Dear Valued Clients and Friends,

The predominant belief since President Trump was inaugurated in early 2017 was that he was unpredictable, unconventional, controversial, and unorthodox – he was polarizing, interesting, and historical – and he commanded extreme emotions on both sides: those who loved him really loved him, and those who hated him really hated him. That dynamic did not change when Trump 2.0 effected one of the most stunning political comebacks in history to win the 2024 Presidential election. But through all of the political divisiveness, negatives, positives, and whatever anyone else might want to say about him (good and/or bad), the market assumption has always been that, underneath it all, he has a fundamental belief in markets, in deregulation, in eliminating impediments to economic growth, and in gauging himself off of metrics like GDP, the stock market, and real wages.

In today’s Dividend Cafe, we are going to evaluate if (a) markets are giving up on that underlying assumption and (b) if so, should markets give up on that assumption.

I will spend very little time assessing my own views of President Trump as President, and really not a lot of time on my views of his particular policies right now (though some of this is simply unavoidable). What today’s Dividend Cafe is doing is different – it is seeking to ask the question, “Does Trump care about financial markets?” And if the answer to that question is yes, we further have to ask, “Does that matter anymore?”

The topic matters a great deal now. It is highly unlikely that I can cover all of this in a way that doesn’t get me some hate mail. But as has been the case so often for nearly a decade now, one letter saying I am too nice to Trump and one letter saying I am too hard on Trump equals zero letters, so it all washes in the end. =)

But this is not a political commentary today, even if it has to be, by necessity, at times, politically adjacent. It is a market commentary evaluating where we stand in markets with the Trump 2.0 administration. The question before us is whether or not President Donald J. Trump still cares about financial markets. That answer and more, in today’s Dividend Cafe…

|

Subscribe on |

Changing of the Guard

Let me first say that the President’s interest in using the stock market as a report card for his Presidency was not a theory of mine, it was not conjecture, it was not speculation – it was a fact. Both from the public record and private sources of mine, I can say with certainty that he, himself, has used the market as a reinforcement of his own Presidency many, many times and privately appealed to market success as a validator of his record in numerous contexts. We are not debating the historicity of this – check the tape. We are now questioning if the facts have changed.

But before we get into the mind-reading of whether or not the President “still cares about markets,” let’s analyze why we are even having this conversation.

The Sequence Matters

Would markets be responding negatively to the uncertainty of tariffs and threats of a global trade war if this were the second year of his Presidency, and in the first year the 2017 tax cuts were made permanent, the corporate tax rate had been reduced to 15%, the deficit had been sensibly reduced by $500 billion, and a year’s worth of deregulatory efforts had been executed? Well, sure, it’s possible – but would it even be the same stratosphere of concern? No way. And there are two reasons for this, one of which is vastly underrated. First, there would simply be the reality of the good news. It would be priced in and known. But second, and this is the underrated part, Markets would know that the economic worldview of the President still reflected, understood, and appreciated the pro-growth, supply-side tenets that markets rightly believe are vital to economic prosperity. Please note: I am not saying he does not; I am saying that this sequence of activity has caused markets to have to wonder.

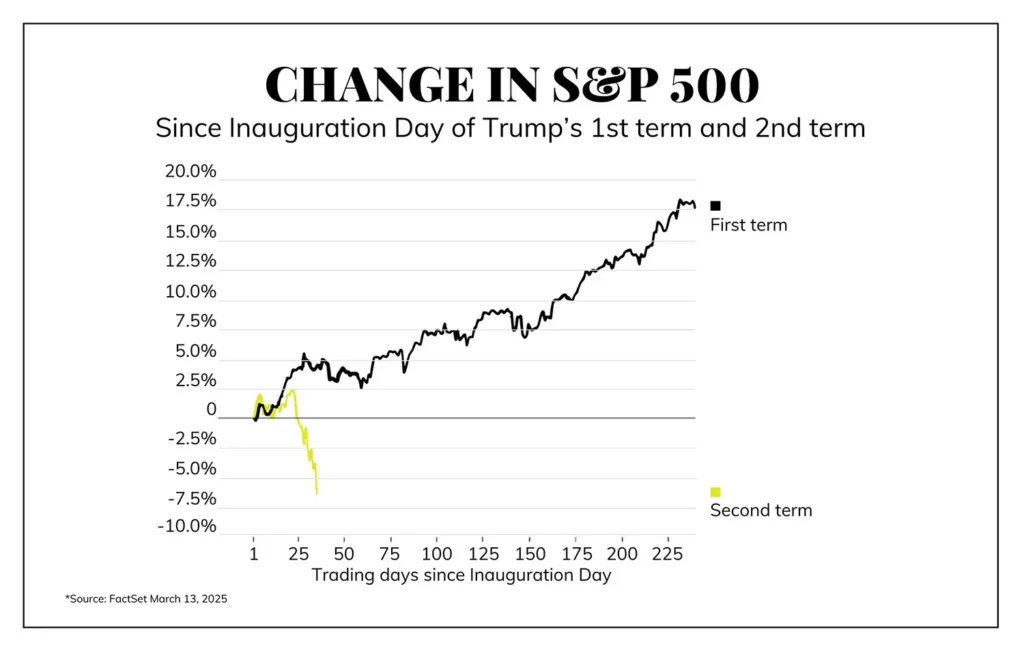

In 2017, the deregulation and tax reform efforts gave the administration a significant amount of house money to play with going into 2018. And yes, there was trade war volatility in 2018, but honest brokers will remember that it was happening while the Fed was significantly tightening monetary policy for the first time in over a decade. But this is the bigger deal: whatever downside volatility markets did see in 2018, it was never close to cutting into the upside gains of 2017…

The sequence matters, for political capital, for real capital, and for narratives.

But also for signaling a philosophy and belief system to markets. And in 2017, the markets had uninterrupted confidence that while the style was chaotic, the messaging sporadic, and some agenda items unconventional, the underlying ethos was pro-growth and essentially market-friendly. So in 2018, the trade endeavors had to be priced in, and over time, were seen more and more as negotiation (and I will add, filled with carve-outs and exceptions meant over and over again to dampen their impact) – and not a threat of a full-blown trade war. Some silly tweets and threats made their way to the airwaves, but for the most part, the 2017 actions provided context for more difficult things in 2018.

The exact opposite is what markets are responding to now. Aggressive flooding of the zone with tariff incoherence, inconsistency, and, in some cases, outright bizarro land have been the predominant economic messaging of the last few weeks, even as things like tax reform have rarely been discussed (though they have some), and the big picture priority of the supply side agenda has been largely outsourced to obscure congressional tactics.

Now, let me be very, very clear. I am 100% certain that President Trump and Secretary Bessent still believe in their tax reform agenda, and I know for sure that they have worked behind the scenes to aid that effort with Congress. I am referring, though, to the fact that (a) The attention and priority between that issue and tariffs/trade has been overwhelmingly skewed, and (b) There was not a measurable and legislative victory in the former before attention was moved to the latter. That sequencing is the source of significant turmoil.

Brass Tax

As of this writing, the S&P 500 is down -10% from its high less than four weeks ago, the Nasdaq is down -15% and the Dow is down -9% … As I have written about countless times over the last 25 years and will write countless times the next 25 years, drawdowns of 8%, 10%, etc. are the rule, not the exception. They happen, on average, every single year. So why am I writing about the impact of tariffs on markets and what it all means for the President’s demeanor about markets if so far it is just “par for the course”?

Because the topic is not the 8-10% adjustment we have seen, but the mentality, thinking, activities, and ramifications around the why of what we have seen, thus far.

Does the administration really believe “a 10% correction is just a short-term pain to get a long-term gain of recaptured American manufacturing?” Because if they really believed that, I promise you, 10% is the early innings of drawdown.

Does the administration want to believe that, but at some other pain point (20%?), pivot yet again to a less cavalier approach?

Does the administration not believe it at all but has to say it as they figure out where things are going?

And here’s the real million-dollar question: Does the administration itself not know what it believes, expects, or is after, and markets left to themselves to adjust as the administration itself moves along in its thinking and objectives?

I believe there is a lot more of that latter point involved than some want to admit, but I also believe there is a “we can take some market pain” mentality, which gets reversed by a threshold crossing whereby a course reversal becomes necessary. But here’s the thing.

One of These Puts is not Like the Other

The Federal Reserve under Alan Greenspan explicitly acknowledged something called the “wealth effect,” where they believed there were downside pain points at which impact to risk assets impacted consumer spending (and so forth). Greenspan developed what became known as the Greenspan put because he had a controversial, but somewhat intellectually defensible (at least prima facie) view of risk assets mattering to his objectives around employment and prices. I believe it is wrong-headed and misguided, but I can define it and explain it, even if I do not agree with it.

There has been a Trump put in markets, too, but it is not the same as the Greenspan put. Trump has not felt he needed to backstop financial markets because he felt the market performance was inter-connected to jobs, investment, wages, and other economic data. The Trump put has essentially been, for right or for wrong, a belief that his own assessment of how it reflects on him would cause him to reverse to a market-friendly posture. It has played out time and time and time again.

Small Business Pivots Quickly, too

I am old enough to remember when a big theme in the Dividend Cafe was the surge in small business optimism as a result of President Trump’s election … That was, ummmm, three months ago (Dec. 13, 2024, to be precise). I specifically said this all of ninety days ago:

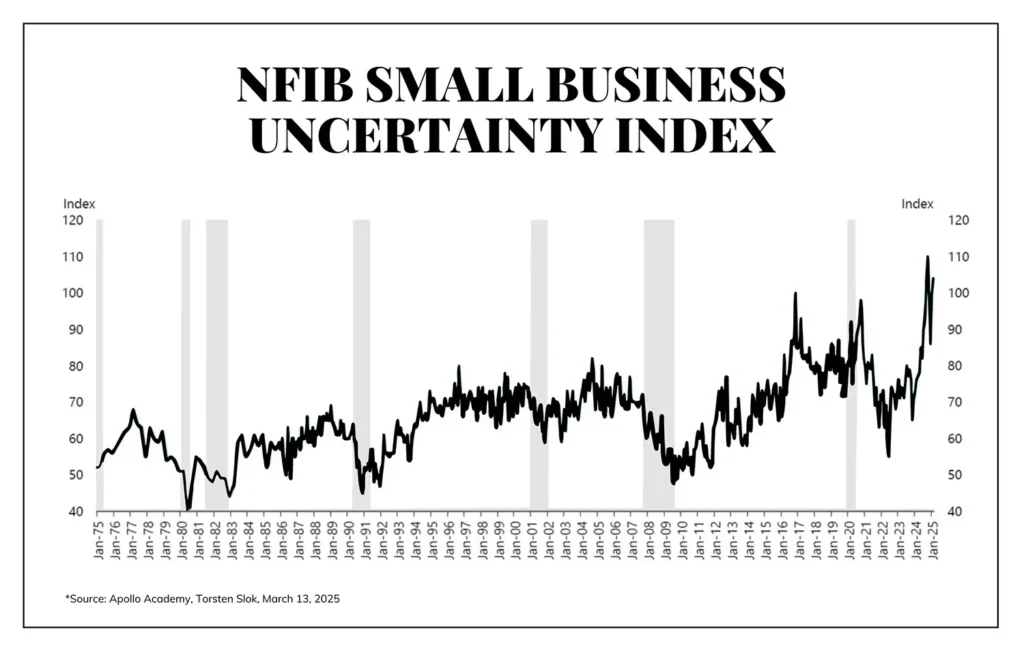

“It doesn’t take a lot of detective work to notice one of the big trends when President Trump was elected President – both in 2016 and now again in 2024: Small Business optimism skyrockets (well, I guess this is a trend if you view two out of two times as a trend. All nine components of the index were positive, uncertainty declined by a stunning 12 points, and some form of optimism around anticipated tax and deregulatory activity is clearly palpable.”

I provided this chart:

But I also offered this caveat:

“Now, that said, this is just that – optimism. It is not, yet, activity. Could disappointment overtake optimism? Could other factors overpower optimism around tax reform and deregulation? Is the Fed likely to be a factor in all this? I am not trying to rain on any parade here, but I think it is worth making two true statements at once: There is a general and meaningful optimism in the small business community right now that reflects a surge of planned investment, hiring, expenditures, and more – and at the same time, the need is still there for that optimism to translate into activity.”

And here is where we are now – the highest small business uncertainty, ever.

Now, note the bait-and-switch I did there … I moved from a high Optimism index, to now a high Uncertainty index … they are not measuring the exact same thing. Uncertainty does not mean Pessimism – but it is correlated. A lower uncertainty facilitates the possibility of optimism. Of course, one can have a high certainty about really bad things, and that would not necessarily facilitate optimism (think: UCLA football – sorry, I am just having fun). But in this case, there is simply no question that “uncertainty’ undermines optimism and, in a lot of ways, does so in a worse way than mere “bad news” does.

Bigger is not More Important

Investors are concerned about risk assets because investors own risk assets are the mark-to-market values of their portfolio are impacted by the up and down movements of things like the stock market. But in the context of the so-called “real economy” (a silly term I use just for simplicity trying to separate wages and jobs and GDP growth from large cap public company stock performance), there are 28 million people employed by Fortune 500 companies, which means there are 131 million people not employed by Fortune 500 companies. Small business decision-making matters a lot.

I believe corporate CEOs are watching the news and meeting with their team to curtail orders, slow decisions, and pause projects, and I think it is a big deal. We know what it has done to market appetite and valuations of risk assets. And I don’t minimize the relevance of all this – it is a big deal. But I would suggest that the uncertainty in NFIB is a bigger data point. What small business making widgets right now, sensing a 25-50% increase in the cost of certain goods they need to import, is going to proceed with that order, or the same order, or the project they were thinking about taking on to increase capacity for even bigger future orders? Don’t ignore that last piece – remember Bastiat’s law – we have to measure economic impact by the seen, and the unseen.

Focusing on Bad News and Missing the Worst News

The idea that the worst thing about “tariff uncertainty” is what it does to “delay consumer purchases” is maybe the saddest commentary one will get from the laughable Keynesian world. Are there people out there not planning a vacation or buying a washing machine because of tariffs? Sure, I suppose so. But how in the world that can trump the far bigger reality is beyond me. That reality? Business decisions to invest in productive activities, from hiring to capital expenditures.

I promise you that no consumer is ever, ever, ever going to consume something that hasn’t been produced. When you put downward pressure on the supply side of the economy, you can expect the demand side to follow suit (I’ll give you a minute to think this through). The driver of economic activity is, always and forever, production. Producing goods and services drives economic growth and raises our standard of living. Our natural human condition is to want vacations and consumer goods, and incentives are not needed to satisfy our appetites. But you know what is needed to satisfy our appetites? Produced goods and services that satisfy our appetites!!!!

The economic loop playing out right now is an enhanced sense of skepticism about the priority, probability, and magnitude of tax cuts, with enhanced concern about tariffs, diminished trade, and increased impediments to exchange. Lower the tariff threat – see risks diffuse. Increase tax cut clarity and direction – see risks diffuse. There is an X and Y axis here, and the two factors at play can both go the wrong way (no tax cuts, high tariffs), but they can both go the right way (high clarity and magnitude around tax cuts, less tariff threat), or they can get pulled in separate directions. But what is most on the line economically about the results of those two respective policy considerations is not who will go to the mall – it is the productive business activity that creates prosperity in a market economy.

More than Tariffs

I do not have the time or space (or emotional energy) to address things like Secretary Lutnick proposing “five million government-guaranteed jobs at $125,000 apiece” – or a variety of other policy suggestions that invite a command-control economic bias that might make Soviet nostalgia blush. I believe, as I have documented already, there is more than a little ambiguity as to what the intentions are at this moment regarding tariffs, and that trade and tariff ambiguity leads to greater worry that some of these absurdities might be serious.

Political Refresher

Promising a recession will not come, then having one come kills Presidencies. Asking for tolerance of short-term pain and then having that pain actually come kills Presidencies. Underwater approval ratings kill Presidencies (and empower legislators to abandon party consensus to save their own seats before midterms). Every Presidency of my lifetime has had difficult periods and recovery periods, and someone writing a moratorium on this Presidency now is being amateurish.

And yet, there was never anywhere near the political capital some wanted to believe there is. The pain of a not-thought-through re-ordering of international trade is far more pain than markets, or the American voter, will stomach. Off-ramps have to surface, and history tells me they will. My patriotic aspirations tell me they will. But I understand if, for some, fear tells them they will not. As long as they do not act on that fear.

Conclusion

I do not believe the verdict is in on the “Trump put”… a ~10% drawdown is not enough to create clarity. There is a point where more clarity will come. If the administration re-focuses before that point, we will never know what the point is. By “re-focus,” I mean the re-prioritization of a supply-side agenda and an off-ramp to a dangerous and counter-productive protectionism that is not going to protect anyone, least of all the people it is intended to protect. But assuming no reversal comes before “that point,” – the question is what will happen when that point comes (for the sake of argument, let’s assume it is a down 20% bear market in the S&P 500 and entry into a recession … Would those events re-focus the President to the economic priorities of his first term, or do we really believe that: (a) He no longer cares about these perceptions, and (b) That economic and market legacy and reputation would not, ummmm, create a chastening effect?

Investors face pickles of uncertainty all the time, and it is one of the reasons markets possess “risk premia” – a superior return over time for the enhanced volatility we endure along the way. I am staunchly critical of what I have seen from this administration over the last few weeks. I am genuinely optimistic that better angels will prevail. And I am completely confident that more unknowables lie ahead. To be totally honest with you, none of this is that new (uncertainty, unpredictability, chaos at the nexus of policy and markets). What is a little new, though, is a President who seems to like it so much.

Chart of the Week

This could happen for any number of reasons outside the realm of policy, and Presidential action. And even though I believe, in this case, both lines were predominantly a by-product of policy emanating from the executive branch, it can (and in this case, does) have a lot more to do with narrative and focus and emphasis than even actual policy implementation. My argument as it pertains to these two respective charts is that they perfectly encapsulate the President’s choice of focus in the first couple of months of both respective terms in office. The first deferred on trade and tariffs while he focused on intelligent deregulation and substantial (paradigmatic) corporate tax reform. The second has seen much less public emphasis on supply-side economic priorities, and has centered economic messaging around tariffs and the like.

Quote of the Week

“Learning is not compulsory…neither is survival.”

~ W. Edwards Deming

* * *

I will actually be in Washington D.C. for much of next week, and will need to wait to talk about some of the meetings I have planned until after they happen and I know what can and can’t be shared. I am locked in on this moment in which we find ourselves and navigating it for clients the right way. Our whole investment team shares both the macro and micro philosophy needed to do our jobs well here. In fact, to those ends we work. For many, the question is less about our commitment to our philosophy right now and more about what philosophy is governing the Oval Office.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet