Dear Valued Clients and Friends –

I really prefer to write each weekly Dividend Cafe with a “primary topic” in my mind, and I believe I will get to do a lot more of that in the future. The new format I am envisioning as I close out COVID & Markets next week and introduce The DC Today will be a lot of “daily market ad hoc stuff” for The DC Today (each day, Monday through Thursday), and a more focused and topical treatment in the weekly Dividend Cafe each Friday. We’ll see how that plays out, but I did find that this week’s Dividend Cafe went sort of all over the map.

There are a lot of places to go on the map right now. Markets were not just “up” throughout most of June/July/August, but they were “boring” in the way they did it. Limited volatility. Total transcendence to some of the silliness in how the media covered COVID. And a pretty consistent slow-burn to the upside. September has now invited normalcy back, and by normalcy, yes, I do mean frothy, over-valued tech positions getting re-priced (and that process could be in very early innings from where I sit), but also just plan going up and down – the standard bi-directional definition of volatility.

We have a number of things going on in markets right now that will be discussed in this week’s Dividend Cafe, and I suspect the conclusions I draw will be really satisfying for some, and really unsatisfying for others. I am hearing more and more people talk about certain things that seem obvious to them. This is the most bullish thing you could hope for if you are a contrarian (or a half-way decent hedge fund manager). Nothing is obvious in investing, ever. What seems so apparent to those who fancy themselves brilliant investing minds is (a) Not that apparent, and (b) Even if accurate, not remotely easy to apply into a real investment solution (that second one messes people up all the time). I am going to jump around the markets today, discussing things that are not at all obvious, not at all easy, and incredibly sure to confound people in the end, including me.

And through it all, through the mystery of markets and surprises that the news cycle and the economy brings, there will be a group that comes out unscathed, even flourishing. It will be those who behave well. That has been, and will continue to be, the great lesson of the COVID investing period. Wild behavioral adjustments (chasing, hiding, whatever you can come up with) do fatal damage; but steady and sober judgment rooted in principles wins the race.

So around that race we now go, looking under various rocks, learning where we can, and doing the right thing day by day. Whatever “primary topics” I cover in future Dividend Cafes, this will remain the most important thing – always and forever: Be humble, be inquisitive, and behave. We look around not to chase and not to hide, but to be informed and prepared. What we won’t do, is misbehave.

In this week’s Dividend Cafe we will look at …

- What all may be wrong or not wrong with markets

- Five facts to focus on through the weeks and months ahead

- Cash levels are still very, very high – but what does that mean?

- Whether or not 2009 has anything to teach us right now

- All the things happening in the economy (must read)

- Politics and Money, and now the Supreme Court?

- And of course, the Chart of the Week

And with that, let’s dive into the Dividend Cafe …

What could be behind this market volatility?

This week I heard that markets were experiencing a pause in their post-COVID recovery because of election uncertainty (seems to be the election was pretty uncertain before this month, too), because of Ruth Bader Ginsburg’s passing (like the Senate was a bipartisan lovefest before the pending Supreme Court fight??), because of the Fed being out of ammunition to help (if you believe that one, I have a bridge to sell you, and you can use zero-percent QE money to buy it), because there is no stimulus relief bill coming (see: July/August), and because tech stocks were over-valued (okay, that one is right).

The truth is that all of these things and none of these things really explain market volatility. Meaning, you can not identify exactly what is behind it, but the very nature of unpredictability, the perpetual reality of uncertainty, and the complexity of how risk assets are more appetizing or less appetizing to investors at given times ensure that months like September will remain a part of the investing journey.

Right here, right now

In the present tense I would call your attention to five facts:

(1) Big tech valuations, down from their September highs as they are, are still manifestly insane relative to real-world common sense. If one’s view of the overall market is that as big tech goes, so goes their portfolio, I do think there is a chance of continued air fleeing the tire.

(2) The COVID economic recovery is underway, but it is a mixed bag, it is confusing, it is inconsistent, and it does easily lend itself to a short term market call. It would take only pedestrian levels of data mining on my part to convince you from economic data that we were in the midst of a surge of recovery, or that we were facing prolonged recession. The truth is that economic data is usually mixed like this; but it is especially so at this time.

(3) When a central bank is throwing the kitchen sink at risk assets, it is almost impossible to bet against them. And in those periods, there will always be zigs and zags.

(4) If you think stocks are expensive, then what are bonds? “TINA” (there is no alternative) is still at play in capital allocation.

(5) The move higher in equities from April thru August is what many of us thought would play out by Q2 or Q3 of 2021, not by September of 2020. The market recovery’s speed makes the market environment of the months ahead more skittish, not less.

Yes, the election plays into all of this (the uncertainty around it all). It is simply not a period where I can rationalize any strong conviction whatsoever in what may happen in a week, month, or quarter. Big tech valuations are too high but they can go higher. The election is uncertain but it could firm up more than people think. The COVID economic conditions are sad in many areas but they have mostly surprised to the upside so far. Investors are perhaps risk-fatigued but liquidity is flowing.

Thoughtful asset allocations were made for moments like these.

A tailwind, eventually

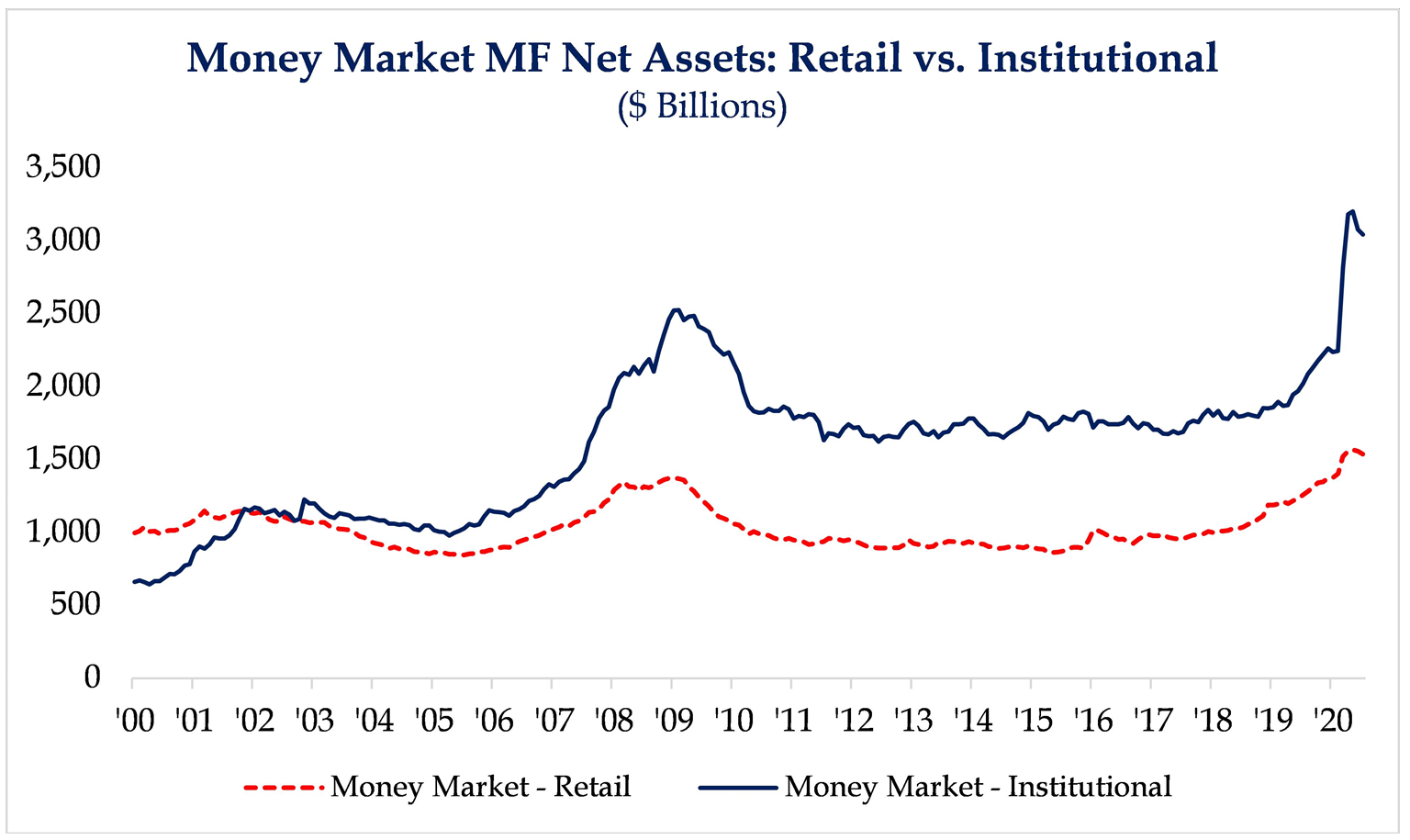

The boost in equity markets throughout the summer, September’s zigs and zags notwithstanding, has not come about because of significant “sideline cash” being deployed into stocks, but rather despite the fact that sidelined cash has stayed, well, on the sidelines.

But what is particularly noteworthy about the money market levels on hand right now, is that there is ample cash in both retail and institutional households. At some point, the potential deployment there does seem to be a future tailwind opportunity for risk assets.

*Strategas Research, Daily Macro Brief, Sept. 25, 2020

Overrated policies, politics, and power

The three top-performing sectors under President Obama:

Consumer Discretionary, Technology, and Health Care

The three top-performing sectors under President Trump:

Technology, Consumer Discretionary, and Health Care

The two worst-performing sectors under President Obama:

Financials and Energy

The two worst-performing sectors under President Trump:

Financials and Energy

So either you believe Presidents Obama and Trump have had the same economic policies, or maybe, just maybe, my point a few weeks ago about the President’s policies being overrated in evaluating markets has some historical merit.

Clear as Mud

I read a report from an economist who I like a lot yesterday who said that the Fed has provided markets “clear guidance” on its rate policy – that it would not hike until maximum employment and inflation at 2% tracking to “moderately exceed that pace for some time.” My economist friend will forgive me if I don’t have the foggiest idea how this constitutes “clear guidance.” Here is what is clear – they are not going to hike for a long, long time.

At the same time, this economist took the Fed to task for not providing clear guidance on their QE policy. What would trigger a change in the pace of the Fed’s bond-buying? What does it mean that the Fed “has the flexibility to adjust” and would do so “when it thinks it is appropriate.” I concur with Ian that this is hardly clear, but I also think economic actors know darn well what Ian wants the Fed to come out and say: “QE is for markets, not the broad economy.” I believe the Fed can’t say that, but I certainly believe it is true. Providing liquidity to capital markets and tightening credit spreads has a huge impact in credit and equity markets, and there is a “broad economy” impact out of that. I don’t believe QE adds lending power into the banking system because I don’t think the banking system was short of lending power – the banking system was short of qualified borrowers and demand. On the margin, QE does hold down rates, but even then the Fed will have to implement yield curve control to effect the shape of the curve in years to come.

Ultimately, QE was (post-financial crisis and post-COVID) a means of getting liquidity breathed into credit markets, impacting capital flows, and it did exactly what the Fed wanted. What remains unclear is: (a) What the Fed’s tools are next time markets revolt and (b) How these bond purchases will ever get off the Fed’s balance sheet. As I have been trying to say ad nauseum since the financial crisis, there is no precedent in history for a central bank that levers up its balance sheet, ever levering it down.

Deja Vu All Over Again

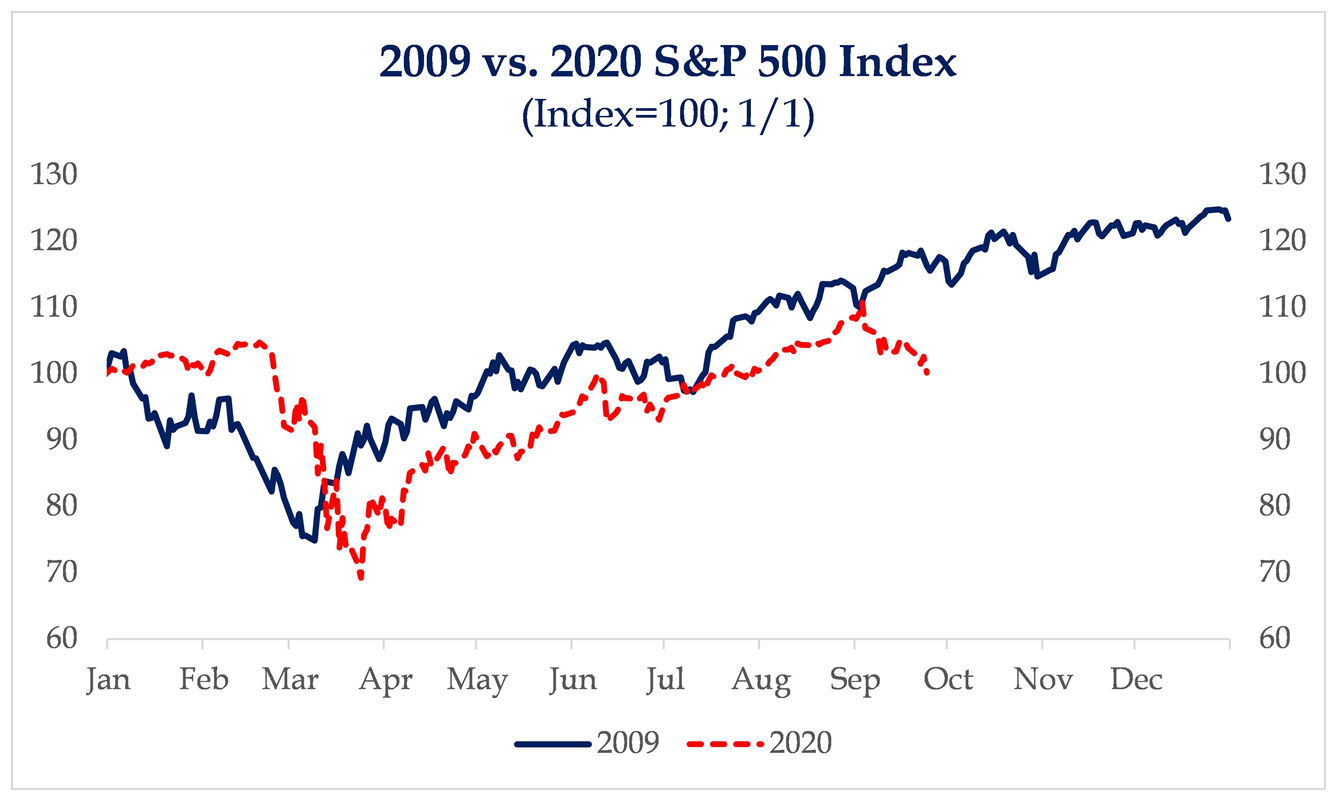

I’ve noted a few times over the last several months that there was a similarity in the shape of this present post-COVID market rebound and the 2009 post-Lehman market rebound. The rally then, as is proving to be the case now, was not straight up, and in fact had two declines of 5% or more as it asserted its upward trajectory. You can interpret this next statement as either bullish or bearish, but I think both things are true at once:

The market is in a generally upward trajectory as a post-COVID recovery, and there has been and will be plenty of zigs and zags along the way (more to come).

*Strategas Research, Daily Macro Brief, Sept. 25, 2020

No monopoly on truth

I may have written a book on dividend growth investing, and I may have built my business around the power of compounding dividends (a power invisibly playing itself out inside portfolios as we speak), but I certainly don’t have a monopoly on all good things that are to be said about dividend growth. And sometimes, someone else says something so well, it makes me jealous that I didn’t do it first.

Alternative facts in direct lending

It is no secret that I believe the senior-secured loan space represents an attractive asset class to limit correlation to equities, decrease total portfolio volatility, and generate the substantial cash flows that are now so hard to come by in many fixed income asset classes. Where leverage is responsibly managed, covenants used efficiently, and underwriting done with expertise, it is entirely possible to see zero defaults, full contractual cash flows, and the avoidance of rescue dollars being needed for a distressed borrower.

One thesis making its way around, evident in the huge flows that have worked into new distressed debt strategies (30% of capital raised in 1H of 2020), is that many direct lenders are battered and bruised out of COVID or are about to be, and the distressed space is ready to feed on the carcasses. I certainly believe there will be some situations where particular assets (and maybe entire portfolios, but I doubt it) are forced into the hands of an opportunistic buyer. But generally speaking, the past two crises have shown us that direct lenders can work out their own paper, can re-structure or re-subordinate with their borrowers, and even take over a business before selling a loan at a loss.

Direct lending is an alternative asset class because it requires talent – there is risk in human execution – but there is no “direct lending beta” out there getting beat up. That is just an alternative fact if one is sharing it.

Is the oil industry dead forever?

As oil stubbornly sits around $40, frustrating the bears who thought it would stay at $20 through COVID and frustrating the bulls who want $50 to see the big integrated companies resume high-profit margins, a simple question does exist to defend the investment thesis …

Do we or do we not need fossil fuels right now to meet our energy needs as a society? And right now, can we get transportation, heating, cooling, and food needs met – the bedrocks of a healthy civilization – from wind and solar?

These are rhetorical questions in the present tense, I hope you know.

But if you believe there will be trillions of dollars of fossil fuel need to keep civilization alive for the next couple decades, an absolutely indisputable fact, it behooves us to wonder what are the companies in public equity markets most positioned to profit from that reality, and deliver returns from these distressed levels. We want to own the highest quality names in the transportation and storage of natural gas and oil, and the highest quality integrated companies from upstream to downstream.

People may have all sorts of different predictions and aspirations for 2035 or 2050. I happen to believe my grand-kids will be passing on the shares of these companies I leave them to their kids. But even if you don’t see 20-30 years of runway, the thesis above strikes me as un-complicated for the next 10-20.

Economic Update of the Week

We are coming up on the end of the third quarter, and a couple weeks after that we will get a print of what quarter-over-quarter GDP growth looked like (annualized). Q2 was the biggest drop in % terms since WW2 and Q3 is going to be the biggest increase. The huge move up will be misinterpreted and over-hyped just as the huge move down was, as transitory, outlier events allowed to be talked about in “annual” terms are always removed from context and reality.

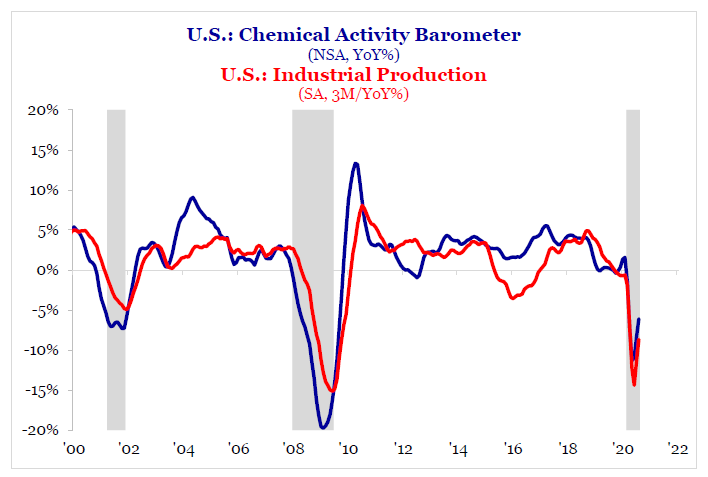

A couple more examples of business conditions substantially improving, but having substantial room to go still to re-obtain pre-COVID levels.

*Strategas Research, Global Economic Update, Sept. 18, 2020, p. 5

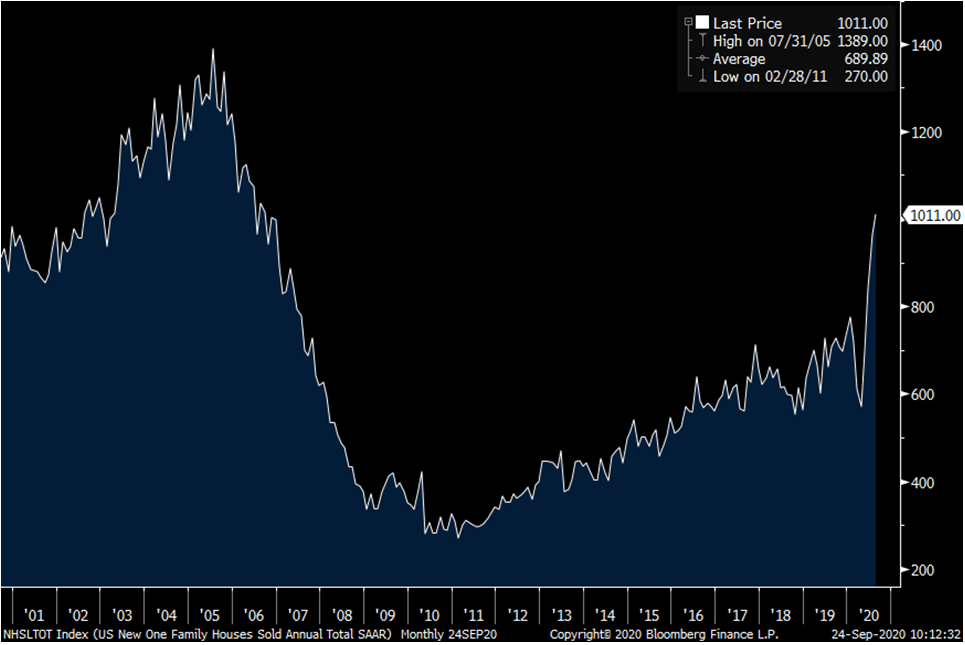

I wrote yesterday about the housing market demand (especially at the low end of pricing) we are seeing right now. Sales volume has skyrocketed in the last two months, even if the activity is heavily concentrated in the sub-500k price point and in the south.

Inventory, on the other hand, is very, very low. The lack of housing supply is the biggest boost to housing prices out there. This is what sellers of housing stock want – high prices created by low supply; and it is exactly what the economy does not need – a higher percentage of income going to housing costs, cutting into other production and consumption.

Durable goods orders were up nicely in August (+1.8% on the month), as Manufacturing rebounds in a significant need to rebuild inventories that were significantly depleted after the shutdown of the spring. This re-ignition in activity is very encouraging and yet will need to be sustained into Q4 to really spark supply-side optimism.

Politics & Money: Beltway Bulls and Bears

- We do know President Trump plans to make his appointment for the Supreme Court replacement of Ruth Bader Ginsberg on Saturday, and it does appear the Republicans have the votes to confirm before the election (at least in theory). This process, the history, the judicial philosophy of the judge nominated – all of these things evoke incredible emotion and passion from a lot of people on a lot of sides, and it is not without my own emotions and passions in this arena that I say I believe it is a non-market event. People point out this adds to the noise and the toxicity, but I simply believe it just adds more of what was already there, it reinforces strongly held opinions and feelings already there, and equally animates the bases of both parties.

- The first Presidential debate will be this coming Tuesday, the 29th. If anything between now and election day is likely to be catalytic it may be these debates. Generally, the first debate is not the one that has the most lasting impact in how an election unfolds but it certainly generates the highest ratings. I will unpack any relevant takeaways next week if there are any to unpack.

Chart of the Week

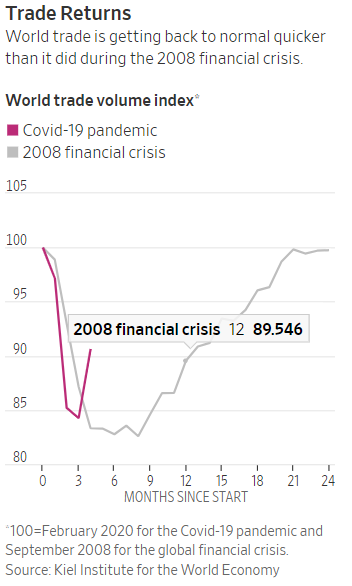

In keeping with the economic news of the week previously provided, and the market parallels to 2009 previously provided, the Chart of the Week notes that world trade is picking back up much quicker than it did post-financial crisis, and this is without a “full economic re-opening” yet upon us. New export orders are growing. Household spending on imported goods is growing. And China factory exports are growing.

Quote of the Week

“A riskless society is unattainable and infinitely expensive.”

~ Edwin Goldwasser

* * *

Next week’s Dividend Cafe is going to be dedicated to our Operation Magnify at The Bahnsen Group, a multi-month all-encompassing project I have spearheaded and worked vigilantly on with my Investment Committee to re-structure client portfolios around multiple dynamics that I believe warranted such. I will leave you in suspense, but be ready for our investment truths to be magnified.

Greetings from beautiful Newport Beach, California. On both of my coasts and from both of my homes and favorite cities, I am so happy to see things becoming “somewhat more normal,” and so anxious for them to be “even more normal.” Yes, it does appear there will be some USC football this year after all.

And maybe, just maybe, November won’t be as crazy as everyone thinks. But it is 2020, sooooo …

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet