Dear Valued Clients and Friends –

There is so much Public Policy today it may feel like other sections were crowded out, but the truth is in Markets, Housing, and Energy you are getting your money’s worth today, as well.

Dividend Cafe on Friday looked into the mentality and incentives of money managers that would cause them to hug an index they no longer believed in. Incentives matter. It also looked at some fascinating market history, a fundamental analysis of the energy sector, and more. The written version is here (my favorite), the video is here, and the podcast is here.

Barron’s interviewed me for a weekend piece on valuation challenges in the market and surfacing bubbles in the tech sector. I also was on Fox Business today talking about the market and the election, DEI, and things.

Off we go…

|

Subscribe on |

Market Action

- The market opened up over +250 points today but then gave that back within the first ninety minutes of trading and stayed in modestly positive territory throughout the day.

- The Dow closed up +50 points (+0.13%), with the S&P 500 up +0.27% and the Nasdaq up +0.83%.

*CNBC, DJIA, July 1, 2024

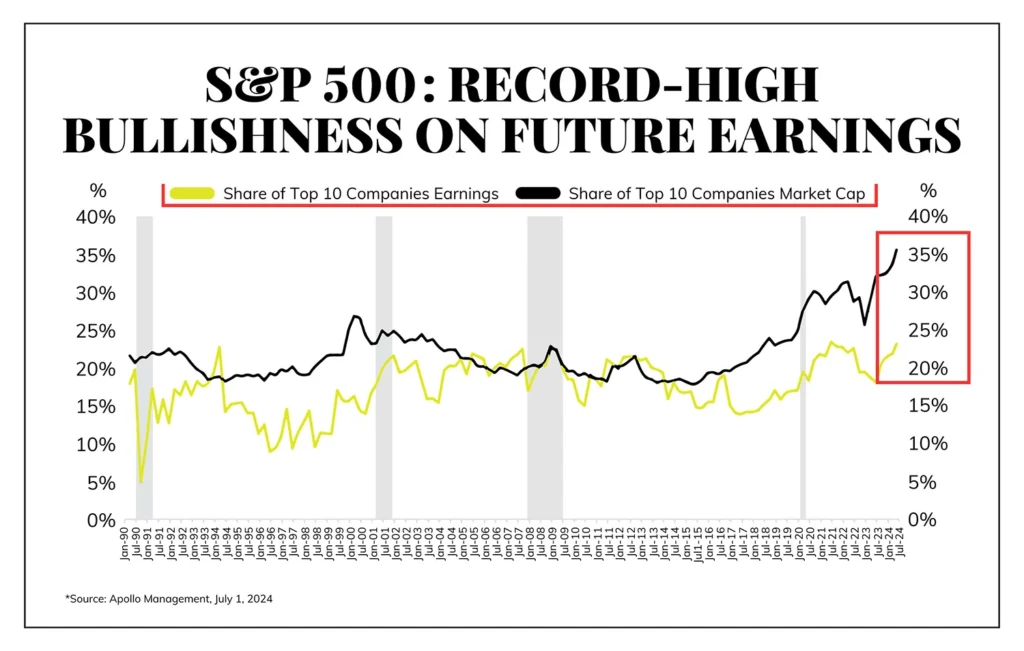

- I doubt I could come up with a more profound chart than this one:

- The ten-year bond yield closed today at 4.47%, up 13 basis points on the day (and a violent sell-off for bonds the last two market days)

- Top-performing sector for the day: Technology (+1.3%)

- Bottom-performing sector for the day: Materials (-1.55%)

