Dear Valued Clients and Friends,

Last week in New York City as part of our annual slew of meetings, Brian, Kenny, and I heard a multi-billionaire money manager who we have looked up to for many years say:

“AI is a revolution. And when something is revolution you don’t ask questions, you back up the truck and just buy. I can see some things going up 10x from here, with $8-10 trillion valuations a norm.”

The next day, we heard another money manager (also a billionaire, and also a genius) say:

“This entire AI setup is extremely concerning; we are certain we have seen this movie before, and we are going to do whatever we can to avoid the carnage that is coming.”

On a daily basis I get asked questions that are not so much in the vein of, “is AI going to go up 10x in the next two years?” but more like, “with AI and these hyper-scalers going up so much is it time to put dividend growth on the sideline for a few months, and come back in after we have enjoyed the spoils of this revolution for a while?”

The question is often worded differently, but some version of that question is posed to me multiple times every day. For everyone who knows my fondness of Matthew 7:24-27 they likely know what my answer is to that question at a high level. But there is something extremely fair about the question, and I intend to unpack it all in this very important edition of the Dividend Cafe.

I want to offer a few possibilities that hopefully are more intelligent than the approach of “backing up the truck and just buying without asking questions.” I want to apply the AI moment to the realm of dividend growth investing. I will answer the question, “Is it sometimes okay to abandon your investment philosophy when a hot opportunity appears to be knocking?” And I will use history to help guide us to a place of thoughtful perspective on all of these issues.

It is a Dividend Cafe I have been excited to write for some time, and a message that is desperately needed at this time. And truth be told, there is, all at once, a “current event” message today about the reality of AI and the circularity investment currently playing out, but also a deeper and more evergreen lesson that ought to be understood by all investors. If I do my job right this week, you might actually see me conclude all of this with some more Bible verses. I am not trying to proselytize, but it just so happens that where we are going today has some ancient grounding. And I didn’t need AI to teach me these lessons.

Let’s jump into the Dividend Cafe …

|

Subscribe on |

The Punch Bowl

Investors have had little reason to think about the thesis behind the AI story. The basic story for:

- Those who design and sell semiconductor chips related to Artificial Intelligence applications

- Those who purchase these chips, computing systems, and infrastructure related to AI (hyper-scalers)

- And even those who just casually mention AI in some adjacent manner to their business have seen stock prices jump exponentially.

Not every company in the three categories above is created equal, and not all have achieved equal results, but there are ample stories within those three categories that have become a new mania for investors. Like all manias, there is plenty of legitimacy behind a part of the story, and there are some holes that warrant caution. But “caution schmaution” is perhaps another way of saying what the aforementioned money manager hinted to us last week … What investor has, thus far, regretted buying with both hands (the A, B, or C scenarios above)? Surely some investors feel a tinge of regret if they have exercised caution. Few investors feel regret if they have not.

Clarity Please

There has been more and more talk lately about the so-called “circularity problem” in this AI investible thesis. I have been focused on it for quite some time, sometimes to the point of amusement, but it does seem to me there is increasing awareness of it as time goes by. Put as succinctly as I can, the lion’s share of investor gains so far have come about as some companies sell the powering ability of AI to customers called hyper-scalers, and the stock of hyper-scalers has gone up because of their large purchases of AI computing power. So, in one easy summary, some companies are going up because they are selling AI computing power to customers, and the customers are going up because they are buying AI computing power from sellers. Well, this is not necessarily a problem, but it does allow us to ask a few questions.

George Soros, despite all the political controversy that has followed him for the latter decades of his life, famously postulated a brilliant investment theory many, many years ago. Known as the reflexivity theory, he essentially taught us that markets are often driven by perception of reality more than objective reality, and that investor perception is material to fundamentals, creating a self-reinforcing cycle where perceptions influence prices, prices impact fundamentals, and then those affected fundamentals shape perceptions – rinse and repeat. The further this process strays from equilibrium, the greater the distortion, and the more susceptible markets become to booms and busts. One does not need to be a fan of George Soros’ politics (I am not) to understand the undebatable brilliance of his reflexivity theory. Note that what he is not saying is merely that “people’s perceptions can be wrong and that can lead to a bad outcome.” That sort of goes without saying. What he is saying is that out of those misperceptions, the cycle of a distorted impact on prices leading to changing fundamentals, leading to new perceptions, leading to a feedback loop of distortion is, itself, a fundamental development. It does not mean that objective reality gets changed midstream; it means that the course correction on our way to rediscovering objective reality can be skewed, elongated, and complicated by this cycle itself.

The circularity in the AI thesis is that the hope and promise of a new technology has understandably led to higher valuations, and those higher valuations have attracted more capital all chasing this hope and promise (this revolution), and then that higher level of capital and subsequent elevated valuations have become the proof of the thing the capital is, itself, supposed to be pursuing: Genuine gains in productivity and profit. There is no need for this new technology to be monetized when it is already monetized by everyone believing it is going to be monetized. And my friends, this is, structurally, one of the most dangerous things I have ever seen in my adult lifetime (besides the fact that I have already seen it a couple of times).

The following quote from the chair of the Investment Strategy Group at JP Morgan has made its way around the internet and social media, and it is worth us looking at for the granularity it gets into:

“Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google. In other words, the tech capital cycle may be about to change.”

~ Michael Cembalest, JP Morgan

None of this is to cast aspersions on the investment thesis of Oracle, OpenAI, Nvidia, or any company involved in some of this AI buying and selling from each other. It all may prove every bit as profitable for all the companies involved in the end. But it is still worth pointing out exactly what investors are falling in love with: a company whose stock price is rising because another company, whose stock price also rose, has promised to order products from it to develop capabilities that other companies, whose stock prices have gone higher, will use. One can believe, or hope, that it will all work out just fine. It very well might. But I do think people should understand exactly what we are talking about thus far.

As more deals get announced with companies like OpenAI, Nvidia, Oracle, and surely other players to be named as time goes by, the structure is undeniably circular. A company like OpenAI (the maker of ChatGPT) was given a $500 billion valuation in its most recent funding round. They have committed to buying $300 billion of computing power from Oracle. Oracle has committed to buying tens of billions of dollars of chips from Nvidia. As you can imagine, Oracle’s stock went up because OpenAI promised them a big order; Nvidia’s stock went up because Oracle promised them a big order; and how does OpenAI pay for this big order from Oracle?

Oh, with a $100 billion investment from Nvidia, of course.

OpenAI has made similar deals lately with AMD and Broadcom. What has never been provided is any estimate of ROI (return on investment) on this massive capex. The ROI has been irrelevant to investors. The valuations and asset prices of all the actors in these three-way transactions have increased, providing apparent validation of the value creation and incentivizing investors to look for the next comparable deal. Checks are getting written. Checks are getting deposited. Money is being spent. Stock prices are flying. But the fundamental, underlying, deep down fundamental question: What is the value creation from the actual underlying product? How do the “big AI capex customers” monetize the massive amount of money they are spending?

These seem like fair questions.

Pouring Water on the Bearish Thesis

If you expect me to say there is no answer to that question, or that the eventual answer will inevitably disappoint investors, you are in for a surprise. I am 100% open to the idea that there will be a path to monetization for those who ultimately have hundreds of billions of dollars at risk (in aggregate, trillions). What I am not open to is the idea that anyone knows the answer to that question now. They do not know the “if”, or the “how”, or the “when.” That is very different than saying “all this AI capex will prove to be a boondoggle that sets trillions of dollars on fire.” I think that is a worst-case outcome, but not at all a base-case outcome.

Where Does it Go from Here?

I cannot answer where it will go from here, but I can answer where it needs to go from here. There simply has to be revenues in the AI story that are coming from people using AI in their everyday life (a normal business outside the technology sector, for example). Tech companies can buy AI products because they are making them available to other companies to use in the real world. If the entirety of revenue and capital flow in this space stays in this incestuous circle, we have a really big problem on our hands.

But David, you say, of course it will, eventually. And I don’t actually disagree (see above). But will the movement from a circular flow of spending inside an AI ecosystem to a market-based application of real productivity and use come with the ROI’s that are assumed in the present AI capex spending levels? Do you know the answer? Does Mark Zuckerberg? Does anyone? How could they? There is a level of speculation in all of this that is deeply concerning. Why would so many people bet the moon on something so speculative unless there was a really good chance that it was all going to pan out?

George Soros already answered that question for us. The assertions of a “really good chance” are captured in price action. The price action is a by-product of perceptions that are not based on fundamentals. And the reflexivity theory is off and running. We alter reality not to fundamentals but to the perceptions that have skewed our reading of fundamentals, and the prices that follow seemingly validate our decision to do so. Until they don’t.

I believe there are thousands of possible outcomes, sub-outcomes, and divisible scenarios of where all this could play out. But to avoid this becoming a 100,000-word edition of the Dividend Cafe, I will suggest three basic categories of outcome that one can use to compartmentalize from here.

- The “Revolution euphoria” outcome – here, every bit of the most desirable outcomes materialize, and outlandish valuations become real valuations, and we spend the next ten years blown away at how much all of this AI capex story was monetized. In this scenario, many unknowns and risks become known payoffs. Risk-takers are rewarded without consequence.

- The “Doomsday panic” outcome – here, the AI story ends like the Metaverse, only with more zeroes and commas attached to the price tag. The whole thing fails to materialize, the self-reinforcing nature of the circularity problem reverses direction, and the basis for stock appreciation in hyper-scalers and computing providers becomes a basis for an indiscriminate crash.

- The “Nuanced reality” outcome – here, there are winners, there are losers, and there are lots and lots of unexpected developments along the way. Those who closed their eyes and bought without diligence are punished. Those who stayed away entirely are regretful. But some form of end-user monetization materializes, rationalizing some capex, mocking other capex, and taking years to parse out the winners and losers. If you want, you could call this the “internet” outcome, or the “history repeats” outcome, or the “natural order of things” outcome. But “nuanced reality” sounds really sophisticated, so we can go with that.

Pouring Water on #1

I don’t do predictions. It is not what clients pay me for. I do risk-reward trade-offs and calculations. What I will say is that the least likely of the above scenarios is #1. One of the best markers for something ending badly is when really smart people who ought to know better start saying things like “revolutions mean you throw out all the rules of investing.” That is classic “near the top” language that usually means a lot of people are about to get their faces ripped off.

We are talking about a business sector currently doing an aggregate of $50 billion in annual revenue, needing $2 trillion (low-end estimates) of revenue in five years to justify current capex. Is the AI customer revenue base about to exceed the combined total gross revenues of the six largest companies in the world?

The far more likely outcome than scenario #1 is that significant over-investment occurs, leading to significant over-valuation, resulting in the standard Misesian cyclical reality: A boom that is solved by a bust, where malinvestment has to be corrected, purged, liquidated, adjusted, and re-allocated.

Investing for #3

I cannot justify investing client capital on rank speculation. I do not consider the entire AI story rank speculation. I have never said such. I consider the part of the story that is purely a play on that circularity thesis to be rank speculation, or else an exercise in greater fool theory (“I know this whole thing is vulnerable, but I can ride it up until the other dummies figure out the jig is up and by then I will have exited profitably.”) Fire TBG if we ever dare.

I believe the story of artificial intelligence leading to greater efficiencies in the delivery of goods and services that meet human needs and wants is highly investible. There is no investible thesis here if that does not materialize. Almost all sensible companies are looking for ways to use artificial intelligence to enhance their business right now. Some have a lot of capital at risk to do this, some have a little, and some do not need any at all. But it is prudent to look for paths to enhanced productivity without being caught on the wrong side of the reflexivity trade. We can do this right.

But in the Meantime?

What if some of these AI hyper scalers trading at 38x, 53x, 241x, 68x, and 29x earnings keep going higher? What if some of these chip designers trading at 84x, 125x, and 58x earnings keep going higher?

You have come to the wrong place if you are looking for someone who holds history in such contempt that they are willing to play this again and yet expect a different outcome.

Can it all go higher, much higher, before some form of market normalization? Sure. In fact, blow-off tops are the rule, not the exception. Is this all setting up in a way that seems quite problematic, given the lessons of history and the basic economic fundamentals at play? It is. Will there be a “reversion to the mean” of sanity on the other side that drives efficiency and productivity and is done in the context of real price signals and fundamentals? I promise you – there always is.

And in the meantime, there is what we do. Before, during, and after the ebb and flow of market manias, fads, and eras, there is dividend growth. Some companies that get over-valued. Some companies lag for a prolonged period. There are companies whose fundamentals are extremely challenged. And some companies execute so well that they outperform their own expectations. I can give examples of each of those categories from our own dividend portfolio, right now! But what there fundamentally is in the portfolio is a company-diversified and sector-diversified strategy that is rooted in the real, in the actual, in the cash flows, which are the very nature of things (when it comes to investing). Dividend growth will have quarters where it lags. It will have years where it trounces everything else. And it is no different than any good investment in that regard: It finds itself in favor and out of favor at different times.

And yet, the feature is not a bug: that feature is a consistency, a fundamental strength, a recurring de-risking reward, and a mechanical reinvestment that drives an entirely different outcome over time. And if people are asking me to substitute those things “just for a little bit” while “this AI thing runs a bit longer,” they are asking me to abandon the very features of investing that have been so handsomely rewarded for decades.

In the meantime, we will do what we have committed to doing: invest with integrity, humility, conviction, and intellectual rigor, attached to the lessons of history, and the basic principles of what public market investing is supposed to be.

Conclusion

Our investment philosophy, practiced for over twenty years and shaped by a deep analysis of a century of market history, guides everything we do. We feel it to be a grotesque violation of our fiduciary duty to be blown around in the wind by cyclical moments of whatever they may be.

In the introduction of this Dividend Cafe, I made reference to the Bible verse that talks about a “solid foundation” versus one of “sand.” It seems appropriate in today’s context to point out that no investor wants to invest “like a wave of the sea tossed and driven by the wind (James 1:8).” I want readers of the Dividend Cafe, and certainly clients of The Bahnsen Group, to never be led astray by “a double-minded man, unstable in all his ways (James 1:8).” There will always be “waterless springs and mists driven by a storm (2 Peter 2:17).”

Investing is not a popularity contest. It is not chasing what just got done doing well. And it is not a contest to “beat” someone else. It is a series of decisions that involve risks and rewards in achieving goals and objectives.

To that end, we work, my friends. Forever.

Chart of the Week

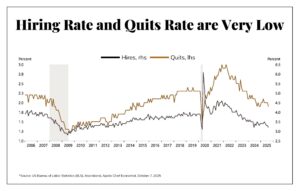

On an unrelated note to today’s Dividend Cafe, let’s not lose track of the biggest tension in the economy right now … People are not quitting jobs, they are not really getting fired, yet they are not really getting hired, either. The jobs market is in a temporary freeze, and that “freeze” is not likely to continue. Either hirings or firings pick up, eventually.

Quote of the Week

“Sell them hope, and you won’t have to worry about selling them goods.”

~ Charles Revson

* * *

As I was writing this morning’s Dividend Cafe, we had a +200-point market rally turn into a 600-point market drop (as of press time) as the first “relapse” of trade war talk took place in some time. A China flex around rare earth minerals was met with a Truth Social flex from President Trump, re-broadcasting the tariff retaliation card. The truth is that if markets really, really, really thought we were going back to pandemonium with China, a 500-point market drop would be child’s play, but it was enough to remind a few people that a lot of things in the market are hanging on by a thread.

Some carbonated beverage companies, biotech firms, telecom carriers, medical device makers, and cheeseburger real estate plays all shrugged it off.

Go Trojans. Fight on, and Beat the Wolverines!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet