Dear Valued Clients and Friends –

I hope everyone had a wonderful holiday weekend, and I hope everyone is as excited for the month of December as I am. Winter has arrived in New York City, and I am loving this cold. I also am loving the busy week ahead and going around the horn in today’s Dividend Cafe (a few days off with family is lovely but I really love Mondays)!

We did a special Thanksgiving Dividend Cafe last week, as we always do Thanksgiving week. The written version is here (my favorite), the video is here, and the podcast is here.

I am grateful to the American Institute for Economic Research, which published a very lengthy white paper from yours truly last week on the mythology of financialization and what the topic means (and doesn’t mean) when it comes to the U.S. economy.

Off we go …

|

Subscribe on |

Market Action

- The market opened down -100 points and stayed around there throughout the day, at one point getting down as much as -200 points.

- The Dow closed down -129 points (-0.29%) with the S&P 500 up +0.24% and the Nasdaq up +0.97%

*CNBC, DJIA, Dec. 2, 2024

- The Dow was up nearly three thousand points in November (from 42,000 to almost 45,000, so +7.2%), and the S&P 500 was up +5.8%, but the small-cap Russell 2000 was up a stunning 11% (on the month!).

- One of the more interesting things in November markets: Emerging markets equities were down, but Emerging markets bonds were actually up quite nicely.

- The ten-year bond yield closed today at 4.19%, flat on the day after at one point being up 5bps

- Top-performing sector for the day: Communication Services (+1.45%)

- Bottom-performing sector for the day: Utilities (-2.08%)

- 77% of companies in the S&P 500 are above their 200-day moving average; breadth has vastly improved in the market. Financials and Industrials have become the leaders in the market, with Technology middle of the pack.

- Consumer Staples and Health Care have understandably been the laggards (who needs defensives when small-cap and cyclicals are charging like this). And these defensive sectors lagging is one of the things I am most excited about going into 2025.

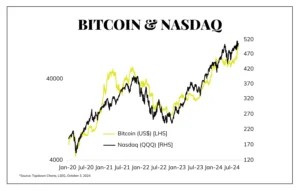

- There is a question in Ask TBG below about Bitcoin, but before we get there, allow me to say that I think I may have accidentally sneaked up on a startling revelation about what drives Bitcoin’s price … who would have guessed?

- See Public Policy below for a comment on markets and tariffs.

Top News Stories

- President Biden pardoned his son, Hunter Biden, who was facing sentencing on felony convictions for tax evasion and gun charges. The pardon covers any crime that may have been committed going back to the beginning of 2014.

- President-elect Trump selected Kash Patel to serve as the new FBI Director. This selection promises to be a noisy confirmation fight with some ambiguity around how current director Christopher Wray will be asked to leave.

Public Policy

- One of the most interesting things to me, so far, in President-elect Trump’s policy declarations about tariffs (again, so far) is how they are connected exclusively to non-economic domestic policy issues (i.e., stopping fentanyl trafficking and securing more support from Canada and Mexico around the border). The rationale has not yet moved into protectionist domain.

- President Trump said this weekend that he would impose 100% tariffs on any country threatening to participate in a new currency (so-called BRICS countries looking to disintermediate the dollar). I am not clear whether or not the stronger dollar or a lesser trade deficit is the priority agenda item, but if I am being honest, I think it is more the flex. The international cross-border payment system the dollar enjoys is decades ahead of competitive currencies. I may not think some of these comments and threats reflect the most sophisticated understanding of trade and capital flows, but I do think the whole topic reinforces something very few are focused on: Trade and tariff conversation in 2025 is going to involve currency, as well. Mark my words.

- I don’t know this, but seeing Justin Trudeau of Canada in Mar-a-Lago this weekend (and subsequent tweets after the dinner) and hearing of the call between Trump and Mexico’s President Sheinbaum, I suspect there will be no tariffs on Canada or Mexico imposed at all after the inauguration, but rather that there will be some sort of cooperation formed ahead of time that provides the concession Trump is looking for.

- Last Wednesday, it was announced that Jamieson Greer was selected as U.S. Trade Representative, meaning Robert Lighthizer was not selected. With Treasury, Commerce, NEC, and now USTR selections all made, the question at this point is whether or not Bob Lighthizer will have any role in the new administration (it appears not). This is significant because he was generally considered to be the most protectionist of the various advisors on matters of trade to the President. However, it should be noted that Greer was Bob’s Chief-of-Staff in the last administration and is generally considered to be a protege of his.

- One of the most common questions circulating in markets, the media, the world of punditry, and even in political circles: Why are markets not more worried about Trumpian tariff threats? Bloomberg wrote a whole piece on it and interviewed yours truly (amongst others). I, of course, have had plenty to say about this going back months, mostly highlighting my general take that (a) There is risk, but (b) Markets see the more likely scenario as being tariffs as a threat to extract concessions, and (c) If they do go forward and markets react negatively, Trump is likely to respond to markets and not persist. I believe the market’s response to Scott Bessent as the President-elect’s choice for Treasury Secretary reinforces this theory of the case. No one has been more vocal in proclaiming tariffs to be a negotiating tactic than Bessent. He has gone so far as to say, “My general view is that at the end of the day, [President Trump] is a free trader. It’s escalate to de-escalate.” This could all prove wrong. Clarity and consistency are hardly things I associate with the Trumpian moment. But it is the best theory of the case we have right now.

- Jay Bhattacharya has been named the National Institute of Health Director. The good doctor out of Stanford University is known for his work with the Great Barrington Declaration during the pandemic.

Economic Front

- Durable goods orders rose +0.2% in October, less than expected. Orders on the year are up +2.7% but excluding transportation, just +1.5%.

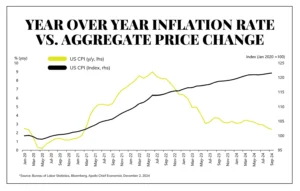

- The year-over-year inflation rate has reverted back to the ~2% range the Fed has targeted, and probably lower than that if the shelter figure were properly weighted or properly calculated. However, the aggregate price change since the beginning of 2020 is still 22% higher (i.e. +30% cereal, +32% electricity, +52% car insurance).

Housing & Mortgage

- The percentage of homes bought by first-time homebuyers this year was an all-time record low of 24%. This is a gross statistic.

Federal Reserve

- No real change in the futures market – still a 62% chance of a quarter-point rate cut in December.

Oil and Energy

- WTI Crude closed at $68.13, up +0.19%

- MLPs were up a stunning +4% last week, even as the overall midstream space was up less than +1% on the week. A fascinating thing about MLP returns in November? Up +14.6% on the month in November 2024, this is the best month for MLP’s since … November 2020, the last Presidential election month (when they were up +23.8%). Do MLPs like Presidential elections?

Against Doomsdayism

- There were so many points of inspiration in this week’s reading that I decided to link to the entire article, so you could read for yourself and cherry-pick which rational point of progress and aspiration most pulls you from the fallacy of doomsdayism. Every week, we all can “take our pick,” – but this week’s link is just overflowing.

Ask TBG

| “What do you believe will be the derailing of Bitcoin and others? Is the Tulip story the analogy here? Or is the value in the blockchain platform?” ~ Harvey S. |

| The most important thing I can say is that I have no opinion as to whether or not this goes to $20,000 or $200,000 – I believe it could see both and neither. I do not expect it to hold value over time because the value is 100% dependent on others believing it has held value, and confidence games do not end well in my study of history. The arguments I have heard in recent months about a federal government reserve fund of bitcoin is laughably stupid, and primarily being promoted by grifters. The blockchain is a tool, and one I should add is hardly limited to one “crypto currency.” Whenever something becomes “cool” the cult of coolness runs price for a while, until it doesn’t. There is less argument for the efficacy of this as a medium of exchange now than there was two years ago, which is saying something. And furthermore, the leveraged ownership is through the roof (like margin buying, only without a real business involved). So on one hand, I offer no prediction at all about when or what this “derailing” takes place; and on the other hand, I suspect it ends with a lot of people very hurt. |

RIP to the great Art Cashin, who led floor operations at the New York Stock Exchange and is nothing short of a Wall Street legend. Art worked at the same firm I started my career at for over forty years, and prior to that rushed into this career by necessity when his dad died very young. He had me from hello. He was a historian, a storyteller, a Luddite if there ever was one (no computer, no phone, no email, no credit card), and he loved the business of Wall Street. Loved it. And I loved him. One of the most likable people Wall Street has ever had the privilege of calling its own. RIP, a life well-lived.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.