Dear Valued Clients and Friends,

The end of summer is almost here, which means the beginning of football season is almost here, which means a lot of joy is coming. But in the meantime, there is an election going on. But I digress. This week markets appear to be right where they started, which gives me the chance to cover a lot of other things. And that is what I will do when you join me in this week’s Dividend Cafe!

A special announcement here!!!

|

Subscribe on |

Jackson Hole

Chairman Powell said today:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

He talked up the need to pivot to labor markets, and more or less reiterated that slow, measured, periodic rate cuts are coming. If you start seeing 100 basis point cuts or cuts in between meetings, it will NOT be something the market likes – it will be because the economy is falling off a cliff. I am not predicting that, but it is pivotal that investors realize as clearly as can be that the dichotomy many think exists is wrong: Interest rate cuts good for the market is NOT true when (a) Markets already know they are coming, and/or (b) The cuts are coming as a belated response to economic weakening. Trust me on this one.

Odds didn’t move a ton in the futures market of a half-point cut in September versus a quarter-point. Where we stand now, 67% probability exists of a quarter point cut and 33% for half … The August jobs data and CPI report may alter things, but I am more convinced of a quarter-point cut than I have been. I am, however, 100% convinced that I couldn’t care less which one it is.

(More to unpack from Jackson Hole on Monday)

Behavioral madness

I was reading an article this week that really, truly sparked immeasurable gratitude in me. The piece referred to the most common mistakes investors make, and it provoked a fair amount of deja vu for me. I spent many, many years obsessing over “the avoidance of big mistakes” in my practice, and it will be at the heart of what we do at The Bahnsen Group for the rest of my life. For very, very good reason, so much of my business was built telling people of the permanent damage done by panicking at the wrong time (fear) or playing into the euphoria and speculative bubbles of the day (often called greed, but really a derivative of fear, too). This is never permanently rectified because human nature is immutable, and it all flows from human nature. However, some investors have more antibodies than others, and I believe TBG has succeeded in becoming a treasure trove of immunity protections from many of these behavioral temptations.

But as this article dug into the weeds of mistakes so many make, I could not help but appreciate how rare it is that we encounter some of these things. Clients who believe they can time the market are a rare part of our orbit (not that we would let them if they wanted to). Someone seeing a billionaire on television saying something and then calling us and saying, “Why aren’t we doing X?” (or “Why are we not avoiding X”) happens, but barely ever. I rarely hear clients ask why their most conservative investments are not outperforming their most aggressive investments (again, it happens, but it’s not a systemic problem). There may be some pathological pessimism in the DNA of those we work for, but it isn’t acted upon. There is intellectual hospitality and a true openness to resist the prima facie impulses many of us have.

In fairness, it is entirely possible that some of these things do happen more than I realize. Still, our firm’s extraordinary Private Wealth Advisor Group insulates me from it or just handles it so well as part of their direct relationship with clients that it never goes anywhere. But that would only intensify my gratitude, not moderate it. The only thing better than having hundreds of clients who believe in what we are doing is having twenty advisors all committed to the same cause. Ours is not a preference or tactic; it is a worldview.

Empirical proof of human anti-empiricism

The statistical variability of economic growth is measurable, and in fact, there is an annualized 1.8% standard deviation around annual economic growth over the last forty years. In other words, economic growth goes up and down, but its variance around its own mean is, well, small. Now, corporate profits have a 9.4% standard deviation around their own average. The idea that real GDP growth and corporate profit growth are supposed to converge over time is (a) Not exactly true and (b) Unhelpful if it were true since the timing, sequence, and variance around such are so different.

But here is the real kicker – the volatility around stock prices from their own average growth is 13.1% over the last forty years. Stock prices essentially measure profit growth, and profit growth is connected to economic growth. Yet, stock prices are significantly more volatile than the earnings they represent, which are themselves much more volatile than the economy that produces them. This is, of course, explained by one thing and one thing only – human psychology, emotion, and behavior – otherwise known as human nature.

h/t Howard Marks, Nick Murray

Golden rule

Gold has tripled in price since 1980, which sounds pretty good until you see that inflation has quadrupled. But if the 3x in gold vs. 4x in CPI doesn’t grab you, maybe the 3x in gold vs. the 49x in the stock market will (and that doesn’t count dividends). (h/t Nick Murray).

