Dear Valued Clients and Friends,

It has been a wild week in the markets, with the -900 point drop of last Friday (Thanksgiving weekend) followed by a +235 point gain Monday, a -650 point drop on Tuesday, a -460 point drop Wednesday (after being up +500 points earlier in the day), and then a +620 point increase Thursday. As I type Friday, we are down -120 points, having been up +160 points earlier, so currently (at press time) reflecting a -330 point drop on the week. Now that’s a lot of ups and downs for -330 points, don’t you think?

But market ups and downs are not a problem for real investors, so why do I mention this volatility at all? Don’t people invested in the stock market (and more specifically, in the earnings streams of the great companies that make up the market) know that markets do this, and in fact, normally experience much more volatility than we have seen this year?

I would hope so. I know our clients do (how could they not?). But the subject of today’s Dividend Cafe is not the mere reality of market volatility, especially when such volatility is a mere 3% or so off of market highs. I mean, really. No, the subject of today’s Dividend Cafe is those who may be unfazed by market valuations and euphoric concerns, but go hysterical over the omicron variant.

In other words, we want to look at that which does not play into our thinking, and that which does, and why we think the media and so much general investor consciousness have their fears and non-fears exactly backward.

So jump on in to the Dividend Cafe. It will be worth your time.

In fairness – a historical context

I am going to make the case that the omicron variant is not a cause for investor angst – by any information, we are likely to get, and especially not by any information we presently have. But before I do such, I feel it important to clarify some historical context on markets, COVID, the past proclamations at The Bahnsen Group, and so much more.

There is no question that when talks about a novel coronavirus first surfaced in January of 2020 we were highly skeptical about the idea of it leading to a widespread health concern, let alone a widespread market concern. Informed by the precedents of SARS, MERS, swine flu, bird flu, EBOLA, Zika, and other such media medical panics, the overwhelming pattern of history for a hundred years had been containment and a story that never played out remotely near the level of concern generated upfront.

We were not alone in such complacency. From Dr. Anthony Fauci to President Donald Trump, to Mayor Bill DiBlasio, to Governor Andrew Cuomo, to the stock market itself all the way until February 16, 2020, the non-partisan, cultural, medical, political, and financial impressions and assumptions early on were one of presumed containment. I remember well watching the last major Democratic primary debate in late February of 2020 from the hotel of an event I was at in Los Angeles, and the subject of coronavirus not coming up once the entire evening.

Well, that turned out to be wrong. COVID-19 offered up all at once a huge blessing and a huge curse. On one hand, it had and has a minuscule mortality rate – not even in the same stratosphere of smallpox, the Spanish Flu, or SARS for that matter. But it was exponentially more contagious than SARS. The infectiousness of COVID is what wreaked havoc in March of 2020, along with the massive uncertainty as to what it all meant.

The health risk posed to the most vulnerable (immuno-compromised, elderly, comorbidities) led to a run on hospitals we were societally ill-prepared for in March/April 2020, and of course, the loss of way too many lives. Many mistakes were made about how we protected (or failed to protect) senior care facilities.

In March 2020, the market did not know:

- How fatal the disease was

- How it would play out

- What the policy response would be

Over-levered financial markets sold indiscriminately as a “national margin call” played out, and significant tail risk had to be priced in. Highly inconsistent messaging from politicians and health care bureaucrats (from both parties) added to the market jitters. The fiscal and medical well-being of the country was in high jeopardy or at least uncertainty.

By April 2020 markets started to know the following:

- The disease had a very low mortality rate

- There was an identity to those who were most vulnerable (age, comorbidities, health risks, etc.)

- That the Fed was pumping unlimited liquidity into financial assets, and that Congress was throwing money at businesses (PPP) and individuals (numerous support programs and payments)

By May of 2020, we ended up losing such a thing as a “national health response” as the “national quarantine” imposed by President Trump came to an end. At that point, it is impossible to speak of “loose” policies or “draconian” ones, because different states went to different extremes, and in fact, some cities and counties within the same state did the same. The federalism of this great country took hold, and there was nothing even resembling a monolithic response to COVID ever to be seen again.

Fool me four or five times, shame on me

I have formed opinions over time about what proved to be good policy and what proved to be bad policy, what was advisable medically and what was rank idiocy, and what could have been done better versus what was effective. But my opinions may be different than yours, and it really isn’t very material to this commentary. What is material is this: From the summer 2020 wave of COVID cases that were largely concentrated in Florida, Arizona, California, and Texas, to the seasonal winter pick-up around the holidays, to the larger case escalation in early 2021 before vaccine uptake took hold, to the Delta variant of the summer – in each and every situation the markets basically had no response.

Not a March 2020 response. Not a miniature March 2020 response. No response. Maybe a day or two here (in fact, there were several days of algos and other weak hands reacting), but it’s a blip now.

The markets advanced behind:

- high liquidity in the financial system,

- a lack of other attractive investment options,

- the reality of divided government out of the election neutering political risk,

- the vaccines coming online much quicker than expected,

- corporate profit growth,

- and the reality that the negatives of COVID in the economy were going to be short-lived, while the positives of human action would be long-term

I don’t think I can say it much better than that. The COVID economy was NOT all good for everyone – it devastated certain small businesses, leisure and hospitality, and the mom and pop businesses of big cities where office employees stayed home leaving coffee shops and dry cleaners to die (economically). But in terms of the macroeconomic aggregates, the market saw that COVID was not an existential risk, and it has never looked back.

Delta

A variant strain surfaced this summer that was quite infectious, and it did create positive tests in some vaccinated people (so-called breakthrough cases). The severity of those cases (for the vaccinated) leading to hospitalization and death was a tiny fraction of the severity in cases for the unvaccinated, but nevertheless, it prompted uncertainty about the direction of things and accelerated talk of booster shots. It also put a highlight on the unvaccinated parts of the population, which inconveniently transcended political storylines many were tribally craving.

I should add that Delta was the third variant that people attempted to fearmonger around. The first two fell flat and there were no breakthrough cases around those, whereas Delta at least invited more conversation around vaccine efficacy and had higher infectiousness.

But the markets went up. Profits grew. Airline travel exploded. The media fearmongering was widely rejected. And I now have to work to get a dinner reservation in New York restaurants.

Long COVID

The other discussion topic that started to generate handwringing was this idea of so-called “Long COVID” – where severe symptoms of COVID last a long time, even if contagiousness and positivity have waned. I know hundreds upon hundreds of people who have had COVID, and do not know a single one who has suffered from so-called “Long COVID,” but I figured that could be merely anecdotal. I read studies that 10-20% of those with prior infections may be vulnerable to such. The number now appears to be closer to 1% and has obviously generated no economic impact.

And now, Omicron

News of an infectious variant in parts of Africa circulated late last week, and questions about the spike protein alterations led to concerns that the present vaccines may be less efficacious. These conversations began before we had a single documented case in the United States, and had something like two in all of Europe. They began when the “growth” of cases even in South Africa were not even remotely close to the prior waves.

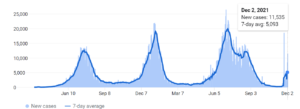

*South Africa, Johns Hopkins University, CSSE, COVID-19 Data, Dec. 3, 2021

Oh, and they began despite the reports of severity even in South Africa being highly benign, with a wide preponderance of asymptomatic cases.

What I am not saying

I do not know if the omicron variant is going to prove to be a nothing-burger or not. All indications right now are that it will prove to be quite infectious, will challenge some vaccine efficacy, and yet looks to be quite low in severity. Many market commentators this week (Pershing Square’s Bill Ackman, JP Morgan, oh, and yours truly) have suggested that this is actually a very bullish possibility – even more antibody creation without loss of life or a strain on the resources of hospitals. Of course, there is a lot we do not know. I am not saying differently.

