Dear Valued Clients and Friends –

A true around-the-horn day today across all of our normal categories!

Dividend Cafe offered a heartfelt letter of advice to young adults as we reach that graduation season of the year. The written version is here (my favorite), the video is here, and the podcast is here. High school, college, grad school, trade school, military, new job, new business – whatever the situation of transition may be, I hope there is something useful for everyone. Share liberally if you wish!

I will also point out that the digital team has created an archive on the home page of Dividend Cafe under “Get Smart” of the past issues of Dividend Cafe. Use this library as you wish, and we hope it is a valuable resource for you!

Off we go …

|

Subscribe on |

Market Action

- Markets opened flat today and went lower but then higher throughout the day to close out dead flat.

- The Dow closed down one point (0.00%) with the S&P 500 up 0.09% and the Nasdaq up +0.31%

*CNBC, DJIA, June 9, 2025

- Pretend there is no trade war or economic uncertainty, and all you have is a stock market in a good earnings environment (which we do), but with this:

- The S&P 500 has not yet made a new high, but it is not far from its February high levels (2.3% away), with the rapidity of the drop from mid-February through mid-April matched by the rapidity of the recovery since then.

- The ten-year bond yield closed today at 4.48, down three basis points on the day.

- Top-performing sector for the day: Consumer Discretionary (+1.08%)

- Bottom-performing sector for the day: Utilities (-0.66%)

- At this point the contrarian in me has no doubt a day of vindication is coming for small caps, but the exhaustion in this under-performance to big caps behind this extended multi-year period is pretty amazing. There is almost no attention being given to the space; flows are abysmal, and valuation deltas are absurd. But when it all reverses is anyone’s guess.

- As is generally the case in these types of things, the companies that may prove long-term winners if some resolution to these tariff/trade matters is found are those most adept at proactively passing on tariff impact to customers now, followed by tariff relief later (trade deals, reversals, etc.). Where that pricing power proves sticky, it results in expanded margins as these things organically play out

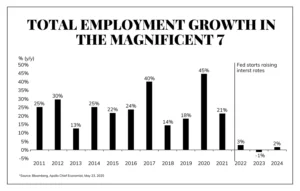

- I thought this highlighted the significance of low interest rates in fueling the Mag-7 moment. The headwind of a normalized rate environment (where we are now) has not been evident in the multiple and stock price action of Mag-7 these last two years, but it has been in employment. Ultimately, the go-forward realities of many (not all) of these names will prove to be different name by name and case by case (different revenue models, growth strategies, valuations, and more).

- It should be no surprise that the strongest currency action since the trade/tariff issues began are Taiwan (+11% vs. USD), Australia (+7%), Mexico (+7%), South Korea (+5%), the UK (+5%), Euro (+4%), and Canada (+4%). The muted movement in Chinese Yuan relative to the dollar speaks to the uncertainty around where that trade deal is going.

- Best performer in the S&P 500 the last forty years? Amgen. Yes, Apple is second (with a 21.6% annualized return), but Amgen is first with a 22.7% annualized return. Amgen had a 64% drawdown along the way while Apple had an 83% drawdown. The AVERAGE drawdown for the top 20 names in the S&P 500 over the last forty years was 72%. That is simply surreal to me.

Top News Stories

- Secretary Bessent, Secretary Lutnick, and Trade Representative Jamieson Greer are meeting with Chinese counterparts in London today for additional negotiations towards a U.S.-China trade deal.

- Riots in downtown Los Angeles spiraled out of control Saturday night, provoking the President to send in the National Guard. At the center of the social unrest are protests against the administration’s efforts regarding illegal immigration.

Public Policy

- As we enter crunch time for this “big, beautiful bill,” I have been trying my best to assess what changes are possible at the Senate before it goes back to the House for unified approval. My working thesis is still that (a) there will be some changes at the Senate, but (b) not enough to dislodge the needed votes for approval. I’d assign an 80% or so probability to that, which is different than saying it is a slam dunk, but meant to capture the high likelihood that some bill which extends the 2017 tax cuts and does a few other things, while still adding to the national debt, is passed (in July or August). In trying to assess what might or might not happen at the Senate level, I have talked to my best possible resources on the Hill, including some Senators directly, people in Treasury and the NEC, and have been in heavy communication with those public policy analysts I most trust and respect. None of this is infallible, but here is a summary of what I think the Senate may do to change the bill, that still maintains needed support (at Senate and House levels, both on an entirely partisan basis):

- The Senate wants to make 100% business expensing permanent, not just for four years as the House bill does (positive). This has budget impact, though, so something else will have to give

- Section 899 (revenge tax on foreign countries, I alluded to in a daily blurb last week) appears to be going in (and the Senate Parliamentarian has now approved it)

- The Senate wants to lower the House’s SALT deduction limit of $40,000.

- I hear from some analysts that the Senate wants to kill the Pass-Through Entity Tax deduction (a workaround to SALT for pass-through businesses), but I hear from the NEC and some Senators that they want to preserve the PTET. The House bill kills it.

- The Hydrogen Tax Credit that the House killed may end up back in.

- The university endowment tax will be going up, but perhaps not as much.

- Some changes to the depth of changes with Medicaid, clean-energy tax credits, and other budget cuts seem inevitable, but which direction is not even clear, let alone the magnitude of such.

- Is the goal of the tariff talks to get lower tariffs across the board? Senator Kennedy of Louisiana asked Secretary Lutnick if the administration would take a “zero-zero” tariff deal with Vietnam (no tariffs for them, no tariffs for us), and he replied, “absolutely not.”

Economic Front

- May Jobs came in at 139,000 for May, a little more than expected but still a pretty weak report. The unemployment rate stayed at 4.2%. Prior month revisions were near 100,000, though, offsetting any victory lap about this month’s result. Manufacturing declined, government declined, but by less than expected, and gains were most pronounced in healthcare.

- The labor force dropped -0.2%, down to lowest level since December 2022 (62.4%).

- Weekly Jobless Claims were above expectations for the second week in a row (247k and 239k the last two weeks). The four-week average is creeping higher, and I think another week or so here and I will have something else to say about this.

- Top concerns from CEO’s in the most recent Business Council survey of CEO Confidence (Conference Board): (1) Geopolitical instability, (2) Trade and Tariffs, and (3) Regulatory uncertainty.

- China’s consumer prices fell for a fourth consecutive month in May as its deflationary reality continued.

Housing & Mortgage

- First-time homebuyers now make up 24% of all home purchases, down from 50% just fifteen years ago (in 2010). This is really a stunning data point to reinforce the crisis of (un)affordability

- One of the most fascinating things in the real estate space (speaking more to commercial real estate now than residential housing): There was no theme more universally assumed to be true the last five years than the “death of office.” Borderline apocalyptic assumptions were baked in around the asset class, often treating it as one monolithic nightmare (with little distinction between Class A and Class C, between Manhattan and Houston and Portland and Nashville, etc.). Now, a few years later, with some loan “amend and extend” deals done, a few bad deals liquidated, but nothing even near the universe of catastrophic or systemic, no one talks about it anymore. Some large investors are slowly adding Office back into their portfolios. Rents are increasing for high-quality office buildings in the most attractive markets. And the world keeps on turning. This was always more of a Credit story than anything – how lenders would work out some sub-optimal loan situations – and it was never a systemic change in societal need or function. Melodrama makes for bad investment policy.

Federal Reserve

- The current federal funds rate is 4.25-4.50% (it is always set as a range). Right now, the futures market for the fed funds rate is pricing in a 7% chance that that rate stays the same through the end of the year. There is a 30% chance of one rate cut between now and then, a 40% chance of two rate cuts, and a 20% chance of three rate cuts. Another way to say it is that there is a 60% chance of 2-3 cuts between now and December.

Oil and Energy

- WTI Crude closed at $65.34, up +1.18%

- Midstream Energy was up +2% last week, and oil itself was up over +6% last week. The OPEC announcement last week definitely proved to be less bad than the whisper number (that is, they hiked production by less than expected). MLPs led the way within midstream.

- Another nine oil rigs have been taken offline over the last week, bringing the total to 42 that have been shut down in the last six weeks. At 442 active rigs, that is the lowest since October 2021. Both OPEC+ and U.S. producers seem to be talking about more production, but with market forces not actually allowing for more production.

- Over 70% of the Energy Sector is now above its 50-day moving average.

Glossary

- Twin deficits – this expression refers to the tandem of our trade deficit and our budget deficit. The trade deficit is simply the difference between our imports and exports (that difference is even out with what we call “cash” – we pay for stuff). The budget deficit is the difference between government revenues and government expenditures. The two things have little to do with each other, yet are stewed in the same pot rhetorically often, generally for propaganda or rhetorical benefit.

Ask TBG

| “If you were to add one more thing to the pro-growth part of your policy proposals in Dave-land to deal with the national debt, what would it be?” ~ J. White |

| My prior piece ended up mostly dealing with the spending side of the equation, what I wouldn’t do to generate revenue because it undermines growth (raise taxes), and only a couple things on elevating growth (deregulation, and a capital gain tax reduction for “super long” holds that unlocks capital.

One item I wish I had covered, that I plan to devote an entire Dividend Cafe to later this summer, is the issue of tort reform. The American legal system, when it comes to plaintiff suits, is completely and totally out of control; it is undermining growth (not to mention justice) and might very well represent the lowest-hanging fruit in our economy for reallocating resources to more productive use. The money spent by big and small companies defending against and/or settling patently absurd and frivolous cases (or threats of litigation) is unfathomable, and it is not just a legal and ethical issue – it is an economic one. More to come. |

On Deck

- Dividend Cafe this Friday will evaluate where things stand with value investing and investigate what its future holds

- Next Monday, the 16th, Brian Szytel will bring you the Monday Dividend Cafe as I will be out of the country with my family for a few days of summer break.

- Tomorrow morning, a special announcement is coming from The Bahnsen Group (actually a few special announcements)

- Wednesday’s weekly portfolio report will be in client inboxes per usual.

Enjoy it all and reach out with any questions, any time.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.