Dear Valued Clients and Friends –

It’s my favorite kind of Monday Dividend Cafe today, a full around-the-horn, with a little extra discussion in the Energy section.

Dividend Cafe did a special Q&A edition around the election and all it represents. The written version is here (my favorite), the video is here, and the podcast is here.

I was on Varney/Fox Business this morning with the highlight reel the team put together here and Bloomberg this afternoon with my market and election comments here.

Off we go …

|

Subscribe on |

Market Action

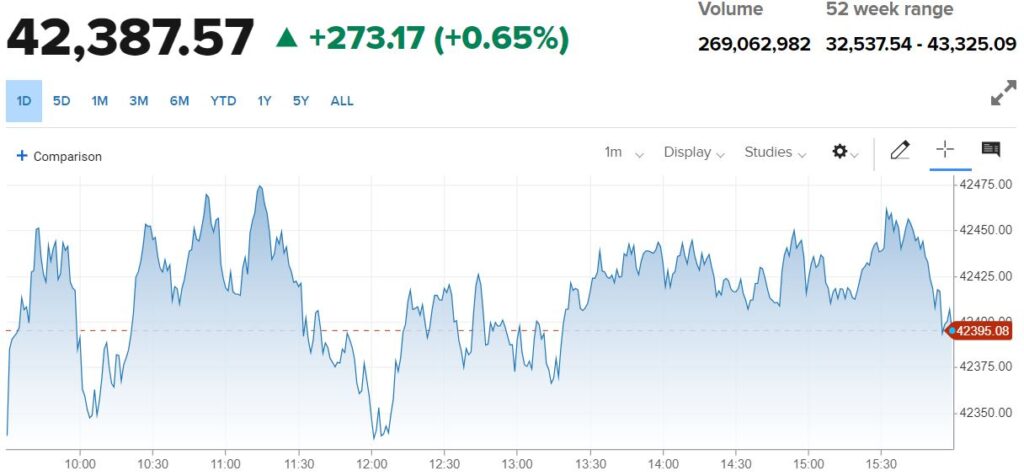

- The market opened up +275 points or so today and bounced up and down from there a bit throughout the day but closed in that same place.

- The Dow closed up +273 points (+0.65%), with the S&P 500 +0.27% and the Nasdaq +0.26%

*CNBC, DJIA, Oct. 28, 2024

- Nvidia has a larger market cap now than all of Canada. And also all of the UK. And all of France. And, all of Germany and Italy – combined. Yep.

- The ten-year bond yield closed today at 4.28%, up 4.8 basis points on the day.

- The stock market has not minded the 4.25% range on the 10-year thus far. 4.5%? I think you see an issue. 5%, it would be a big equity market sell-off. I am skeptical that we get to 5%, but I am not skeptical that bond yields moving that much higher would re-price equities.

- I can’t emphasize enough – the VIX has moved a bit higher and held there (near 20); credit spreads have NOT widened – BOTH have to happen to represent a risk paradigm change.

- Top-performing sector for the day: Financials (+1.14%)

- Bottom-performing sector for the day: Energy (-0.65%)

Top News Stories

- While everyone is focused on the U.S. election, the Liberal Democratic Party of Japan lost parliamentary majority for the first time in fifteen years! Prime Minister Ishiba has said, for now, he intends to continue running things.

- Israel attacked highly specific military installations in Iran this weekend, leading to a drop in oil prices as markets interpreted the response as less aggressive than had been feared!

Public Policy

- I stated in the Friday Dividend Cafe that I continue to believe the Presidential election results are a 50-50 proposition – a jump ball if you will. Many disagree because they see candidate Trump having made progress in a lot of the polling, including key battleground states. I am aware of the polling and momentum, yet also see a lot of states and variables that are all well within the margin of error. I do not believe there is a key element of persuasion in the next week; I think there is only turnout. I am sure someone knows somebody who doesn’t yet know they are voting for, but I sure don’t – and I don’t believe there are but a handful of such people in the country. What I do think is up for grabs is who will actually vote. Those turnout components will matter in the end, a lot.

- Sen. Elizabeth Warren and a handful of progressive Senators are objecting to private equity ownership in real estate, this time focusing on 5,200 apartment units recently acquired by KKR. There is no jurisdiction for the United States Senate to desire to set the rents, the fees, the anticipated profits, or any other metrics here, but a Senatorial inquiry for answers has been launched.

Economic Front

- Durable goods were up +0.5% in September, higher than expected, with metals rising but electronics falling.

- Shipping rates are way down, which is quite disinflationary (higher than where they started the year but down almost 50% from the mid-year high).

Federal Reserve

- It should be boring by now but the futures market is at a 97% chance of a quarter-point cut at the FOMC meeting next week and a 73% chance of a further quarter-point cut in December. What this means is that there is a 0% chance in the futures market of a half-point cut at either meeting and a 27% chance of no cut in December, but overwhelming odds of a quarter-point at each. Next week is basically baked in at this point; December’s 73% goes up or down based on the BLS jobs report, weekly claims numbers, and CPI/PCE print between now and then

Oil and Energy

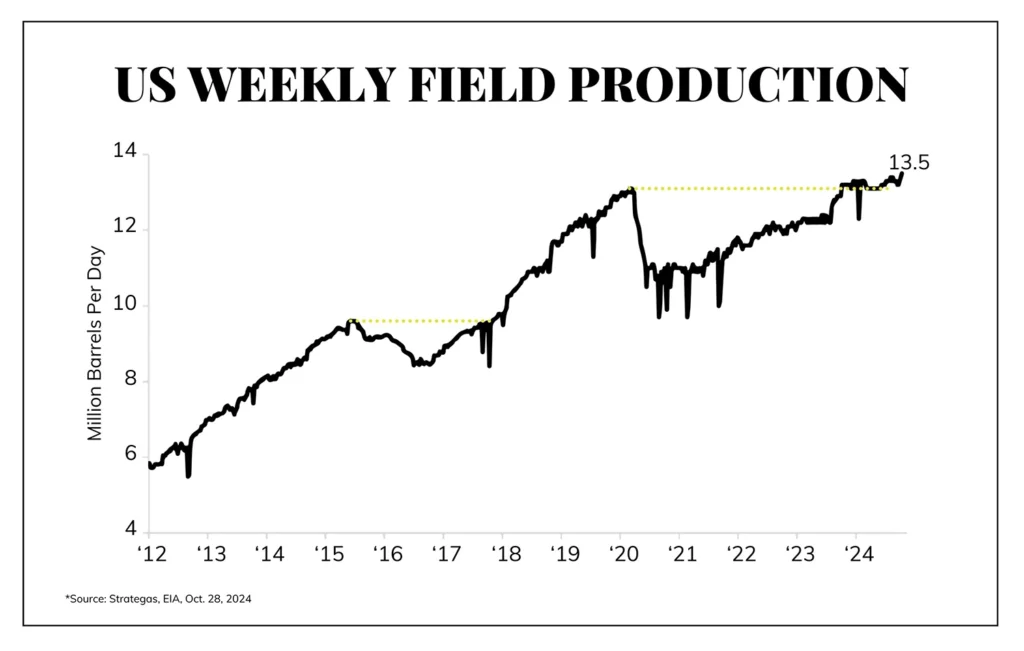

- WTI Crude closed at $68, down -5.28%

- This is one of my favorite charts: First, the huge increase in domestic oil production after the explosion of fracking capability post-GFC; then the Saudi/OPEC war to try and break the U.S. system (a career moment that began at the end of 2014); then the huge increase in oil production throughout the Trump administration; then the collapse of production throughout COVID; and then the recovery of production post-COVID, recently into a new all-time high!

- When you think about power demand and how it gets manifested in your portfolio, an additional 18 GW of power capacity will be needed in the next 5+ years for data centers (per a data center market overview published by Newmark this year). A study from Apollo I read this weekend pointed out that total power consumption in New York City is currently 6 GW. So an additional THREE New York City’s (all five boroughs) must be added to the power grid in five years. How much is ONE gigawatt? Not 18, but ONE? Per our own Energy Department, it is 100 million LED bulbs, or half of the Hoover Dam, or 1.3 million horses, or 294 wind turbines. So, ummmm, I think it is safe to say the data centers we are building need more power, and that power has to come from somewhere, and the need and the mechanism for production and the mechanism for delivery are not being understood in an adult way.

- With the S&P down -1% last week, and Utilities and Infrastructure each down -2%, the midstream space proved resilient (anywhere from flat to barely down). A very high percentage of midstream companies report quarterly results this week.

Against Doomsdayism

- How many cases of malaria have there been in Egypt in the last three years? Zero. Not a single one. Egypt has struggled with malaria for thousands of years and still struggled heavily in the last century. Now, it is the 44th country on earth to eradicate the disease. Was there a big concern about malaria in Egypt that prompted this note? No. What there is, though, is often a real failure to recognize that many huge, fatal problems, get solved.

Ask TBG

| “Why there was such a huge deficit when Ronald Reagan left office if his economic policies spurred growth? Was it just military spending?” ~ Debra Y. |

| Keep in mind, the budget deficit was 2.7% of GDP when he came into office, and it was 2.7% when he left. The dollar amount of debt went up, but not more than the growth of the economy. I am sad to say that is unheard of the last 24 years.

But yes, the notable growth of spending category was defense, and many of us believe that was a huge cost savings. In other words, the investment into winning the cold war provided a peace dividend in the 1990s that was incalculable. |

On Deck

- Earnings season heavy all week

- I can’t think of anything going on next week?

You know how to reach me!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.