I use my weekly Dividend Café commentary to provide a high-level overview of all macro-economic matters that we believe are relevant to the state of capital markets, and this includes frequent coverage of the need for increased capital expenditures from corporate America to lengthen this economic expansion. That the tax reform bill and broad business confidence that preceded it led to a strong boost in capex is uncontroversial but more difficult to discern is what caused the business investment data to collapse in the second half of 2018. While our belief is that it was the necessary drop in confidence and business assurance that came along with the trade war’s escalation, there certainly are legitimate supplemental theories as well – a destabilization in oil prices, rising interest rates, and global uncertainties – to name a few. Today we focus not on the high-level need for increased capex or a re-statement of the thesis for such a need, but rather on the more granular state of capex in present economic conditions.

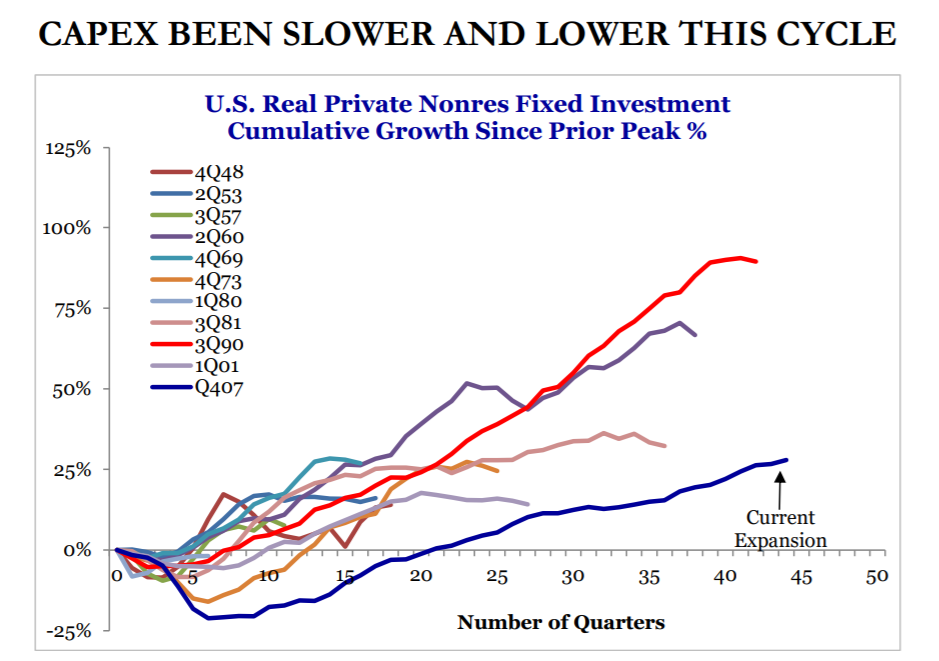

We know that the missing ingredient in the post-crisis economic recovery was business investment. Capex growth did not come with the financial re-leveraging of corporate America or the balance sheet normalization of American households.

* Strategas Research, Economics Report, March 11, 2019, p. 4

Expenditures for the sake of expenditures is not what we are after in economic terms. Rather, “investment” is a more holistic term, because unlike consumption-driven or wasteful expenditures, it captures the productivity objective that is actually at the heart of this discussion. Unproductive capital expenditures will accomplish nothing for the economic cycle (digging a ditch for the sake of doing so); whereas intelligent business investment that drives productivity higher will help restrain unit labor costs as wages continue to grow (neutering the allegedly inflationary concerns of wage growth). The “demand side” benefits of capex are outside our interest (short term effects from the actual transactions themselves); it is the “supply-side” impact that we care about whereby sustainable and secular advantages are achieved in the heart of the economy.

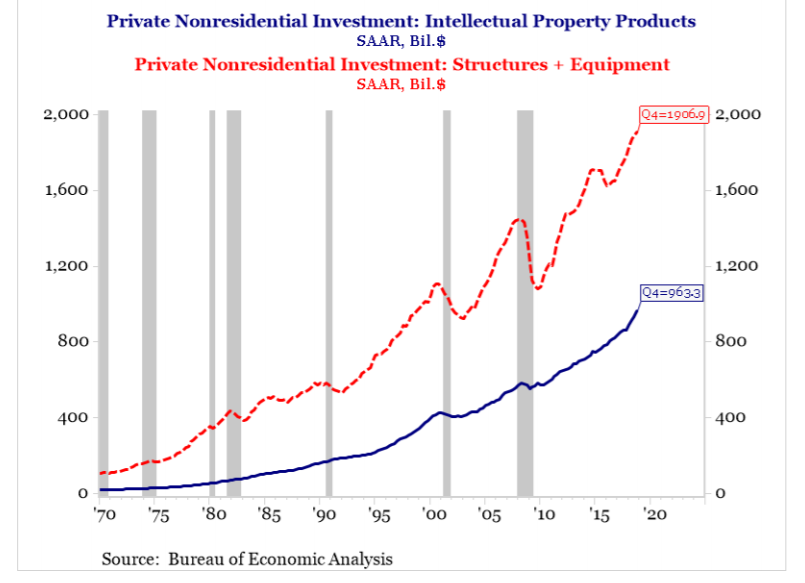

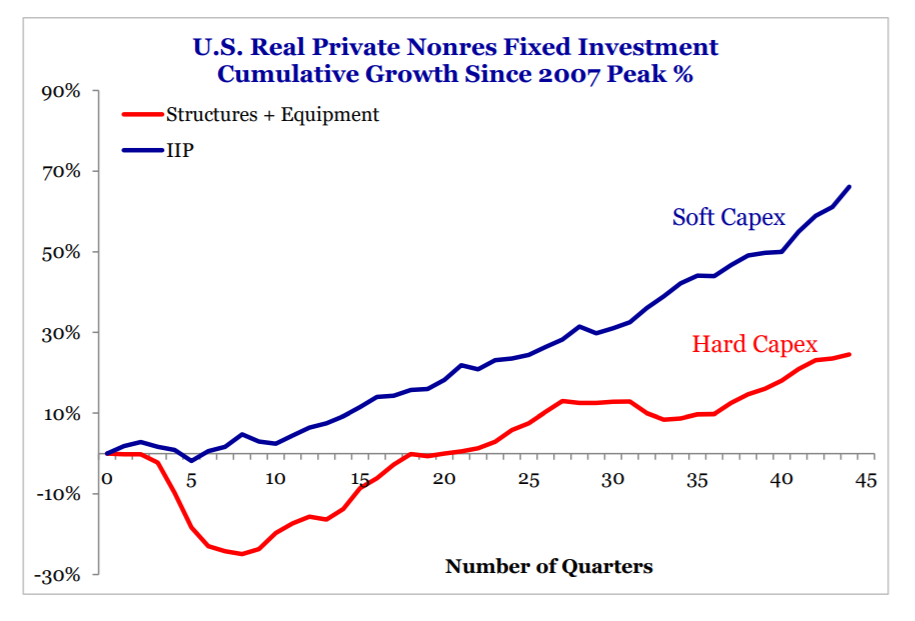

When it comes to capex, we need to distinguish between what is fairly called “hard assets” (equipment and structures) and “soft assets” (intellectual property, software, R&D). Hard Capex is subject to cyclical market conditions (e.g. oil prices, interest rates), and therefore is more volatile than Soft Capex. But it also is much larger than Soft Capex, and therefore packs a much bigger punch in economic impact.

It has not been Soft Capex lagging this cycle, as indeed, pharma R&D, software, AI, and a plethora of technological and medical advancements have been significant drivers of Soft Capex this last decade. Rather, it has been the investment in equipment, structures, and other such Hard Capex needs that have been lagging, as businesses have lacked the confidence necessary to make long-term investments into growth and infrastructure.

* Strategas Research, Economics Report, March 11, 2019, p. 4

The news we wanted came in recent weeks as the Q4 GDP figure reflected a healthy pick-up in hard capex, led by oil and natural gas structures, amongst other hard asset investment needs. However, business confidence has wavered as of late, and it is difficult to project a reversal of the capex decline trend without strong business confidence driving capex acceleration.

Our view at this time is that the news is modestly good, with a resumption of the late 2017/early 2018 trend on the table if a China-trade deal is found and oil prices find stability in this $55-65 range (a $40-50 price undermines the hard capex thesis). The paradigm shift of the new corporate tax regime has never been fully appreciated by markets, as instant-expensing, repatriation, and extended low marginal rates work their way through the system. Once the focus on capital return to shareholders has subsided, capex becomes a logical consideration for companies looking to invest in a more productive future, and with that, an extended economic expansion.

This week’s report features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet