Dear Valued Clients and Friends,

For those of you who read last week’s Dividend Cafe answering your questions about the election and its potential impact on markets, you may recall that I stated today’s Dividend Cafe would be dedicated to the subject of tariffs – what they are, what their effects on the economy would be, and how to think about the overall subject in the context of global trade, domestic manufacturing, and overall economic health. I think it is an important topic. I have a lot to say about it. My views on it will not make me popular with certain constituencies on the left or the right (you may or may not have noticed, but I don’t care). And yet, I am not writing about it this week.

The subject of tariffs is something candidate Donald Trump has put front and center in his campaign, at times referring to them as negotiating tactics and other times referring to them as “love” and “beautiful” and “something that makes our nation rich.” The need to unpack targeted tariffs, broad tariffs, potential impact of tariffs, and for that matter, retaliatory tariffs, presupposes a Trump win this coming week. As I have stated over and over, I see that as a 50% proposition. Some see it as 55%. Some see it as 47%. Of course, some say it is 100%, but they may not be totally serious people. Either way, I presume all readers of Dividend Cafe take me at my word that my sincere outlook is that we have a 50-50 election in front of us, and therefore it seems more prudent to write 3,000 words of substance and analysis on a topic if and when we know it is material, not the week before. Ergo, I am deferring a tariff issue Dividend Cafe to the future, conditioned upon a possible Trump victory. I have other topics in mind for all sorts of potential election outcomes between now and the end of the year (you should see my contingency issue on what happens if Jill Stein defies the odds and pulls this out!).

But in the meantime, the Tariff Dividend Cafe is on hold, and this week’s Dividend Cafe is focused on assorted election issues, the future of the leadership at the Fed, what to make of the Yen carry trade, the dollar after the election, and other items of equal importance that should leave you elated with anticipation.

Let’s jump in, to the Dividend Cafe …

|

Subscribe on |

A bipartisan question

Lina Khan is the Biden/Harris-appointed head of the Federal Trade Commission. Ms. Khan and her regulatory agency at the FTC have been one of the most relevant factors of the Biden administration in progressive efforts against corporate America. Frankly, if I were a betting man, I would guess that Lina Khan has a lot more to do with the [Bezos-owned] Washington Post’s decision to not endorse for President than anything else (would you endorse if they wanted to break up your life’s work?). While her FTC has not had a great track record at winning, they have sought to block an unprecedented amount of mergers these last four years, and are pursuing an unprecedented amount of antitrust claims and even corporate break-ups. Would a President Harris keep Khan in this role? I can’t imagine why not – she was part of the administration that hired her to begin with, and the progressive left will lose their cookies if she is displaced.

But I said “bipartisan” … Surely a Trump/Vance ticket would seek to go a different direction than the one Harris would with the head of the FTC, right? Well, not so fast. Senator Vance said that Khan was one Biden holdout he may want to keep:

“I don’t agree with Lina Khan on every issue, to be clear, but I think that she’s been very smart about trying to go after some of these big tech companies that monopolize what we’re allowed to say in our own country.”

“I look at Lina Khan as one of the few people in the Biden administration that I think is doing a pretty good job,”

Agree or disagree with what Harris and Vance believe about Khan, but just realize it may not be an area where there is a change coming, regardless of the outcome next week.

Frenemies or something else?

If there was one thing I wished I had written about more in my special election Dividend Cafe or that I wish someone had asked about in the Q&A follow-up, it is what I expected by way of Fed action and monetary policy specific to the election. Does one outcome versus another alter the trajectory of what I expect from the Fed in the months and years to come?

One particular aspect of this is what Chairman Powell’s posture might be if Trump is elected (Trump once suggested he was a worse enemy of the United States than Xi of China). Past acrimony and current suggestions from candidate Trump that the Fed should run their monetary policy decisions by the executive branch could cause Powell to resign before his May 2026 term expiration (though I don’t think so). Will Powell and the Fed alter their behavior if Harris wins? Would they alter their behavior if Trump wins? Here is a summary of my expectations:

- No matter who wins, the Fed talks the same way for the next year that they would if the other candidate wins.

- No matter who wins, the Fed is going to reduce the short end of the curve by 100-150 basis points by the end of 2025

- No matter who wins, I expect Powell to finish out his term

- No matter who wins, I do not expect Powell to be around after May 2026

- I expect Harris would nominate someone very progressive-friendly to replace him. I do not know what direction Trump would go.

The quiet part out loud

There are $1.5 trillion of commercial real estate loans having their rate reset over the next year. There was not even $100 billion of investment-grade bonds maturing this year, but there are nearly a TRILLION dollars of such each of the next three years. High-yield goes from $0 to a lot over the next year (more so in 2026-2028). Levered loans also pick up a great deal in 2026, going parabolic in 2028. The point I am making: 2022-2024 saw very, very, very few borrowers in commercial real estate, corporate debt, or bank loans take on the current [high] market rate for borrowing; the “maturity wall” which changes that is here (front-loaded with commercial real estate, then leaning into different aspects of corporate borrowing). And that, my friends, is why I believe the Fed is cutting rates, and will continue to do so.

Well, that, and for the biggest borrower of them all.

An election thesis not making the news

One theory of how a hypothetical Trump win next week would impact markets is that it would rally the U.S. dollar as long-term rates would rise behind a higher return on invested capital (ROIC) for U.S. companies (that is, less taxes and regulation would boost corporate returns who would then have more capacity to borrow because of better ability to service debt which would push long term rates higher). And, of course, if rates structurally went higher, this would rally the dollar and, therefore, be very negative for the Euro, European bonds, etc. And carrying this theory out further, the higher rate environment from higher structural growth in the U.S. would devastate high borrowing countries like France and Italy, etc. Ergo, Trump equals a bearish thesis on European assets.

Okay, this is what we call a “valid” argument (form) but not necessarily a “cogent” one (premise accuracy). Is it true that if Trump prevails, there will be lower tax rates? Maybe, but even he has not actually promised broad-based lower rates (note: to assume higher structural returns, tax rates have to be lower across the board, not just for preferred companies and sectors). And we do not know where tariffs would or would not fit into this. But let’s say we do get higher Returns on Invested Capital from corporate America in Trumpian policy … does that mean we get higher yields on the long end of the curve? This thesis is that real GDP growth is growing so much from an improved corporate sector that it offsets the impediments to growth that burgeoning deficits and a massive federal government create (or else it believes that a Trump administration is shrinking the size of the federal government, which, sure, maybe could happen – but doesn’t exactly sound like the base case based on the last term). And will companies with higher ROICs necessarily borrow more with current leverage levels? Maybe, but not necessarily. And would their borrowing levels push long-end bond yields higher? Maybe, but not necessarily. History is filled with periods of higher corporate borrowings that did not push yields higher and, for that matter, did not push ROIC higher. Now, if all that happened, and we found ourselves with a steeper yield curve and higher long bond yields, would the dollar rise? All else being equal, likely yes – but all else is very often not equal, and if bond yields (and yield differentials) were the only factor in currency exchange, then currency exchange would be very easy (note: it is not). And if the dollar did rally, would it be bad for an overly-indebted Europe?

Well, that last part, yes. Certainly, yes.

But that begs the question – who hates a strong dollar more? Europe, or Donald Trump?

Yen you put it that way

We should note that, whether or not it is related to the election (I am skeptical that it is, but it certainly could play in marginally), bond yields have moved higher the last six weeks, and the dollar has rallied, hard. The Dollar/Yen has rallied a stunning +8.6% in the last six weeks. Is this driving risk assets in that it is putting the infamous Yen Carry Trade back in play? I do not believe so. As my friends at Gavekal Research highlighted this week, volatility is a killer for carry trades, and the dollar-Yen has rallied hard this year, then sold off massively, then rallied hard again, and these violent swings are not the stuff carry trades are made of. Plus, the massive political uncertainty in Japan right now is a huge red flag, too. I don’t buy it, which, in this case, means two things at once.

(I think writing my sub-titles is becoming my favorite part of writing Dividend Cafe, and this one is one of my all-time faves)

Not our Oval office

Would Trump or Harris be worse for Chinese stocks? I cannot get behind much of the consensus material I am reading on the subject, as it all requires a level of conjecture I am not good at (and do not believe the person doing the conjecture is good at, either). Empirical data and my own analysis would tell me that the biggest problem for Chinese stocks is not a President Trump or a President Harris, but a President Xi.

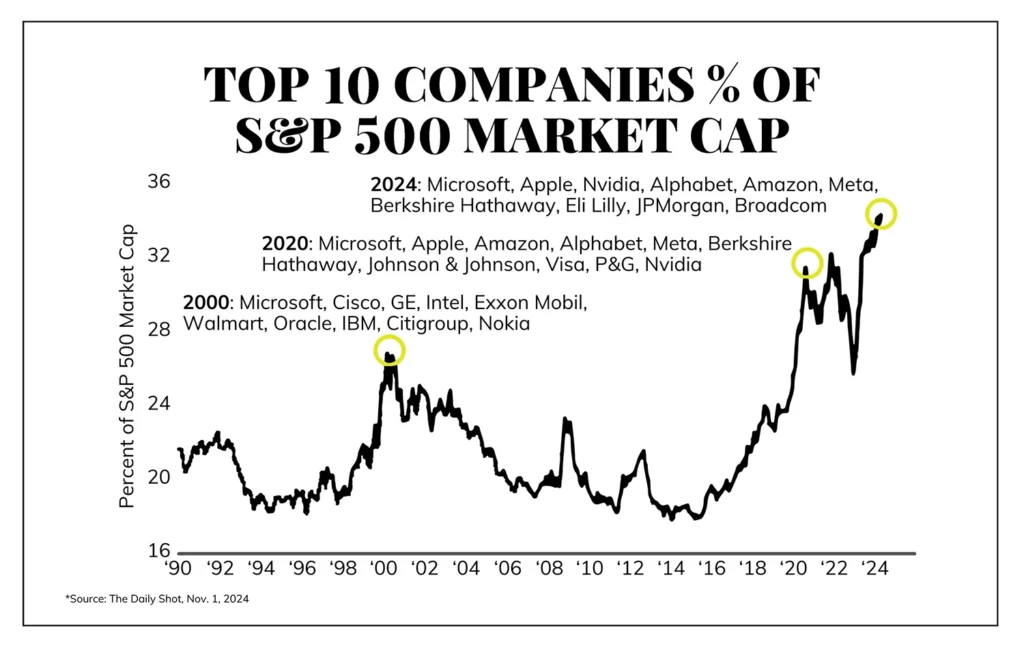

Chart of the Week

Nothing to see here? Oh, I think there is something to see here. And it isn’t nothing.

Quote of the Week

“You can avoid reality, but you cannot avoid the consequences of avoiding reality.”

~ Ayn Rand

* * *

I do not know if we will know who the president-elect is by next Friday’s Dividend Cafe or not. I do know that I am excited for it to be done, and not just because of the unusually high toxicity in the current political environment. The ads, the posters, the signs, the video pop-ups, the banter, the conversation – it is all just too much. And while many people in the country are highly vested in this outcome emotionally, I would just like to say that many, many, many other things trump politics in the order of our loves. In fact, many other things trump politics when it comes to markets. This, too, shall pass. And we are hopefully just a few days away from people starting to tell us that “the 2028 election is the most important election of our lives.” It is not just investing that reveals an immutable human nature.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet