Dear Valued Clients and Friends –

The market dropped over a thousand points today, led by the Nasdaq’s drop of -3.43% (which had been much worse). A lot of things need to be said about all of this. Today’s commentary is heavy on markets but still contains nuggets from the other categories. This is a good day to read the Monday Dividend Cafe, trust me. (It might even be a good day to send to others).

Those looking for one clear explanation of everything are going to be disappointed. This market action has not one, and not two, but three primary and mostly (but not completely) separate dynamics playing out at once … I will unpack these below:

(1) Unwinding of a Yen carry trade

(2) Grotesque over-valuations in U.S. big-cap tech sector

(3) Questions about U.S. economic viability

In the meantime:

Today’s Varney appearance (short hit) and today’s Hugh Hewitt Show appearance (a bit longer).

Dividend Cafe on Friday did a much deeper dive into the issue of valuations than we have done before. Why it matters, why it is hard to discern with good companies, and why the market’s “over-valuation” right now is hardly democratic are all discussed. The written version with key charts is here (my favorite), the video is here, and the podcast is here.

Off we go…

|

Subscribe on |

Market Action

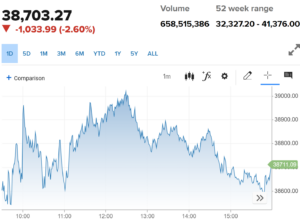

- The market opened down over a thousand points after a night from hell for the futures. All market indices stayed down dramatically throughout the day but did improve from the lows before re-testing them near the end of the day.

- The Dow closed down -1,034 points (-2.6%), with the S&P 500 down -3% (worst day in two years) and the Nasdaq down -3.43%.

- The S&P is now down -8.5% and the Nasdaq is down -13% from their July highs.

*CNBC, DJIA, Aug. 5, 2024

- Those who started off Sunday night believing that the Nikkei drop (down -12.4% in one day) was a knock-on from the American sell-off late last week were hopefully refreshed in cause and effect by this morning when it was clear that a big part of the American market drop was actually collateral damage from the far worse clubbing that the Nikkei took. A lot of leverage was embedded in the Yen carry trade, obviously, and that Yen rally has ripped the face off of Yen shorts and those borrowing in Yen to leverage.

- The Yen’s rally to the dollar has been a sight to behold, as the USD/JPY dropped from 155 to 142 in the last five days, and from 161 in less than a month. The short covering has to be done by now, one would think.

- Repeat after me as many times as it takes: The market is almost always DOWN 200-300 days after rate cuts begin. Not up, but down. Why? Because generally, the reason for the cuts – economic stimulus – is coming as a result of weakening conditions. This generally means declining corporate profits. Maybe that won’t happen this time, but that would be the exception, not the rule.

- Before I talk about the ten-year bond yield, we really have to talk about the TWO-YEAR. At 3.85%, it is now 165 basis points below the fed funds rate, perhaps the biggest spread between the two in my lifetime. This is the bond market SCREAMING at the Fed to cut rates, period, point blank.

- The ten-year bond yield closed today at 3.78%, down just one basis point on the day but at one point down another ten basis points. The yield recovered mid-day.

- Top-performing sector for the day: Industrials (-1.72%)

- Bottom-performing sector for the day: Technology (-3.78%)

- Bitcoin, at one point, was down -15% in one day and is now down -21% in the last week.

- The impact to the “mag 7” today was, at one point, an aggregate drop of over $1 trillion (with a “T”) in market capitalization.

- The VIX closed at $38, up +60% on the day, but at one point, it was $65, up +182% intra-day (that might not have reflected a beacon of rationality and sobriety)

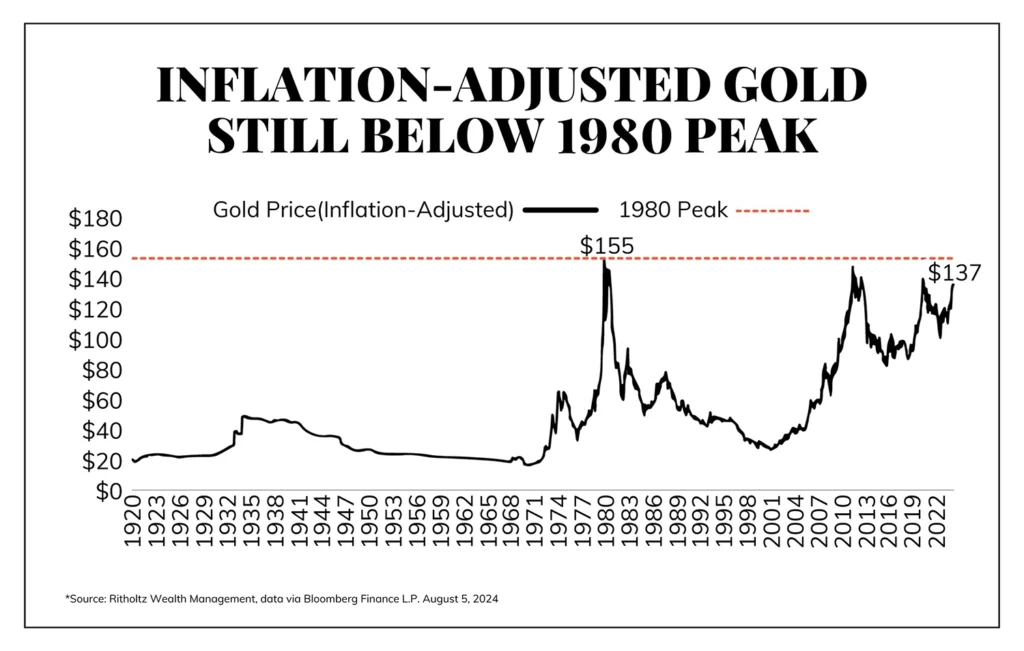

- When one talks about the dangers of buying at the wrong spot in valuation, as I did Friday, and as I do all the time, there is no need to limit that principle to the world of stocks. Some may say the greatest example in history was not in the stock market whatsoever:

Top News Stories

- The Defense Department intervened on Friday night, revoking the outrageous plea agreement that would have spared the 9/11 masterminds the death penalty. Secretary Austin assumed authority of pre-trial agreements and rendered this plea null and void.

- The big non-market story is the market, which has all sorts of impact throughout the news cycle, culture, and, of course, the election. But, what actions Iran may have planned against Israel is a significant story we are watching as well.

Public Policy

- $20 billion in Employee Retention Tax Credit dollars will be distributed shortly, and there is $90 billion that is sitting in the application phase. The program has been sitting on pause, but with the Senate officially killing the bipartisan tax deal last week that would have expanded the child tax credit and business deductions, the ERTC can come back to life. The ERTC was set to be ended by this bipartisan House deal because it has become a boondoggle of fraud, waste, and excess. But why should that bother anyone?

- A very important special Dividend Cafe on government debt is coming. One of its huge points will be that government debt has grown 11.6% since 2019, while nominal GDP has grown 6.7%. Debt growing at this faster clip than the economy itself (a) is the problem, and (b) speaks to the ineffectiveness of government spending as a growth catalyst at this stage of economic life.

- Vice President Harris is expected to name her running mate for the 2024 Presidential race by this time tomorrow. My sources had been adamant that Governor Josh Shapiro of Pennsylvania was the candidate, but now are a mix of “still confident but less so” that it will be him vs. “sure that it will not be.” If it is not Gov. Shapiro, I believe it will be Gov. Tim Walz of Minnesota. The problem with having multiple sources is that they don’t always agree!

Economic Front

- The jobs report came in at a much weaker-than-expected 114,000 jobs created in July and a much higher-than-expected 4.3% unemployment rate. Expectations were for over 200,000 jobs created.

- Wage gains are outpacing inflation, which is the good news in the report.

- The growing divergence between CEO survey optimism (i.e., large companies) and small business optimism (i.e., small companies) is worth keeping an eye on. Different access to capital markets and different costs of capital out of Fed tightening largely explain the delta, and perhaps this will converge when the Fed begins easing. But if there are other factors at play it may matter for hiring plans, wage growth, and economic activity in the year ahead.

- ISM Services came in at 51.4 for July, a little better than expected and much better than the contraction territory of last month.

Federal Reserve

- We are now at an 85% chance of 50bps of rate cuts in September, with just 15% odds of only a quarter-point cut. The market is now at a 95% chance of 100bps of cuts between now and the end of the year.

- Several have asked whether or not the Fed would do an emergency “between meeting” cut. I don’t think I have the words for what a stupid, counter-productive, panic-inducing move that would be. And no, they will not do it.

- Inflation expectations have utterly collapsed, with the five-year TIP spread now 1.91% (it had been 2.43% in April). The ten-year bond yield and the accompanying breakevens in TIP markets are the loudest indicator we have that inflation expectations have fallen through the floor, and the Fed is behind the curve in cutting.

Oil and Energy

- WTI Crude closed at $73.77, up a tad. If the Strait of Hormuz is about to be cut off, no one told the oil market.

Ask TBG

| “How do you see the cultural leanings toward more socialism and the mindset toward ever-increasing entitlement affecting productivity and thus the marketplace?” ~Ted T. |

| This warrants a long and more involved answer that is not going to fit in the Dividend Cafe today. First of all, I believe that socialism, properly defined, is primarily something attractive to people in college faculty lounges and on social media accounts of 23-year-olds. I do not believe it has real political traction or any sense of cultural momentum here in the United States. That said, I think the general societal view of work, dependency on government, and overall enabling of mediocrity are all net negatives to productivity, and in some cases, significantly so. The main impact has been to affect the distribution curve – more work getting done by fewer people, allowing the spoils to go to the productive, while the unproductive bemoan such. For the marketplace to respond to a downward move in productivity, it would need to be more systemic, not merely a distribution change, impacting corporate profit. But by the grace of God… ~David L. Bahnsen |

I just want to say in closing that while I feel our dividend growth portfolio has held up very, very well over the last few weeks, I understand even a few percentage points can be upsetting. I do not believe it should be, but I do understand that it is. Why do I not believe it should be? Because it is going to happen every year, it is part of the risk premium of equity investing; the lower beta has proven very defensive, withdrawers are not impacted by price volatility, and accumulators are benefitting from reinvesting dividends at lower prices. These rational and calm assessments are honest and accurate, but they also do not replace the human emotion of hearing news headlines, seeing market craziness, and just generally being concerned.I say this from the bottom of my heart: Properly constructed investment plans like the ones our clients have do not warrant an emotional reaction. I would not feel good about being over-levered in certain parts of the market right now, but there is not a single holding in Core Dividend I am bothered by owning today – not one. There are a lot, though, that I hope we may get to buy more of soon!

We are here to help with any questions, to make sense of things, to drive a response that is appropriate and prudent. To those ends, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.