Dear Valued Clients and Friends,

As I finish up this writing Friday morning, the Dow is tracking for its eighth consecutive day in positive territory (I have little doubt that my mere typing of that sentence likely jinxed it). The market reversal from April into May can be credited to a combination of:

- Renewed acknowledgment that regardless of when the Fed begins cutting rates they have made it reasonably clear they are done hiking rates, and

- Marginally improved financial markets liquidity in the present tense and with a vision to the future around the tapering of quantitative tightening, and

- A good fundamental backdrop for corporate profits with another earnings season in the books reflective of enduring margins, reasonable forward guidance, and revenue growth in line with expectations

It is a bad time to be a market-timer. But I don’t think anyone can even time when it is a good time to be a market-timer, so maybe I am just repeating myself over and over. Anyway, we know what time it is at The Bahnsen Group …

… and it is time to jump into the Dividend Cafe.

|

Subscribe on |

When you put it that way …

A very good summary of how to think about the difference between investing for multiple expansion (i.e. a higher P/E ratio creating a higher price which creates more momentum and more buzz leading to a higher valuation, still) and investing for cash flow growth (i.e. a company growing its cash flow and subsequently growing the dividend they pay to shareholders from that cash flow) is this:

- The latter strategy (ours) is attempting to get paid by the company we are invested in

- The former strategy (many others) is attempting to get paid by other investors

I think it is a pretty good breakdown (h/t David Einhorn)

In theory but not practice

I have been critical of Fed Chairman Powell for verbal coddling to the Phillips Curve, the obsolete fallacy of academia that pits unemployment as at odds with inflation at various moments throughout this tightening cycle. At the ECNY luncheon, I attended with him in October, he explicitly stated that the model appears to work in some periods better than others (i.e., sometimes high employment fuels inflation and other times it doesn’t), which is a funny definition of a “model.” I emphatically disagree with the model and theory behind it, and I have been critical of the belief (implicit in the media and explicit from many policymakers) that a healthy jobs market is hurting the effort to stabilize prices.

But apart from his half-hearted friendliness to the model and my belief that they ought not be setting the price of capital at all, I will say that he appears to at least be willing to be right in practice if not in theory. Unemployment remains low and yet he has enacted what will be a one year pause in rates soon, he has begun tapering quantitative tightening, and I (and the futures market) believe he will be cutting rates by the end of the year. And I say all of this in a backdrop of a very healthy jobs market.

This isn’t a commitment to the Phillips Curve; it is defiance of it.

But hey, do as I do, not as I say. Or, as Nassim Taleb says, “Don’t tell me what you like; show me what is in your portfolio.”

QE, QT, and thee

I want to do a whole Dividend Cafe on quantitative easing someday, but I need to figure out how to do it without making people’s eyes gloss over. It is a wonky subject when discussed accurately, and sometimes I am content to let Danielle DiMartino Booth do the talking here (one of the great Fed commentators, ever). But at a surface level, it is still hard to answer what the Fed hopes to accomplish with quantitative tightening if we did not/do not understand what they hoped to accomplish with quantitative easing.

One could argue that QE was “an extra policy tool when rates were already zero” – or, “how to pile on when your first tool was maxed out.” Therefore, wouldn’t QT be the opposite – an added layer of tightening when the first policy tool is maxed out? Well, not exactly, and that asymmetry between QE and QT is an important part of the present landscape. Rates can always go higher, so tightening with rates is not ever maxed, where rates as a tool for easing financial conditions can hit a max (i.e. zero). But why tighten the balance sheet if rates are only at 5.25% – not exactly an “absurd” level of tightening? Don’t get me wrong, a 5.25% fed funds rate is (a) Tight, (b) Really tight compared to the 0% we have been used to for fifteen years, and (c) Circumstantially tight in an environment of this level of sovereign and corporate indebtedness. But it is by no means the peak of where they could go, or many thought they would go for that matter. So again, why go to QT when policy tool #1 had bandwidth?

This is where I believe QT is different than QE, in that QE was a policy tool to loosen, I think QT was less a policy tool to tighten, and more an effort to “reload the QE gun to use again.” With reverse repos so high (when they began tightening) they had a chance to get significant levels of assets off their balance sheet without really tightening, all the while leaving the balance sheet in a position to “fire again” next time something happens. I don’t have to answer what something is, because an adult lifetime filled with various crises is enough to set the precedent for some future thing.

When that happens, I think the Fed would rather have a balance sheet between $6 and $7 trillion than between $9 and $10 trillion. That is the purpose of QT at the current moment.

Steadily rising baseline

Wait, wasn’t the balance sheet $4.5 trillion after the financial crisis? Yes, yes it was. Why am I using $6-7tn as my guess on their desired baseline versus a lower reset? It is not perfectly scientific, but I do not believe the Fed can get it back there, and I do not believe the Fed believes they can get it back there. I think they are content to do monetary policy around the “good enough” principle, here.

A decade of industrials?

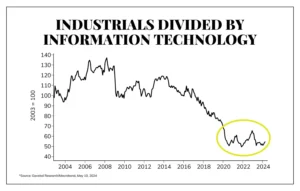

I talk so much about the historical pattern of Growth vs. Value on a decade-by-decade basis, for good reason. Upon seeing this chart in a report I read from Gavekal Research this morning, it occurred to me that another trend may very well be playing out in a similarly cyclical fashion.

The post-tech crash in the first decade of this new century saw Industrials significantly outperform technology. A few years after the financial crisis, that reverted and the decade of FAANG began. That has recently paused, and it occurs to me a mean reversion is very possibly in the cards.

This would require the capex renaissance I frequently reference, and it would presuppose that the U.S. industrials sector could hire enough people to drive growth and innovation. Factory construction and recent onshoring intentions indicate this is a distinct possibility. But more than a prediction, I consider it a “theme to be watched” largely correlated to the state of deglobalization, productivity, and yes, capital investment.

Conventional wisdom

1980’s: All you have to do is invest in Japan, and you will crush it! Japan is on fire and growing into an economic superpower

Stock market in Japan last 30+ years: 0% return

1990’s and 2000’s: China is the new world superpower. They are about to pass the U.S. in economic dominance. They have embraced market reforms. It is time to invest in China.

Stock market in China since 1992: 0% return

Thirty years of economic growth in China, yes. But 0% returns in their market (though in fairness, there was one good decade in between two atrocious decades). Real estate was done well. Economic activity has done well. Deal flow has done well. But public equity pricing has not. Interestingly, the size of their market has grown significantly – it is just from new issuance, not price performance.

There is always more investment work to be done than merely hearing the line, “[such and such] is so hot right now, you can’t lose.” In fact, those last three words are a good reason to run before you do.

OPEC pins and needles

OPEC+ countries voluntarily took 2.2 million barrels per day of production offline in the aftermath of the U.S. release of oil from the strategic petroleum reserve some time back. Has OPEC+ kept prices higher than the lost revenues of lower production volume? Are prices at a level where demand is beginning to suffer? Are some members of OPEC+ cheating the system, leading to a lower view of the benefit of this collective action to begin with?

The next OPEC+ meeting in June may answer all of these questions and more. With $79 oil, I suspect the incentive is very strong to maintain these production quotes through the end of 2024. At $90 oil, I am not so sure. Is OPEC an interventionist, distortive cartel operating outside market mechanisms of price discovery and equilibrium? Well, of course, it is.

But that doesn’t make it smart for us to do the same!

Chart of the Week

There are so many data points from the COVID moment that both stuck and are highly unfortunate (i.e. lower labor participation force, higher budget deficits, greater government transfer payments, etc.). But there is one data point that has stuck which I consider a great positive, and that is the number of new business launches. Business dynamism has been on the decline for quite some time, and something in the COVID moment did launch a surge in new business creation that has not reverted to the mean since the lockdowns and other components of that era subsided. I consider this hugely promising for productivity. Entrepreneurialism drives productivity and innovation, and ultimately, the competition it fosters creates a positive feedback loop with even more productivity and innovation.

Now, one thing people could do (read: cynics) is look at the data and opine that many of these new launches are doomed to fail. And indeed, this is true. The more businesses that launch, the more that will fail, because starting your own business is tough, some things don’t work out, some ideas don’t land, some elements don’t go as planned, etc. But at the risk of ruining the day of those soulless joy-suckers for whom even full glasses are half empty, risk is part of entrepreneurialism, and failure is a stepping stone on the way to success. There is no way to spin the data that greater new business creation is a positive for the U.S. economy. And to move from the macro to the micro, it is a huge positive to those entrepreneurial creators participating in the miracle of a market economy, as well.

Quote of the Week

“You’re not learning anything if you’re not making mistakes.”

~ Charlie Munger

* * *

I do want to wish all of the mothers reading this week’s Dividend Cafe a very Happy Mother’s Day. May your weekends be filled with families and love, and thank you for so, so much.

And with that, I am looking forward to a big trip around the horn in Monday’s Dividend Cafe!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet