Dear Valued Clients and Friends –

It was an eventful weekend, with the events in Israel and Iran creating significant angst on Saturday (lots more below). And it was an eventful day today in market action. Today’s is an important read in the weekly Monday edition of Dividend Cafe. And I will add the Against Doomsdayism, today is one of my favorites …

Dividend Cafe looks at the first couple weeks of April and the current market sell-off, the last couple weeks of March and that market rally, inflation reality, and the attempts to box 2024 into either a 2023 or 2022 narrative. The written version is here (my favorite), the video is here, and the podcast is here.

I do not know right now if the new and improved Dividend Cafe website and the programmatic changes I laid out last week will start next week or the week after, but they are coming, and we are very excited! As a quick recap:

- Friday Dividend Cafe article continues on, same as it ever was

- Monday Dividend Cafe will be much like what you are reading right now same as it ever was

- A daily market recap available on the Dividend Cafe website and in your inboxes every day, Monday through Friday.

- An ASK TBG section on the Dividend Cafe website updated daily with an email blast once per week

- Special articles and contributions from other TBG advisors and guest contributors on the Dividend Cafe website

- A video every Monday and Friday

- A podcast every day

With all that said, off we go …

Market Action

- Futures opened up +75 points last night and pointed pre-market this morning to a +100-point open after the big Friday sell-off. Oil prices were dead flat around $85, surprising some who thought weekend events would spike oil.

- The market opened up +350 points and, within a half-hour, began losing steam, eventually dropping -600 points from its high level on the day.

- The Dow closed down -248 points (-0.65%), with the S&P 500 down -1.2% and the Nasdaq down -1.8%.

*CNBC, DJIA, April 15, 2024

- The market sold off Friday with bond yields down (meaning bond prices up), and it rallied today with bond yields up (meaning bond prices down). This action has been almost unheard of for a long time, and it the clearest sign that geopolitical noise was trumping monetary noise. Monetary noise has created a high correlation between stocks and bonds; geopolitical noise, for a hundred years, has created the traditional reverse correlation between the two.

- Bank earnings did not kick off well on Friday, though results from all who released were actually quite strong. The sell-off in JP Morgan was related to how high up it has already been and was about marginal questions around forward net interest income. Other banks reporting had better-than-expected results and initially traded higher (Citigroup, Wells Fargo) but modestly traded down throughout the day as the big market sell-off gathered steam.

- Apple saw a 10% decline in iPhone shipments in Q1, far greater than expected

- The ten-year bond yield closed today at 4.61%, up eleven basis points on the day

- Top-performing sector for the day: Health Care (-0.19%)

- Bottom-performing sector for the day: Technology (-1.99%)

- Geopolitical conflict like we have seen over the weekend, particularly that focused in the oil-centric region of the Middle East, is addressed very well with dividend growth for two reasons:

- Dividend growth is lower beta, more focused on quality and reliability, and more removed from exogenous shocks to the system; AND

- Consistent dividend growth in midstream energy and key upstream names aligns dividend growth with the energy sector. The energy sector is an embedded hedge against Middle East/oil turmoil. It is our third largest weighting as a sector and our largest relative to the S&P 500

- When I harp on and on about market valuations for index investors, I want to make clear that while the price-to-earnings ratio is, in my opinion, the most important one, and the best one, it is by no means the only one:

Top News Stories

- On Saturday Iran launched a massive attack on Israel featuring hundreds of missiles and drones. Past attacks on Israel by Iran were perpetrated by Hamas and Hezbollah as proxies for Iran but this was a stunning attack from one nation-state on another. 185 drones, 110 surface missiles, and 36 cruise missiles were fired. Over 99% of the drones and missiles fired at Israel were intercepted by aircraft and missile defense activities.

- Perhaps the strangest thing I have ever heard is that if a nation attacks another nation with over 300 missiles coordinated from three different fronts with capacity and intent to kill thousands upon thousands of people, but it doesn’t succeed, then it doesn’t count. I have no words.

Economic Front

- Retail sales jumped +0.7% in March, much higher than expected

- I was laughing about the above bullet point this morning because Friday, the bullet point was that Consumer Confidence dropped a couple points on the month (per the monthly famous index from the University of Michigan). Maybe consumers were feeling so nervous about shopping last month that they dealt with their fear and anxiety by, well, shopping?

- The New York Manufacturing Index was down quite a bit more than expected on the month

Housing & Mortgage

- The NAHB Homebuilder Sentiment stayed at the same place as last month, just barely above 50 (though it was above 50 for the second month in a row). Prospective Buyers Traffic remains dismally low.

Federal Reserve

- As I type we are sitting at a 94% chance of no rate cut in two weeks (it is really 100%), and now an 81% chance of no cut in June. We are up to a 56% chance of no cut in July, but that can and will move around “cover” data in the next two months. Futures are pricing a 64% chance of some cut by the September meeting.

Oil and Energy

- WTI Crude closed at $85.60, basically flat on the day

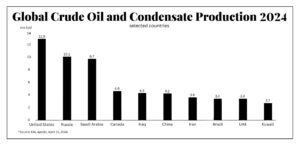

- As we say in my house a lot, “We’re number one!”

*EIA, Apollo, April 15, 2024

Against Doomsdayism

- Where this Iran-Israel atrocity goes from here, what should and should not have been done, what it will mean for markets and oil prices – all these things notwithstanding, the winner of the weekend appears to be anti-missile defense systems, first pursued by the Reagan administration in the 1980s. The ability of this technology across multiple mediums to bat nearly a thousand in putting down missiles and drones coming in hot to do unspeakable damage is, well, vindicating. The specifics of the various technologies and strategies are fascinating, but for now, we celebrate those whose vision was to shoot down missiles and missiles, from ground and from air. Such military investment saves lives, and deserves our celebration.

Ask David

| “I often hear the phrase, ‘The Fed continues to cut its balance sheet.’ What exactly is on the Fed’s balance sheet? And when they cut or increase their balance sheet, what exactly does that mean?” ~ Cleo L. |

| The process known as quantitative easing is when the Fed buys bonds, essentially crediting cash to the party the Fed bought the bonds from (i.e. primarily banks), and leaving the Fed as the bondholder (receiving the interest and principal payment from the Treasury Department). This is the same as “increasing the balance sheet” – that is, ADDING bonds (assets) to the balance sheet of the Fed. What the Fed has been doing for close to two years now is reducing their balance sheet – and while this has not meant actually selling bonds they own, it has meant not re-investing proceeds from bonds when they mature, thereby reducing the assets they hold on their balance sheet. This is why the Fed’s balance sheet (i.e. assets of bonds they own) has come down by $1.5 trillion over the last 20+ months. The entire process is essentially an added policy tool since the financial crisis, previously made popular by the Bank of Japan, as a means of effecting financial market liquidity and interest rates in the economy. |

On Deck

- Big week ahead in earnings, market weirdness, bond yields, and Israel/Iran drama

- Right now we are hoping to launch our new programming plans at www.dividendcafe.com NEXT Monday!

Have a great night and reach out with any questions.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The DC Today features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.