Dear Valued Clients and Friends –

So we again had one of those days (which I really do not think are good ideas) where they had banking activity and bond markets closed, but the stock market opened. As I said, every Columbus Day and Veterans Day, there are a lot of economic actors that need money funds and bond activities to offset other risk asset activities, not to mention generic asset allocators. When one part of the engine is on, and the other parts are off, expect the car to run funny.

Dividend Cafe began an assessment of post-election realities for markets and the economy. The written version is here (my favorite), the video is here, and the podcast is here.

I was on The Big Money Show (Fox Business) where they asked how a guy like me navigates my feelings on President Trump…

Off we go…

|

Subscribe on |

Market Action

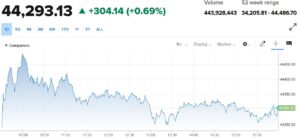

- The market opened up over +300 points today, even as the Nasdaq and S&P were down with a sell-off in big tech. The Dow would go up over +500 points before giving some of that back and still ending the day up near where it opened.

- The Dow closed up +304 points (+0.69%), with the S&P 500 up +0.10% and the Nasdaq up +0.06%.

*CNBC, DJIA, Nov. 11, 2024

- Corporate profits are currently projected to grow +11.5% for the next year (which is actually lower than the +13.3% estimate of a couple of months ago).

- Beyond the move higher in treasury yields and the massive higher in stock prices, it behooves us to focus on ever-tightening credit spreads. Since the election, average high-yield bond spreads got as low as 274 basis points, down from 288 before the election and 325 throughout the summer. We are not back to the summer 2007 level of 250, but we are close. Forgive me for believing two things at once here: (a) This indicates a very high confidence in credit, risk, and economic conditions right now, and (b) The contrarian in me does not like this one bit.

- The ten-year bond yield closed today at 4.31%, because that’s where it closed Friday and the bond market was closed today.

- Top-performing sector for the day: Consumer Discretionary (+1.75%), Financials (+1.41%)

- Bottom-performing sector for the day: Technology (-0.89%)

- Here is the lay of the land, and it has nothing to do with whether or not valuations already reflect all of this or whether or not things are overheated. The backdrop is one of very high corporate profits, expanded profit margins, strong U.S. household balance sheets, improved GDP growth, anticipation of more M&A coming, very tight credit spreads (see above), and very low corporate defaults (bonds and loans).

- The VIX has absolutely collapsed in the S&P: from 22 just a week ago to below 15 today. Pre-election fear escalated volatility, but credit spreads were tight, indicating no confirmation. Just a few days later, the cost of protection in the S&P collapsed, as well.

- Don’t look now, but the Russell 2000 (small cap index) is back to a whisker from its all-time high of three years ago. It is up nearly +50% from where it was just over a year ago.

- The S&P 500 has closed at an all-time high of 50x this year. For those who think that sounds like a bad thing, what would you have thought (what did you think?) the first 49x? The S&P 500 closes at an all-time high of 18x per year, on average. “All-time highs” are things that get hit on their way to new all-time highs. Every number the market was ever at was, at one point, an all-time high.

Top News Stories

- The various federal prosecutions brought by special prosecutor Jack Smith against President-elect Trump have been dropped, as requested by the special prosecutor’s office.

Public Policy

- Here is what we know so far about incoming personnel:

- The President-elect announced over the weekend that former Secretary of State Mike Pompeo will not be re-joining the administration this term, and neither would be former UN Ambassador Nikki Haley.

- Stephen Miller was appointed Deputy Chief of Staff for Policy. He was a speechwriter and senior advisor in the first term and is known as a hardliner on immigration.

- Former ICE Director Tom Homan has been named the new administration’s “border czar.”

- New York GOP Congresswoman Elise Stefanik has been offered the UN Ambassadorship.

- Former New York GOP Congressman Lee Zeldin has been appointed the head of the EPA (Environmental Protection Agency).

- The electoral college results have settled at 312-226, with all fifty states now being called, and President-elect Trump has swept all seven of the battleground states.

- Arizona and Nevada Senate seats will narrowly reflect a split ballot decision by voters, with Democrat candidates holding those seats (one a new Democrat replacing a former Democrat and one incumbent Democrat) over narrow challenges from Republican candidates. This means the Senate flips in the Senate will include West Virginia, Montana, Ohio, and Pennsylvania, moving the Senate to a 53-47 Republican majority.

- There has been a loud online effort from some to push for Sen. Rick Scott to be the new GOP Senate Majority Leader, and I guess I can’t say with 100% certainty that it is going to die. But there is no question that the majority of GOP Senators support either John Thune of South Dakota or John Cornyn of Texas and that Senators who do not run for a long time and vote on this by secret ballot really don’t have to be moved by a Twitter threat. We shall see where this goes.

Economic Front

- China’s deflation is picking up more than expected, with producer prices dropping -2.9% year-over-year (worse than the -2.5% that had been expected).

Federal Reserve

- The Fed has now cut rates by 0.75% in the last two meetings (a quarter-point last week and a half-point in September). The futures markets are now pricing in a 68.5% chance of a quarter-point cut in December and a 31.5% chance of no cut. We shall see what data points come between now and December 18 that influence the optics of the next decision.

- Over the weekend, Sen. Mike Lee of Utah tweeted that the Federal Reserve should be under the Executive Branch, but he also said in his tweet, “End the Fed.” So I guess it isn’t really clear if he is advocating for a Fed that runs its monetary policy decisions by the President or instead advocating that there not be a Fed. Either way, I expect two things to be true at once: (1) A lot of jawboning from the new President and some of his, ummmm, fans regarding less independence for the Fed, and (2) Very little to actually change in this regard beyond the noise.

- Quick hint: If the President got to set interest rates, I think Presidents will favor, wait for it, low rates all the time. I am out on a limb here, I know.

Oil and Energy

- WTI Crude closed at $68.22, down over -3% on the day.

- The midstream sector responded to the election results by rallying +9% last week and is now up well over +40% on the year.

- There was more to the midstream vibrations than just an energy-friendly election result: The earnings season has thus far produced significantly positive results across the sector.

Against Doomsdayism

- I just love this article so much. Some of you reading this Dividend Cafe are not billionaires (I know, some of you are saying, “speak for yourself” – you know who you are). But for those who are not billionaires, you are sort of in the billionaire club in the sense that you can pay $9 per month to watch movies that cost others $2.8 billion to make. You can buy a phone for $500-$1,000 that costs $32 billion in R&D to make (and improve). The article lays it all out more, but marginal economics in a free society means we pay very little for what others pay very much, and everyone benefits. The real question is why we are not overly jubilant about this every day.

Ask TBG

|

“During President Trump’s first term there was talk of Secretary Mnuchin looking into the U.S. issuing super long-term bonds to lock in the low rates and help with our debt interest. I know I am Monday morning quarterbacking here, but even at the time, it seemed like a good idea. Why did this never happen?” |

| You are correct; there most certainly was discussion of either 50-year or 100-year Treasury bonds at the point of low rates throughout the first Trump term. Secretary Mnuchin ultimately concluded they didn’t have the time, resources, or demand to see it through. In hindsight, obviously, plenty of people wish it had been done (for various reasons). In fairness, it is not like trillions of dollars were ever going to be bought; it is unclear if hundreds of billions even would have. A 20-year treasury issuance they did was only able to find $20 billion of buyers. I believe when the curve was inverted or when we were at a 0% ZIRP (two distinct moments), there was a great reason to do it, and any part of the term structure that takes out that risk is worthwhile to the borrower and any vehicle that creates such an instrument for hedging deflation is worthwhile to the lender. Fingers crossed for another bite at the apple. |

On Deck

- President Biden and President-elect Trump are set to meet at the White House at 11 am on Wednesday.

- This Friday’s Dividend Cafe is going to be a Part 2 of post-election analysis. Some very thoughtful and substantive questions have already come in about social security, medical policies, tariffs, and more. I also will have even more of an update (and commentary) on key personnel later in the week, and I believe this Dividend Cafe is going to be a meaty one.

Have a wonderful night, and if some question about election ramifications is gnawing at you, hit me up!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.