Yes, the stock market is up 49x since 1980, with gold up 3x (we can more precisely say 3.1x if you want), and inflation up 4x.

Time keeps on ticking

Ben Carlson always does a wonderful job assembling charts that tell important investing stories. Seeing that the market has had a positive return in 100% of 12-year, 15-year, and 20-year periods since World War 2 is not a big surprise to me, and shouldn’t be a big surprise to you (i.e. free enterprise works, etc.). But that only 54% of DAYS see a positive return in the market, and only 64% of MONTHS, and 88% of 2-year periods, and by the time you get to 7-year periods, virtually 100%, is just a powerful reinforcement of (a) The silliness of short term market noise, and (b) The important of aligning goals with solutions properly (to that end we work).

But, not all positive is created equal

It should be said, though, that a market return that averages 3% per year for ten years (very rare) would still count as positive … and yet it would likely mean many, many financial plans being underfunded. The above chart, in other words, captures the risk of “loss” but not the risk of “shortfall.”

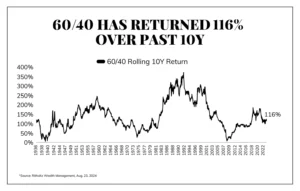

This point is captured well here. An indexed 60% stock, 40% bond portfolio has had a positive return in 100% of ten-year periods since the Great Depression! And yes, there have been periods where a 10-year return was 250-300% (so 13%+ per year). BUT BUT BUT, while the “average” return over a ten-year period of a 60/40 index portfolio is 116% (so a bit over 7% per year), there have been several periods where that 10-year return was somewhere around 1-3% per year.

Note: Dividend growth focuses on a yield that is sufficient, and advancing, regardless of market conditions, making the price performance in intermittent periods immaterial).

Partying like it is no longer 2022

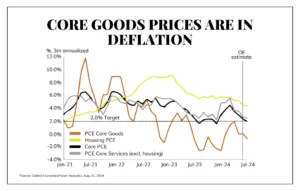

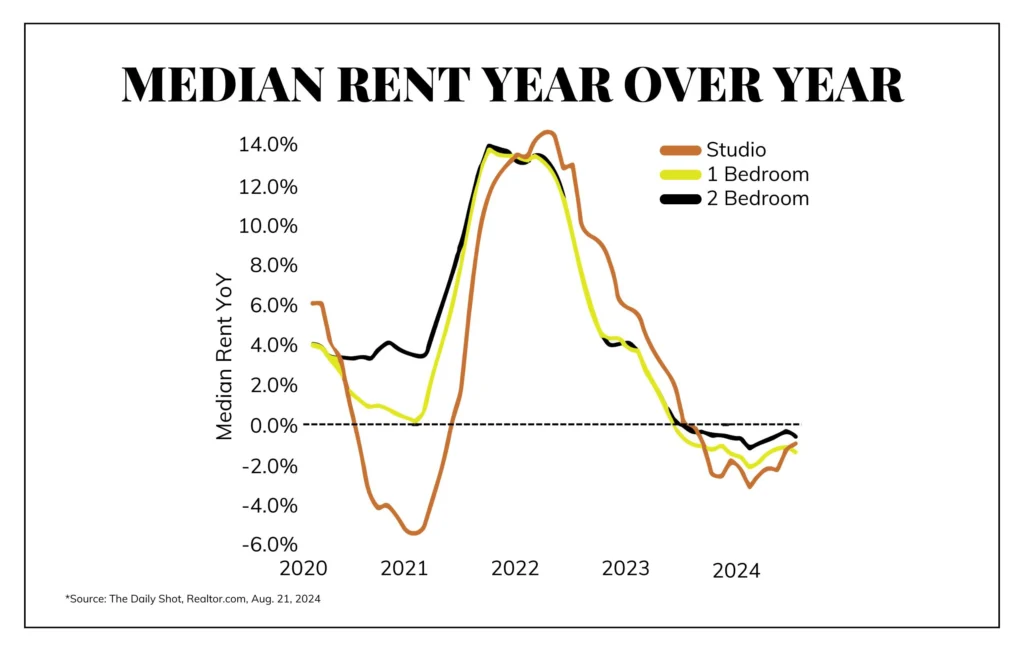

As I have been pointing out for months, core goods prices are in outright deflation. Housing is highly distorted (see second chart below). And the core PCE level is now at the Fed target of 2%.

Rents are LOWER than last year’s level; they are not experiencing “+5.4% inflation”

Party of one

Torsten Slok, Chief Economist at Apollo, had an interesting theory about the recent revision of the jobs number covering the period April 2023-March 2024 … Business applications for new businesses flew higher during COVID, and has stayed elevated since; but, the percentage of these businesses that converted into “high propensity” businesses that hired multiple people dropped a great deal. So in other words, a lot of “one person” businesses formed, and it appears a great deal of them persisted and have made it (I love that!), and yet, they did not end up hiring a lot of people, so the BLS birth/death model overestimated employment in their 5-year look back. More businesses with fewer workers than historical averages out of the COVID moment skewed the model …

500,000 jobs were revised away in 2019, by the way.

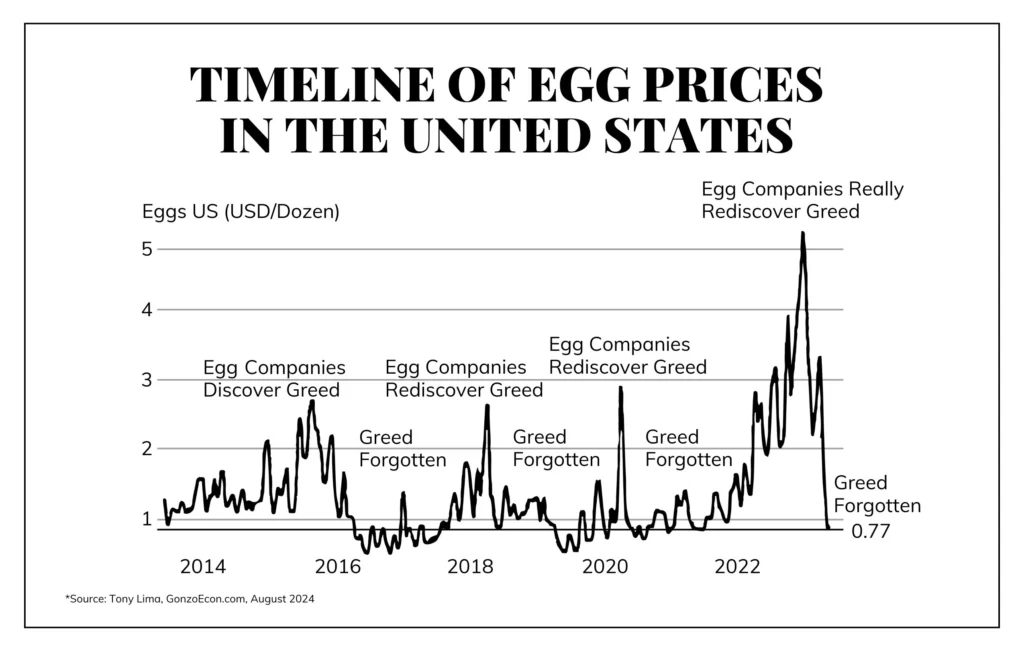

Chart of the Week

I couldn’t resist. A very humorous manner of dealing with the poor understanding of certain economic concepts prevalent today.

Quote of the Week

“Live your life in a web of deserved trust.”

~ Charlie Munger

* * *

Enjoy your weekends. It will be nice to spend a week in the Newport Beach office, and I welcome all of your questions, any time. And for you clients, know that I mean it when I say I am very grateful for you, your concerns.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet