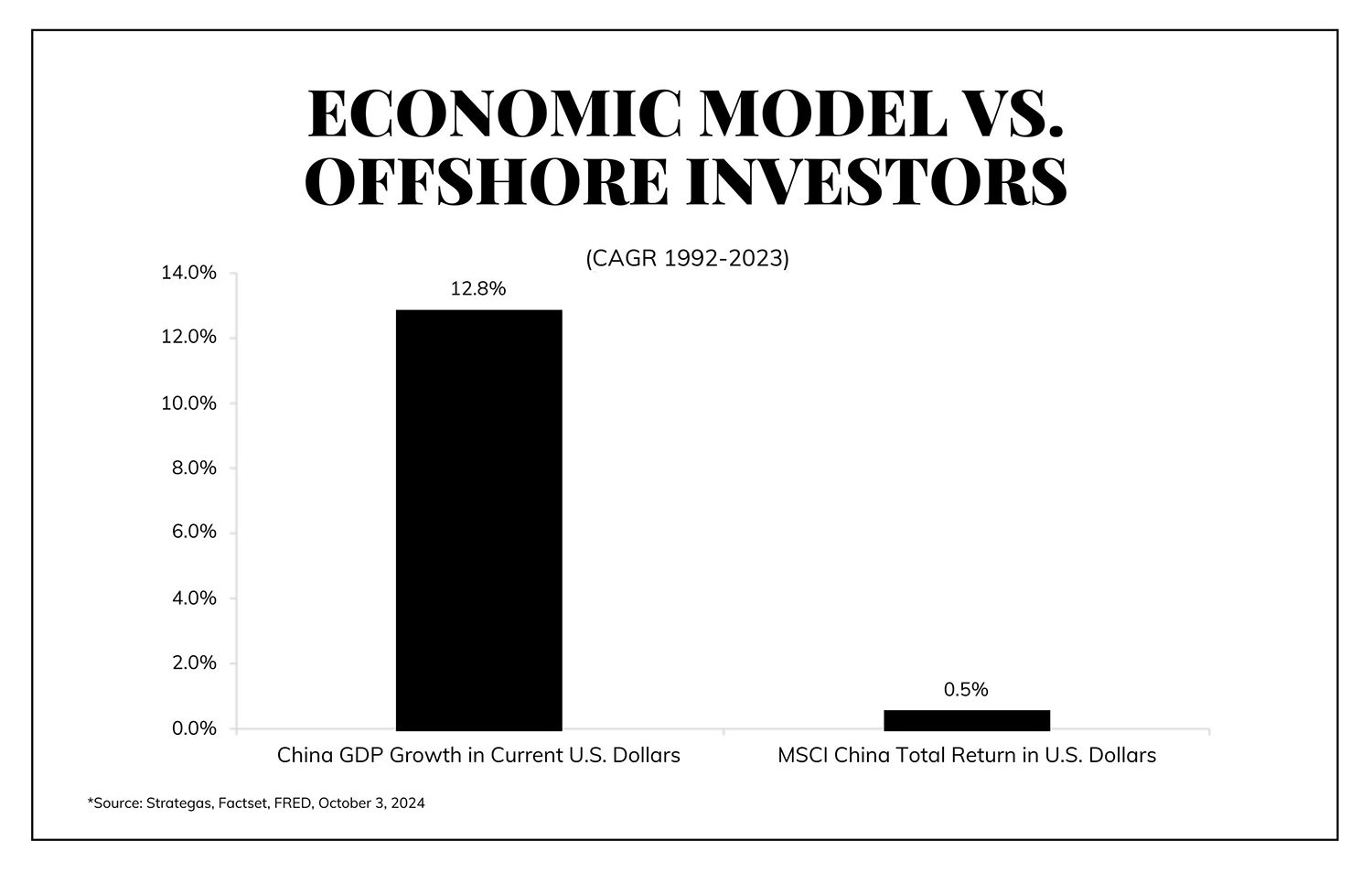

The story of my entire adult lifetime has been an ECONOMY that has grown (as a Communist, isolated regime entered the global economy with tinges of market economy embrace), all the while equity investors made no money whatsoever.

A lack of free markets and property rights seems to well, matter to foreign investors.

What does it mean?

China is in a deflationary mess that may be worse than we know and may necessitate more aggressive action than we know. Whether they reflate, negotiate, stimulate, or obfuscate, there is a risk-reward trade-off we do not like as investors. Their money supply is contracting, their government is intervening, their markets are activating, and we can’t get excited about any of it.

And yet …

A few actionable takeaways:

(1) Never underestimate the efficacy of a superpower determined to export its deflation to the rest of the world. We’ve seen it before, and it has worked. And it puts downward pressure on bond yields, and I don’t mean in the home country – I mean globally. This is a MACROECONOMIC story that so few people understand.

(2) It may very well be much worse than Chinese policymakers have let on, in which case these “dramatic” steps might be early innings. There is no easy way to plug this hole. And those who believe fiscal and monetary accommodation is counter-deflationary are only right for a time. I fully agree that it will be reflationary for China if done right, and I fully agree that medicine sometimes works for a bit before the need for more of it counters its effectiveness. I expect a similar story to play out for China – some boosts and leaps and other feelings of counter-deflationary efficacy, as well as all the long-term self-reinforcing demographics and distortions, put downward pressure on growth. Hedge fund giants like David Tepper jumping in on Chinese equities may have themselves a “trade” (or not). Still, there is more to being an equity investor than timing intervention impacts.

(3) If, and it is a big if, President Trump becomes the new President, I expect President Xi of China to have a lot less bargaining power than he did from 2017 to 2019. Let’s put it this way: they may be buying a lot more LNG from us than you think.

(4) Our almost negligible exposure to equities based in China does not mean China does not impact us – we are, and the whole world is. We see their macroeconomic reality as absolutely net negative for them, with some of their current actions potentially net positive for the world, but only marginally. And we do not see the risk/reward trade-off as compelling enough to jump in. There are some aspects of their equity market with aggressive dividend growth (14% annually, as policymakers increasingly push for the right form of capital return to shareholders). But this is an economic story, not a markets story, for us. And we have seen it before.

Chart of the Week

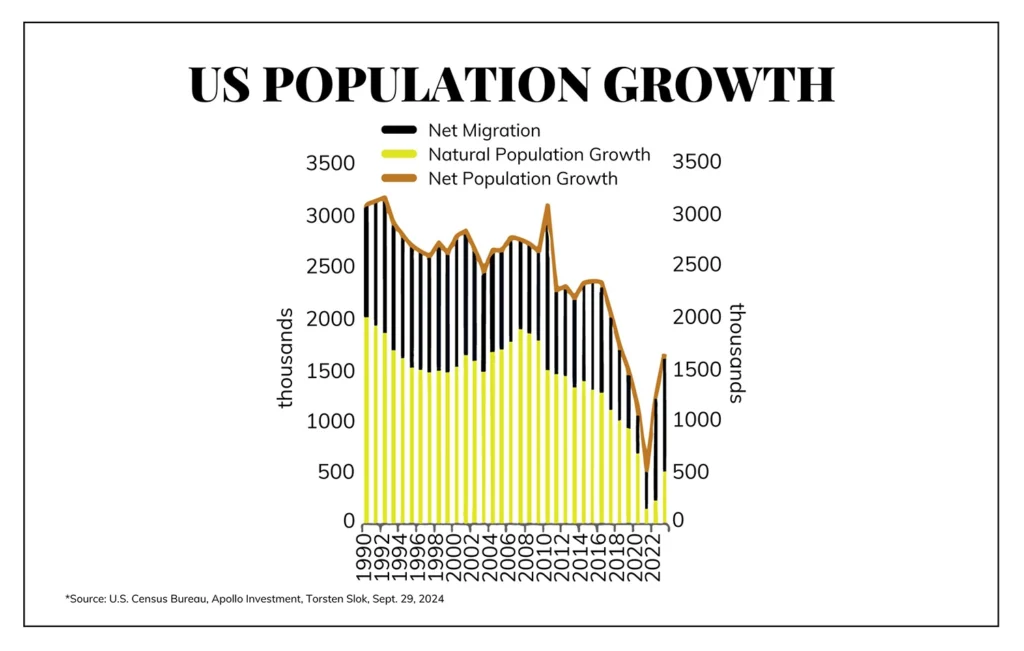

The U.S. still has positive net immigration, but barely, and it is on the decline. Natural population growth (fertility, for lack of a better word) has gone from two million per year to less than 500,000.

Why do I provide this chart? Economic Growth = Population Growth + Productivity Growth

Quote of the Week

“Don’t make the mistake of thinking you will grow up and live in a world without fear.”

~ Eric Tao

* * *

As I finish writing this Dividend Cafe, we are fresh from 20+ meetings this week in New York City with portfolio managers, hedge fund managers, department heads at leading asset managers, and a wide array of financial talent in the world’s financial capital.

We met with two different infrastructure asset managers we do not currently have client money with for consideration, as well as a couple of different alternative managers we are considering for new capital (one systematic/macro and one special situation in mortgage securities) and a small-cap equity manager we may incorporate into our Growth Enhancement strategy. Other than those five meetings for new capital consideration, all of the meetings were with managers that represent billions of dollars of the money we currently oversee.

I am working on a recap document now covering what is currently over 30 pages of typed notes, and our Investment Committee is meeting next week to really assess key takeaways and applications. The “sneak preview” has to do with the way private assets are changing the landscape in alternative management, the way in which corporate leverage is changing (for good and for bad), and the challenges of risk asset management when “nothing is really cheap.” We have takeaways across all asset classes and really found this week’s meetings to be abundantly fruitful. My mind is stirring, which is why I should probably hit send and leave you for your weekend.

Go Trojans, Go Cowboys, and Go Private Credit. Markets never sleep.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.