What I am saying

I am skeptical that omicron’s news will cause greater public fear, or cause more people to want to mask up 5-year olds playing sports outdoors. I just believe the uncertain, uninformed place we were all collectively in 18+ months ago is gone, and that the fervent craving for normalcy across the bulk of society will win out. Where warranted, rational and reasonable precautions may or may not be a part of the conversation, but no, I do not believe that we are going backward. We’ve been there, done that, and the risk to economic activity is simply not there by my estimation when one considers:

- Vaccines

- Boosters

- Antiviral treatments

- Almost universal safety for kids

- Minimal outdoor transmission

- Non-existent surface transmission

- Natural immunity from prior infection

- And the insatiable desire to have one’s life back in some normal context

I believe those who use omicron to extend economic inactivity are likely those looking to extend economic inactivity (or diminished inactivity) regardless. I do not see this leading to a measurable slowdown in activity.

But the policy side?

Will this lead to extensions of mask-wearing on airplanes, possible quarantines for international travelers, travel bans from some countries, and other such things that may or may not be a nuisance depending on your point of view? Some things have already happened, and some more are likely to come.

But the disconnect between the policy side and the market side has been one of the phenomenal stories of COVID for a long, long time.

So everything is okay and markets are going to continue ripping higher?

See, that is NOT what I said. I see markets filled with 2020 winners that have gotten creamed in 2021, and no one is talking about it. I see hot-dot frothy bubble spaces disconnected from reality falling out of favor. I see some serious cracks in the armor in parts (but not all) of FAANG. And I see a crypto-mania that just feels like a complete sequel to 1999 and 2005 in almost every sociological context (sports arena naming rights, taxi driver recommendations, you name it).

Some stuff to watch

Corporate bond spreads remain quite low. If this blows out higher it would certainly indicate financial system anomalies are coming back to roost. The yield curve is quite flat right now (85 basis points on the 2/10 curve). If it gets much flatter it points to greater fear of a Fed policy mistake.

We can certainly watch for any signs of silliness and policy abuses (school closures, etc.), but we are cautiously optimistic that those things just won’t be tolerated any longer.

Our focus is on financial markets because as I have been writing all year (and longer), the financialization of the economy created by excessive monetary interventions has done more than just boost the market multiple of your favorite app or social media company. It has created distortions and leverage and financial mal-investment that makes the system less stable.

Period.

Conclusion

Much like the inflation/disinflation debate, where taking one side versus the other is often confused with one being optimistic versus pessimistic, my sanguine view on how this omicron matter plays out is not to be confused for a pollyanna view of present market conditions. Rather, it is the recognition that what we often get hysterical about is distracting us from that which ought to faze us much more.

And in properly ordering our priorities and removing both hysteria and complacency, we can get things much more right as investors.

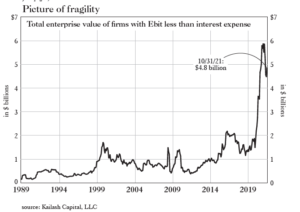

Chart of the Week

Companies that can stay alive because of low-interest rates are called Zombies. Companies that earn less in profits than their interest expense are zombies with an accelerated shelf life. This is anecdotal, not systemic, but it is one of many anecdotes that monetary interventions have made the financial system more fragile for many companies.

Quote of the Week

“What is done for effect is seen to be done for effect; what is done for love is felt to be done for love. A man inspires affection and honor because he was not lying in wait for these.”

~ Ralph Waldo Emerson

* * *

I do hope everyone enjoys this beautiful December weekend. What a special time of year This has been a truly wonderful week for me for a lot of reasons, and I cannot wait for the week ahead. That is the gift I have been given – being excited for every day, every week, every month. Family, friends, work, and the God who makes it all possible. To those ends, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet