Dear Valued Clients and Friends,

The second quarter of 2024 hit its midpoint this week, and markets have continued with what has been a big rally in the month of May. As earnings season has now concluded and the Fed is sidelined for a bit, we might expect things to chill out for a bit, but markets never sleep, so who knows. But this week’s Dividend Cafe does give you a pretty good look at the yield curve and what it predicts (or doesn’t), along with a cogent expectation for inflation, some fascinating things Japan can teach us (or not), some campaign questions for Team Biden, and then ultimately – a real behavioral lesson that may just make or break your success as an investor.

So yes, the opportunity inside this week’s Dividend Cafe is serious. Let’s jump in!

Remember the inverted yield curve

Only two things can happen at this point in the aftermath of the yield curve’s lengthy inversion:

(1) No recession follows despite the curve being inverted for 675 days now (and counting)

(2) Eventually, a recession does come, somewhere around three years (or longer) after the curve first inverted, making it the most worthless leading indicator in history (“Hey, trust me, most of the time this happens, you can know that either three weeks or maybe three years, later, such and such is going to happen”). Try placing a sports bet with such precision!

As a refresher, the yield curve’s inversion is when a short maturity of Treasuries (say 90 days all the way up to two years) trades at a higher yield than a longer maturity (use the 10-year). The yield curve thus “inverted” two years ago, and a recession either didn’t happen or ended up happening so long afterward that it may leave this indicator obsolete for generations.

By the way, the market has been up about 40% since the continuous yield curve inversion began in July 2022.

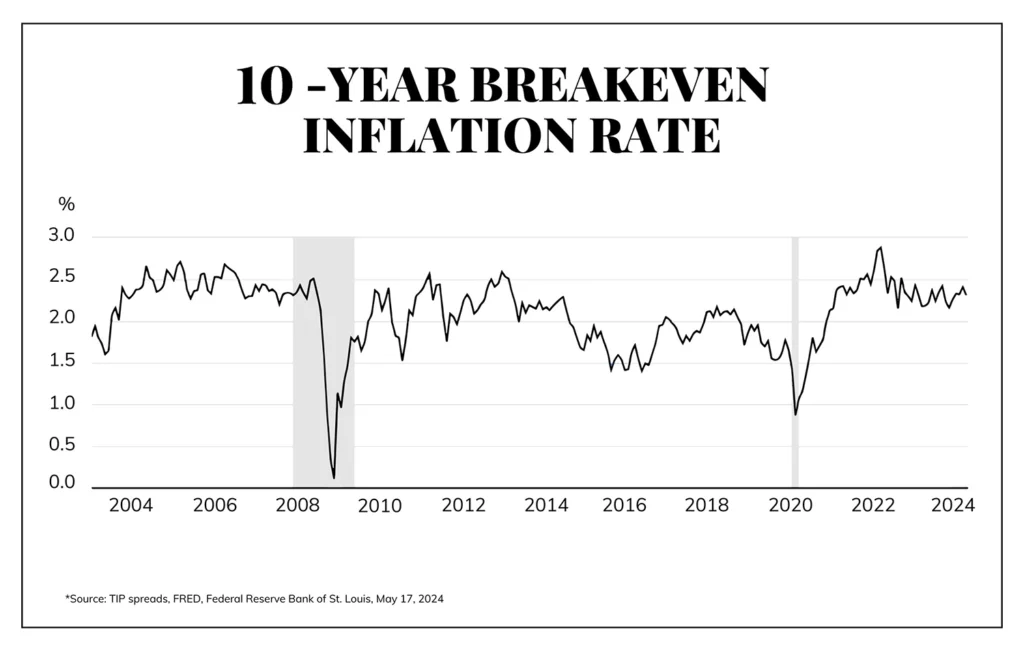

The greatest data point we have

After a couple of months of CPI coming in a pinch higher than expected, this month saw it come in a pinch lower than expected, and the normal punditry ensued about what it will mean and not mean for the Fed, etc. (I am guilty of being part of that chattering punditry, I confess). But really, through all of the noise, projections, predictions, and commentary, inflation expectations over the next ten years have been, and remain, between 2% and 2.5%, as measured by the best measuring stick we have … TIP spreads (that is, real people, real investors, real countries, real insurance companies, real pensions, real hedge funds, real banks, and real corporations with trillions of dollars on the line). Treasury Inflation-Protected Securities are real government treasuries that adjust their yield to the impact of inflation, allowing an implied expectation to be measurable at all times in a highly liquid and reliable way from extremely sophisticated economic actors. And that 10-year expectation remains …

… the low 2%. Same as it ever was.

