Dear Valued Clients and Friends –

I know we had a Dividend Cafe on Friday, but in a lot of ways, today feels like the real beginning of 2025 to me. The Year Behind, Year Ahead white paper is coming out Friday, and today, we do our standard Monday “around the horn.” …

The Dividend Cafe on Friday was shorter than normal but provided a perfectly prescient look at the Speaker of the House drama in the White House (it took three hours for my baseline case to become reality), a bipartisan critique of the Nippon/U.S. Steel drama, a hard look at the fatal flaw of “thematic” investing, and all kinds of fun. The written version is here (my favorite), the video is here, and the podcast is here.

I was on Hugh Hewitt’s morning show just before the President-elect was this morning talking about the complexities of the planned omnibus tax and reconciliation bill.

Off we go …

|

Subscribe on |

Market Action

- The market opened up a hundred points, got up +400 points, and then spent the second half of the day giving all of that up.

- The Dow closed down -25 points (-0.06%), with the S&P 500 up +0.55% and the Nasdaq up +1.24%.

*CNBC, DJIA, Jan. 6, 2025

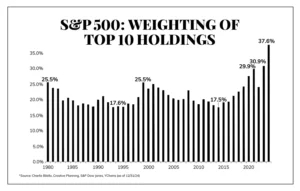

What S&P index investors currently own:

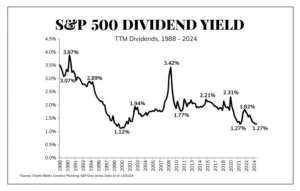

Also what S&P index investors currently own:

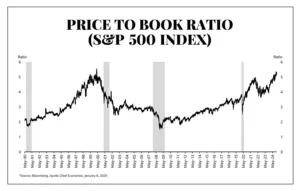

And one more:

Recap: The dividend yield of the S&P 500 is at an all-time low, the price-to-book ratio is at an all-time high, and the concentration of the top ten companies is at an all-time high

- The ten-year bond yield closed today at 4.62%, up three basis points on the day

- Top-performing sector for the day: Communication Services (+2.13%)

- Bottom-performing sector for the day: Real Estate (-1.40%)

- Currency volatility has been elevated as of late, even as stock and bond volatility has more recently subsided

- The 2/10 spread is now 35 basis points, the widest in a very long time

Top News Stories

- Speaker Michael Johnson was confirmed for the new session of Congress as the renewed Speaker of the House. Three Republicans voted no in a roll-call vote on the first ballot, which would have forced a second ballot (he could only lose one Republican vote), but two of the three no-votes switched their vote on the floor to allow Johnson to go through on the first ballot.

- Prime Minister Justin Trudeau of Canada resigned today. The Canadian dollar rallied 1% on the news, which is the equivalent of when a CEO retires and the stock price rallies.

Public Policy

- As was discussed at length in Dividend Cafe on Friday, President Biden blocked the Nippon Steel acquisition of U.S. Steel. Treasury Secretary Janet Yellen, Secretary of State Anthony Blinken, Ambassador to Japan Rahm Emmanuel, and CEA Chair Jared Bernstein all recommended approving the deal.

- The most significant policy development of the weekend is the shift in strategy for the Trump 2.0 agenda to attempt one large reconciliation bill which would incorporate his immigration, tax, and energy agenda all together, as opposed to the prior discussion of delaying a tax bill through budget reconciliation until later in the year, and pursuing an easier, single bill now. If they do, indeed, proceed with a “one-bill” approach, I suspect it will take a few months to put together. A two-bill approach may have seen the first bill come together quicker, but the second part of the bill (the tax portion) gets pushed to near the end of the year.

- A factor in the potential change of strategy? Not so much fear that a second bill focused on tax would not succeed, but rather than uncertainty about a tax package (by delaying it all year) would hamper economic progress throughout the year. Whoever is making that argument sounds like my kind of economic thinker.

- Indications are that some of a mega-reconciliation bill pay-for will come from a border adjustment tax (initially discussed and discarded in 2017) that charges a cash flow tax on corporations that rebates exports but charges a tariff on imports (exempting energy refiners). I am trying to get more information on the thinking and discussion here.

- All this said, President Trump did state today that he preferred one big bill, but would be open to two bills. Nothing is set until it is set.

Economic Front

- Credit card debt as a percentage of disposable income is less than it was before the pandemic.

- The ISM Manufacturing Index increased to 49.3 in December (the highest in nine months), getting very near the 50 level that indicates expansion (below 50 indicates contraction). New Orders increased for the fourth month in a row.

Federal Reserve

- We are close to a 100% chance of no rate cut this month (93% in the futures market), and at this point are looking at a 44% chance of one cut by JUNE, and a 21% chance of two cuts (the rest being no cut).

Oil and Energy

- WTI Crude closed at $73.43, down -0.72% on the day

- Midstream ended 2024 and began 2025 up +3.4% last week. December was the worst month of the year for midstream (same as 2023), but it was still a substantially big year for the sector, up well over 40% on the year. MLPs only did not fare as well (still up around 24%), but the sector with MLPs, corporations, and Canadians together had a blockbuster year. As has been mentioned in recent weeks, this represents the fourth year in a row of the space being up over 20%.

Against Doomsdayism

- Substance abuse and alcohol consumption amongst teenagers is fast declining. Now, it is declining from truly depressing levels, but the “things have never been worse” narrative has no grounding when it comes to the level of teen drinking and drugging in the 70s, 80s, and 90s compared to now. If we could just get the phone consumption to decline …

Ask TBG

| “I noticed some of your Dividend Growth strategy literature mentions a preference for essential service companies. Is that true of every name, or does it also sometimes make sense to incorporate Industrials within the portfolio?” ~ Mike F. |

| We do own Industrials, and I am not sure why industrial companies do not make goods or services that are essential. I would not see those two categories as mutually exclusive. We do tend to have less cyclicals than non-cyclicals and generally see consumer staples, health care, utilities, and REITs as being less prone to cyclicality and, hence, a reliable source for reducing beta. But the “essential” argument is more about “things that matter all the time” versus “discretionary” (i.e. consumer luxury goods). Our portfolio has a strong bias for more durable, defensive, and non-cyclical components, even though certain companies and sectors certainly will have more cyclical characteristics than others. |

On Deck

- A pretty comprehensive and granular portfolio breakdown is on deck this Wednesday in the client Weekly Portfolio Holdings Report

- And yes, this Friday, the annual Year Behind, Year Ahead white paper in this very Dividend Cafe

Reach out with questions any time!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.