Dear Valued Clients and Friends –

Lots of everything today, especially Housing. Read on!

Dividend Cafe asked some practical questions about valuations, and what it does and doesn’t mean. The written version is here (my favorite), the video is here, and the podcast is here.

Off we go …

|

Subscribe on |

Market Action

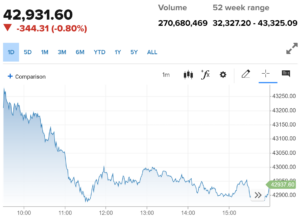

- The market opened down just a little today and sold off further throughout the day.

- The Dow closed down -344 points (-0.80%), with the S&P 500 down -0.18% and the Nasdaq up +0.27%.

*CNBC, DJIA, Oct. 20, 2024

- The major issue in the stock market today was, well, the bond market. Yields moved higher and stocks and bonds dropped. The market had been up six weeks in a row.

- A big difference in the market now vs. the period that preceded the 2022 drop in the Nasdaq and S&P: Breadth had been weakening then in advance of the drop; it has been strong now

- A different tale is the story of semiconductors, where the top couple names are stronger than ever, and the breadth of the overall space has collapsed. I’ll let you guess what historically leads what – the strong bringing the whole space up, or the weakness of the space bringing the strong down.

- The ten-year bond yield closed today at 4.19%, up 11.7 basis points on the day

- Top-performing sector for the day: Technology (+0.93%) – only positive sector today

- Bottom-performing sector for the day: Real Estate (-2.08%)

- 45 years ago, the United States was 25% of global GDP. Today, it is 25% of global GDP. China was 3% of global GDP and today is 17% – not a bad increase on the world stage. But if we stayed flat and China flew that much, who shrunk? Japan was 10%, got as high as 18%, and is today 3%. Yep. 3% of global GDP. Economic empires come, and economic empires go, and sometimes it takes decades, not centuries, for those cycles to play out.

- Speaking of decades – India was barely 1% of Global GDP just thirty years ago. They are over 4% today and headed to double that in less a decade.

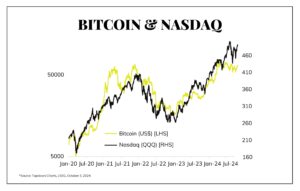

- Not the diversifier, stable asset some say it is, eh?

Top News Stories

- Someone has leaked intelligence regarding Israel’s planned attack on Iran.

- The Yankees and Dodgers are playing in the World Series. The last time they did, I was seven years old.

Public Policy

- The election is just fifteen days away, and the polls are very tight. Where specific polls, models, and momentum are, I will let you read and watch from your own sources (I learned a long time ago that the messenger gets blamed for the message, a lot, when it comes to politics).

- This Friday’s Dividend Cafe will take all your Q&A about the election!

- Say what you want about Donald Trump (I have certainly said plenty), but he has better taste in french fries than some people do!

Economic Front

- Why are bond yields around 4% right now and not 3.6% or 3.75%? Retail sales were strong. Employment was strong. The Atlanta Fed’s GDP estimates are over 3%. The “soft landing” and even “strong landing” camps have had a good string of data. It can change when it changes. You are welcome to write that last sentence down.

Housing & Mortgage

- Housing starts declined 0.5% in September and are down -0.7% from a year ago. A year ago, housing starts were pitifully low. Two years ago, it was pitiful. Each year, they have gone lower, not higher. This is a decision, a choice, not a circumstance. The September report primarily saw a drop due to multi-family decline, though.

- Mortgage applications for new purchases are down well over 50% from where they were just two+ years ago.

- The NAHB Homebuilder Sentiment came in at 43, well below 50, with expectations doing slightly better, but the present situation, and especially prospective buyers, is really, really low.

- In a time where most national economic conversations are essentially illiterate, one major shift seems to have happened that I am both surprised by, and extremely encouraged by. No one is talking about the +48% increase in national housing prices since 2019 (or > +100% increase in dozens of major counties) as if it were a good thing. Upper-middle-class earners who actually lack much balance sheet beside their home still like feeling house rich for their own ego, but the general conversation is rightly on the fact that this absurd bubble (driven by a supply deficit) has created an affordability crisis, not a newfound prosperity. It is pretty universally talked about as a bug, not a feature. While the national political ideas to address it range from the illiterate to the tragically humorous, I still believe it is a net positive that the go-go years mentality of 2001-2006 is not the way the culture is responding this time. Rather, people are rightly wondering, “how in the world did my high-earning 30-something-year-old kid get priced out of THAT neighborhood?” The times have changed, first slowly, then suddenly.

Federal Reserve

- Forgive the redundancy, but it is what it is. Futures indicate a 91% chance of a quarter-point cut next month and a 77% chance of another quarter-point cut in December. They indicate a 0% chance of anything more than a quarter-point cut at either meeting and some chance of no cut at both (though slim).

Oil and Energy

- WTI Crude closed at $69.85, up +1.70%.

- Energy stocks were down last week as oil itself dropped -6.5%. Canadian midstream did well, though, and natural gas pipeline companies had a good week (just not natural gas liquids).

- U.S. oil field production is at an all-time high (13.5 million barrels per day).

Against Doomsdayism

- You hear a lot about the romantic old days of farming, and I, for one, am not qualified to say how great or not great it must have been. I probably would have enjoyed the early hours, but I make no pretensions about the physical side of it. That said, the reality of pre-industrial farming versus what we experience today is, shall we say, not very well understood by people. From the vantage point of agricultural producers, animals, and consumers, no comprehensive and intelligent understanding of the evolution of farming could allow for doomsdayism. I’ll stay light on details on purpose.

Ask TBG

| “I’m a baby boomer who has tended to save rather than borrow and was perturbed by the incredibly low interest rates we were getting for savings accounts and even high yield accounts before the Fed increased interest rates the last few years. I’ve enjoyed the recent levels of return but now can tell the good days are going to be over again. What do you consider to be a happy medium for those of us who like to get at least something back for saving cash?” ~ John Z. |

| Well first let me say that I agree with you that fifteen years of zero interest rates were perturbing for savers, and for me, more perturbing that so many don’t realize that for every borrower benefiting there is a saver suffering. Interest is an income item for the saver (lender) and an expense item for the borrower. Those who believe low rates are an obvious and permanent benefit to the economy are only considering the part of the ledger they choose to look at, and ignoring the other half (classic broken window fallacy).

That said, I do not believe the answer lies in “what I consider a happy medium to be,” or what anyone would personally like it to be, or what an excessive borrower would like it to be. I believe the ideal “price of money” is what lenders and borrowers come to across a variety of circumstances, and so the Fed’s intervention distorts price discovery, rendering economic calculation harder to do – muddier, if you will. I believe a “natural rate” right now that neither contracts nor stimulates is probably somewhere around 3% short term, which would allow a 1% term premium if the ten-year was reflecting expectations of 4% nominal GDP growth (2% inflation and 2% real growth). Some of that may prove to be wishful thinking, but I think it is close (the ten-year part will prove to be wishful thinking, eventually). Short term, a 3% rate avoids the zero bound with cushion, and comes lower than the contractionary level we have been (or would be if more people were actually paying the higher level). |

On Deck

- Earnings season escalates into very high gear this week

- Nothing major in economic news this week – the standard new home/existing home sales, weekly jobless claims, and on Friday, durable goods orders

Wishing you all a wonderful Monday evening! Looking forward to a busy and productive week ahead.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.