Where the money is

The high-yield bond market’s share of corporate debt has dropped 19% over the last five years. Syndicated bank loans have dropped 12%. High-grade bonds share down 1.4%. But private credit?? Up 93%. Now, it still represents a total share of the corporate debt universe that is below 19%, but it is now essentially the same size as the high-yield bond market and, just five years ago, was less than 40% of its size.

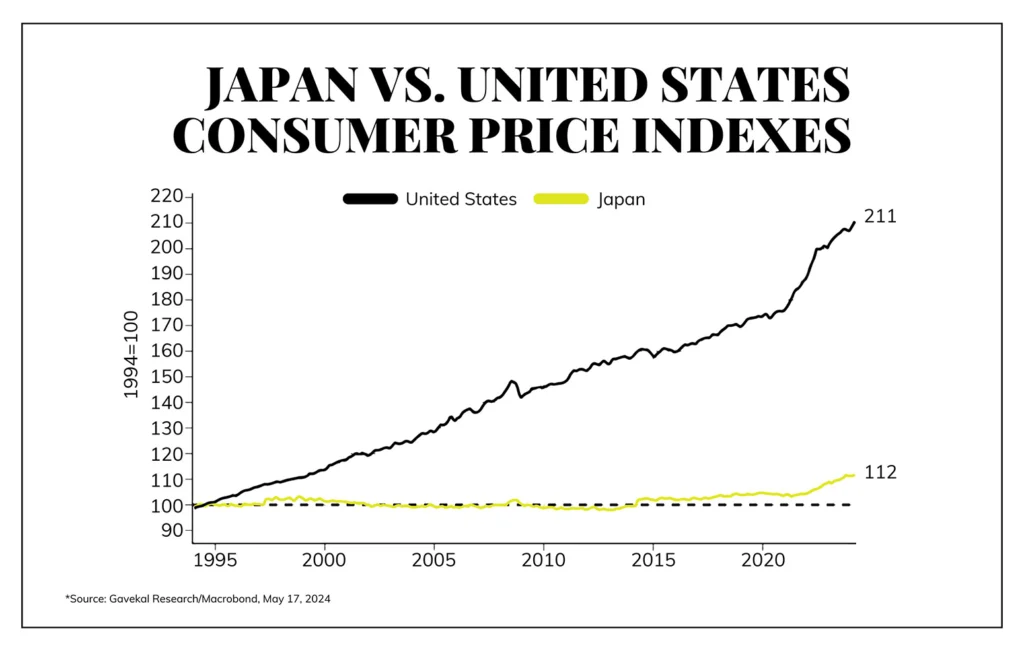

Charts that don’t lie

Which country do you think has spent more money, run up bigger national debt, and more aggressively used monetary policy to manipulate economic outcomes? Hint: It’s stock market recently hit 40,000. Okay, that isn’t helpful. Hint #2: Its stock market hit 40,000 in 1989 and then didn’t do it again until 2024.

Inflation is a real thing. But what causes it in the short term and sustains it for the long term is not what many understand it to be.

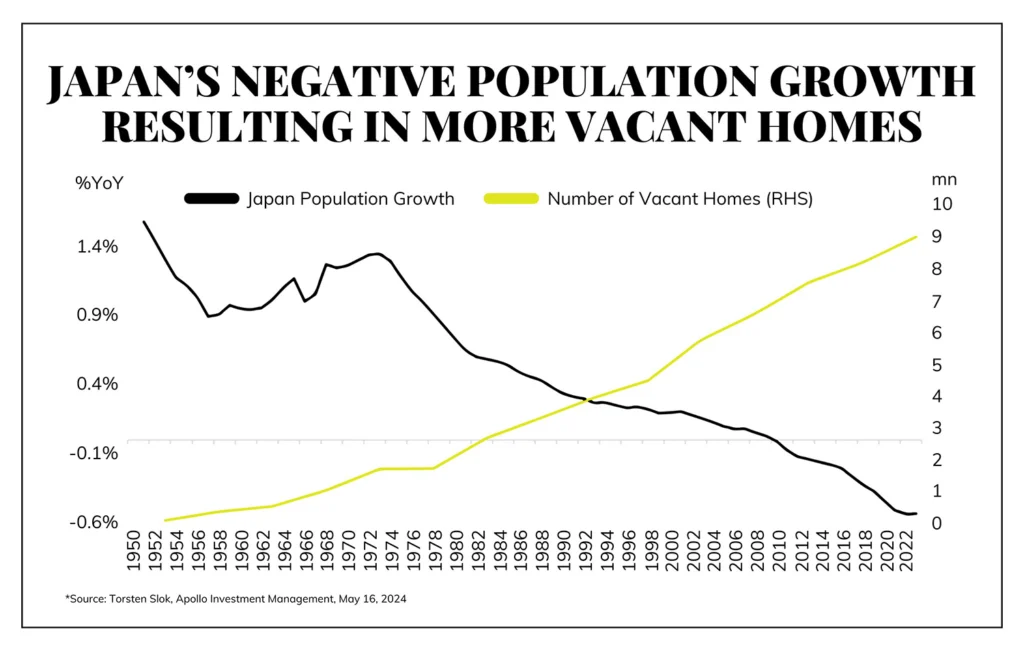

A solution worse than the problem

Well, here is one way to solve the inadequate supply of new homes! Yes, about thirty years ago Japan’s population began shrinking (more seniors passing away than babies being born). Over this 30-year period the population decrease has perfectly correlated with an increase in available housing supply.

So there you go – all you have to do, United States, to get more supply of housing is extinct your population over time. Of course, the decrease in production and consumption that a declining population represents might nullify the reality of more housing stock, but hey, it’s a creative solution.

(Newer readers – there isn’t an iota of seriousness in what I am saying. It is deadly serious that this is what Japan has done, but the last thing people who believe in Housing as an investment want is a lot of houses with a declining population. The last thing anyone who believes in economic growth wants is a declining population. Economic growth = Population + Productivity growth. This is a brutal chart to look at depicting one of the great global economic tragedies of our lifetimes).

Election strategy

The Biden administration made an interesting policy move this week in imposing hefty tariffs on China as it pertains to their electric vehicle, battery, and solar panel industry. As one who was opposed to the heavy tariffs (and threats of tariffs) under the Trump administration, my own policy convictions here have been pretty consistent (i.e., tariffs are paid by American consumers and result in tit-for-tat retaliations that prevent meaningful improvement in whatever people are trying to improve). But what is interesting to me here, regardless of my own views of tariffs, regardless of who is imposing them, is that this move by the Biden administration makes it impossible to criticize the Trump administration for their own threats of tariffs. Some of the aggressive tariff posture the Trump campaign has been floating could theoretically be criticized by a competitive campaign as “reckless,” “dangerous,” or “destabilizing to the economy” (all things that have previously been said about this very issue). But now it seems that Team Biden has removed this issue as a potential wedge against Team Trump, and yet without any corresponding political benefit (does anyone really believe that for whatever voters “tough on China” is a determinative issue are now going to lean over to Team Biden?).

But the bigger thing I would point out, inspired by a thoughtful research report written by the always thoughtful Louie Gave of Gavekal Research, is that this complicates Team Biden’s climate change communication. Particularly with younger voters for whom some form of climate fears were or are a big issue, how does one simultaneously maintain that (a) Fossil-powered cars are a threat to humanity, and (b) We need to charge 100% penalties on those buying electric cars if they come from another country?

Again, there may very well be answers to these questions. My own views on tariffs and federal mandates around vehicle selection are both well-known and irrelevant. I only mention it to point out the political complexity underlying the policy … I do believe tariffs weigh on economic growth, but that is hardly a partisan comment from me in this cycle since it appears both candidates are all in on them. But the environmental message here may be problematic for the base of voters who care about such things.

The real truth is that the EV imports from China for the U.S. market are practically zero, so no, this isn’t doing anything to destroy the environment; but then if that market truth about U.S. consumption of Chinese EVs is true, I guess one can be forgiven for wondering what the purpose of the tariffs is, to begin with, eh?

A behavioral reflection

One of the most consistent themes in the Dividend Cafe (and its predecessor versions) has been the primacy of behavioral modification in investor outcomes. The need to modify behavior is, itself, only necessary because of something else that precedes the behavior – and that is the emotions that drive bad behavior. In other words, optimal behavioral modification when it comes to investing takes the form of a negative action – the modification is in not doing what your human nature often pushes you to do, led by emotional impulse. As I have long said, emotions are not wrong when it comes to investing; giving in to them is through unwise behavior and action.

I stand by all of this and spent 25 years seeing it play out in profound ways. I have built a business in which I believe from the bottom of my heart that the greatest value we have created is in assisting people to not do some of the destructive things they are otherwise wired to do. We have decades more in front of us doing the same thing.

