Dear Valued Clients and Friends –

It is a long and meaty Dividend Cafe this beautiful Monday, as I love these editions to be. Let’s get right into it all.

If you happen to be a financial advisor reading Dividend Cafe, would you mind sending me a note to ? We are considering a fresh content idea for fellow advisors and would like to get your opinion on something!

Dividend Cafe went deep into what is going on in China and tried to make the case for how it does (and doesn’t) impact U.S. investors. The feedback on this was almost as significant as the special election issue the week prior. The written version is here (my favorite), the video is here, and the podcast is here.

My whole Varney show clip from Friday is here (a highlight reel, if you will). And today’s Big Money Show appearance is here.

Off we go…

|

Subscribe on |

Market Action

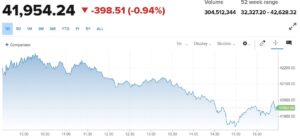

- The market opened down -200 points and worsened throughout the day.

- The Dow closed down -398 points (-0.94%), with the S&P 500 down -0.96% and the Nasdaq down -1.18%

*CNBC, DJIA, Oct. 7, 2024

- The tech sector is sitting around 60% of its positions, above its 200-day moving average; it was 80% for most of the first half of 2024.

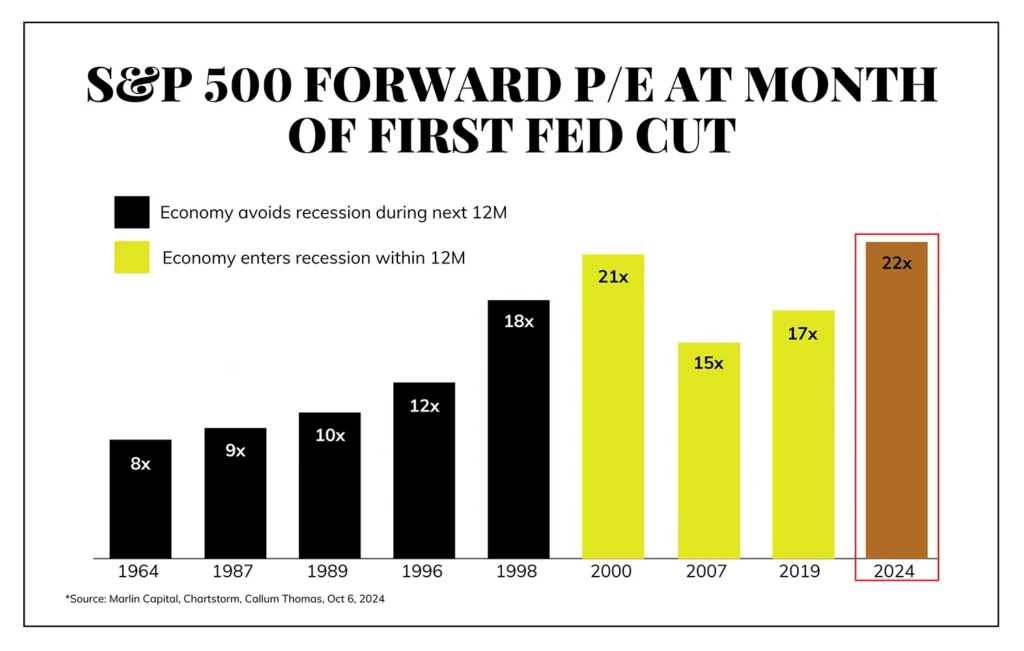

- When people say, “Don’t fight the Fed,” it is always true, within the context of a lot of other things going on and the context of what the Fed is really doing. In other words, I am a “don’t fight the Fed” guy, too, but it requires a more nuanced understanding of what the Fed is up to. Now, as for the idea that “whenever the Fed is cutting rates, it is good for stocks,” I just suggest the history of the market’s valuation at that time may matter, too.

