Dear Valued Clients and Friends –

Lo and behold, a drama-free Monday Dividend Cafe with the standard trip around the horn…

Dividend Cafe re-evaluated the state of the “Trump market put,” it laid out five present issues in markets going forward, and it looked deeper at investing if the world were to end. Yes, there was a lot to chew on! The written version is here (my favorite), the video is here, and the podcast is here.

Off we go…

|

Subscribe on |

Market Action

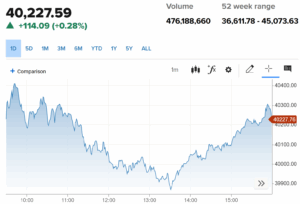

- The market futures were down -150 points all night, then up +100 this morning, then the market opened up +100, gave it all back and went down -250 points, and then made all that back up and went back to where it opened.

- The Dow closed up +114 points (+0.28%) with the S&P 500 up +0.06% and the Nasdaq down -0.10%.

*CNBC, DJIA, April 25, 2025

- Current market assessment:

- One would like to think announcements of deals with India, Japan, and Europe could be a catalyst for markets. Unfortunately, I think a lack of announcement could hurt markets, but I am not sure an actual one will help markets, simply because I believe markets have priced in that some announcement is coming, and it is highly unlikely to be a needle-mover as it pertains to real market activity.

- I believe a budget reconciliation deal that includes anything new and meaningful on the supply-side of the economy could be an upside surprise (again, with the caveat that a lack of progress on tax reform or underwhelming results when it does happen creates downside risk).

- Any “better than expected” results in Q2 and going into Q3 on the economy, hiring, capex, business plans, etc., could create upside surprise.

- My friends at Strategas Research reminded me this morning that the Fed’s new regulatory environment (with support from the Treasury) may very well be changing the supplementary leverage ratio for banks with more favorable treatment of Treasuries on their balance sheet. This seems wonky and granular, but would very likely result in downward pressure on bond yields, which should help risk asset valuations.

- Nothing is likely more “noisy” for markets in the weeks and months ahead than the fate of what transpires with China. So far, they have been mostly unmoved by the aggressive tariff impositions and show no signs of backing down (quite the contrary).

- The ten-year bond yield closed today at 4.20%, down six basis points on the day. Rumors of the bond market’s demise were, ummmmm, greatly exaggerated. [See Ask TBG below]

- Top-performing sector for the day: Utilities (+0.70%) and Real Estate (+0.68%), and Energy (+0.63%)

- Bottom-performing sector for the day: Technology (-0.30%)

Top News Stories

- Canada is holding its national election for the nation’s new Prime Minister today.

- President Trump met with Ukrainian President Zelenskyy on Saturday, and this week appears to be a big week in the discussions around a U.S.-led agreement between Russia and Ukraine.

- The Conclave to elect the next pope will begin on May 7th.

Public Policy

- Federal spending is up $200 billion in the first three months of Trump’s new term versus what was spent in the same three months last year. Higher entitlement costs have driven the bulk of this increase.

- The minerals deal with Ukraine (and us) is supposed to be signed this week. We are watching. Let’s just say we feel more optimistic about a U.S./Ukraine minerals deal than we do a Russia/Ukraine peace treaty.

- The “Big Six” that matter for the budget negotiation bill are meeting as I type: Speaker Johnson, Senate Majority Leader Thune, Finance Chair Mike Crapo, House Ways & Means Chair Jason Smith, Treasury Secretary Bessent, and NEC head Kevin Hassett.

Economic Front

- John Mauldin had some strong material in his weekend newsletter about the impact of tariffs on recent shipping activity. Trucking activity out of Los Angeles is down -23% and headed to down -50%. Capital expenditure intentions are down to COVID lockdown levels. Shipments to the U.S. from China are down 60% over the last week, according to Flexport. The big questions right now are not about a tariff-induced slowdown in economic activity, but rather (a) When certainty does come back, and (b) How much damage will have been done before then.

Housing & Mortgage

- The average 30-year mortgage nationwide is 6.93% as of this morning. Besides that brief September dip last year, it has basically stayed between 6.6% and 7% for a long, long time, and is right now pretty much exactly where it was one year ago.

Federal Reserve

- We are essentially at a 0% chance in the futures market of a rate cut in May. The odds reflect a 60% chance of a cut in June, which is surprising, considering that 40% still say no cut in June. The odds get split roughly evenly between whether or not there will be three, four, or five cuts from current levels by the end of the year.

Oil and Energy

- WTI Crude closed at $61.89, down -0.26% on the day.

- Midstream energy stocks were up roughly +1% last week and remain up about +2% on the year despite the challenging backdrop for risk assets (especially the last month). Oil is down -12% on the year, and natural gas is down -19%, with the stock market down -7%, and the resilience of midstream in this stock and commodity backdrop speaks to the relative non-correlation benefits of the sector.

- U.S. oil production has been basically dead flat since election day, and only two new rigs have been added in a hundred days. This is obviously not due to a stricter regulatory environment, as the administration has gone to great lengths to ease regulatory burdens on producers. Rather, it is the market reality of supply, demand, margins, and pricing. “Drill baby drill” has always been more of a political line than a market line. Cumbersome regulations can be an impediment to new supply, but removing those impediments is only a necessary condition, not a sufficient one.

Glossary

- Midstream Energy – the part of the energy industry dealing with transporting energy and storing energy (i.e. after exploration and production and before refining and distributing; the former is considered upstream and the latter downstream, so the processing of moving that which has been drilled to that which will be refined and sold is appropriately called “midstream”). Pipelines and terminals are the best examples of companies in this space.

Ask TBG

| “We’ve seen that the simultaneous slump in U.S. Treasury prices and the dollar has been accompanied by a surge in the Euro while German Bund yields were going down. Some observers are explaining it as a sign of capital flight to the Eurozone induced by concerns regarding U.S. policymaking, in the context of increased German issuance to finance public spending on defense and infrastructure following the debt-brake reform. What is your take on the matter, and do you think that this trend could signify the beginning of an enduring diversification in safe asset holdings away from the U.S. and to the benefit of the Eurozone ?” ~ Josef N. |

| I am very open to some theoretical discussion as to why these things are happening, IF they were happening… But with the 10-year bond yield down to 4.25%, U.S. bond prices are HIGHER, not lower. The U.S. dollar, coming off of years of appreciation vs. the Euro, has unsurprisingly dropped a tad since the U.S. announced all of its tariff confusion, but I think we are a long ways away from seeing some validated trend into Euro-based assets and out of U.S.-based ones. Of course, it could happen, but it is not remotely evident yet. I would theoretically agree that current U.S. policymaking will make U.S. assets relatively less attractive, but I do not think the U.S. bond market is yet showing this coming to fruition. |

On Deck

- Massive week for earnings season ahead.

- Big TBG client dinner event in Denver Wednesday night.

Reach out with any questions, any time.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.