Dear Valued Clients and Friends –

This is a long one this week because there was so much to say on policy and on the Fed, but it is all worth your while (I promise).

Dividend Cafe on Friday was a play-by-play look back of those fateful weeks five years ago when markets melted down at the onset of the COVID pandemic. Today, as a matter of fact, is the five-year anniversary of that market bottom (markets are up well over 100% from where we were five years ago today, which is crazy). This was a nostalgic, but not in a positive way, Dividend Cafe. The written version is here (definitely my preferred medium this week), the video is here, and the podcast is here. I am confident that I got more feedback from this Dividend Cafe than any one I have ever written.

I was on Varney/Fox Business this morning with a highlight reel here.

In the Public Policy section below, I try to summarize some of my takeaways from last week’s meetings in the Treasury Department. And with that said, off we go …

|

Subscribe on |

Market Action

- Markets opened up +200 points today and moved higher throughout the day. The general catalyst was that on Sunday both the WSJ and Bloomberg announced that the administration will be coming in April 2 with “more targeted” tariffs than previously believed. More on the tariff side of policy below.

- The Dow closed up +598 points (+1.42%), with the S&P 500 up +1.76% and the Nasdaq up +2.27%

*CNBC, DJIA, March 24, 2025

- The market had been in a four-week losing streak that it barely broke out of last week, with the market up a paltry +0.5% on the week. It remains below its 200-day moving average, with a lot of uncertainty around the looming April 2 announcements.

- I object all the time to the argument that “share buybacks are the same thing as dividend payments” when it comes to returning capital to shareholders. But if one wanted to add the buyback volume to the dividend yield to create a “total shareholder yield,” it is the energy sector offering the highest return to shareholders (7.4%), with both technology and consumer discretionary at the bottom (2.3%). (In reality, it is even worse, as the buyback yield cannot account for how many shares bought back were merely making up for new shares issued in compensation)

- The ten-year bond yield closed today at 4.34%, up over eight basis points on the day.

- Top-performing sector for the day: Consumer Discretionary (+4.07%)

- Bottom-performing sector for the day: Utilities (Flat)

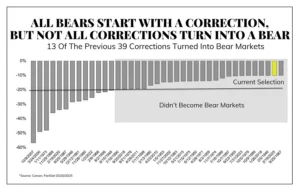

- The good folks at The Weekly ChartStorm reminded me this weekend of a line I had forgotten: All bear markets start with a correction; not all corrections turn into bear markets.

- A major question for investors is going to be whether or not the heavy bias of global investors for U.S.-based assets is coming to an end. To say it has been a strong trend for a long, long time (since the GFC) is the biggest understatement I can summon. Valuations, earnings growth, multiple expansion, and all sorts of fundamental plus sentiment characteristics have favored American assets over other international assets – especially European ones – for a long time. China’s stock market is crushing the U.S. this year, and Europe has caught an outperformance bid that is either a pump fake or a paradigmatic shift. If there is a large trend amongst global asset allocators to “re-Europeanize” their portfolios then the unwind of American markets is far from over. But many have prematurely made this call to their own regret over the last fifteen years.

- Do we have such permeated, overdone, excessive bearishness that the contrarian in me is singing with glee at the free money about to be made in imminent reversal? Not by a long shot. Dip-buying is all over the place, and the “everyone is bearish” permeation that I love, love, love is not yet on the horizon.

- My favorite part of this very volatile market over the last few weekends as a religious asset allocator? The non-correlation amongst asset classes … When everything goes up together or down together, asset allocation does not work. This has not been a market moment where everything went down together. Certain non-dollar risk assets have done quite well, and certainly, “boring bonds” have done quite well. For the time being, bonds and stocks are in a strong reverse correlation, which is healthy and preferred.

Public Policy

- My time in Washington D.C. last week was illuminating and productive, and my meetings with Treasury Secretary Bessent at the Treasury Department were at the top of the list as to why. I do hold the Secretary in high regard and while I cannot say I agree with everything he has publicly said the last few weeks, I am not especially convinced that he agrees with everything he has said the last few weeks. I realize this is hard to wrap our arms around fully, but he (and many others in the administration) have a very difficult job right now if they are to zealously advocate for what they believe in, keep their jobs, respect their boss and his agenda, and seek to be effective without compromising. It is easy for me to throw stones and demand purity, but there is a tightrope some of these guys are walking, and I get it. That said, here are a few takeaways, and I likely need to cover all this in more depth on Friday to avoid this Monday Div Cafe from becoming obnoxiously long:

-

- I do not believe there is clarity in markets, in the media, or in the public about tariff policy, or what is coming April 2, because I do not think there is clarity in the administration around tariff policy or what is coming April 2.

- Everyone involved has done a pretty good job keeping this out of the public eye, but I believe there is a more intense competition of intent, direction, and philosophy between the Commerce Department (Lutnick, USTR Greer, etc.) and the Treasury Department and NEC (Bessent, Hassett) than previously understood. The bad part of that, from my perspective and market’s perspective, is that Commerce is driving the specifics of what is forthcoming April 2.

- The Secretary has way, way, way more of a focus on making permanent the 2017 Trump Tax Cuts (TCJA) than I previously believed. I came away last week convinced they possess the intensity of priority for this they ought to have, even as tariffs have dominated the media story (for good reason). This does not mean they will be successful – it is far more complex and challenging than can be expressed here – but Secretary Bessent’s major focus is on what it will take to pull TCJA and new tax cuts over the finish line. This was by far the most encouraging part of my meetings.

- If I were a betting man, I would say the following two things about where we go from here:

- The biggest thing I can see in where all this is going is to a place on April 3 that is no more clear than where we were on April 1. The President will have a lot of discretion as to what sectors, what companies, what rates, what countries, what tariffs, all get done – and I think chaos and Presidential discretion is the likely outcome, not clarity and policy cohesion. I do not say this as a compliment.

- I do not believe that markets have moved enough to alter the President’s approach to this. I do believe that there is a point at which they do, and that would force him to do something he generally does very well: Find an off-ramp and find a way to claim victory. If that market threshold for such an alteration is 20% (i.e. a bear market), it may very well be that regardless of what pivot takes place from there, a recession will become inevitable as a sort of self-fulfilling prophecy.

There is already talk about the April 2 announcement being less burdensome than previously feared. The administration is already looking for ways to soften impact to farmers (a strange concession, don’t you think?). I didn’t get clarity from Treasury as to what is coming April 2 because they don’t have clarity. This is a wildly uncertain week or two we are going into.

Now, all that said, much more has to be unpacked about reciprocity, “cheating,” and what this all means and doesn’t mean. I see Friday’s Dividend Cafe serving that aim at this time.

******************************

- The team at Strategas Research estimates the cost of the tariffs, set to go into effect on April 2, to be $233 billion, which equates to 0.7% of GDP.

- A lot of market focus is on the April 2 announcement supposedly coming from the Trump administration regarding “reciprocal tariffs” (where we charge American importers a tax to punish foreign countries for charging their own importers a tax). The market has obviously been pricing some expectation here for a few weeks, but what is unknown is the extent to which these proposed tariffs will actually go. The ambiguity of their intent (offsetting VAT, offsetting “non-tariff barriers) leaves a lot of bandwidth for how dramatic they may go, and that uncertainty strikes me as not easy to discount. The market heard what it liked today – that the administration is seemingly backing down from some of the more draconian threats. In fairness, this has been an up-and-down roller coaster.

- On our theme in 2025 of “financial deregulation,” Secretary Bessent’s call last week for more coordination with Treasury is a call for more collaboration and less adversarial regulation. We believe this deregulation is a tailwind for the sector and also for M&A (where financial transactions dropped over 40% in the Biden administration versus the first Trump term).

- I am going to lose you all with how much I have attempted to bite off in this Dividend Cafe. Still, there is nothing going on more important to policy right now than what “policy baseline” the Senate parliamentarian will use in the budget reconciliation process. What does this mean? If they assume the CURRENT policy (not adding in the expense of extending the Trump tax cuts), then it leaves trillions of dollars in the room relative to current policy as they form a budget and tax cuts around that budget in a reconciliation bill. If, on the other hand, they use the assumption that those tax cuts did expire and then came back on, it takes trillions away from what they can do out of this process. This is all a huge TBD, and I can tell you from my time in Washington last week that it is a huge priority for the Treasury Department in their work ahead.

Economic Front

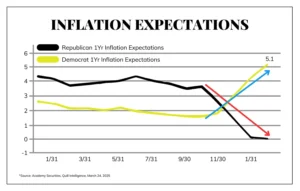

- I have to say, this is just embarrassing:

Federal Reserve

- The Fed announced that its “quantitative tightening” of its balance sheet will be reduced to $5 billion per month (with Treasuries), down from $25 billion.

- Now, do I believe the Treasury Department wanted the Fed to do this to keep the long end of the yield curve in line? Yes, I do believe that. Would I say that “I am sure Secretary Bessent and Jerome Powell are in cahoots on this” (as my friend, Peter Boockvar, suggested)? Well, no, I wouldn’t say that, out loud.

- The mortgage-backed securities on the balance sheet will continue being reduced (via roll-off) with a $35 billion cap per month. Still, it is important to note that, in actuality, they have not been reaching that cap in any month and really only “rolling off” about $15 billion per month, or so. The Fed had $2.7 trillion of MBS on its balance sheet three years ago and has reduced that by $500 billion (to $2.2 trillion) since. Had the Fed “tightened” MBS by its target cap since they began this process the MBS balance would be $1.6 trillion, meaning they have reduced their holdings by a tad less than half of what the cap would have indicated. Mortgage bonds have simply not matured at the pace the Fed would like to reduce their holdings and effect roll-off, as pre-payments are dramatically down, given the rising rate environment.

- Projections are that a rate cut will take place in the June meeting are up to 72% probability—55% chance of three cuts by December; 85% chance of at least two.

- Since the Trump administration announced Michelle Bowman would be the new vice chair of the Fed responsible for bank supervision the financial sector is up +2.9%. The capital standards suggested by her predecessor were considered draconian, and most believe this appointment assures banks of more sensible capital cushion requirements. Markets have been assuming for some time that Basel III’s worst-case scenario was off the table, but this appointment assures markets they were right.

Oil and Energy

- WTI Crude closed at $69.20, up +1.36% on the day

- The S&P bounced back about half a percent last week, but midstream flew 2.5% higher on the week, expanding its spread to the market on the year to nearly 10%.

Glossary

We are adding a weekly “glossary” to the Monday Dividend Cafe because, at the suggestion of a reader, I sometimes use words and expressions with the assumption of understanding in the reader that might be a little unfair. If you have suggestions for words to add to this glossary, you know where to send them!

- Roll-off – when we are talking about the Fed owning bonds on its balance sheet and them “tightening” by using “roll-off,” we are talking about bonds maturing, the Fed being paid cash for the bond’s principal, and the bond NOT reinvesting the cash – essentially letting the bond “roll off” its balance sheet. If the Fed reinvested that cash by buying more bonds, it would be putting money back into bank reserves, but by letting the bond “roll off,” it is a passive way of “tightening” (that is, reducing liquidity from bank excess reserves).

Ask TBG

| “President Trump keeps indicating that tariffs will ultimate be good for the economy by driving up domestic manufacturing, but with some negative impacts initially. Is this a real and positive impact? How should we think about free trade relative to domestic manufacturing? I assume there are trade offs (pun intended).” ~ David E. |

| There is a lot to say here, and I have done entire Dividend Cafe commentaries dedicated to the subject (here and here). No, I do not believe there is any world in which tariffs will be good for the economy or domestic manufacturing. The one argument that I have tried to be open-minded about is that the threat of tariffs would lead to certain outcomes that would be useful for various policy objectives. But the threat of tariffs and the implementation of tariffs are two different things. Tariffs do not drive up domestic manufacturing – they impede total trade. And where they allegedly decrease U.S. imports to enable more domestic manufacturing they also decrease U.S. exports, which puts downward pressure on domestic manufacturing. There are other reasons proposed for tariffs (i.e. “fairness,” “reciprocity,” “revenge,” “fentanyl,” “human rights,” etc.), but the idea that tariffs drive higher domestic manufacturing has not been demonstrated in history by either select, targeted tariffs or by mass, universal tariffs.

I will likely be covering this topic yet again this coming Friday. |

On Deck

- I will be on Kudlow/Fox Business Wednesday this week, talking about “the business of business.”

- April 2 is a week from this Wednesday, for those circling the date of pending tariff announcements.

A friend who was also a tremendous source of information and interaction throughout the COVID period sent me the following this weekend:

“Both COVID and the financial crisis were extended periods of learning about the mechanics of how the world really works by watching what happens when it stops working.”

I couldn’t agree more. But I also agree with the next sentence in his note to me:

“I wouldn’t wish for a similar situation, but I have to admit they were among the most dense periods of learning for me.”

Two of the most difficult experiences of my life were two of the most informative and educational. There is always a bright side, my friends. Always.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.