Dear Valued Clients and Friends –

A trip around the horn today, with a bigger focus on Policy than our other normal categories …

Dividend Cafe on Friday did a deep dive into the new tax and budget bill known as the “One Big Beautiful Bill Act.” The feedback has been, shall we say, plentiful. The written version is here (my favorite), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

- Markets opened down nearly a hundred points today and just puttered around from there throughout the day.

- The Dow closed up +88 points (+0.20%) with the S&P 500 up +0.14% and the Nasdaq +0.27%.

*CNBC, DJIA, July 10, 2025

- Earnings season kicks off tomorrow with a barrage of financial companies reporting over the next couple of days. I am very interested to see where M&A appears to be headed and where appetite is for corporate finance activity in light of deregulatory ramp-up. Of course, other big themes throughout this earnings season will be where things are in the AI Capex world and where tariffs are impacting activity, prices, and hiring.

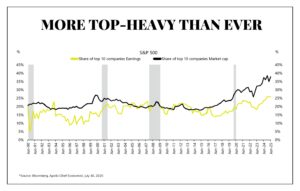

- Ten companies in the S&P 500 (2% of the companies) are now a record high 40% of the S&P 500’s market cap. The delta between the weighting of these companies in the index and the earnings they represent is staggering.

- Nvidia at a $4 trillion market cap is a staggering 3.6% of global GDP. In 1999, at its peak, Cisco was 1.6% of global GDP. (h/t Peter Boockvar)

- The ten-year bond yield closed today at 4.43%, flat on the day.

- Top-performing sector for the day: Communication Services (+0.73%) and Financials (+0.67%)

- Bottom-performing sector for the day: Energy (-1.20%)

- As much as everyone feels the Mag 7 is carrying the market and is the place to be, as a group, it is down -3.5% since its high in December. YTD, Apple is down -15%, Tesla is down -22%, and Google is down -5%.

Top News Stories

- The President announced this morning that the U.S. is ramping up the missiles it will provide Ukraine (through NATO) as his frustration with Vladimir Putin intensifies.

- It appears a Senate bill imposing much stricter sanctions on Russia is going to get to the President this week and this could be a catalyst for new administration action. The administration is talking about sanctions on countries that sell Russia oil.

Public Policy

- The biggest question in markets now, with a barrage of daily tweets and threats about tariffs, is what is going to actually happen. It appears that the President believes markets are now more comfortable with sky-high tariff taxes than they were a few months ago, while most market analysts (present company included) believe market apathy about the various tariff threats stems from disbelief that they will happen. To the extent that a baseline tariff of 15-20% was implemented, this would mean $500-650 billion in new taxes the economy would have to absorb. To the extent anyone believes that would (a) actually happen, and (b) not come at a cost to markets and the economy, I have a bridge (made with imported steel and copper) to sell you. That level of tariffs would double the total taxes paid by businesses in America. Now, again, the economy is not impacted by talk and threats. If these things don’t happen, then it is correct that there is no impact. But if there is still a question as to whether or not an actual $600 billion hit to the economy would matter, let’s just save a lot of time for everyone. The answer is yes.

- The latest threats for those trying to pay attention include:

- A 30% tariff on all imports from Mexico, besides automobiles

- A 30% tariff on all European imports, besides automobiles

- A 50% tariff on all copper imports (this one perhaps being the most insane of all of the threats being floated; copper, by the way, has averaged $4.75/lb for the last six months; it has hit $5.50 over the last few days, a quick spike of over +15%). This, of course, impacts semiconductors, construction, appliances, batteries, data centers, transportation, and industrial equipment. And it is a perfect storm of bizarre because (a) We make plenty enough to not be able to remotely claim that our military or national security needs are compromised, and (b) We do not make enough to meet these other commercial needs, making tariffs both totally unhelpful to critical infrastructure, and deeply burdensome economically.

- The European Union announced it will not be imposing retaliatory tariffs at this time because it believes a deal will be struck in the next 2-3 weeks

- There are more and more murmurings about a second reconciliation bill later this calendar year. Senate Majority Leader John Thune has hinted that the possibility exists of a second bite of the apple, with greater reduction of spending and more tax code simplicity to be pursued. I think it is worth noting that the chatter about a second reconciliation bill is not accompanied at this time by even theoretical particulars.

Economic Front

- The CPI number for June will come out tomorrow morning, and the PPI number will come out Wednesday

Federal Reserve

- The President said last night “we should have the lowest interest rates on earth.” I am hopeful he doesn’t know something about recessionary conditions that we do not know.

- As much as I do not want to believe the administration is seriously preparing to fire Chairman Powell over the pretext of “cost overruns in the Fed building renovation,” I confess that I am slightly worried it is being set up to happen. The more likely scenario is that they have used this nonsense to pressure Powell to resign, but that it will not work. I remind you of Powell’s response to the House Finance Committee when asked if he would leave his seat early under pressure from the President:

“I will never, ever, ever leave this job voluntarily until my term ends under any circumstances. None whatsoever. You will not see me getting in the lifeboat.”

Oil and Energy

- WTI Crude closed at $66.95, down -2.2% on the day.

- Midstream was down about -1% last week, with no real correlation to equity markets or oil or gas or other energy stocks

Ask TBG

| “While I generally agree with you [about the OBBBA and the national debt], there seems to be a contradiction in your stated goal: that of reducing federal debt. A $2 trillion dollar tax increase would have gone a long ways to solving our deficit spending problem but you claim this would be undesirable as it would result in a recession. If all we have to do to solve the federal debt problem is endure a recession, on what grounds do you object? Is not a recession for a year or two (or even three) a small price to pay to avoid the alternatives?” ~ A.B. |

| Can you give me an example of a recession that increased revenue to Treasury?

Can you give me an example of a recession that was not met with public demand for more government spending? Can you give me an example of a recession that created higher trendline growth, the kind that results in sustained revenues needed to feed government debt? If revenue to Treasury is the problem (the poor, undertaxed Americans), why has tax revenue as a % of GDP not moved, even as spending as a % of GDP has skyrocketed? Wishing for recessions is something those of us with assets can do. Poor and middle-class people do not have the luxury of cosplaying about the benefits of a recession. Wishing for people to lose their jobs despite the historical certainty that it leads to more indebtedness in the end is not a solution I feel morally or economically willing to embrace. |

On Deck

- Earning season kicks off tomorrow, and clients will receive their Weekly Portfolio Holdings Report on Wednesday morning per usual.

- Dividend Cafe this Friday will be a real blast from the past with a real lesson for the future. I will leave you in suspense beyond that, other than to say that it took the reading of three different books (on the same subject) to drive the inspiration for this Friday’s Dividend Cafe.

Questions are always welcome. Have a wonderful Monday night!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.