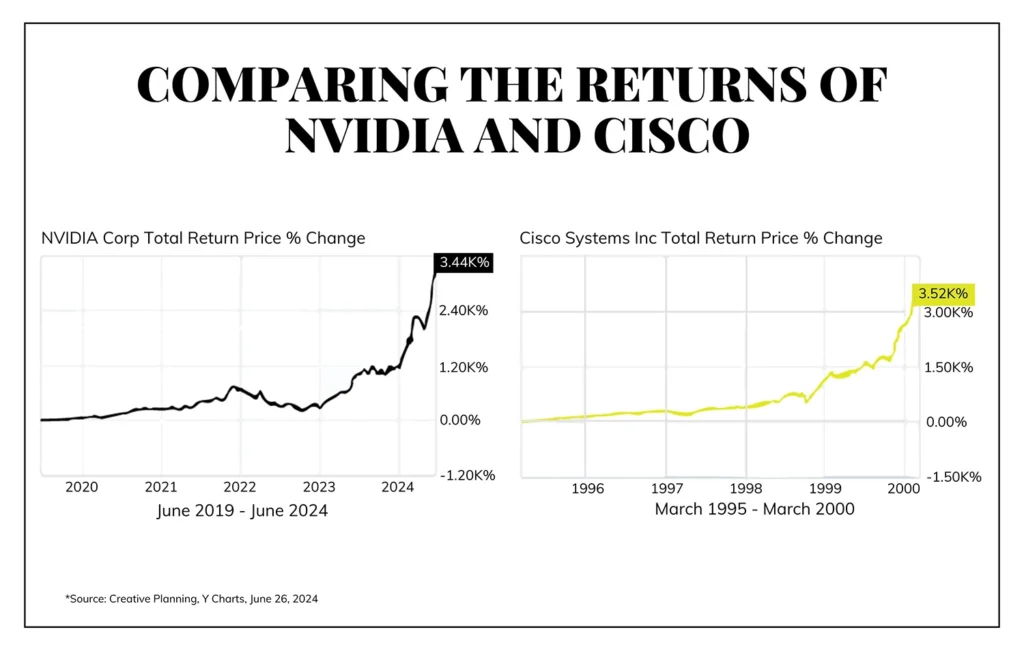

- Nvidia has perfectly matched Cisco’s +3,500% return in exactly five years.

Top News Stories

- The Supreme Court today ruled that Presidential immunity does apply to official acts taken while in office but does not apply to “unofficial acts.” This surely delays a good portion of the charges brought against former President Trump by prosecutor Jack Smith and sends things back to the lower court in the meantime.

- While everyone is talking about a U.S. election over four months away, Marine Le Pen’s National party in France looks posed to take a massive plurality in the French government, perhaps tripling or even quadrupling the representation President Macron’s coalition will have. An outright majority is unlikely with three parties represented, but a plurality above 40% looks almost assured.

Public Policy

- There has been more conjecture in the media and across the land about the aftermath of Thursday night’s debate than is humanly comprehensible, so the last thing I need to do is pile on here. What people believe will or will not happen from here is not my concern, let alone what people think should or should not happen. My concern is where it all impacts markets and the economy.

- President Biden appears very determined to stay in the race, and my sources, who I cannot name and who I trust to know things more than anyone I could ever read in the press, tell me he is not going anywhere. Obviously, things can change, but there are reasons I now believe he will be the nominee.

- Betting odds have moved to a 60% chance of President Trump being elected, but betting odds are what they are, which is sometimes right and sometimes wrong. The more interesting thing is that the 40% chance of the Democrat winning is actually not the whole story because President Biden is only at 30% (meaning the implied chance of a different candidate winning is 10%).

- I could have put this in the Energy section below, but if I were to speculate on any market response from the debate Thursday night, it would have been in the LNG space on Friday, where the likely correlation between a rally in the stocks that benefit from LNG permitting and the debate results seems more plausible.

- All the debate talk has distracted from the biggest development of the week—the so-called Chevron ruling from the Supreme Court on Friday. This ruling will force Congress to write clearer laws and not allow such broad expansionary authority for federal agencies. Marginally, this is a deregulatory result that markets should appreciate over time.

- The IRS and Treasury Department announced last week that partnerships will no longer be allowed to move liabilities from one entity to another to maximize tax deductions and that transactions that “lack economic substance” will be more scrutinized in future audit efforts. Much of this effort has to do with transfers meant to optimize basis within partnership entities.

Economic Front

- The Personal Consumption Expenditures (PCE) Index was up +2.6% year-over-year, in line with expectations and strikingly close to the Fed’s target. The +0.1% move on the month was also in line with expectations. It should be pointed out goods prices were DOWN -0.4% on the month, and are down -0.1% on the year.

- June ISM Manufacturing fell a tad, down to 48.5 from 48.7. It has only been above 50 one month in what will soon be two years (50 and above is expansion). 8 out of 18 industries saw net positive growth so breadth wasn’t terrible.

Housing & Mortgage

- Yes, pending home sales were down another -2.1% in May (after being down -7.7% in April), but the bigger development is that they are now below the April 2020 COVID shutdown level. Fewer houses are selling now than when the whole country was locked down and shut in place.

- Per Redfin, for the first time since spring 2020, the typical U.S. home sold below list price in June. The average closed selling price was -0.3% below listing price in June (an average obviously meaning there are plenty above list and plenty below it, but the average leaning into a negative number is quite a move from the more regular dynamic the last few years of houses closing above list price).

- With listings up +8.2% nationwide (versus last year), but closings down -4.3%, listings are stacking up, and time-on-market is finally shooting higher (early innings of classic moves away from a seller’s market).

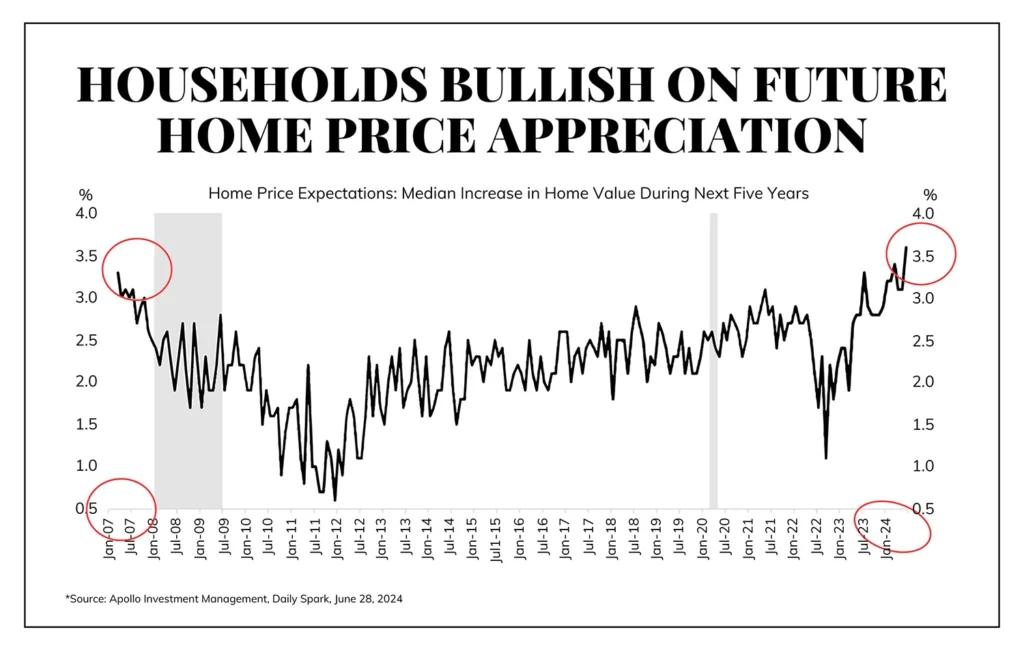

- I am just doing my part to keep this in front of people:

Federal Reserve

- Not a lot of changes this week—the futures market still suggests a 35% chance of a rate cut in September, a 77% chance by November, and 94% by December.

Oil and Energy

- WTI Crude closed at $83.38, up $1.84/barrel (+2.26%)

- Midstream energy rallied significantly last week, up +2.5% or so on the week across various midstream and MLP indices, despite flat equity markets, higher bond yields, and not much movement in commodities.

- This closed out what was a very good June in the midstream space, where MLPs have been positive 11 of the last 13 years, but the broader midstream space only positive 8 out of the last 13 years (due to weakness some of those years in the Canadian names) – h/t Hinds Howard.

- MLPs have been up eight quarters in a row, which is pretty crazy. It has now been annualizing at 22% per year for the last three years, but since the cherry-picked bottom during COVID (March 2020), the MLP space has been up +470% (51% annualized). Also, h/t Hinds Howard.

Against Doomsdayism

We are now to Law #6 of the Seven Laws of Pessimism from Maarten Boudry.

#6 The Law of Self-Effacing Solutions: Once a solution has been achieved, people forget about the original problem (and only see further problems).

Progress becomes invisible over time as standards get raised to accommodate the “new normal.” On top of that, solutions do generate new problems over time, and yet as we focus on the problems that a solution may organically create, our minds completely tune out the fact that the new problem came because of a solution that eradicated another problem (usually a much worse one),. New problems still mean progress when we consider that the previous problem was worse than the current one, but our minds are focused on the new problem, not the memory of the old one. Many things we bemoan are “side effects” to other larger problems that we solved.

Ask TBG

| “What do you make of the data that shows the lion’s share of new [net] jobs created in recent years being from those who are foreign-born?” ~ Kevin H. |

| A lot of it has to do with the fact that baby boomers are the ones of age who are leaving the workforce for retirement, and those who were born 60, 65, and 70 years ago were, at that time, almost entirely native-born in our country. Therefore, the percentage of the population at birth 65 years ago was so little in the foreign-born category that the net labor force number now is disproportionately benefiting from immigration, while boomers pull the net number down (that is, boomers who were predominantly native-born). There are other factors, too, marginally, but this is far and away the largest contributor to the current data. |

On Deck

- We will have a special mid-year check-in in the Dividend Cafe this week, and it will come on Wednesday the 3rd, this week, due to the Fourth of July holiday on Thursday and likely long weekend many will take ahead.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.