Dear Valued Clients and Friends –

There is a lot here today because I think what I have to say this week about “market euphoria” is important, and yet there is all the normal “around the horn” material, as well.

Dividend Cafe went into an update on new economic appointments from the incoming Trump administration and sought to analyze current expectations for tariffs in light of Trumpian policy objectives (and current personnel). The written version is here (my favorite), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

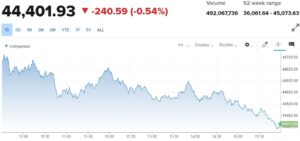

- The market opened up +70 points, with the Nasdaq and S&P opening down a bit and all indices worsening throughout the day, especially in the last hour.

- The Dow closed down -241 points (-0.54%,) with the S&P 500 down -0.61% and the Nasdaq down -0.62%.

*CNBC, DJIA, Dec. 9, 2024

- Technology and Health Care are estimated to represent 50% of the year-over-year earnings growth in the S&P 500 next year. Back of napkin, round figures only, the S&P kicked off just over $2 trillion for 2024 (including Q4 estimates) and is expected to kick off just over $2.3 trillion next year, with $100 billion of that $300 billion profit growth expected to come from Tech, and $50 billion expected to come from Health Care.

- The ten-year bond yield closed today at 4.20%, up 4.6 basis points on the day.

- Top-performing sector for the day: Health Care (+0.22%)

- Bottom-performing sector for the day: Financials (-1.41%)

- Apparently, China is doing some investigation or something or another regarding Nvidia, and the stock is down today. But just as a point of note, Nvidia is up +1.8% since the election (before today), while Tesla is up +54%, and the market is up over +5%. The Mag 7 have all been up since the election, and in total, more than the market, but not in anything close to equal or monolithic fashion.

- I can’t keep commenting on market euphoria and other “sentiment” indicators that (a) point to what we historically think of as excessive optimism or risk complacency, and (b) I freely confess to believing have some contrarian utility without discussing what I believe it supposed to be done about it. When you see something like this chart below, or a VIX below historical levels, or a P/E above historical levels, or a put-call ratio well below historical levels, or credit spreads below historical levels, does it give one pause about the state of market pricing? I would imagine so, and for any who have read any bit of history or been an investor longer than a few minutes, I can understand why. But what does that mean? What is one supposed to do about it? This is perhaps the most important thing I can thing say: If your investment portfolio is constructed correctly, not very much. The asset allocation one has in their portfolio is the thoughtful weighting of various asset classes that diversifies according to the targeted risk/reward blend, cash flow needs, liquidity needs, tax status, age, and comfort level with volatility that all serve to form a coherent portfolio strategy for you. That risk assets are sometimes over-valued is no more a surprise to me or a disruption to an intelligently designed portfolio than the fact that they are sometimes under-valued. It is, as we say, in the cake. Now, if it is data to be ignored, why do I bring it up all the time? Well, candidly, because a lot of you are not our clients, I do not take for granted that your asset allocation was designed as previously described. And because if I am right, which I am, that the vast preponderance of an investor’s success is connected to their behavior over many years of investing, then expectations matter. Therefore, understanding one’s exposures and risk levels matters. Their general awareness of and preparation for sentiment matters. Those with inadequately allocated portfolios ought to address such. Those with properly allocated portfolios ought to have a refresher in how these assets are designed to behave … And at all times, from my lips to God’s ears, these things matter so that you will have a better chance of being one of the ones who is winning in such times, not one of the people helping the winners to win.

Top News Stories

- The major news event of the weekend played out on the world stage as Syrian dictator Bashar Al-Assad was removed from power. He and his family fled the country (shockingly, to Moscow), and the rebel forces took over Damascus.

- *I rarely use the word shockingly without irony and sarcasm

- It has to be said for perfect clarity in a day and age that is often devoid of clarity, especially moral clarity, Assad was a brutal, repressive, criminal, terrible figure guilty of awful crimes against humanity. This does not mean that the insurgency group are good, or even desirable people. This does not mean that the overall situation in Syria is not deeply complex or problematic. It does not mean a new and unsettling level of uncertainty with absolute connection to and implications for Russia, Iran, Israel, Saudi Arabia, and more is not to be expected. It just means, in no uncertain terms, a brutal actor is now gone.

- The incoming Trump administration’s nominee for Defense Secretary, Pete Hegseth, appears to have his chances for confirmation resurrected over the last 4-5 days.

- Police announced the arrest of the prime suspect in last week’s murder of the United Healthcare CEO outside the midtown Manhattan Hilton Hotel.

Public Policy

- A federal appeals court ruled that Congress does have the power to shut down TikTok, meaning that the federal law already passed to force its shutdown (if Chinese ownership is not divested) is set to take hold. Now, there are things President-elect Trump can do to delay, derail, or diminish this ban, but what will happen here is sort of unclear. He could simply refuse to take action against service providers who host and run the popular app. He could lobby Congress to reverse the bill they already passed, but it is not clear that he faces legislative success. More than likely, he could pray the enactment is delayed by appeal and that the Supreme Court does the work for him here or that while that delay and appeal play out, some sale event is brokered.

- The top 1% of income-earners in our society do, in fact, earn 26% of all income earned in society. But, they pay 46% of all federal income taxes (adding in the state tax numbers makes the disproportionality worse). The middle class, defined as those in the top 50-75% of wage earners, earns almost 18% of all income but pays 8.4% of all federal income taxes.

Economic Front

- The November jobs report reflected 227,000 new jobs created for the month (just a tad above consensus). The September and October revisions were to the upside, being increased by +56,000. The unemployment rate increased to +4.2%. Hourly earnings were up +0.4% and, on a year-over-year basis, are up +4.0%.

- The jobs number last month was skewed by the hurricane and revisions were inevitable. Civilian employment (which includes small-business start-ups) was down substantially (a consistently inconsistent number)

- Used car prices are dead flat year-over-year in the latest Manheim vehicle index report.

Housing & Mortgage

- SL Green had said it wanted to lease 2 million square feet of office space in New York City this year. It ended up leasing 3.5 million square feet. Thirty million square feet of office space has been leased out across NYC this year, the highest in six years. The old and severely antiquated office space in NYC is hurting, but demand is extremely high, and for good space, it is very costly. Premature demise expectations, again.

Federal Reserve

- I read a piece this weekend suggesting the Fed may need to hike rates in 2025 – the opposite of the debate over how much they will be cutting – because they have to deal with an economy that “keeps growing” (heaven forbid, he was bemoaning +2.8% annualized growth in Q3 and the Atlanta Tracker suggesting +3.3% in Q4). All of this malarkey comes from the insane – utterly insane – concern that economic growth is inflationary. It is no such thing, and out of that error comes the worst form of monetary economics.

- In the meantime, the fed funds futures are suggesting that there is a 85% chance of a rate cut in the FOMC meeting next week.

Oil and Energy

- WTI Crude closed at $68.14, up +$0.94 or +1.40%.

- Midstream dropped about -3% last week as Utilities were down about -4%.

- The annual Wells Fargo midstream conference takes place in midtown Manhattan this week.

- The following was in Friday’s Dividend Cafe but warrants a re-post here as we digest the most important things to say about Oil and Energy:

“OPEC+ announced another delay in raising their oil production quotas, this time putting it off until April. Another way of saying this is that they are [allegedly] holding back on what they otherwise would be [allegedly] producing at the pump. The estimates are that they are holding back in supply about 6% of what is needed to meet global demand. Now, why am I skeptical that there is really another 6% need for supply to meet demand, and that OPEC+ is refraining in order to boost the price they achieve on that other 94%? Because oil prices are sitting at $67/barrel, down from the low-80’s where it spent much of 2024 and down from the mid-70’s where its average was in 2024. I just don’t believe supply-demand imbalances like that are met with lower prices. The more reasonable assumption here is that if OPEC+ were producing 6% more than they are, oil prices might be $60-62, not $67-69.

All of this forces a great question: Is the new Trump administration really going to get a “drill baby drill” dynamic in immediate and current oil production? Do U.S. producers want to turn up the production spigot with prices in the 60’s? I don’t believe they even can, let alone will. Increased production has to become a policy mantra around capacity and around control (serving as the marginal producer for global needs, not ceding that control to OPEC+). But immediate increases in daily supply and prices in the 50’s or low 60’s? I would be shocked, but I guess I am often shocked.”

Against Doomsdayism

- Education and Health Care may cause hours to have to be worked for the services received fifty years ago, but for the vast majority of goods, workers can buy more goods now for the same time output as then. The time price has dropped for most things, meaning Americans can work fewer hours for the same things or the same hours for more things.

Ask TBG

| “Do you agree with the economic theory that printing more money cannot change the fundamental nature of the economy and that relative prices adjust flexibly and always toward equilibrium? In other words, do you agree that changes in the supply of money do not appear to change the underlying conditions in the economy.” ~ David H. |

| It is a preposterous theory that very few people take seriously at all. Changes in money supply proportionate to changes in the size of the economy do not change conditions in the economy. However, changes in money supply disconnected from the size of the economy (supply of transactions) have profound effects on the economy. |

I will leave it there for the night. As always, reach out with any questions at any time.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.