- The S&P 500 currently has a 1.2% dividend yield. It had averaged 4-5% for ~75 years coming into the financial crisis. The frequent rebuttal to this data point I bring up is that stock buybacks are a newer convention, and companies are tax-efficiently using buybacks as a partial replacement for dividend payments. Okay. I have serious objections to this, and I even wrote a chapter in my book about it. But let’s say they were one and the same… The COMBINED buyback/dividend yield is now 3% … far less than the 4-5% that drove markets for years.

- The ten-year bond yield closed today at 4.02%, up four basis points on the day.

- Top-performing sector for the day: Energy (+0.35%)

- Bottom-performing sector for the day: Utilities (-2.32%)

- An interesting thing about this market run… A gazillion companies said in 2022, “We are postponing our IPO due to market conditions.” Markets generally see a collapse of IPO activity in strained markets, and M&A has been down since the Fed began hiking rates. However, markets have been on fire since the beginning of 2023, and yet IPO volume is non-existent. Companies are not going public, but why? Market conditions are just fine, so where is the IPO activity? I think that it is a by-product of (a) Way fewer companies wanting to go public, (b) Way fewer companies needing to go public (there are ample ways to capitalize a company without an IPO these days, and the same can be said about early investor monetization); and (c) While markets have been fine, there has not been an appetite for shiny object shams, and I suspect a lot of the companies NOT going public these days are, well, shiny.

- I have talked a lot about various correlations among asset classes and within markets. Right now, the way that interest rates, the dollar, and oil are all correlated together is quite powerful. It may not be sustainable, but it matters now.

Top News Stories

- On this one-year anniversary of the utterly horrific October 7 attacks against Israel, the depraved Hamas terrorist atrocity of a year ago proved to be more than just the bloodshed and violence of that day; it provoked and catalyzed the events that would shine a light on evidence of far more severe anti-semitism around the world than many people knew existed, not merely in the villainous caves of depraved Hamas cells, but on American college campuses, various media outlets, and other fringe corners of far-right and left circles. It also has now provided the world a chance to see that Israel’s vows and determination for self-preservation are not merely bark, but a whole lot of bite, and her foes under-estimate her resolve to their own peril.

- As for the latest in what is going on there, particularly in the heightened moments of this last week and involving Iran (I promise you, this is all about Iran), Israeli air strikes are expected to continue against Hezbollah military leadership. Geopolitical macro research firm Corbu believes they are seeking to destroy 60,000 of the 120,000 missiles believed to be inside Lebanon. It is not currently believed, from available intelligence and reports, that Israel plans to take out Iranian refineries or pipelines, or nuclear facilities.

Public Policy

- With a lot of discussion about what federal land may be useful for certain elements of the U.S. federal debt, I thought it was interesting to note that the federal government owns no land at all in Connecticut, New York, and Iowa – literally zero percent – and yet owns 85% of the land in Nevada.

Economic Front

- The story of the week was the 254,000 jobs created last month, over 100,000 more than expected. Unemployment fell to 4.1%, and the past two months were revised higher by 72,000. It was an unmitigated good month, and apparently, one of the Presidential candidates felt called to tweet my take on it all LOL. Manufacturing appears to be the only sector that was negative.

- Average hourly earnings were up +0.4% on the month as well and 4% year-over-year. The Labor Participation Rate of 62.7% did not move.

- The fly in the ointment is hours worked, going down on the month (to 34.2, a 14-year low excluding COVID).

- The big question right now in the economy is whether or not the economy is really picking up steam, as some recent data indicates, versus slowing down, as some prior data indicated, and what it would mean for (a) Policymakers and (b) Markets.

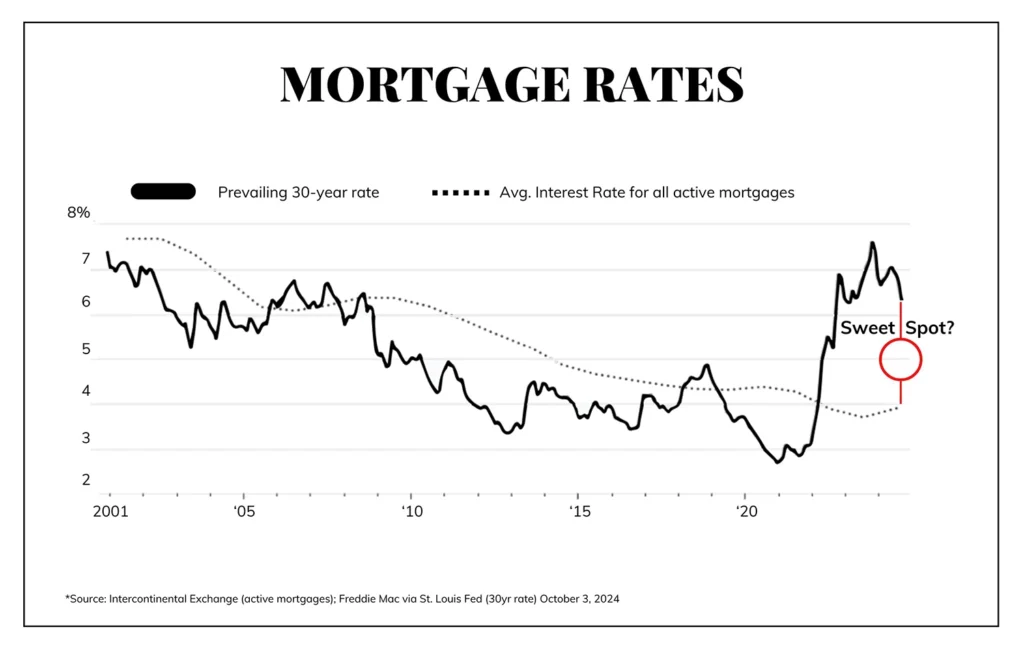

Housing & Mortgage

- I believe a key issue for the psychology of housing activity right now is going to be how sellers (and buyers) think about a new rate reality. Are there really some waiting to see the preposterous, reckless, unrealistic, distortive, unprecedented low rates of 2020-2021 again before acting (you know, the rates many of us secured in that period in our own borrowing), OR is there some middle ground number that is lower than the highs of 2023-2024, but higher than the lows of 2020-2021, that will be seen as “good enough”… My view is that the latter is simply going to have to be the case, but the question is timing and the path to getting there.

Federal Reserve

- The events of last week did a lot to dampen market expectations for more aggressive Fed rate cuts this year. The odds of a quarter-point cut in November are now 88%, with a 0% implied probability of a half-point (those two were 50-50 not long ago). So, there is even a 12% tail possibility of no cut in November. As for December, the odds of a quarter-point cut after the November quarter-point cut are at 79%, with only an 11% chance of a 4% Fed funds rate by the end of the year. Bottom line – the odds were overwhelmingly high for TWO half-point cuts by the end of the year after the first half-point cut they did last month, AND there was some tail chance of even more than that. Now, the odds are almost exclusive at two QUARTER-point cuts between now and the end of the year, with barely a tail chance of more than that and barely a tail chance of less. That leaves the Fed Funds rate at year-end at a target range of 4.25-4.50%. Assume that this is the base case now and that only changes if a massive drop in the jobs data surfaces in the next month or two.

Oil and Energy

- WTI Crude closed at $77.32, up +4% on the day. Oil was also up +9% last week.

- Energy stocks jumped +7% last week, no doubt emboldened by heightened drama in the Middle East. MLPs were “only” up +1.7% last week, but the midstream sector at large, led by c-corps, was up over 4.5%. This issue of divergent performance between MLPs and corporations was thoroughly addressed in our meetings last week with our UMI portfolio managers from Miller-Howard Investments. While MLPs had led the way last year and the year before, this year has seen a bigger performance from the corporations as more and more investors are happy to get natural gas pipeline exposure without the tax complexity MLPs add (even if one person’s “complexity” is another person’s “advantage”). Much more to say in our client report this Wednesday.

- By the way, this makes nine positive quarters in a row for midstream…

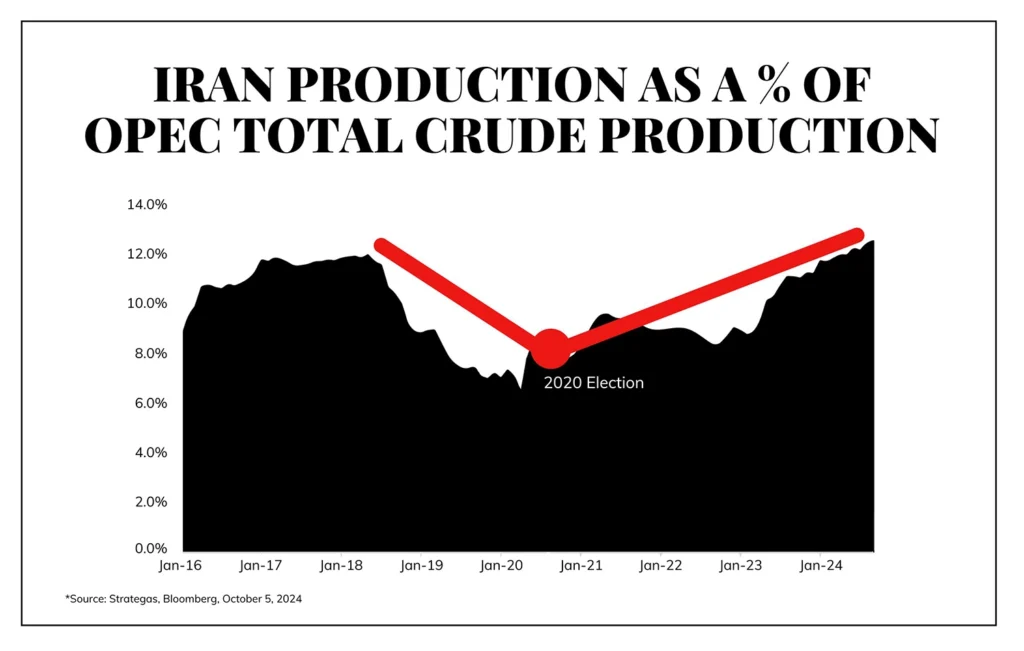

- The massive drop in Iranian oil production in the middle of Trump’s term in office is clear in the data (when he re-imposed sanctions), as is the resurgence of Iranian oil production in the last four years.

Against Doomsdayism

- In Argentina, rental listings are up a massive +184%, and rent costs have dropped by 40%. How did these two highly correlated feats of wondrous magic happen? The new President, Javier Milei, repealed rent control.

Ask TBG

| “How does a stock with a high yield continue to increase its dividend payout if the payout ratio already exceeds 100%?” ~ Michael R. |

| By growing earnings!

Hypothetical: $5 earnings – $5 dividend – 100% payout $5.50 earnings – $5.50 dividend – still 100% payout, but 10% dividend growth Now, a company can’t ACTUALLY pay out over 100% of earnings without essentially paying from the balance sheet of the company (not good). That is why the better metric is ANNUALIZED FREE CASH FLOW. Earnings can sometimes be the wrong barometer to evaluate payout ratios because of depreciation and amortization. |

On Deck

- Earnings season is off and running this week as company Q3 results get announced throughout the next five weeks of Q4.

No words for how gorgeous a fall weekend is here in New York City. And though the Trojan’s pitiful loss Saturday night took away from my weekend, the Cowboy’s thrilling win Sunday night salvaged it. (Even though it was past my bedtime). Reach out with any questions, any time!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

The Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.