Dear Valued Clients and Friends,

One of the hardest things about being an economic commentator in this day and age is that economic commentary requires nuance, and this day and age requires narratives. There is to be a single narrative about X, and any variation around, above, beneath, or of the exact X narrative is heretical or at least unappreciated.

It is a tough way for society to function, but it is an especially tough way to do economic analysis.

I do not merely refer to the inevitable complexity involved in topics like these that are, well, complex. You are smart readers, and I do my very best (sometimes better than others) to make complex topics a bit more comprehensible in my writing and speaking. Readers and listeners can judge how effective I am there, but I do try. No, this is not about complexity, but nuance, which basically can be quite simple at times; it is just that it doesn’t fit into the script of a narrative. It isn’t binary. The nuances of proper economic analysis aren’t always fit for a forced narrative.

Such is the moment we are in, and today I want to answer your questions about the state of the economy. If I do my job right, everyone will be mad at me when all is said and done (I should fail at landing in either of the primary narratives of the day). Such is the plight of an economic truth-teller in 2022 …

Jump on into the Dividend Cafe!

|

Subscribe on |

What is a “recession”?

I am hopeful most of you have gotten this part out of your system by now, but let’s just cover the basics …

It is not disputable that traditionally we have viewed a recession in a technical sense as two consecutive quarters of negative GDP growth. It was not governmentally decreed to be such, and there is no academic journal granted such authority over vocabulary. But it has been the traditional both understanding and use of the word.

What is also not disputable is that the body given the ability to label something a recession is called the National Bureau of Economic Research (NBER). They are not a government agency but rather a not-for-profit organization founded in 1920. They do receive significant government grants, along with funding from other research institutions and various foundations.

The NBER defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” That “more than a few months” piece is where we get two quarters from (a few months is three, so that is one quarter; more than a few months must mean at least two quarters).

They collect a lot of data to feed their models and make their assessments. Their data is provided by the Federal Reserve Bank of St. Louis (FRED, the data website the Fed maintains that is really quite impressive). According to NBER, the following monthly data plays into their inputs for calculation purposes:

- FRED real personal income less transfers

- FRED nonfarm payrolls

- FRED real personal consumption expenditures

- FRED real manufacturing and trade sales

- FRED household employment

- FRED index of industrial production

They also look at Gross Domestic Product (GDP) and real Gross Domestic Income (GDI) in considering quarterly changes in the economy.

- FRED real GDP

- FRED real GDI

What is notable is that the NBER is very clear that a “recession” or “expansion” do not look at the level of economic activity but merely the direction. A move from 4% growth to 1% (still) growth is not a recession despite a lower level of growth, as 1% growth is still a positive direction. It is when the direction is actually negative and “significantly” so, per their definition, that recession talk fits their bill.

But, their definition of “negative activity” is not linked only to GDP. They also look at GDI (gross domestic income), and they use a “range of indicators” in analyzing economic activity.

And it generally has taken between four months and fifteen months past the point of either peak or trough occurrence for it to be labeled as such.

Did this recent GDP print prove a recession?

I am wholeheartedly willing to prove my political objectivity by saying the following things … but first, by “politically objective,” I do not mean I lack a political worldview. I am a movement conservative, have never shied away from labeling myself as such, and am registered as a Republican even though I do not vote purely party line (especially the last six year). So I am not pretending I lack a political direction – what I am asserting is that my interest in this topic and the commentary I am about to share is not remotely political. I am calling balls and strikes as best as I can here.

(1) I believe those wanting this to not be labeled a recession right now despite the traditional “two quarter” understanding are likely politically motivated.

(2) I believe those desperately wanting it to be labeled a recession right now despite the nuance in the definition and economic environment are likely politically motivated.

(3) I think those in camp two would switch to camp one if the political shoes were on the other foot, and those in camp one would switch to camp two if the political shoes were on the other foot.

(4) Finally, I believe the semantics are reasonably unhelpful other than the fair desire for consistency … The people know how the economy is doing with or without NBER, with or without the President, with or without CNN, and with or without Fox News. And virtually everyone being objective knows that:

a – If we are in a recession right now, today, at this very moment, it is right now, today, at this very moment, a mild one; and,

b – Whether or not we end up calling this very moment a recession, economic activity is clearly slowing down

There’s no I in team but there is GDP in recession

Regardless of the various ambiguities in the NBER’s rules of the road explained above, we do know that “GDP” is the essence of what we are trying to get to. In theory, the “gross domestic product” is an attempt to measure the total market value of all goods and services in a given country (in a specific time period). Fair enough. But how in the world do we measure the total value of such?

The formula used in the U.S. is as follows:

Private Consumption + Gross Private Investment + Government Investment + Government Spending + (Exports – Imports)

A simple way to say it is that we add up consumer activity, business investment, government spending, and the trade deficit.

Looking under the hood

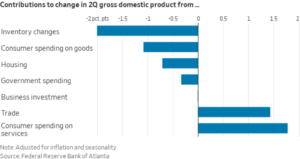

When we look at the second quarter’s -0.9% real GDP activity, we see that exports outpaced imports vs. the prior quarter, as I predicted several times, largely on the hunch that imports would be lower based on China’s lockdown, and exports higher versus the world’s need for our energy hydrocarbons. We further see that the consumer spent well on services but declined in spending on goods and that business investment was not helpful in advancing economic growth, but it also was not contractionary. The large negative was in inventory changes.

Trade was a negative in Q1 but became a positive in Q2 for the reasons I cite above. But that very trade issue in Q1 is what fed the inventory issue in Q2 – meaning, companies built up inventories like crazy fearing ongoing supply chain disruptions, That led to high imports in Q1 and less imports in Q2, and inventories were still high in Q1 but then contracted in Q2. The intertwined logic in trade and inventories are all part of the same dynamic. Inventory build-up in 2021 added to GDP; inventory depletion in 2022 is hurting GDP.

Oh, and yes, COVID lockdowns and re-openings have their fingerprints all over this!

Note, however, that total trade grew by $3.3 billion in June and is up +21.2% versus a year ago. Total trade tells us more, in my humble opinion than the delta between the two.

Not the last time I will bring this up

Quarter-by-quarter, in terms of measuring the rate of growth of total output (whether positive or negative), I think the current formula for measuring GDP change is fine. I am sure it can be misleading at times, and I am sure there are moments when some tweaks to the formula would have helped, but generally speaking, this formula is fine in a “good enough” kind of way. Plus, it has been consistently used forever, so to change it now forces apples-to-oranges comparisons.

But remember, that formula is good at measuring quarter-over-quarter changes and is not at all designed to be predictive. In fact, by definition, inventory build-ups are usually not very predictive of what will happen in the future, and neither are inventory depletions. In fact, they are somewhat susceptible to a reversal by their very nature. And while government spending going down means a lower GDP in one quarter, I probably like it longer term (what contracts GDP one quarter may be benefitting GDP down the line if it means an improved allocation of capital and resources).

As for the consumer, you know how I feel. Yes, their activity matters a lot and is heavily weighted in GDP’s formula (as a measurement of expenditures). But I simply never doubt the American consumer’s will to spend, and that figure never tells me much predictively. Admittedly, in those rare periods where their consumption is contracting, it must mean something is really wrong, but it is backward looking.

So Business Investment becomes the operative component for a Classical-Austrian economist and supply-sider like me. When businesses invest in the future, I believe it creates the goods and services of tomorrow that drive economic growth – that drive sustained prosperity – that foster job creation – that allow for consumption (good luck consuming something before it has been produced) – which drives a productive increase in the economy.

And that “non-residential fixed investment” number sits at a big zero.

Did someone say “jobs”?

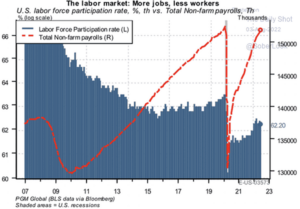

The labor market is loosening. It is not doing so dramatically. It is not doing so catastrophically. And in some contexts, it is a healthy and needed thing (unfilled job positions were inflationary; the opposite is not). But if a strong labor market is becoming a looser one, that is relevant for our interpretation of the direction of the economy.

Just moments ago, the July jobs report came out from BLS reflecting a huge 528,000 increase in jobs last month. The unemployment rate dropped to +3.5%. Wage growth was up +5.2% as hourly earnings increased +0.5% last month. It was a strong report, and there is no way ambiguity around recession is going away with jobs reports like these.

That said, the Job Openings data this week showed a slight decrease in job openings, but not a severe one. The initial jobless claims each week have inched higher in the last few months. Not severely, but a little.

And by the way …

While the unemployment rate has remained quite low, the number of employed people is not even back to pre-COVID levels; we simply have fewer people in the workforce since COVID pushing the percentage down. That is worth considering when we think about the jobs market, but also worth considering when we think about the productivity we want to see in the economy.

Not a good time to get cocky

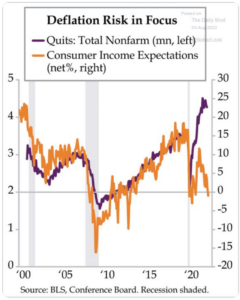

I know we have heard so much about employees quitting jobs at record levels and employers unable to fill jobs at record levels, but I am not so sure that is remotely sustainable. Income expectations tend to correlate heavily with the confidence to quit one’s job, and all of a sudden, the de-coupling is severe.

Conclusion

We are in what has traditionally been called a recession, with circumstances that were traditionally not recessionary.

Both of those things are true no matter what your politics.

But things are worsening in many categories, even if slowly. I have no doubt that we will tip into what is more clearly and unambiguously seen as a recession if we do not see more business investment in the near future. With the cost of credit expanding and a desire to see headline inflation come down, that is not likely. We operate policy under the false pretense that productive investment is inflationary. It is not. But sometimes, one can be a victim of the other, and here we are.

But will any of this matter in the end? The political side is pretty well set (do you know a lot of people switching their political allegiance in the next ninety days based on inventory levels???). Economically, the market has priced in at least a shallow recession.

Yes, we still need the NBER to “officially” weigh in down the road a bit. But really, what we know is this: The lockdowns of 2020 created a V-shape in 2021, and the clean-up of fiscal and monetary decisions from that era is creating a ruckus now. There’s an “R” word we can all agree on.

Chart of the Week

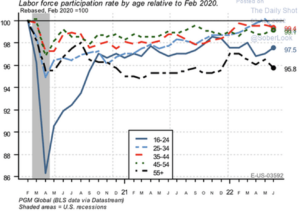

A particular source of tragedy in the current labor participation force that I have highlighted before: The highest amount of people to have left the workforce are ages 55+, followed by those ages 16-24. For entirely different reasons, those are two age groups I truly wish were not statistically driving a smaller workforce.

Quote of the Week

“Pessimists sound smart. Optimists make money.”

~ Nat Friedman

* * *

My new Economics 101 class goes live on Monday at my new website, and I am pretty excited. I feel strongly that so much of what is required for people to become better investors, for policymakers to become decision-makers, and for all of us to have a better framework for understanding the world in its economic dimension is for people to have a refreshed understanding of the first principles of economics. I hope for various students and interested people, this class will play some role in providing that refreshed foundation.

Your non-partisan, objective, honest, caring author wishes you a good weekend and wishes USC a healthy fall camp. Fight on!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet