Dear Valued Clients and Friends –

Early December is a tough time of year for my writing inspiration. I have soooooo much I want to say about 2020, but we really aren’t done yet, and this year as much as any other, affirms the reality that a lot can happen in a few days, let alone a few weeks. I also have a lot I want to say about 2021, but my “forecast” and “positioning” perspectives for the year ahead are also better served later in the month or early next month. Patience is a virtue, and as much as I am excited to delve into a yearly review and yearly projection, we are a few weeks off still.

But it isn’t like there is nothing else to write about. Markets ended November and kicked off December this week with a move higher (as of press time, which is pre-market Friday, the Dow is up +330 points on the week, and futures are pointing to a +125 move higher. Congressional leaders in both chambers and from both parties are in heavy discussions about a new stimulus/relief bill. The incoming administration is announcing more and more of their incoming policy team. World energy markets are re-calibrating around clearer (and more improved) supply/demand dynamics. And, of course, the reality of a highly contagious respiratory virus continues to work its way through society, with various policy and economic ramifications coming in its wake.

Every year the first couple of weeks of December have a few things in common – we are too far away from recapping the year we are in, we are too far away to start making the year ahead predictions, tax-loss harvesting needs to be executed, various holiday and seasonal events and tasks take center stage, and yes, regular market and news “stuff” takes place.

This week’s Dividend Cafe will jump around a bit but offer a bit of history, a bit of present market tension, and of course, a bit of looking into the future. Some of the takeaways will surprise you. Jump on into the Dividend Cafe.

December Deja Vu

In the early years of my career as an investment manager, December did feel different than it does now. I guess part of it is that I used to actually go to holiday event after holiday event (one year Joleen and I have tried to forget, we had 21 evenings out from December 1 through December 23; suffice it to say, this was before we had kids). This odd COVID year notwithstanding, I try to keep my holiday events to a minimum now – mainly because I am too old and too tired to work my normal 3:30 am-6:30 pm day and then go out to a party. We may have an event or two we attend in a non-COVID holiday season, but the days of doing a dozen or two dozen events are long gone.

I also remember the good old days of lunch meetings at The Ritz every day in December. Most of the Decembers of my Morgan Stanley years were spent with a stone crab appetizer, a Christmas goose entree, and some obnoxious dessert, pretty much every single day, as I rotated various lunches with clients, team members, money managers, or other colleagues or vendors in our business. It was the same menu at the same table at the same restaurant, every single day in December. Now those memories are more enjoyable than the years of evenings out, but still, those days are long gone. Not only is the greatest restaurant in Orange County history long gone, but so is my tolerance for that level of caloric intake and my time capacity for such rendezvous.

It seems that twenty years ago and even ten years ago, clients were more focused on their own holiday activities, and portfolio and markets work was just secondary to everything else people had going on. For several years now, and this one is right at the top of that list, December barely feels different from any other month. Regular review meetings are happening. Portfolio allocations are flowing. New clients are joining us. And at least until we actually get to Christmas week itself, it just feels like business as usual, which in our world means “feels really intense and really busy.”

There are some traditions of the past still in effect. I must have gone out to the desert for an isolated weekend of next-year business planning every year for two decades. I’ll be doing the same next weekend from our house in East Hampton (different weather, same solitude). Tax-loss harvesting planning and execution is a never-ending annual affair. It seems we have new employees to hire almost every December as we look to enter the new year with any desired new positions filled (this year, we have a new office manager starting in New York and a new private wealth advisor starting in California; last year our new Financial Planning Director started year-end; I bet we have had someone new joining our team entering a new year each of the last five years).

And, of course, there is always the simply delightful holiday cheer in the air. Cool, crisp weather. Gorgeous lights. Festive decor. Candy. Gifts. And all the fun things. It’s the most wonderful time of the year. The only person who loves the holidays more than I did as a kid is me as an adult.

But what about the market in December?

Our business has a really silly tradition whereby certain pundits try to extract investment wisdom out of calendar happenstance of years past. “Sell in May and go away.” “The first half of the year is better than the second half.” “September is the worst month.” I could go on and on. These adages are tired and absurd and totally meaningless in any present tense or future tense. Unless one can establish causation between a particular calendar season and market behavior, the alleged correlations are naturally unreliable. And historical “averages” are meaningless, too (do you think September of 2008 might be skewing the numbers a bit for how September averages look in the last twenty years?).

So if there was some historical trend about December, it wouldn’t tell us anything about this December or next December. But there isn’t. Last year markets rallied hard in December despite having rallied already in October/November. The year prior, my Christmas week got substantially interrupted as markets collapsed on Christmas Eve, capping off what had been a 19.8% decline in the market in Q4 (markets did us the favor of recovering a bit in the days following Christmas). In 2017 the landmark corporate tax legislation became law in December. In 2015 markets were absorbing post-election results. In 2015 markets were boring in December, but proved to be the calm before the storm as January 2016 became the worst January in history. In 2012 markets faced the fiscal cliff of Bush tax cut expirations, only to see permanent tax relief worked out, creating a huge rally in December’s waning days. (As an aside, the two people who constructed that tax resolution – then Senate Minority Leader Mitch McConnell, and then Vice President Joe Biden). In 2008 markets couldn’t find a break in any month, and even as December didn’t do anything to relieve the pain of September through November, it only got worse in January and February of the following year.

I actually more or less remember without using Google Search every December in the markets since Joleen and I were married, and I can safely tell you this: There have been big up months, big down months, and plenty of in-between. Pretty interesting, eh?

Write this one down

If I didn’t know better, I might have to conclude that in years where a market-moving event happen (tax reform, trade tensions, fiscal cliff, Fed tightening), you see a market response (no matter what month it is), and in years where nothing market-moving is going on, December can be pretty boring. In other words, the month in the calendar is irrelevant; the action in the economy and market and the news cycle is relevant.

This year

Markets digested the reality of a Biden Presidency and the reality of split government between the executive and legislative branches in November. Every day right now, almost Hollywood-like headlines are appearing on various “news” websites about COVID, and markets have shrugged them off. Some legitimate questions exist as to whether or not a stimulus/relief bill will get passed that impacts the economy and outlook for corporate profits, but there is not a lot of doubt in the markets that whether it happens in December or February, some bill is coming. Some mayors and municipal authorities are making bold declarations to limit economic activity but watering them down with so many exceptions as to seem, well, confusing. Some European countries did shutdowns in the spring where schools, businesses, stores, and factories were shut down. Now, they have brought back those shutdowns, that is, except for schools, businesses, stores, and factories.

No matter how confusing it may be that markets are performing well, the simple reality is that markets are up for two very rational reasons: (1) They see better things ahead for corporate profits on the other side of this silliness; and (2) Monetary policy has promoted a better valuation for risk assets, and is universally expected to continue doing so.

Coal in the stocking

Christmas metaphors mixed in with market adages are another December tradition in my business, and I actually am pretty sick of them. But if you can’t beat em’, join em.’ Here is the reality that makes the difference between a Christmas stocking and a lump of coal … it is not bad news that hurts markets; it is surprising bad news. Nearly every data point that markets are absorbing right now is a data point that is either (a) Expected or (b) Better than expected. This is not a December lesson for markets; it is a permanent one.

Plenty of unexpected surprises could come for markets. I continue to reiterate that I am uncomfortable with how to feel people are talking about the myriad of things that could happen with U.S./China relations in the months ahead. I will devote more time in my 2021 projections to those various market risks that are actual risks. But if you wonder why all the things people are talking about are not hurting markets, just know that you answered your own question – it is because people are talking about it!

Politics & Money: Beltway Bulls and Bears

- Brian Deese has been appointed head of the National Economic Council for the Biden administration (this does not require Senate approval). Deese is an Obama administration alum who most recently worked for Blackrock.

- By the time you are reading this, what I am about to say may be obsolete, or it may be confirmed, or most likely, it may still be in flux, but Speaker Pelosi and Senator McConnell have had a [very rare] phone call in the last 24 hours, and it appears there is some increasing chance of lawmakers forging ahead. I reiterate what I have said in The DC Today this week: Biden’s support for this has given cover to legislators who previously opposed a compromise.

Chart of the Week

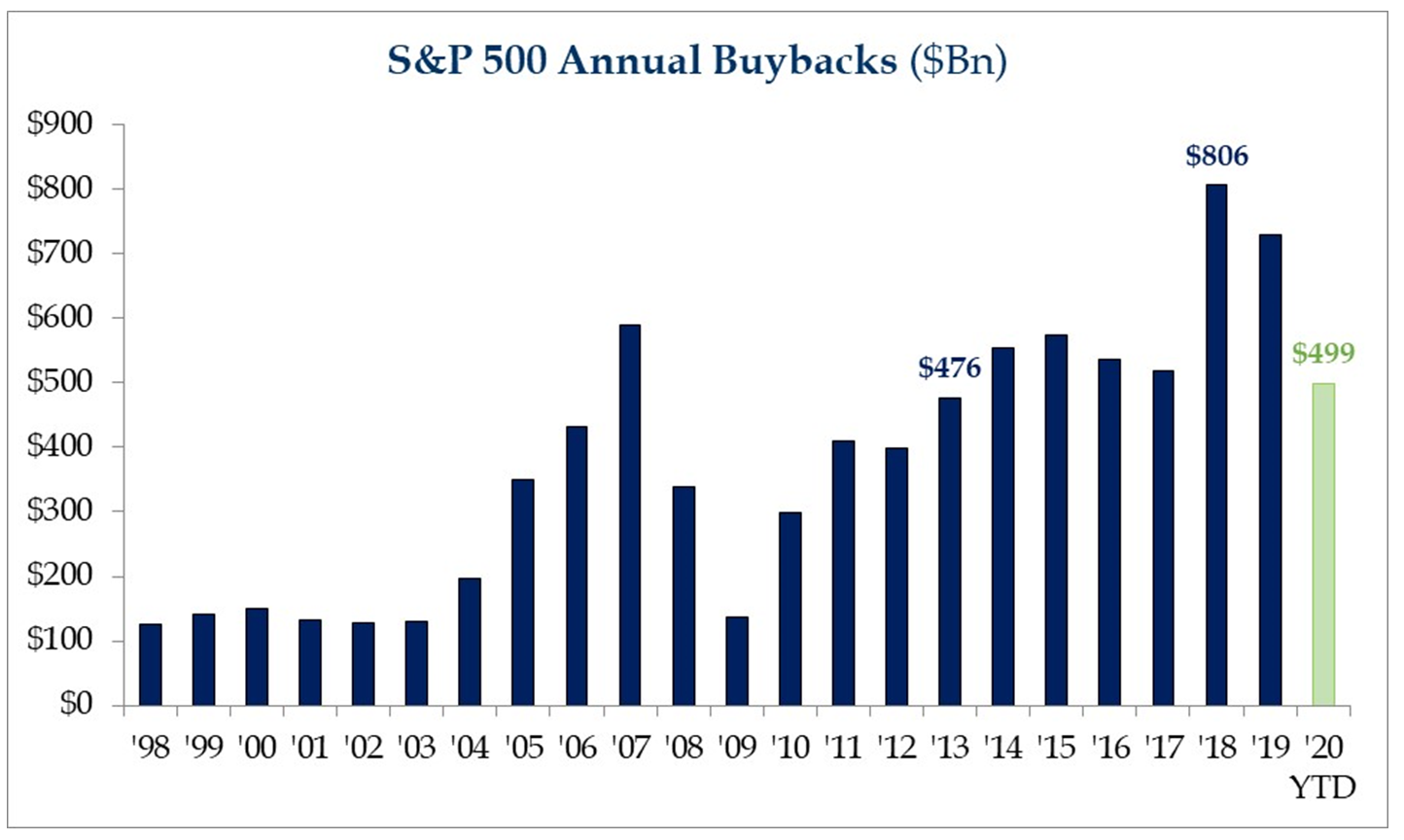

Stock buybacks have often been presented as a case for dividend payments being obsolete – that companies have a consistent, repeatable, beneficial, tax-efficient way of returning cash to shareholders now that trumps dividends. I have responded to this fallacious and inadequate argument for years by pointing out (a) Authorizations for buybacks do not have to be executed; (b) Most buybacks just offset new share issuance being used as employee compensation; (c) You just compound risk with buybacks – you can’t eat the anti-diluted share, and then the whammy of them all …

Stock buybacks aren’t repeatable, consistent, growing returns of cash to shareholders. They are the first thing to go when the going gets rough, they are inconsistent, and the actual invisible cash they represent to shareholders is dubious, to begin with, because of competing accounting realities.

Well, this week’s Chart makes clear … Stock Buybacks will be at their lowest level since 2013 this year! I will argue two things here: (1) Stock buybacks are no substitute for all-weather return-of-cash to shareholders, and (2) Next year will probably see a LOT of stock buybacks!

*Strategas Research, Daily Macro Brief, Nov. 25, 2020

Quote of the Week

“Never trust models. They are garbage.”

~ Andy Kessler

* * *

As I have been writing this Dividend Cafe, the November jobs report came out. 245,000 jobs were created, below the headline expectation number, but above the whisper number of 200,000. The unemployment rate ticked down to 6.7%. The labor force participation rate sits at 61.5%. Markets are pointing to a +120 point opening. I have to hit “submit,” and who knows what happens from here (today).

What I do know beyond today is that December is here, and it has been fun reminiscing with you a bit this morning. There will be lots of fun in the weeks ahead, no matter what happens in the market.

I am jumping on a plane to New York in just a few minutes and will be there for the next couple of weeks. Who knows – maybe it is time to create some new December traditions … =)

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet