Dear Valued Clients and Friends –

There is our standard “around the horn” in today’s Dividend Cafe, but I don’t think there is anything more important than the Ask TBG question and the Ask TBG answer. Skip ahead if you want the important stuff. Or read through the rest – it was all a blast to write.

Dividend Cafe looked at the posture of President Trump towards the market, whether or not anything has changed, and how investors should be thinking about the lay of the land in this current stew of policy and market challenges. The written version is here (my favorite), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

- The market opened up a bit today, then stayed flattish for a few hours, then rallied in the second half of the day (though gave some back into the close)

- The Dow closed up +353 points (+0.85%), with the S&P 500 up +0.64% and the Nasdaq up +0.31%

*CNBC, DJIA, March 17, 2025

- Obviously, a 10% drop in the S&P 500 is not that severe historically (markets have gone down 10% or more a gazillion times). But how fast was this particular 10% drop? It was the seventh fastest on record. I mean, 7th place for rapidity. I don’t know – doesn’t seem like it hits the history books or is all that dramatic, but it also isn’t a totally worthless factoid.

- I mentioned last week that the S&P 500 had dropped below its 200-day moving average early in the week. It closed below its 200-day average on Friday, even after the rally day to close out the week, and this was the first weekly close below its own 200-day moving average since November 2023

- The 9-to-1 advance-to-decline ratio on Friday was pretty robust, and any strength in the market is found somewhere other than the very top in market capitalization.

- The ten-year bond yield closed today at 4.29%, down 1.1 basis points on the day.

- Top-performing sector for the day: Real Estate (+1.66%) and Energy (+1.56%) and Consumer Staples (+1.55%)

- Bottom-performing sector for the day: Consumer Discretionary (-0.44%), the only sector in the red

- The average leveraged loan (LSTA Leveraged Loan Index) at the beginning of the year was $97.75. Ten weeks into the new year, the average loan is $96.54 (down -1.2% on the year). This is not a significant deterioration of credit, but there is enough spread widening to pay attention to economic signaling.

- There is nothing more optimistic in equity markets than the sentiment indicators. Equity flows have totally dissipated, and the various sentiment indicators have gotten quite negative. The put/call ratio is not that severe, and a VIX at $21 is still not indicating that much fear, but sentiment at least moved from silly euphoria to borderline panic, and anyone who doesn’t love that doesn’t understand.

- Take away tariffs and policy uncertainty, and you still have this:

Top News Stories

- The U.S. undertook a comprehensive bombing of the terrorist Houthi group in Yemen this weekend.

Public Policy

- The news of the weekend was the passing of the continuing resolution to keep the government funded through September, with just enough Democratic senators joining all but one Republican Senator to get the 60 votes needed to avoid a filibuster.

- The latest analysis I have read (this one from data and consulting firm Oxford Economics) projects there will be 200,000 fewer federal government employees by the end of the year than there were at the beginning of the year.

Economic Front

- Retail sales (core) came in up +1% on the month, and year-over-year are basically flat (up +0.3%). Internals throughout the report were pretty mixed.

Housing & Mortgage

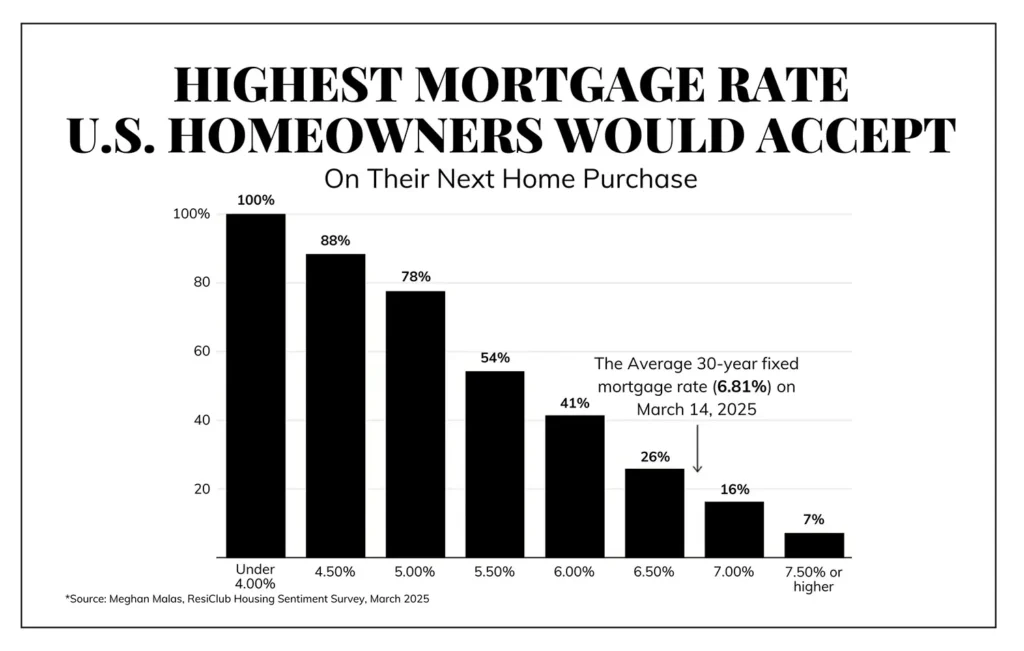

- In the recent ResiClub Housing Sentiment Survey, 10% said they will never sell their current home, 10% said they would only buy a new home by paying cash, and of all the remaining respondents, only 16% said they would buy with a 7% or higher mortgage.

As for the housing impact in the benign inflation data last week, with a h/t to Danielle D’Martino’s recent Quill Intelligence and John Mauldin’s recent Thoughts from the Frontline:

- Peak rent growth was 29 months ago, and lo and behold, peak CPI was 22 months ago

- The Cleveland Fed New Tenant Rent Index now shows prices as -2.6% (that’s a negative number) year-over-year

- Only 47% of newly built apartments were rented in the first three months after opening. Ouch.

- Per Redfin: Typical home now selling 2% below asking price, biggest discount in two years

- Per WSJ: Nine-year high for the number of sellers who have pulled their home off the market

Federal Reserve

- We are sitting at a 52% chance of another 75 basis points of cuts (or more) between now and the end of the year, and just 21% chance of 100 basis points. But yes, the “range” of Fed cuts expected for the rest of the year has moved from 2-3 to instead 3-4.

- President Trump announced that the current Fed governor, Michelle Bowman, will be the new Fed vice chair for supervision. President Biden’s appointment for that role, Michael Barr, famously heavy-handed in terms of bank regulation, resigned earlier this year.

Oil and Energy

- WTI Crude closed at $67.53, up +0.52% on the day

- Though up a tad since last week, WTI hit a six-month low last week as concerns about the economy weighed on all risk assets. However, midstream stocks rallied hard on the week, up over +3.5% on the week and up around the same for the year, substantially disconnecting from both the broad stock market and oil and gas prices. MLPs, in particular, are up about 15% more than the S&P 500 year-to-date.

Ask TBG

| “Stocks are a long term investment or I try hard to think of that way. However, the current market volatility has me very uneasy. Given, where things are right now and the expected (assumed GDP poor outlook) is it unwise to continue to hold? No one has a crystal ball, but is there some guidance on how much loss is acceptable, albeit in a volatile period, before one acts?” ~ Heidi S. |

| Our investment philosophy believes that downside volatility comfort level needs to be defined and understood before an investment portfolio is created, and before market volatility events ensue. If an investment plan was created that accounted for the realities of market volatility, income needs, liquidity, tax sensitivity, timeline, goals, and all the other particulars that play into matching a real-life portfolio to a real-life person’s real-life needs and goals, then I would never change a properly constructed investment plan because of downside volatility that was, itself, assumed to be inevitable in the construction of the plan. The damage those wired to believe they know market downsides in recent history, and since public equity markets existed, is unfathomable. Do not become a statistic. IF your investment plan was properly developed, do not abandon it. Selling after a downside market event is one of the most bizarre things human beings do, yet I suppose it is most easily explained by the fact that, well, they are human.

To that end, we work. Now, let’s remember a few things: Can recessions happen? Yes, they are assured. That was true a month ago when markets were at highs. Can policymakers make mistakes? Yes, they do all the time. Do valuation excesses get reined in? You bet. Do geopolitical events (wars, terror attacks) or other acts of God (weather, pandemic) happen? All. The. Time. And how have investors who tried to time these things done? Let’s just say they send a lot of emails but don’t send me a lot of trade confirms (if you catch my drift). How have investors who have been properly invested through the inevitable ups and downs of life done? We call it: the powerful compounding of capital. |

On Deck

- I head to Washington, D.C., tomorrow for a significant amount of meetings this week and will return to New York City Friday night.

- This Friday’s Dividend Cafe will look at the five-year anniversary of a not-very-pleasant memory and some extraordinary lessons learned.

Questions are always welcome and encouraged – reach out any time! And if you are doing a bracket for this week’s March Madness, a lot of Mag 7 names have fallen out of their #1 seeds, and a lot of upset picks are winning … You heard it here first!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.