All of the focus on fear, though, risks too truncated an understanding of fear. Yes, too many have shot off their own noses “afraid” of their entry point into markets, and too many have done irreparable harm to their portfolio by deciding to “go to the sidelines for a little bit, with plans to come back in after ABC event.” Exiting during sell-offs is the most notorious of these “fear-driven” mistakes – and the stories are legion of people who made other investors rich by selling them their high-quality investments and the dumbest of low prices [I have kept receipts].

But fear is not just the negative of concern over loss. Greed takes the form of fear, too, when we understand the human dynamic of “fear of missing out.” Those who feel the need to do something dumb because they see their neighbor doing it are not operating outside the bounds of humanity – they are being perfectly human.

The problem is that their neighbor is likely a liar, and certainly a fool, and not worthy of being emulated [note: “neighbor” here is metaphorical and not meant to be insulting to a particular person who lives near you, but if the shoe fits ….]. But I have never, ever, ever seen someone be able to resist at least asking the question of, “Hey, I see some people who seem to be getting super rich with super big returns by doing X, and I would like some of that action, too, and I was wondering if I could please dabble in this thing that seems like it creates free money for people.” That is fear, too. Fear of being left out. Fear of not getting something that the laws of math, science, and economics do not tolerate. Fear of feeling stupid. Fear of having to be stuck in the life of a normal person who plays by the rules and does not believe the unbelievable.

And this is the duty of behavioral modification – to remind us all how incredibly stupid so many of the things people do are, generally rooted to some incredibly stupid things some people believe. They do not believe them because they are stupid people; they believe them because they are people. And people sometimes need to believe things that cannot possibly be true.

Successful investors cling to truth. And behave accordingly. To that end, we work.

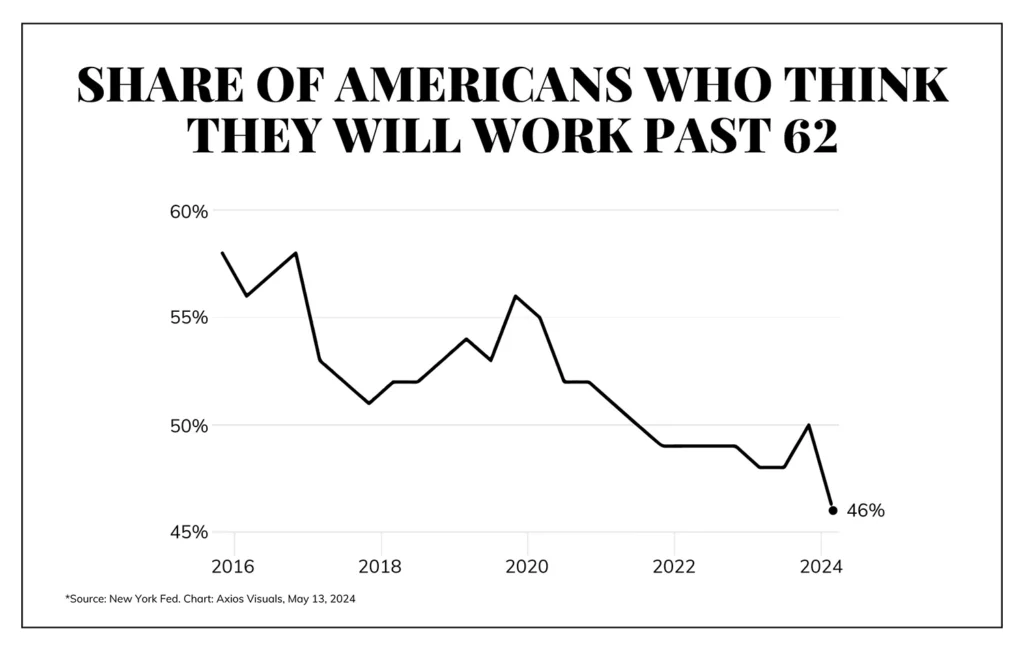

Chart of the Week

We don’t merely have a declining labor participation force; we also have a population that deeply desires a labor participation force that declines even further!

Quote of the Week

“We suffer more in our imagination than in reality.”

~ Seneca

* * *

I will have a lot to say in the Monday Dividend Cafe on the normal subjects we cover there, though I will be out of the country with my bride for a few days early next week on an annual trip. Next week’s Dividend Cafe will come back from New York City, and the final Dividend Cafe of the month is going to be particularly special. Yes, I have the May 31 Dividend Cafe planned already, but not the May 24 edition. There is a method to the madness.

In the meantime, enjoy your weekends and all that lies ahead. Life is precious, isn’t it?

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet