Dear Valued Clients and Friends,

Rarely have I hyped up a Dividend Cafe so much and set you all up for such disappointment. The topic I write about today is one that has been on my mind and in my research orbit for a long time, and on a couple occasions I actually teased up that it was coming, only to pull the plug and defer publication to a later date. Well, that later date is today.

We know the huge hype around Artificial Intelligence in 2023 – not merely in stock prices but throughout society. On a daily basis, we hear of some reference to how AI may change education or business or politics or, my favorite, farming. And as is always the case, this “hype” has a foundation to it – there is a profoundly interesting evolution in technology playing out that will change the way a lot of things are done. It will involve policy adaptations, cultural pushback, misallocations, great advancements, and, yes, certain negatives. All of these things are par for the course in a world that grows – that is, a world that was created to see human beings innovate around the raw materials they were given. Someone should write a book! But fundamentally, artificial intelligence is a big deal, even if the early years of its introduction will be filled with misunderstanding and wrongly directed reactions.

But people do not read Dividend Cafe for my assessment of the technological or even cultural context of new innovations. Rather, our job here is to assess a whole host of subjects for their economic and market impact – particularly for investors (and to be more particular than that, for our investors, that is, clients of our firm – or those of you who will be clients of our firm). The Artificial Intelligence story is an investor story, too, and that requires a sober reflection on a lot of things. Today’s Dividend Cafe is that sober reflection.

The idea as we assess Artificial Intelligence is to be naturally intelligent, meaning, to incorporate lessons from history and remember our first principles. ChatGPT did not tell me to say that – I already know that we do not leave our briefcase full of principles at home when we go to assess “new things.” And we certainly do not believe the past holds no information about the present or the future. So today, we will assess Artificial Intelligence, and we will dig into the treasure chest of history to do so. We won’t have to go back too far!

Let’s jump into the Dividend Cafe …

|

Subscribe on |

Narratives are not investible

“I like artificial intelligence” is not an investment strategy. We have seen, from crypto to dotcom to even COVID relief, that all sorts of companies are willing to market a narrative, no matter how disingenuous it may be. A sandwich shop with dotcom at the end of the name of the company is not a play on the internet narrative; it is a play on Turkey & Cheese (which apparently may require the intervention of Teddy Roosevelt!). So when we talk about “thematic investing,” whether that “theme” is data centers, rental real estate, midstream energy, or artificial intelligence, the “narrative” is not investible. You can’t get a bid or an ask on a theme – only a stock, a bond, an option, a fund – an actual, wait for it, “investment.” And so, with AI, we are not talking about investing into an amorphous blob of smart computing … an investment only gets made when a COMPANY is selected. And for those who believe a “sector fund” that captures the narrative across a basket of companies haven’t refuted my point – even then, real companies had to be picked and then put into a real fund.

And so, once we understand that we are talking about companies, I want to use a couple as an example to draw some historical lessons from, and to drive some investment wisdom.

A tale of two companies

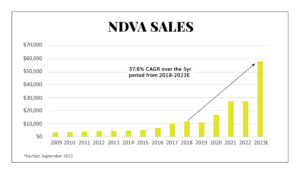

I want you to think about a company that has grown sales by 40% per year for five years in a row – a pretty stunning feat. That company is called Nvidia. Their revenue growth is largely driven by the fact that they are the leading player in artificial intelligence supercomputing, primarily due to their chips and software development that serve AI models.

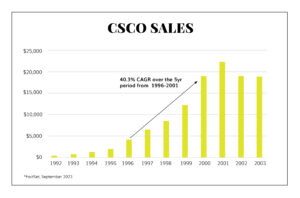

And then let’s think about another company with 40% per year revenue growth for five years. Hyperbolic growth back in the late 1990s when the internet was taking off and the demand for their first-in-kind routers that connected multiple computer networks changed the world. Their concept of a local network connecting computers from all over the place via a router system opened the door to a whole ecosystem of products right at the time that enterprise and personal computer and wireless use was exploding.

Did the company’s revenue fall apart after that five-year “40% per year” level? In 2001, did things all go to hell? Hardly. Revenue has nearly tripled since then (from $22 billion to $57 billion). Profits are up dramatically. The firm has grown leaps and bounds.

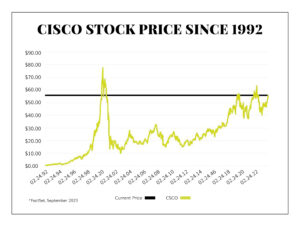

And here is the stock price.

This entire thing would be so much easier if all the results fell part after 1999. They didn’t. If business struggled, we could say, “Well, of course, the stock is still down -75% from its all-time high, and spent the last 20 years just getting back to a point still way below its 1999 peak level – the company’s revenues and profits fell apart because of [fill in the blank – 9/11, or the financial crisis, or whatever].” But no, the company has grown, performed, been profitable, and maintained all the leadership one could hope for. So why is the stock, despite being up ~400% from its 2001 low, still down -50% from its 1999 high?

Because. Of. The. 1999. High.

It was too stinking high. The entry valuation matters. Period. And Cisco from 1999-2023 is the quintessential lesson of this crucial truth.

But this time it’s different?

Nvidia’s and Cisco’s particulars are not my exact point here. I am not making any claim whatsoever about the prospects for Nvidia in terms of stock price going forward. I am simply saying this: There are precedents in companies that:

(a) Grew revenue through the sky for five years (40% per year)

(b) Had hype, buzz, leadership, and impenetrable market position

(c) Continued to execute from that place very well with phenomenal results

(d) Saw their stock price go nowhere for many, many, many years

I do not know if Nvidia is one of those or not. I do know that the parallels between the internet in 1999 and artificial intelligence in 2023 are uncanny.

The quicker they rise

You may note from the Cisco stock price chart above that besides the point I make about its stock from 1999 until 2023, there is also the insane rapidity with which it went up from 1997-1999. The quicker they rise, the quicker they fall? Not always, but often.

Look, the technological evolution that was playing out in the late 1990’s was real. The hope and hype around the internet, e-commerce, etc., played out. Now, that didn’t stop 90% of the IPOs of the dotcom era from going bankrupt. That didn’t keep Super Bowl commercial companies from the year 2000 from becoming a laughing stock. The celebrity endorsements. The cultural craze. All of it was, how do I put this? Not good. But in the macro, many of the things we hyped in 1999 played out and then some.

I believe that Artificial Intelligence is going to be useful in so many applications of business and life going forward; it is sort of inevitable (and mostly positive). I also believe monetizing that will prove very elusive without the right perspective.

A means to an end, not an end

The beneficiaries of the artificial intelligence era will be the same companies that benefitted from the internet – all of them. The companies that “do” the internet are not the ones who most benefitted from the 1995-1999 innovations – most of those companies were bankrupt and gone by 2001. Sure, a few standouts like Amazon, eBay, and Google are the exceptions to that rule, but were the beneficiaries of the internet just those companies with websites that we all use and transact? Or did the internet change the world for everyone? Does everyone’s supply chain, purchasing habits, commerce, workflow, systems, logistics, and so forth and so on benefit from the internet?

In other words, are we asking the wrong question when we say, “How do we invest in companies that do artificial intelligence?” Shouldn’t we be asking, “If this thing is real and will have monetizable actual utility and value, who will benefit from the use of artificial intelligence?”

The graveyard of 1999 internet companies is a laughingstock. The same is highly likely to be true of Artificial Intelligence. Yes, there will be standouts and exceptions, and perhaps those price moves already happened. But if this thing is real, if it really is the world-changing moment people say, why would not all business and commerce benefit, just as they did from the wheel, the steam engine, the light bulb, the microprocessor, and the internet.

Fiduciaries ask questions

If one has a fiduciary duty to care for a client, their well-being, and the stewardship of their assets, what is a more appropriate question for a fiduciary advisor to know the answer to?

How high can [fill in the blank AI company’s] P/E ratio go?

OR

Can Mr. and Mrs. Smith afford a permanent erosion of capital in their financial big picture?

The notion that any financial advisor or investment professional is going to do any of the following, let alone all of them, is fantastical:

- Know which companies in the AI space are going to survive

- Know which ones have elevated prices that will soon drop

- Know when that drop is complete, and the water becomes warm again

- Know who will thrive on the other side

If someone bought Cisco in 1995, sold it in late 1999, and bought it back in late 2001, well, I guess they did pretty darn good. And if your goal is to have that advisor who will do the same thing this time around with whatever the AI exposures are, I wish you all the best in that pursuit. But make sure the costs are not existential when you realize you have been hoodwinked because that day will come.

What happens next?

I am not convinced that anyone knows how useful Artificial Intelligence will be. One day, we are told AI is writing legal briefs. The next day, we find out a judge ripped a lawyer to pieces for mistakes in their AI-written brief. One day, schools are handwringing over opportunities for students to plagiarize with ChatGPT (for the first time in human history, a college student could finally borrow from work not of his or her own) =) … The next day, schools are, well, finding workarounds. One day the leading machine learning platform is worth $86 billion. The next day it is worth zero. The day after that it might be worth more than $86 billion?

We do not know where the regulatory apparatus is headed. We do not know what the governance structure will look like. We do not even know what society’s appetite for a lot of it will be. Will there be challenges to adaptation? Sure. Will there be widespread adaptation over time? Sure. But I have as much confidence in my ability to know exactly how all this plays out as the people who thought we were all going to walk around wearing smart glasses around our heads to get the internet imposed into our brains even before we looked at a screen that, you know, had the internet on it. People can be hilarious.

I believe that bubbles come out of all good things and sometimes bad things. Plant-based meat and non-fungible tokens never seemed to me to be worth hundreds of billions of dollars, and those valuations came and went like a beanie baby. But gold in the 1970s, Japan in the 1980s, Tech in the 1990s, Housing in the 2000s, cool tech in the 2010s, and AI in the 2020s – there are some important common experiences here.

One is that they all had and have real intrinsic value. They were not exercise bikes with an iPad on top, or a plant sausage patty at Dunkin Donuts (dear God), or a digital token of a monkey. They had and have real value. And yet, massive, incalculable, breathtaking value erosion took place in each case. Investors saw plans ruined and goals destroyed.

I believe “AI investing” will leave some people in ashes. And even if in ten years, we are looking at certain companies with breathtaking returns, we will surely have an ash heap of inconvenient history to sort through. And when we do, I think we ought to bring back the Pets.com people to join us.

In all thy getting, get this

We own 32 companies in our portfolio that benefit from electricity. None of them invented electricity. We own 32 companies that use light bulbs. None of them invented light bulbs (though we used to own that one, too). We own 32 companies that are by-products of the industrial revolution. None of them existed then (well, maybe one or two, sort of). We own 32 companies that are inextricably connected to use of the internet, the cloud, data, and enterprise applications in the technological reality of their business operation. Only two or three are even tangentially connected to technology at the core of their business purpose.

And so it will be with Artificial Intelligence, two (maybe three) will have a more direct revenue line to the use of AI in their business model, and yet all 32 will end up using AI in some form or another by way of application (at least 25). Supply chains matter to a lot of our companies. AI will play a role in supply chain management. Inventory management is a key part of many of our companies. AI will play a role in inventory process.

AI needs to be understood as a means to an end, not the end, or else you risk paying now for growth that only rationalizes itself in price over 25 years, back to where you started.

Theological conclusion

AI cannot reason. It can process text. It cannot see beauty or feel emotion. It can efficiently search data. AI cannot replace humanity. Because I have read Genesis 1 over a thousand times in my 49 years on planet Earth, and on the sixth day, God made us. Period.

Invest accordingly.

Chart of the Week

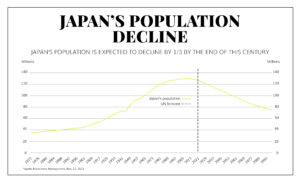

I worry far more about population decline than I do artificial intelligence. People produce new ideas. Less people produce less of them.

Quote of the Week

“The great investors are always very careful. They think things through. They take their time. They’re calm. They’re not in a hurry. They don’t get excited. they just go after the facts, and they figure out the value. And that’s what we try to do.”

~ Charlie Munger

* * *

It is appropriate to quote Charlie Munger in this week that he has passed, and especially appropriate to quote him in the context of this week’s Dividend Cafe. Value matters. Narratives don’t. That is how we miss out on lucky investments, but also miss out on predictable implosions. It’s the right way to be. And to that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet