Dear Valued Clients and Friends,

I thought I would do something really fun with this week’s Dividend Cafe, but just as soon as I typed that I realized that, like beauty, fun is in the eye of the beholder. But what “fun” thing I was going to do was write a full recap of the recent Mauldin Strategic Investor Conference that took place from May 5 through May 14, and use that recap to capture some of the profoundly important takeaways that I want to share with readers of the Dividend Cafe.

However, for that to be “fun” for me I need to do it thoroughly, and this week was a hysterically insane week here in the California office between projects, portfolio work, client meetings, morning research, DC Today, and all the normal things. I also got inspired by another few things this morning, and so I am going to call an audible and use next week’s Dividend Cafe as my Mauldin SIC recap, and use this week’s for a whole different kind of fun.

I basically do a deeper dive into inflation this week, which is all the rage these days, and for good reason. People are not discussing it because they are stupid; they are discussing it because they are smart. But I think the discussion is too simplistic when it plays out in short sound bites on TV, and I also think the discussion too often lacks the needed nuances for investors that actually make it practical.

Now, I kind of lied. I said that I was saving my Mauldin SIC recap for next week (and I am). But the truth is that some of the things I get into this week are itches that were somewhat scratched at the conference. So consider this a tease into next week, and I promise I will make it all worthwhile next week.

I disagree with a lot of what I heard at the conference. I agreed with a lot more. Anyone who agrees with everything that everyone says is a compass-less fool. But that conference did for me what I earnestly want the Dividend Cafe to do for you every single week – foster thought and consideration.

The conclusions that come out of that? Well, to that end we work.

Necessary but not Sufficient

Anyone who does NOT believe that “inflation is always and everywhere a monetary phenomena” as the late, great Milton Friedman taught us probably does not understand inflation very well. He not only taught us that but he taught us the unimprovable maxim that inflation is “too much money chasing too few goods” (I would add, “and services.”)

But the utterly brilliant economist, Charles Gave, pointed out this week, saying that inflation is always a monetary phenomena is not the same as saying that all monetary phenomena are inflation. In other words, you need excess money creation to get inflation, but it does not assure you will get inflation.

Other ingredients needed for inflation stew?

As I have written time and time again in recent years, it is the velocity of that money that determines its inflationary impact. Changes in the money supply do not, in and of themselves, impact the velocity (Irving Fisher 101). And by velocity we mean the rate at which money is exchanged in the economy.

What causes an increase in velocity is economic activity. If we print money and put it in a bank’s excess reserves just to sit there, it doesn’t generate economic activity (largely the lesson of QE post-financial crisis). It may bid asset prices up, it may exacerbate wealth inequality, it may hold interest rates down, it may lubricate credit markets, but it doesn’t create economic activity that can be lead to velocity, a necessary ingredient in inflation.

However …

But what about printing money and giving it to people? That seems more likely to create economic activity than excess reserves at banks, right? Well yes, it does. And what we have done post-COVID is a combination of the two – more and more bond-buying/QE at the central bank (an action I believe has been proven to have no inflationary impact at all), but also direct government payments to people. $2,000 here (last spring), $600 there (early this year), and $1,400 more (second payment in March). Add those payments to the federal subsidies in unemployment, and now the legitimate question becomes whether or not this represents actual inflationary activity.

Have you added “transitory” to your lexicon?

This is more or less why the word “transitory” (when you hear “cyclical” it is usually interchangeable) has become a household term in this discussion. The Fed and many others believe price increases in this environment will prove to be “transitory” – others (including some very smart economists) believe it will be more long-lasting.

Some Inflation Perspective

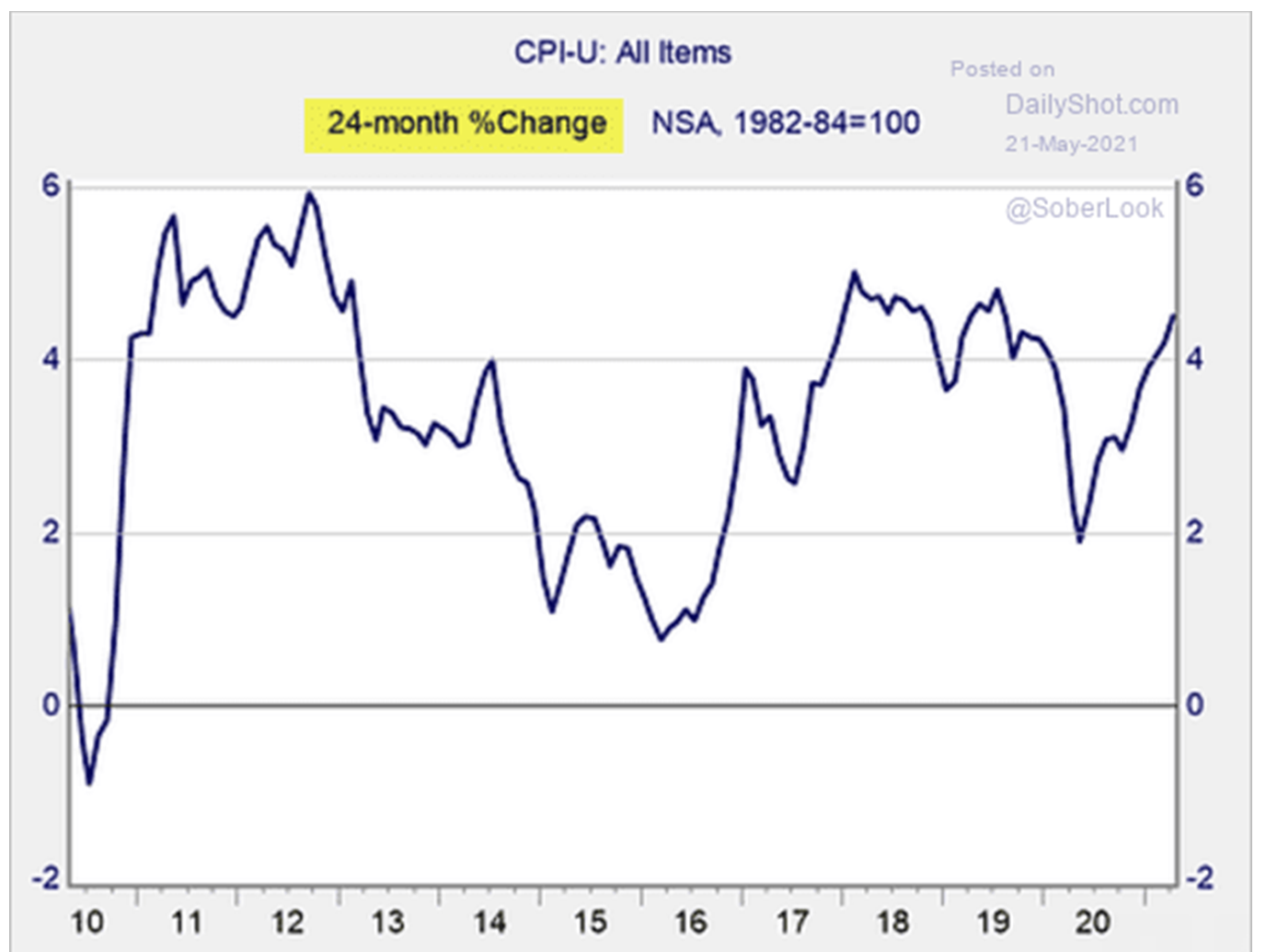

*Bureau of Labor Statistics/Haver Analytics

A 4% move higher in consumer prices in one year sounds severe. A 4% move higher in TWO YEARS (i.e. 2% per year) sounds less severe. I think smoothing for “base effect” considerations and looking at recent history provides a more useful perspective, here.

Note what I did not say or have not said

Pointing out that the two-year average of inflation is more benign than the one-year number is not saying there is not inflation. And saying that there is not going to be secular hyper-inflation is not the same as saying there will not be negative impact of inflation to certain groups in certain environments.

At any level, the purchasing power of money going down relative to prices is inflationary. There is absolutely no doubt in my mind that this is the policy aim of central bankers and politicians.

I do not doubt what they want to do. I doubt what they can do.

Why is it so hard to create inflation?

The fact that central banks have been unable to create the inflation they have wanted is a subject of much debate in economic circles. Whether it be the famous story of Japan, or post-crisis dynamics in both the U.S. and Europe, there is ample debate about why deflation has won out or over inflation in modern times.

Readers of the Dividend Cafe know that my thesis has been (and remains) that the self-reinforcing impact of excessive debt is deflationary. I have written about this at great length, and tried to nuance “multi-factor” realities into the discussion (i.e. demographics, globalization, technology, etc.). But yes, I believe the primary challenge over-indebted developed countries (U.S., Japan, EU) have in their policy goal of creating inflation is the deflationary offsets of excessive debt.

But my friend Louis Gave, son of the aforementioned Charles Gave, has a different thesis, and I find it fascinating. He may or may not believe in the other dynamics I have written on as well, but he introduces another explanation of this generation’s deflationary presence that is quite compelling:

Asia.

What he means, and he is mostly talking about China but it can be applied to much of ex-Japan Asia, is that over two billion people of working age have been added to the global economy in Asia over the last 20-25 years. Here is Gave’s explanation in his own words:

“Such a surge in workers was unprecedented, and to my mind was hugely deflationary. As young men and women left farms and streamed into cities across Asia, governments had to provide a lot of jobs very quickly. This is why China, for the longest time, maintained an 8% GDP growth target, as a rule of thumb suggested such growth would create about 20mn jobs a year, which is what China needed to absorb its new city dwellers.

Asian countries thus adopted a simple model: manipulate your exchange rate to an undervalued level, offer your excess labor to the world at cheap prices, run big trade surpluses, hoard forex reserves, build infrastructure, repress consumption and offer ‘first world infrastructure at third world prices’.

In this way, Asia became the world’s factory floor and, as a byproduct, unleashed serious deflation on Japan, Europe and the US. But concretely, this also meant that roughly 2bn Asian workers subsidized consumption for roughly 500mn Westerners for over a generation.”

This invites more debate to the discussion. We know U.S. debt is not going anywhere, but what if the Asian dynamic begins to reverse – if Asia becomes more consumption-oriented and less of a cheap-producer (exporter of deflation) to the world? What if their currencies rise out of this moment, and capital is drawn into their countries?

Investment impact

I believe that these two things can be true at once – that the U.S. will fight its own deflationary-debt battle even as Asia/China change the global dynamic? Would that suggest a change in fixed income positioning? Would that alter the inflation-deflation scenario in the states? Are there other dynamics not even being discussed yet that could change all of this – productivity catalysts, health care improvements, etc.?

What I am in the middle of doing with my investment committee is exploring where our Asia thesis should lead to alterations in fixed income positioning (if at all). We will not rush it and we want to get it right, but I do believe these decade-long realities are more important than the daily, monthly, and quarterly obsessions around retail sales and stimulus checks and lumber prices.

Spending impact

One of the things that frustrates me most about the inflation debate is that we seem to frame the conversation around the least practical elements possible. I can think of nothing weirder than talking about CPI and lumber when health insurance premiums are going higher. Everyone pays health insurance premiums, every year. One or two quarters of lumber prices are clearly more limited in their impact both in duration and audience size.

I am a published “deflationista” – meaning, I believe the dominant secular theme in the American economy right now are the deflationary forces that excessive indebtedness have unleased. And yet if I wanted to talk about the clear and present negatives in inflation, the focus would be in health care, higher education, and housing costs.

Where this matters MOST

See, no one on either side of the inflation/deflation debate in macroeconomics can deny that the cost of renting or owning a home is going higher. I’ll stay away from the health care and college tuition part of this for our purposes here (for now), but in all three cases – higher education, housing, and health care – we have had undeniable price increases. And in all three cases, I would argue, “monetary inflation” has had nothing to do with it.

Of these three categories, I have had the most to say about housing. The housing crisis and the cultural causation and ramification around it was the inspiration for my first book, and remains a passion for me to this day. I believe our national and cultural view of housing is broken, and at the same time believe it is not an inflationary story, whatsoever.

Coming full circle

We started off the commentary this week by saying that not all money supply increase is inflationary but all inflation starts with a money supply increase.

I would add that all monetary inflation increase hits the “stuff that matters” but not all impact to the stuff that matters is monetary inflation.

This will be the stuff we unpack for a long time to come.

Transitory transfer payments

So right now, day by day, the newspaper articles, TV segments, and web entries you see or read are going to be filled with comments about the inflation dynamic that will very likely fail to get to the heart of the matter. They obviously won’t talk about 25 years of Asia exporting its deflation. They won’t talk about debt-deflationary feedback loops. They won’t talk about “practical considerations” in housing, college, and health care (and the non-monetary policy and cultural blunders that matter). The commentary is mostly limited to short-term political jabs or sound bites that are almost always wrong, and even sometimes accidentally right, totally unhelpful in creating investor application.

My suggestion to you? Consider this a “cheat sheet” in how to think about this debate:

(1) “Printed money” that sits atop bank reserves is not inflationary (QE, etc.)

(2) “Printed money” that circulates and creates loan demand is inflationary.

(3) The transfer payments of the last three spending bills have an undeniable marginal impact to inflation.

(4) Therefore, in determining the “transitory” nature of inflation, it will come down to how “transitory” those payments prove to be.

I remain in the “transitory” camp on both fronts.

And finally …

I got the CEO of Strategas Research to tell me this week (we will have the podcast for you soon) that IF the ten-year bond yield is less than 3% in one year (and has stayed there all along), then he will admit the inflation predictions were wrong. This is my conclusion on the matter from an investment standpoint: The bond market is the judge and jury. The “deflationistas” of the last generation were only right in their portfolio to the extent they rode long-bond yields down the whole way (and saw generational returns for the ages in their bond portfolio).

I do believe that bond yields will stay low for all the reasons I have outlined. Investors care about the inflation/deflation debate for this reason (it impacts the cost and value of money which impacts the value of assets). I am determined to focus the conversation around such practicalities, and hope you will benefit from these attempts.

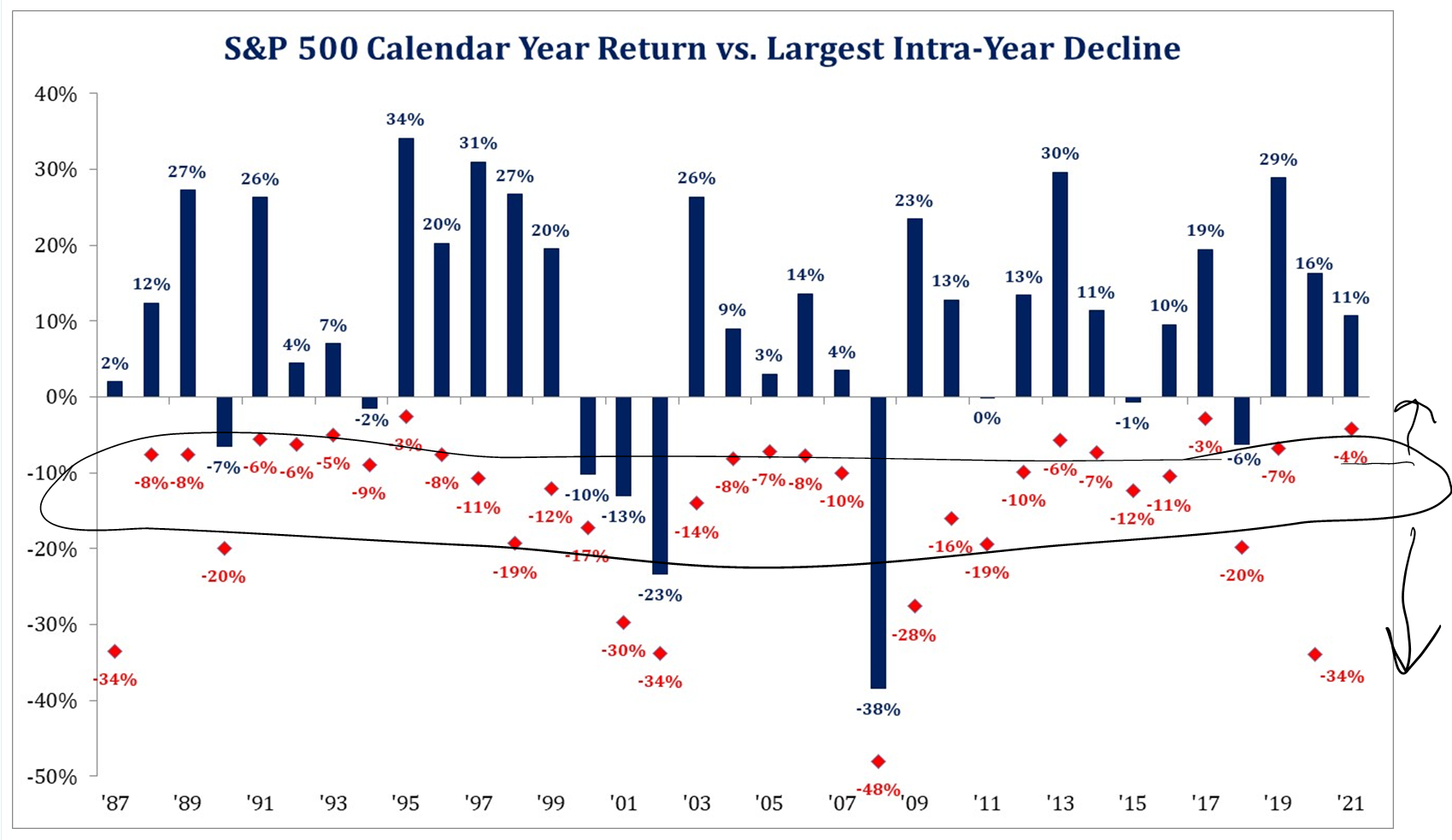

Chart of the Week

I think this chart (I believe it was JP Morgan that kind of made it famous in our world a while back) will always be legendary for what it captures and says about markets. You see a lot of “big years” up in the market over this generational period. You see a few down years, a couple of which are big. You see “flattish” years here and there. All of those “annual returns” are the blue bars.

But then the red diamonds below represent the intra-year move lower along the way to the blue bar final return. And yes, there are some (not many) years above my circle, where the drawdown was small. And there are some (not many) years below my circle where the drawdown was more substantial. But that range of roughly 8-15% “intra-year decline” is basically almost every single year.

And therefore when people are asking about the possibility of a correction this year, it strikes me as more informed to just let history answer rather than one’s flawed view of current events.

*Strategas Research, Daily Macro Brief, May 21, 2021

Quote of the Week

“Never ask anyone for their opinion, forecast, or recommendation. Just ask them what they have—or don’t have—in their portfolio.”

~ Nassim Taleb

* * *

It’s a lot to chew on this week, but there’s a lot that goes into this topic. I am excited for next week’s recap, and even if you don’t care about the conference, I do believe you will find the discussion around some of the takeaways very provocative.

I am jumping on a plane now from LA to NY and am excited for what next week holds. Enjoy your weekends, reach out with any questions, and thank God for dividends this weekend. In dividend growth equities, so much insulation exists against this obnoxious debate.

I was on Varney/Fox Business yesterday talking about the case for dividend growth.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet