Dear Valued Clients and Friends –

It is a pretty balanced trip around the horn today, with a lot to say in the Housing arena. The Dow’s eight-day winning streak finally came to an end. And I don’t talk about the Trump trial or Michael Cohen at all, just as Brian and I avoided talking about Stormy Daniels last week.

Dividend Cafe looked at the reasons for the recent market rally, the Fed’s relationship with the Phillips Curve, the reality around quantitative tightening, and some conventional wisdom about economic growth and the stock market. The written version is here (my favorite), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

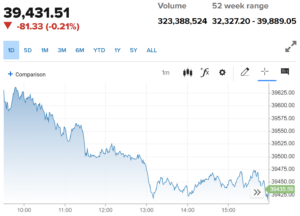

- Markets opened to the upside and then spent the first half of the day declining (but not by much) and the second half of the day around that declined spot.

- The Dow closed down -81 points (-0.21%), with the S&P 500 down -0.02% and the Nasdaq up +0.29%.

*CNBC, DJIA, May 13, 2024

- Since the market rally began in Q4 of last year, and over 70% of the companies in the S&P 500 got above their own 200-day moving average, at no point has that number dropped below 70%. It got back down to 70% in April but has basically stayed above that level (at 80% now) non-stop for six months.

- Consumer Discretionary is doing the worst it has done relative to the market in quite some time and is only up +2% on the year compared to markets up more like 9%.

- The ten-year bond yield closed today at 4.49%, down 1.6 basis points on the day.

- Top-performing sector for the day: Technology (+0.48%)

- Bottom-performing sector for the day: Industrials (-0.45%)

Top News Stories

- Brand new New York Times/Siena polls show Donald Trump defeating Joe Biden in five of the six crucial battleground states likely to determine the election, with the economy and immigration the two issues most on voters minds.

Public Policy

- President Biden announced a quadrupling of tariffs on Chinese electric vehicle imports today. Other sectors and items saw large tariff increases, as well. No tariffs were reduced or eliminated. Of course, tariffs on the U.S. importing Chinese electric vehicles are rather moot since, well, the U.S. consumer doesn’t buy any such thing from China.

- A federal judge on Friday blocked the illegal efforts of the Consumer Financial Protection Bureau to cap credit card late fees at $8. Of course, the entire illegality of the CFPB is about to be ruled on by the Supreme Court, not just the illegal small-ball things they do from time to time.

Economic Front

- China’s CPI was up +0.3% for the last twelve months, basically at deflationary levels.

- About 11% of tech sector jobs were in California a few years ago. The number is 8.5% now. Some may say this is just a 2.5% reduction, but that would be an inaccurate way to mathematically express California’s loss of tech job market share – down 22.7% would be more accurate.

Housing & Mortgage

- Real Estate data firm ATTOM reported that only one out of 37 homes (2.7%) is “seriously underwater” right now, a reference to homes that have a mortgage 25% more than the estimated re-sale value of the home. It is worth noting that before COVID the number was estimated to be 6% of all homes, and of course at the apex of the financial crisis fifteen years ago the number was nearly 50%.

- 40% of Americans don’t have a mortgage. 57% of Americans who do have a mortgage are paying less than 4%. These two data points more than anything else explain why the high current mortgage rates have not had the negative economic impact they otherwise would have had.

- Single-family homes saw their cost to rent grow +14% in 2022 and only +3.4% as of right now (last twelve months). Why is the CPI data still reflecting something more like 6% in shelter increases versus this lower number in “new rents”? Because of the number of people staying put, taking a lease agreement rental cost increases versus a new lease or new purchase (with interest rates high). The lower lease rates we see in the market are not evidenced in the inflation data because of higher-than-normal renewals versus new leases.

Federal Reserve

- Fed governor Michelle Bowman said on Friday that she remains of the mindset to keep rates where they are until she is confident the Fed’s 2% inflation level is coming.

- Neel Kashkari (Fed governor in Minneapolis) said that he believes the implied inflation rate in the 10-year TIPS market is the best proxy for monetary policy (I have heard that somewhere before). Suffice it to say, I emphatically agree.

Oil and Energy

- WTI Crude closed at $79.23, up +1.24% on the day.

- Midstream energy was up > +2% last week and is up > +14% on the year. The earnings season just completed reflected a high number of companies raising full year guidance and keeping capex guidance within previous ranges. Overall revisions were positive, a few companies had big beats, and capex creep was modest at the most.

Ask TBG

| “You argue there is currently no hyperinflation. But what if certain aspects are experiencing hyperinflation? Insurance. Real estate. Higher education. And probably the one we feel the most is: Nutritional food and restaurant prices. Your thoughts?” ~ Bill M. |

| The idiosyncratic nature of the inflation you describe really makes my case for me – that if prices are moving at extreme levels in a couple of categories of goods or services, and not moving at all in many, and are, in fact, moving lower in many, it is not “inflation” as defined by economists (the overall price level moving higher when too much money is chasing too few goods), but rather indicative of something going on in a particular space. And usually, that “something going on” is not good, either.

Now, when Taylor Swift concert tickets go through the roof we do not generally refer to that as “inflation” – we see it as a unique situation where demand has skyrocketed higher and supply is highly constrained – a normal dynamic in a market economy. If I announced a concert tour tomorrow where I was the featured talent (extremely low demand) and made millions of tickets available (high supply), we would not refer to that as “deflation of concert prices,” either. Taylor would merely be a market success, and I would be a market failure with no regard for inflation or deflation. But what is happening in a few select areas of the economy is neither a monetary phenomenon (inflation) nor is it a by-product of market success (Taylor Swift) or market failure (David Bahnsen’s Banjo Live). Rather, it is a by-product of government subsidy with higher education (if you want higher prices, subsidize something. It is a consequence of high demand that has not reached pushback from consumers (YET) – restaurants. And it is a by-product of high replacement costs and a lag effect (auto insurance). Price levels with restaurants and insurance are regulated by markets and competition. Price levels with higher education are mostly not (unlimited government financing for all). But in all these cases, with so many other price levels flat or headed lower and with clear outlier explanations available, these things can’t be described as inflationary, either. Not even my banjo tour. |

On Deck

- Wednesday’s CPI report will be one of the more anticipated economic data points in a long time. I expect the report to come in either a tad below expectations, a tad above expectations, or right at expectations. This forecasting reminds me of this.

Enjoy your Monday nights and we shall see you again tomorrow. Reach out with questions any time!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.